International News

PGI Initiatives at Jewellery and Gem WORLD Hong Kong Spotlight Platinum as Priority Metal for Brighter Future

Expert panel to illuminate accelerating innovation and new segment growth

Platinum Guild International (PGI) pinpoints a shining new era of platinum jewellery opportunities at Jewellery & Gem WORLD Hong Kong 2025, particularly in light of the soaring price of gold. A trio of initiatives staged at Hong Kong’s influential annual jewellery trade show, headlined by a panel discussion uniting platinum jewellery experts from three continents, will advocate platinum’s strong incremental business potential. Held from 17-21 September 2025 at the Hong Kong Convention & Exhibition Centre and attracting the industry’s global decision-makers, the fair will also be enriched by a precious metal exhibition spotlighting platinum and PGI’s inviting Platinum Pavilion.

The alloy’s enduring attributes of innate strength, resilience and authenticity; unparalleled technological innovation; and sustainable sourcing have been cast into the limelight by gold’s record highs. Its advantages as a priority metal for fine jewellery have been accentuated, and compelling openings for expansion have forged beyond the bridal segment, where it has been traditionally dominant. Platinum is now poised to gain market share in other areas, including men’s jewellery.

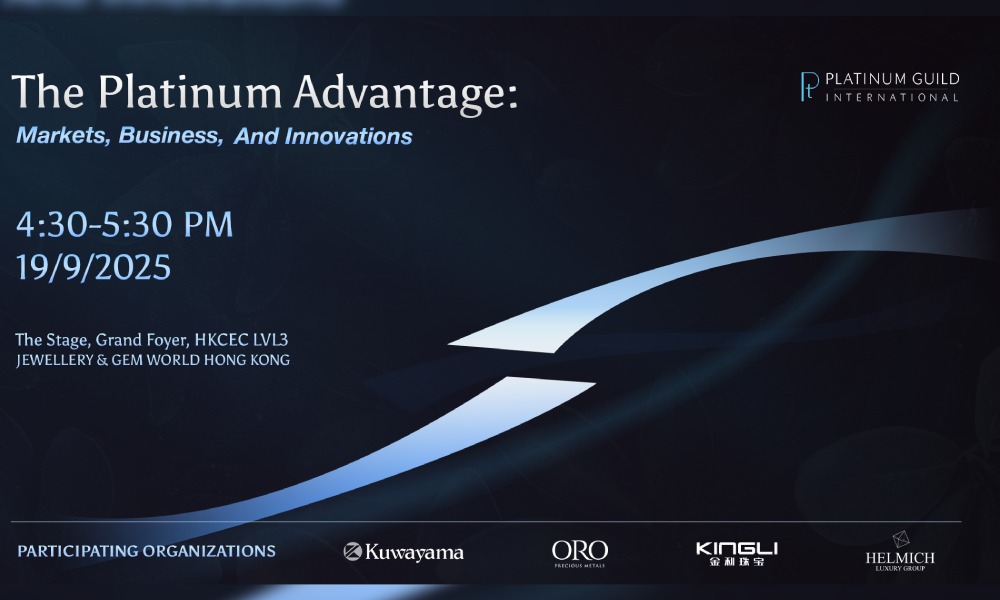

PGI’s panel, moderated by the worldwide marketing organisation’s CEO Tim Schlick, will address “The Platinum Advantage: Markets, Business and Innovations”. Five respected industry insiders will step onto the Grand Foyer Main Stage on Friday, 19 September to share valuable insights on maximising platinum’s current edge over white gold, and explore pathways for platinum jewellery designers and manufacturers to develop new products and leverage incremental business in their respective regions. Attendees are invited to a networking drinks reception after the event.

The diversity of the speakers reflects the global surge in platinum’s appeal. They are Andy Zhou of Kingli Jewelry from China; Josh Helmich of Helmich Luxury Group in the USA; Jason Brimelow of Brimelow Group that operates in Australia and Southeast Asia; Noriyuki Kamei from Kuwayama Corporation based in Japan; and Avinash Pahuja of ORO Precious Metals Pvt Ld from India.

Besides focusing on platinum’s relative price advantage, the discussion will highlight emerging markets ripe for penetration, strategies to enter new product segments to broaden portfolios, and investments in innovation by other platinum-rich fields that are rapidly translating into significant advances in jewellery production.

“Sublime Shine: Metal Innovation in the Art of Jewellery”, a comprehensive exhibition brought to Jewellery & Gem WORLD Hong Kong in collaboration with PGI, will serve as an informative and interactive backdrop to this illuminating panel discussion.The 430-square-metre display, supplemented by an area dedicated to men’s jewellery, offers evidence of platinum’s multiple beneficial facets, from ethical sourcing to facilitating advances in clean energy and medicine.

A welcome addition at previous Hong Kong jewellery fairs, PGI’s Platinum Pavilion allows attendees to experience cutting-edge products firsthand and communicate with creatives in a relaxed environment. This year, it showcases the creations of six exhibitors from China and India lauded for their innovative production practices and aesthetic designs: B.N. Jewellers India; Guangdong Jinbotong Technology Co Ltd; Jewelex India; Kingli Jewelry; Kinch Jewelry; and ORO Precious Metals.

Other platinum powerhouses – Kuwayama Corporation, Nagahori Corporation; Shenzhen Longjia Jewelry and German enterprises egf – Eduard G. Fidel and Schofer Germany – will present their collections elsewhere in the exhibition halls.

