National News

Kira Scales Up to 4,000 Reactors, Becomes Global Leader in Lab-Grown Diamond Production

Kira, a part of the renowned Kiran family, has significantly expanded its production capabilities, increasing its CVD reactor count from 2,600 to 4,000. With this leap, Kira is now officially the world’s largest producer of lab-grown diamonds (LGDs), generating over 250,000 polished carats every month.

This achievement aligns with the vision of Vallabhbhai Lakhani, founder of the Kiran group, whose guiding principle “Har Ghar Hira, Har Ghar Kira” underscores the mission to make diamonds more accessible, sustainable, and globally trusted.

Fully Integrated & Sustainable Operations

Kira stands out as a fully integrated diamond manufacturer—managing every stage from growing to cutting, polishing, and jewellery production. Its state-of-the-art 1 million sq. ft. facility in Surat employs over 10,000 skilled artisans and is powered by 75 MW of solar energy, with plans to double to 150 MW in the near future.

The company adheres to global ethical standards, holding SMETA and SEDEX certifications, and proudly champions India’s Make in India initiative on an international platform.

Global Reach & Industry Impact

With offices in Mumbai, Surat, Hong Kong, and New York, Kira serves over 4,700 partners worldwide, including manufacturers, designers, and major retail chains.

Leadership Speaks

Rajesh Lakhani, Founding Partner of Kira Diam LLP, stated: “Reaching 4,000 reactors is more than a capacity milestone — it’s a bold statement of India’s leadership in the global lab-grown diamond industry. Kira is proud to empower over 10,000 Indians, reduce dependence on imports, and deliver unmatched scale, trust, and sustainability for our global partners.”

National News

IJEX 6TH Fam provides¬Ýcomprehensive insights into ME market

Five-day immersion under GJEPC’s Export Mentorship Programme equips Indian exporters with market intelligence, retail exposure, and strategic clarity across the UAE jewellery landscape.

The five-day Familiarisation (FAM) Program by GJEPC’s India Jewellery Exposition Centre (IJEX), Dubai, provided Indian jewellery exporters with comprehensive insights into the Middle East market, focusing on regional dynamics, consumer preferences, and retail environments across the UAE.

The 6th batch of the IJEX FAM Programme,¬Ýinitiated¬Ýand facilitated under GJEPC‚Äôs Export Mentorship Programme (EMP),¬Ýdelivered a structured five-day immersion into the UAE jewellery ecosystem, combining market intelligence, design orientation,¬Ýlogistics¬Ýguidance, and extensive retail visits across Dubai, Abu Dhabi, and Sharjah. Participants consistently highlighted the programme‚Äôs practical value, mentorship, and clarity in building export readiness.¬Ý

Day 1: Understanding the Middle East Landscape

The programme commenced at IJEX with an introduction session followed by a presentation on navigating the Middle East jewellery market, covering regional dynamics, consumer preferences across emirates, export opportunities, and positioning strategies across wholesale and retail segments. Delegates then visited Ithraa Wholesale & Retail, Goldcenter Building, Gold House, Jewel Plaza, Traditional Gold Souq, African Souq, and Gold Land, together representing around 475 retailers and 460 offices, giving participants a broad view of both wholesale and traditional trading ecosystems.

Day 2: New Dubai Retail and Design Insights

A designer interaction session focused on branding, cultural motifs, and regional aesthetics relevant to GCC consumers. Market visits to Mall of the Emirates, Lulu Hypermarket ‚Äì Al Barsha, Gold & Diamond Park, and Dubai Hills Mall allowed delegates to¬Ýobserve¬Ýnearly 115¬Ýjewellery retailers across luxury malls, diaspora-focused outlets, and specialised diamond boutiques, highlighting differences in merchandising, product mix, and customer behaviour.¬Ý

Day 3: Logistics, Compliance and Market Diversity

A session by Ferrari Freight Forwarders covered import procedures, documentation, duties, and secure¬Ýlogistics¬Ýhandling.¬ÝSubsequent¬Ývisits to Dubai Mall, Dubai Design District (d3), Karama Centre, and Meena Bazaar brought delegates in contact with about 150 retailers, spanning ultra-luxury international brands to culturally driven Indian diaspora markets, reinforcing the diversity of customer segments within the UAE.¬Ý.

Day 4: Abu Dhabi Market Exploration¬Ý

Visits to Madinat Zayed Gold Centre, Hamdan Street, and Abu Dhabi Mall covered¬Ýroughly 132¬Ýjewellery stores, offering insights into the capital‚Äôs consumer preferences across luxury, traditional Arabic styles, and price-sensitive segments. Delegates reported improved clarity in¬Ýidentifying¬Ýsuitable positioning and product strategies for different emirates.¬Ý

Day 5: Strategy Alignment and Expansion

The final day focused on one-to-one consultations with the IJEX team, followed by a certificate ceremony and a visit to Sharjah Blue Souq, where delegates explored around 110 jewellery stores known for 18kt, 21kt, and 22kt gold, diamonds, and silver collections, further expanding their understanding of regional demand across the Northern Emirates.¬Ý

Overall, participants described the programme as informative, well-organised, and strongly supportive, with several stating that the experience provided clarity, confidence, and a concrete roadmap for entering export markets through IJEX.¬Ý

-

DiamondBuzz5 hours ago

DiamondBuzz5 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz5 hours ago

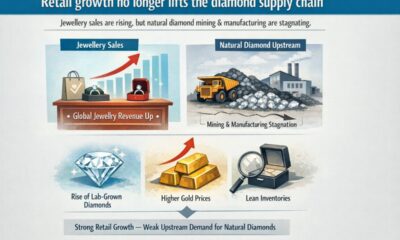

DiamondBuzz5 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News7 hours ago

International News7 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News7 hours ago

International News7 hours agoGold continues to get strength on the Middle East conflict