JB Insights

Natural diamonds are more than just an investment

Russell Mehta reflects on the diamond industry’s evolution, noting a shift from romantic experiences to transactional purchases due to increased transparency and lab-grown alternatives. While the market faces fluctuations, natural diamonds retain intrinsic value, rarity, and emotional significance, distinguishing them from commodities like gold.

Consumer perspectives have shifted significantly over the 40years that I have been in the diamond business. When I started out in the early 1980s, buying a diamond was a romantic, emotional experience. Its mystique was linked to its rarity, its perceived uniqueness, and the joy of discovery during the shopping process. This traditional view of diamonds has shifted with the rise of certification, transparency, and the accessibility offered by the internet. The diamond market has become more commoditized, where consumers can compare prices, examine flaws, and get a better understanding of what they are buying, often without stepping into a store. The process of acquiring a diamond, once filled with romance, has become increasingly transactional.

Recent reports have raised doubts over diamonds as viable investments, often comparing them to gold or other financial assets. Unlike other luxury items, such as designer bags, diamonds’ value comes from a combination of art, history, and sentiment—an acquisition that can be passed down through generations. I own a diamond from my grandfather, and its value to me is immeasurable; no price tag could ever capture its significance.

Unlike gold, with which diamonds are erroneously compared to, or art, diamonds occupy a middle ground. While not as liquid as gold or as illiquid as art, natural diamonds retain intrinsic value over time.

For example, I have collected numerous works of art, but only a handful have appreciated significantly over two decades. This unpredictability does not make the art any less valuable to me, but it highlights the varied nature of investments. I cherish the stories behind my art collection—how I discovered each artist and acquired each piece alongside my wife. That does not mean diamonds do not serve as a form of security in times of crisis. History has shown that in turbulent moments, diamonds have been portable assets that can be used to re-establish stability.

The value of diamonds can fluctuate, but it doesn’t depreciate—nor does it get damaged—as quickly as other commodities. According to a Bain & Co report, on an average, prices have increased by 3% year-on-year over the last 35 years.

The rarity of natural diamonds will only grow, as their supply is limited. No significant new diamond deposits have been discovered in the past two decades and the current mines are gradually depleting. The natural pink diamonds that the Argyle mine in Australia produced over 30 years, for instance, are now coveted collectors’ items, providing extraordinary returns as the Argyle mine is now closed.

The introduction of lab-grown diamonds has added a layer of variety to the industry. These diamonds, created in a controlled environment, are more affordable and abundant compared to natural diamonds. While they share the same physical properties, they lack the rarity, preciousness, and emotional weight of natural diamonds. They follow Moore’s Law—as technology improves, their production becomes cheaper, their quality better, and their size larger—further reinforcing their status as a manufactured commodity, rather than a unique and naturally-available gem.

Their rise reflects the broader trend of commoditization in the diamond industry. Some consumers may be drawn to the lower price point of lab-grown diamonds. For example, it may work for the 25-27 year-old on his—dare I say—first marriage proposal. But for his 10th wedding anniversary, his gift would be the real thing, a natural diamond.

After an unprecedented boom in 2021 and 2022, the market has contracted, with the value of global retail-studded diamond jewellery declining from $90 billion to approximately $75 billion in 2024. This was due in part to slowing luxury demand in China and some cannibalisation from lab-grown diamonds in the U.S. While the diamond market may go through its cycles, the emotional and lasting value of real diamonds will continue to endure.

I see this as an industry that’s in the business of bringing joy to consumers, through birthdays, engagements, anniversaries and gifting. Life is an assimilation of memories, time spent with loved ones and natural diamonds are attached to landmarks in life. It’s the only commodity that’s a brand in itself.