Jewellery & Gem WORLD Hong Kong marks an opportunity for PGI to solidify its new, cohesive global positioning for platinum jewellery – emphasising substance and sophistication, provenance and purity. “The technological advancements driving innovation are proceeding at a rapid pace, allowing manufacturers and designers to capitalise on unique growth opportunities. Indeed, we have witnessed more progress in platinum technology and innovation in the last two years than the last two decades,” says PGI CEO Tim Schlick.

“An ingredient for a better world, platinum is best suited for the future as it offers young consumers the rarest, purest metal with ethical credibility and an edgy contemporary look. I invite all jewellery designers and manufacturers to attend our essential panel discussion on ‘The Platinum Advantage’ in order to unlock exciting opportunities for growth in new market segments afforded by current pricing and technological ingenuity.”

International News

Geopolitical tensions and Fed rate-cut bets push precious metals to record highs

Gold and silver surged to fresh record highs, with gold crossing $4,600 (~Rs.1,40,000) and silver moving past $83 (~Rs.2,60,000). The rally was driven by a mix of rising geopolitical tensions and growing expectations that the U.S. Federal Reserve will be forced to cut interest rates further. Last week itself, gold ended up nearly 4%, while silver jumped a sharp 12%, as markets reacted to weaker-than-expected U.S. jobs data and an increasingly uncertain global backdrop.

Geopolitical tensions back in focus

Geopolitical risks have once again taken centre stage. Tensions remain high amid escalating unrest in Iran, the ongoing Russia–Ukraine war, the U.S. capture of Venezuela’s President Nicolás Maduro, and renewed signals from US about taking control of Greenland.

Investors are closely watching the protests in Iran, now in their third week, with reports suggesting more than 500 deaths so far. President Donald Trump has warned Iran’s leadership against using force on protesters and hinted at possible U.S. action if the crackdown continues. Iranian officials, in turn, have warned against any U.S. or Israeli intervention and threatened retaliation, including targeting U.S. military bases in the region.

All of this comes at a time when Trump is projecting U.S. power more aggressively on the global stage—ousting Venezuela’s president and openly discussing the possibility of acquiring Greenland, either through purchase or force.

Growing pressure on the Fed to cut rates

U.S. economic data is adding to the case for easier monetary policy. December nonfarm payrolls rose by just 50,000, falling short of expectations, while the unemployment rate edged down to 4.4%. The numbers point to a weakening job market, which, combined with geopolitical risks, firmer oil prices, and rising uncertainty, creates a supportive environment for precious metals.

Markets continue to price in two rate cuts this year, even though the Fed is expected to hold rates steady at its upcoming meeting. Adding to the drama, Fed Chair Jerome Powell said on Sunday that the Trump administration had threatened him with a criminal probe over his Congressional testimony—moves Powell described as an attempt to pressure the central bank into lowering rates. The comments pushed the dollar and U.S. equity futures lower, while gold and silver gained further.

Supreme Court ruling on Trump tariffs in focus

Another major risk event is brewing. There is growing speculation that the U.S. Supreme Court may deliver a ruling on January 14 on the legality of tariffs imposed under emergency powers.

If the court upholds Trump’s authority to impose tariffs without Congressional approval, tariff threats could return quickly—this time aimed not just at China, but Europe as well, potentially linked to U.S. ambitions around Greenland. If the ruling goes the other way and declares such tariffs illegal, markets could see sharp volatility. That said, the administration reportedly already has alternative legal routes lined up to reimpose tariffs.

In either case, precious metals are well positioned. Trade tensions typically weigh on the dollar and push investors toward safe-haven assets like gold and silver, while supporting currencies such as the euro and Swiss franc. An even more intriguing outcome would be if the court places clear limits on presidential powers—something that could make Trump’s policy responses even more unpredictable going forward.

What to watch this week

This week’s economic calendar is packed, with the spotlight on U.S. inflation and consumer data. Tuesday’s December CPI report will be especially important, as it may be the first inflation print unaffected by the government shutdown. That said, geopolitics could easily steal the spotlight. Any Supreme Court decision on tariffs—or fresh developments on the geopolitical front—could end up driving markets more than economic data.

The gold boom began in mid-August around $3400 and reached $4400 by mid-October. The prices then retraced and have been taking support from the uptrendline since. Gold has crossed its previous high resistance of $4570. The next level to watch for is of $4745-50 (78.6% fibbonnicci extension) and $4966-70 (100% fibbonnicci extension).

The Silver rally started from $45 in October, and extended up $82.7 in December 2025. Fibonacci extension suggests that this rally can extend further towards $84, $88, $93 and $99 in the coming few months of 2026 with strong support at $70.

-

GlamBuzz2 weeks ago

GlamBuzz2 weeks agoGIVA Launches ‘Glow in Motion’, Unveils New Jewellery Collection Fronted by Barkha Singh

-

International News2 weeks ago

International News2 weeks agoSilver retraces down on margin hike pressure AUGMONT BULLION REPORT

-

JB Insights2 weeks ago

JB Insights2 weeks agoThe JewelBuzz E-zine: Your Fortnightly Pulse of the Jewellery Industry

-

JB Insights2 weeks ago

JB Insights2 weeks agoIIJS Bharat Signature 2026 set to open the year with scale, innovation and global momentum