JB Insights

Lustre ‘n’ luxe : Global pearl trade rides the wave of modern demand

The global pearl trade has undergone significant changes in recent years, driven by evolving consumer preferences, technological advancements, and economic factors. This report provides a comprehensive overview of the current state of the pearl trade, highlighting key statistics and trends as of 2023 and projections for the coming years.

Global Market Overview

The global trade of raw pearls (classified under HS Code 7101) reached approximately $1.29 billion in 2023, marking a 30.8% increase from $985 million in 2022 . While specific data for 2024 is not yet available, this upward trend suggests continued growth into 2024. Custom Market Insights estimated the market at $13.1 billion in 2024, forecasting growth to $34.4 billion by 2033, with a CAGR of 11.5%. IMARC Group also valued the market at $13.2 billion in 2024, projecting it to reach $34.6 billion by 2033.

The pearl trade continues to show resilience, with various factors influencing market dynamics. The market is characterized by a few dominant players, with Japan, China, and French Polynesia leading in production and export

Box item

Top Pearl Exporting Countries in 2023:

- Japan: $450 million

- Primarily exports Akoya pearls (75% of exports), with finished jewelry and natural pearls making up the remainder.

- China: $350 million

- Leads in freshwater pearl production (65%) and also exports saltwater cultured pearls (25%).

- French Polynesia: $150 million

- Known for Tahitian black pearls, with 90% of exports being these unique gems.

- Australia: $200 million

- Renowned for South Sea pearls, which constitute 85% of its exports.

- India: $100 million

- Exports mainly freshwater pearls (60%) along with finished jewelry (25%).

- Vietnam: $50 million

- Gaining recognition for freshwater pearls (70%) and cultured varieties.

Import Dynamics

The United States is one of the largest importers of pearls, accounting for approximately $300 million in imports. Other significant import partners include Japan ($200 million), the United Arab Emirates ($120 million), Italy ($110 million), and Hong Kong ($80 million). These markets show strong demand for high-quality pearl jewelry, particularly from Japan and China.

Market Trends (2020–2024)

Between 2020 and 2024, the pearl market experienced notable shifts:

- Consumer Preferences: There has been a shift towards elegant designs that emphasize craftsmanship rather than ostentation. Consumers are increasingly looking for heirloom-quality pieces that reflect timeless beauty.

- Technological Advances: Improvements in farming techniques have enhanced the quality of both freshwater and sea pearls. Innovations in sustainability practices are becoming crucial as consumers demand ethically sourced products.

- Economic Factors: Post-pandemic recovery has led to increased consumer spending on luxury goods. However, inflationary pressures are influencing buying behavior, with consumers prioritizing value.

Regional Insights

- Asia: Continues to dominate pearl production and consumption. China remains the largest producer of freshwater pearls, while Japan is known for its Akoya pearls.

- North America and Europe: These regions are seeing a rise in demand for sustainable luxury products. Consumers prefer minimalist designs that reflect ethical sourcing.

- Middle East: The market favors opulent designs, often combining pearls with gold and diamonds. There is a strong demand for high-grade sea pearls.

Outlook for 2025–2030

Looking ahead, several trends are expected to shape the pearl market:

Pearls are no longer confined to traditional jewelry; they are now incorporated into contemporary designs alongside other gemstones and metals, appealing to younger demographics seeking bold fashion statements.

• Pearls are also gaining popularity in non-traditional markets, such as men’s jewelry and innovative accessories like watches or eyewear.

• Sustainability: The emphasis on environmentally friendly practices will drive growth in ethically sourced pearls.

• Technological Integration: Advances in aquaculture will likely improve production efficiency and quality.

• E-commerce Growth: The shift towards online shopping will continue to expand, allowing niche brands to reach global audiences more effectively.

Conclusion

The global pearl trade is poised for continued growth as it adapts to changing consumer demands and embraces sustainable practices. With major exporting countries like Japan, China, and Australia leading the way, the market is expected to thrive through innovation and a focus on quality. As we move into the latter half of the decade, stakeholders must remain agile to capitalize on emerging opportunities within this luxurious segment of the jewelry industry.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