– News Courtesy-TOI

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

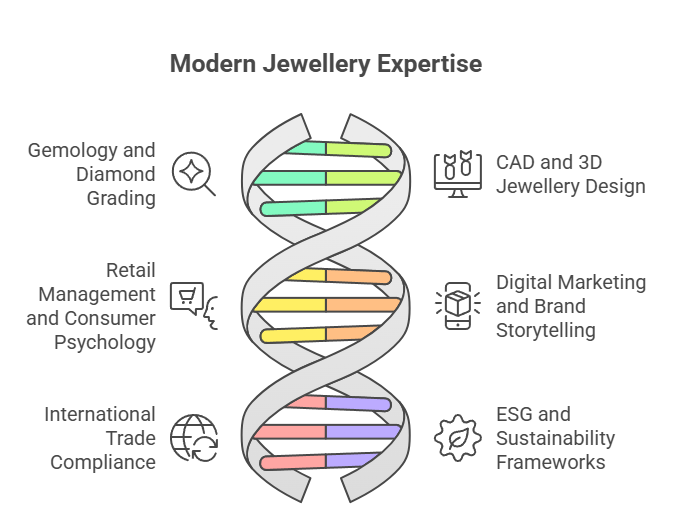

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

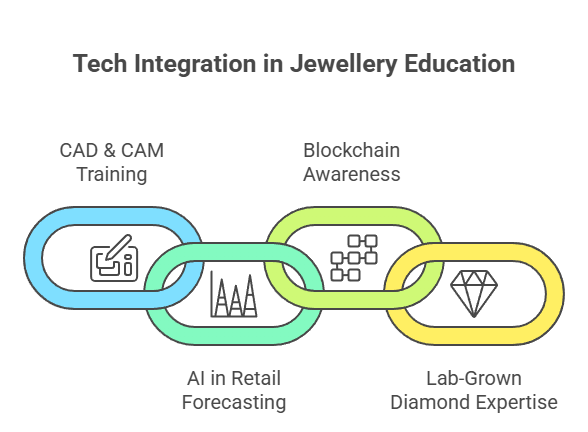

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

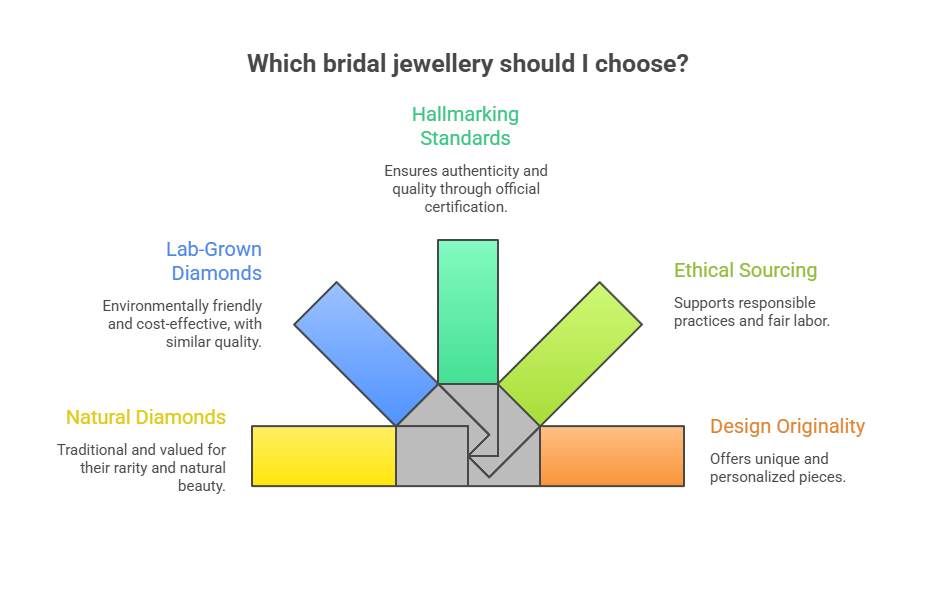

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

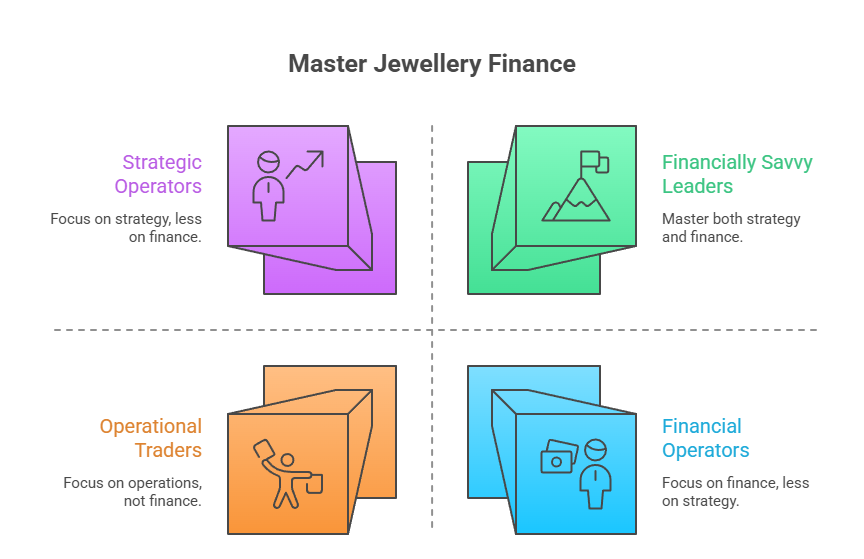

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

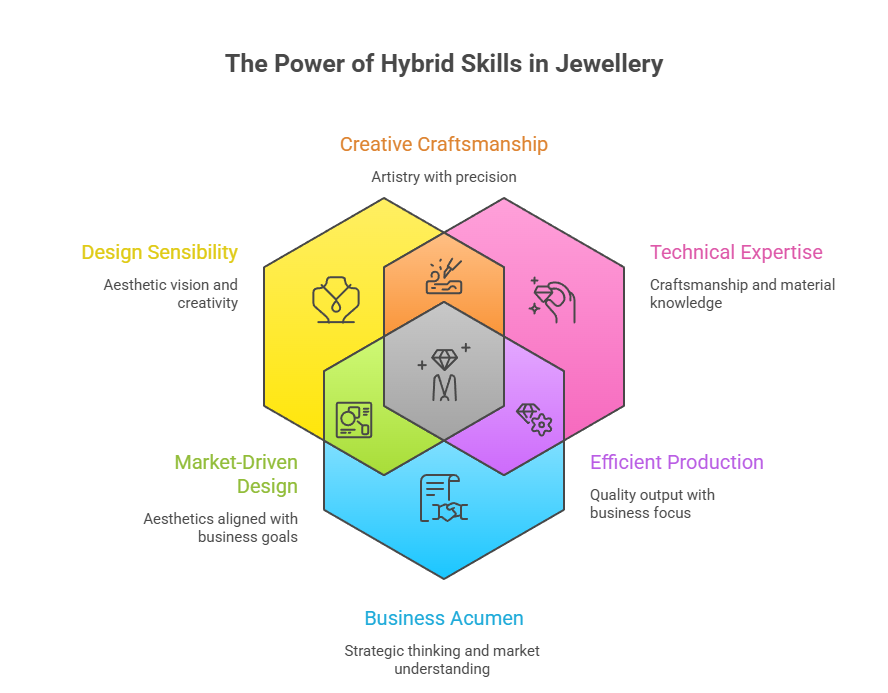

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

National News2 hours ago

National News2 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz19 hours ago

BrandBuzz19 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration