National News

Tiffany & Co. Acquires Historic Titanic Pocket Watch for $1.97 Million

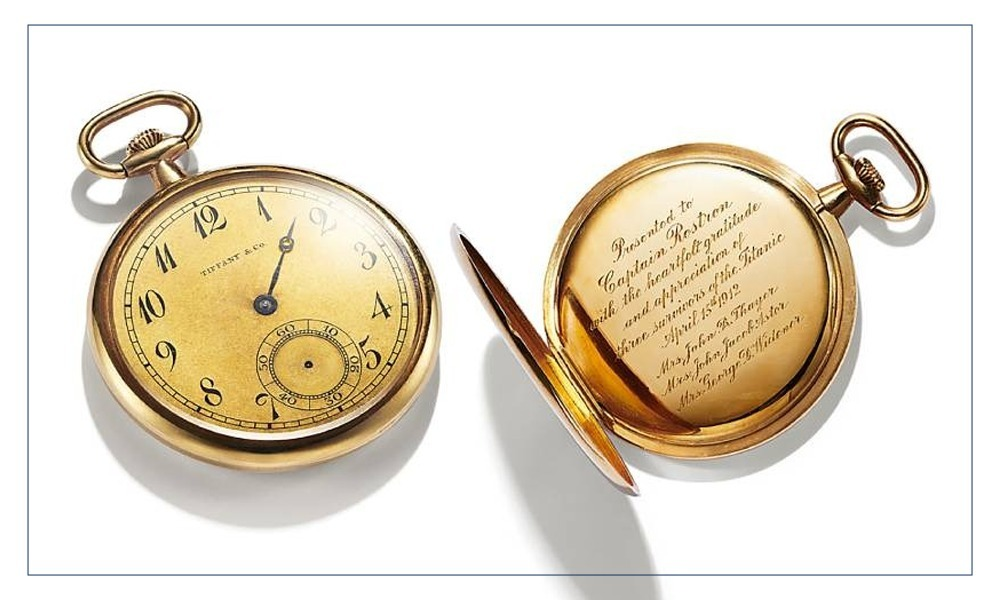

Tiffany & Co. has set a new record with the acquisition of a rare 18k gold pocket watch for $1.97 million. The timepiece, once owned by Captain Arthur H. Rostron of the RMS Carpathia, was a gift from three Titanic survivors—Mrs. John B. Thayer, Mrs. John Jacob Astor, and Mrs. George D. Widener—who expressed their gratitude for his heroic efforts in rescuing passengers after the Titanic sank.

The pocket watch, purchased from Henry Aldridge and Son Ltd., is engraved with a heartfelt message from the survivors and features the monogram “AHR” on its caseback. This historic artifact honors Captain Rostron’s courage and pivotal role in saving hundreds of lives. Christopher Young, Vice President of Creative Visual Merchandising at Tiffany & Co., emphasized the significance of the acquisition, stating that it highlights the brand’s long-standing connection to history and its role in the luxury world.

National News

GJEPC Leaders Tackle US Tariffs, Unveil Growth Roadmap at Surat Industry Meet

Key Stakeholders Unite to Address Trade Challenges and Explore New Opportunities for India’s Gem & Jewellery Sector

On April 24, the Gem & Jewellery Export Promotion Council (GJEPC) led by Chairman Mr. Kirit Bhansali held a high-level industry interaction in Surat, bringing together major stakeholders to address current challenges, including the recent US tariffs, and to strategize for future growth.

Joining Mr. Bhansali were Mr. Saunak Parikh, Vice Chairman; Mr. Sabyasachi Ray, Executive Director; and Mr. Jayanti Savaliya, Regional Chairman – Gujarat. They were welcomed by industry stalwarts including Mr. Govindbhai Dholakia (MP – Rajya Sabha and Chairman, Surat Diamond Bourse), Mr. Laljibhai Patel, Mr. Nagjibhai Sakariya, Mr. Vallabh Lakhani, and heads of associations representing natural and lab-grown diamonds and jewellery manufacturers.

A key focus of the meet was the impact of recent US import tariffs on Indian exports. Mr. Ray presented a detailed overview of the situation, while Mr. Savaliya shared positive updates on resolving Customs-related issues affecting the trade.