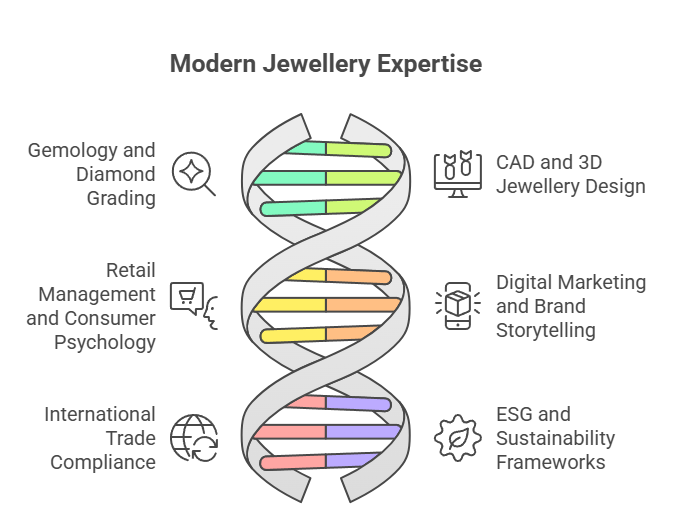

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

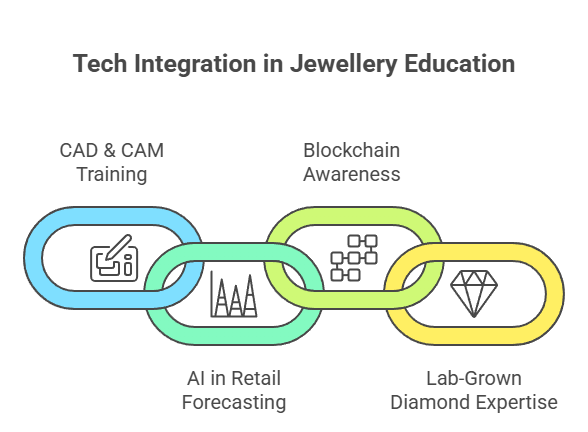

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

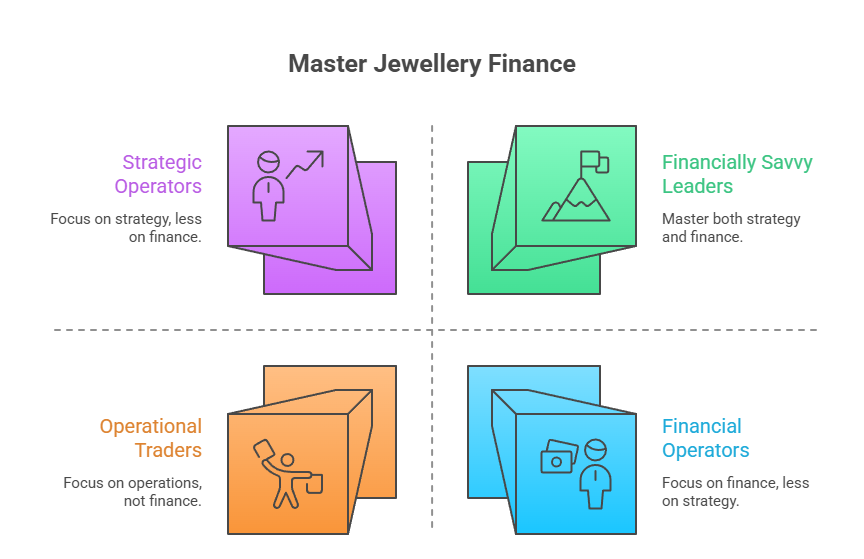

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

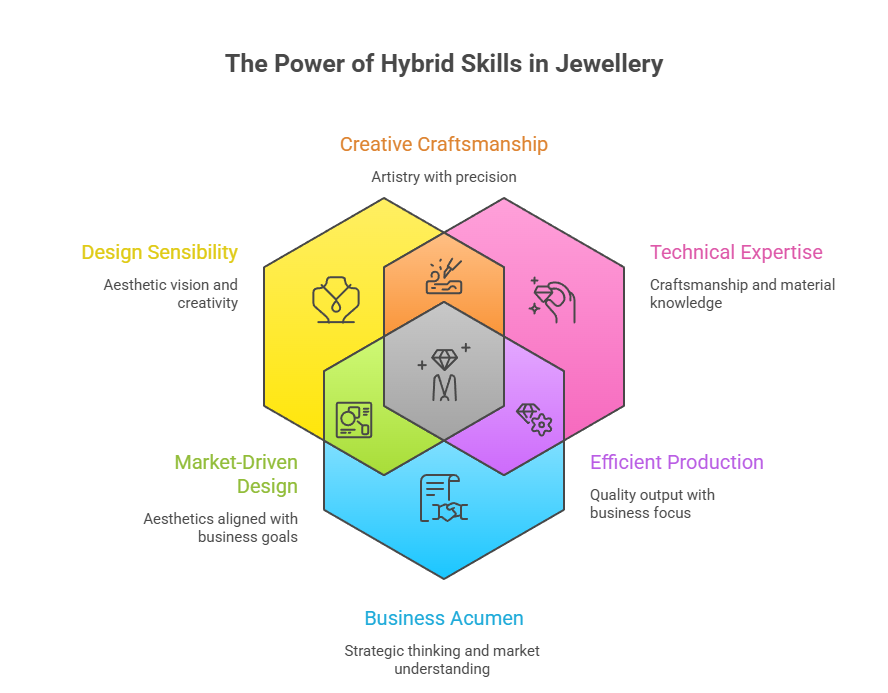

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

National News16 minutes ago

National News16 minutes agoGold Rebounds in India After Five-Day Slide; Dollar Strength Keeps Pressure Intact

-

National News1 hour ago

National News1 hour agoKumari Fine Jewellery Celebrates the “Modern Indian Original” with Exclusive Women’s Day Showcase

-

National News5 hours ago

National News5 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz21 hours ago

BrandBuzz21 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA