National News

Jewels of Legacy: The Docu-Series on JioHotstar Spotlights Mahesh Notandass Jewellers Among India’s Iconic Jewellery Houses

Streamed on JioHotstar, the series highlighted heritage, craftsmanship and generational continuity, with a special focus on the timeless elegance of Jewellers

Jewels of Legacy, a docu-series streamed on JioHotstar, offered an intimate look into the people, philosophies and traditions behind some of India’s most iconic jewellery brands. Moving beyond design and craftsmanship, the series explores jewellery as a carrier of memory, culture and family legacy.

The series brought together four iconic jewellery houses, four distinct journeys and one shared heritage:

- Kishandas & Co. – Guardians of Hyderabad’s Nizami legacy, celebrated for reviving royal artistry and heirloom craftsmanship.

- Mahesh Notandass Jewellers – Renowned for couture fine jewellery that reflects elegance, restraint and timeless design.

- VBJ Since 1900 – A century-old institution shaped by temple-inspired aesthetics, authenticity and enduring consumer trust.

- Abaran Timeless Jewellery – A heritage brand built on purity and precision, seamlessly blending tradition with contemporary expression across generations.

Through rare archival footage, personal family narratives and the skilled hands of master artisans, the series revealed how these brands continue to define and inspire India’s enduring love for jewellery.

Among the featured houses, Mahesh Notandass Jewellers too, took a centre stage as a symbol of refined couture jewellery rooted in elegance, restraint and timeless design. The episode traced the brand’s journey through generations, highlighting its distinctive aesthetic, commitment to fine craftsmanship and the values that have sustained its reputation among discerning patrons.

Jewels of Legacy also featured Kishandas & Co., VBJ Since 1900 and Abaran Timeless Jewellery, each representing a unique regional and cultural expression of India’s jewellery heritage. Through archival visuals, family narratives and artisan-led storytelling, the series captured how these houses have preserved inherited knowledge while adapting to changing times.

A key narrative thread across the series is also about the role of the next generation in the family legacy business. The show initiated the thought of sharing the changing perspective on succession, responsibility and evolution—balancing legacy with modern approaches to design, sourcing, technology and customer engagement.

By offering parallel insights into family-run jewellery businesses across India, the series underscores shared values such as trust, continuity and the emotional significance of jewellery within family histories.

With its thoughtful focus on Mahesh Notandass Jewellers, Jewels of Legacy reinforces the brand’s standing as a torchbearer of timeless elegance in Indian fine jewellery. The series not only honours heritage but also captures how legacy brands are preparing for the future—making it a compelling watch for jewellery enthusiasts and industry observers alike.

National News

GJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

GJEPC informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

The Gem & Jewellery Export Promotion Council (GJEPC) informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

A letter issued by Sabyasachi Ray, Executive Director, GJEPC, addressed the Termination of IEEPA-Based Reciprocal Tariffs and outlined key implications for exporters.

