International News

Platinum, palladium prices decline on easing of U.S.-China trade tensions

Platinum: Platinum prices have also declined, falling by 0.6% to $983.56 per ounce in mid-May, and reaching as low as $955 per ounce in April. The metal faces headwinds from weaker industrial demand and macroeconomic uncertainty, despite ongoing supply constraints. UBS and other analysts have cut their price expectations, citing a lack of compelling demand growth and investor nervousness about the macroeconomic outlook.

Palladium dropped by 0.5% to $965 per ounce as of May 2025, with earlier declines of 5% in April, bringing its price below platinum. Over 80% of palladium’s demand comes from the auto sector, making it particularly vulnerable to any downturn in vehicle sales. Analysts expect only a modest recovery ahead, with looming surpluses likely to cap prices in the longer term.

Improved Risk Appetite: The easing of U.S.-China trade tensions has increased investor risk appetite, leading to profit-taking and liquidation in safe-haven assets like gold and, by extension, other precious metals.

Industrial Demand Concerns: Softer industrial demand, especially for platinum and palladium, is weighing on prices. Both metals are heavily used in automotive and industrial applications, and any slowdown in global growth or vehicle sales directly impacts demand.

Macroeconomic Uncertainty: Ongoing uncertainty about economic growth, interest rate policies, and trade relations is making investors cautious, particularly for metals with significant industrial uses.

Supply Factors: While platinum faces constrained supply, this has not been enough to offset weaker demand. Palladium, meanwhile, is expected to move into surplus as supply outpaces demand, further pressuring prices.

Platinum is likely to remain rangebound, with its price outlook hinging on supply constraints and the potential for demand growth from emerging sectors like hydrogen.Palladium faces a more challenging outlook, with analysts warning that prices could fall further if auto sector demand weakens and market surpluses grow.

International News

Gold prices climbed above $4,250 ahead US ISM Manufacturing PMI release

US spot Gold prices climbed above $4,250 early Monday, touching a six-week high as investors turned cautious ahead of the upcoming US ISM Manufacturing PMI release. The yellow metal is poised for further upside momentum if it secures a sustained daily close above the crucial $4,250 resistance level.

The US Dollar opened December on a softer note, pressured by rising expectations that the Federal Reserve may announce a rate cut next week. Growing market confidence in easing monetary conditions has boosted the appeal of non-yielding assets such as gold.

Analysts note that a decisive break and close above $4,250 could reinforce bullish sentiment and pave the way for an extended rally in the days ahead. As global markets await fresh cues from the US economic calendar, gold continues to benefit from a favorable macroeconomic backdrop and robust safe-haven demand.

-

BrandBuzz9 hours ago

BrandBuzz9 hours agoMCA raises “small company” thresholds – up to ₹10 cr capital & ₹100 cr turnover from 1st December 2025, major relief for jewellery trade

-

JB Insights10 hours ago

JB Insights10 hours agoWomen Leaders Driving the Luxury Renaissance

-

National News14 hours ago

National News14 hours agoSHINESHILPI Announces the Launch of The Shine House, India’s Biggest B2B Jewellery Hub

-

National News12 hours ago

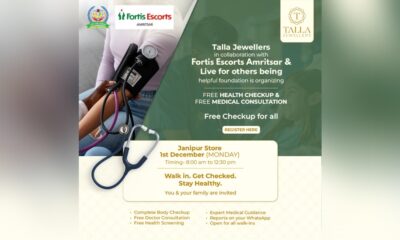

National News12 hours agoTalla Jewellers Successfully Hosts Free Health Checkup Camp with Fortis Escorts Amritsar and Live For Others Foundation