Emphasizing the city’s importance, Mr. Bhansali stated, “Surat is not just a city of diamonds; it is the pride of our industry.” He praised its critical role in the global supply chain and reaffirmed GJEPC’s commitment to supporting the region.

Mr. Dholakia applauded GJEPC for building trust between the industry and policymakers, while Mr. Parikh highlighted future opportunities. He suggested that India could benefit strategically from the shifting global dynamics caused by the US tariffs and identified silver jewellery as “the next big thing” for expansion. He also stressed the need to promote direct rough diamond trading in Surat.

The event concluded with a unified commitment to strengthening India’s position as a global leader in gems and jewellery, with Surat at the heart of that vision.

National News

India must radically rethink its export strategy, overhaul EPCs: Policy Circle Bureau

India must urgently rethink its export strategy or risk long-term stagnation, warns Policy Circle Bureau, a leading policy think tank. The caution comes in the wake of the United States imposing a 26% import duty on Indian goods—currently eased by a temporary 90-day reprieve.

While recent government measures like the ₹2,250 crore Export Promotion Mission and revised duty drawback rates offer short-term relief, the think tank argues they do little to resolve deeper structural challenges.

With merchandise exports remaining flat at $437.4 billion in FY25, Policy Circle urges a fundamental shift in India’s approach—moving from top-down policymaking to a more decentralised, state-led export strategy driven by key investors and tailored to sector-specific needs.

A major reform of Export Promotion Councils (EPCs) is also deemed necessary. Currently seen as symbolic bodies, EPCs should be made accountable through performance-based KPIs such as export growth by sector, success in opening new markets, and resolving tariff issues.

The think tank further recommends rapid market diversification, faster execution of free trade agreements, and the adoption of a realistic and competitive currency policy. Without regulatory reforms, decentralisation, and clearer strategic direction, India risks falling behind in an increasingly fragmented and competitive global trade environment, it warned.

National News

Titan Bets on Value-Led Growth This Akshaya Tritiya Amid High Gold Prices

Shifting focus to diamonds, bridal jewellery, and region-specific collections, Titan aims for double-digit growth despite cautious consumer sentiment.

As gold prices continue to soar, Titan Company is pivoting its Akshaya Tritiya strategy towards value-led growth over pure volume expansion. Aiming to ease consumer concerns, the brand is focusing on higher ticket sizes rather than pushing bulk gold sales, anticipating double-digit growth this festive season.

“With so many global uncertainties, gold has turned into a safe haven,” said Ajoy Chawla, CEO of Titan Company’s Jewellery Division, as reported by ET Retail. “But with prices spiralling, it has put pressure on consumer sentiments.”

Titan expects only a marginal increase in buyers this Akshaya Tritiya. To adapt, the company is shifting its marketing lens from traditional gold offerings to diamond and precious gemstone bridal jewellery, launching four region-specific wedding collections, and boosting the visibility of The Rivaah Aashirwad, its gold rate lock-in program.

“Gold is a commodity—it can’t stay elevated forever,” Chawla added. “We’re cautiously optimistic. India’s festive spirit is intact, even as global headwinds persist.”

While walk-in footfall remains muted, investment-driven gold purchases, particularly gold coins, have held strong. In response, Titan has slashed weight-dependent making charges to as low as 3.5%, depending on the product.

Part of the Tata Group, Titan’s fine jewellery portfolio includes brands such as Tanishq, Mia by Tanishq, and Zoya. Its broader offerings span watches, wearables, fashion accessories, and fragrances.

“In FY 2024-25, our best gold rate offer has seen 2.5x growth compared to the previous year,” Chawla shared, underscoring the shift in consumer behavior toward smarter, investment-led buying.

-

BrandBuzz3 weeks ago

BrandBuzz3 weeks agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

BrandBuzz16 hours ago

BrandBuzz16 hours agoGemfields and PureJewels Launch ‘Zariya’ Emerald Collection to Celebrate May and 75 Years of Craftsmanship

-

BrandBuzz17 hours ago

BrandBuzz17 hours agoOropel Launches ‘Noor’: A Bold New Jewelry Collection Inspired by Music & Nature

-

GlamBuzz20 hours ago

GlamBuzz20 hours agoTBZ-The Original Shines Brighter in Hyderabad with Grand Opening of Kondapur Store by Payal Rajput