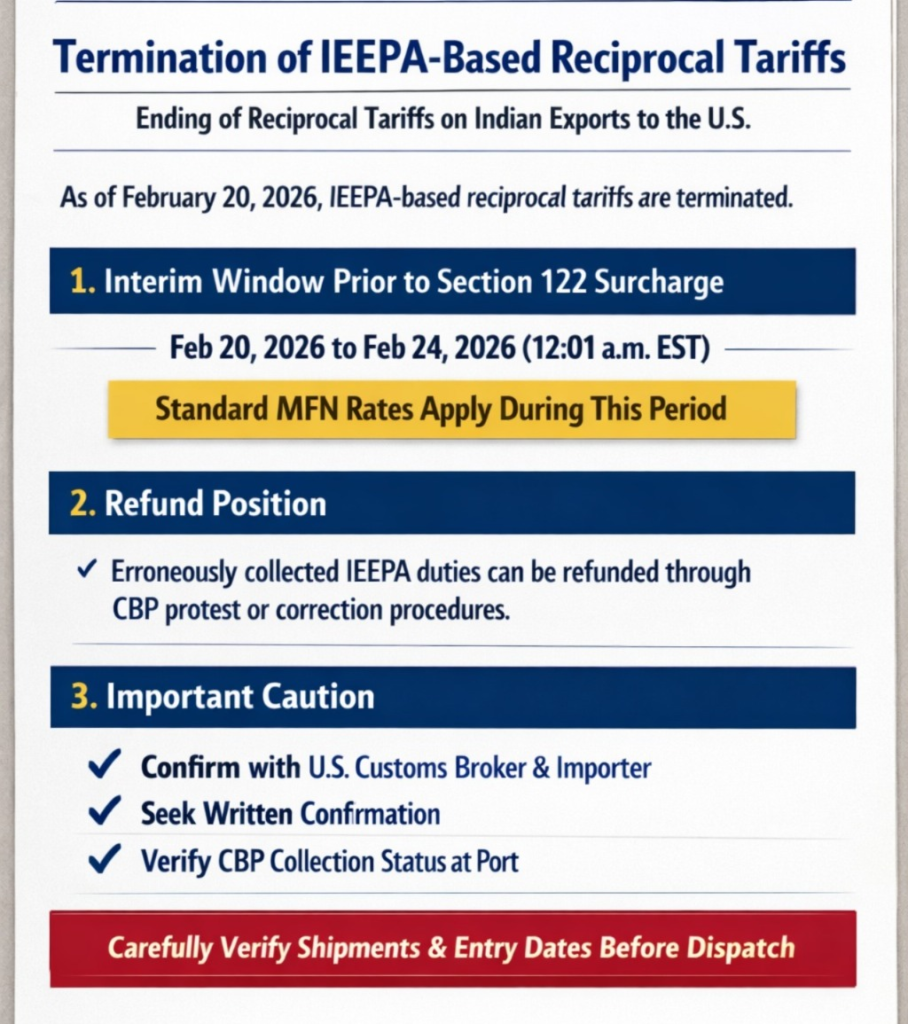

Termination of IEEPA-Based Reciprocal Tariffs

Pursuant to the Executive Order dated February 20, 2026, titled “Ending Certain Tariff Actions”, the additional ad valorem duties imposed under IEEPA, including the reciprocal tariff framework under Executive Order 14257, shall no longer remain in effect and are directed to be terminated as soon as practicable.

Accordingly, entries made on or after February 20, 2026 should not be subject to the earlier IEEPA-based reciprocal tariffs.

1. Interim Window Prior to Section 122 Surcharge

A separate Presidential Proclamation dated February 20, 2026 imposes a temporary 10% surcharge under Section 122 of the Trade Act of 1974, effective 12:01 a.m. EST on February 24, 2026.

Therefore, between: February 20, 2026 – before 12:01 a.m. EST on February 24, 2026 imports into the United States should be subject only to ordinarily applicable HTSUS (MFN) rates, without the earlier reciprocal tariff, and prior to the commencement of the Section 122 surcharge.

For products such as cut and polished diamonds (where the MFN rate is ordinarily 0%), this period represents a limited operational window.

2. Refund Position (If Collected in Error or Due to Implementation Lag)

In cases where reciprocal IEEPA duties are collected due to implementation lag, such duties should be eligible for refund through the standard:

- U.S. Customs and Border Protection (CBP) protest mechanism under 19 U.S.C. §1514, or

- Post-summary correction procedures, as applicable.

However, exporters should note that there is no assurance that the refund process will not be time-consuming.

3. Important Caution for Exporters

While GJEPC is actively engaging with U.S. customs authorities and keeping customs at Bharat Diamond Bourse informed, members are strongly advised to:

- Seek confirmation from their U.S. customs broker and trade counsel

- Obtain written confirmation from their U.S. buyer/importer regarding entry treatment

- Confirm that CBP has ceased collection of the reciprocal tariff at the port of entry

Given the evolving implementation environment, entry-level verification is critical.

Members are encouraged to carefully assess:

- Shipment timing

- Entry dates

- Applicable HTS classification

before dispatching consignments, wherever applicable.

source: GJEPC

-

National News14 hours ago

National News14 hours agoGJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

-

National News15 hours ago

National News15 hours agoWGC India gold market update: Price strength fuels demand Looking ahead

-

International News17 hours ago

International News17 hours agoIGI approves an investment of up to $150,000 in Saudi Arabia

-

National News16 hours ago

National News16 hours agoIndia’s polished diamond exports dip by 3.6 per cent yoy in  January 2026