National News

IGI will apply traditional 4Cs grading standards to all diamonds, including LGDs

The International Gemological Institute (IGI) has publicly reaffirmed its commitment to applying traditional 4Cs grading standards to all diamonds, including laboratory-grown stones, positioning itself in direct contrast to competitor GIA’s recent policy shift toward simplified grading for lab-grown diamonds.

The International Gemological Institute (IGI) has publicly reaffirmed its commitment to applying traditional 4Cs grading standards to all diamonds, including laboratory-grown stones, positioning itself in direct contrast to competitor GIA’s recent policy shift toward simplified grading for lab-grown diamonds.

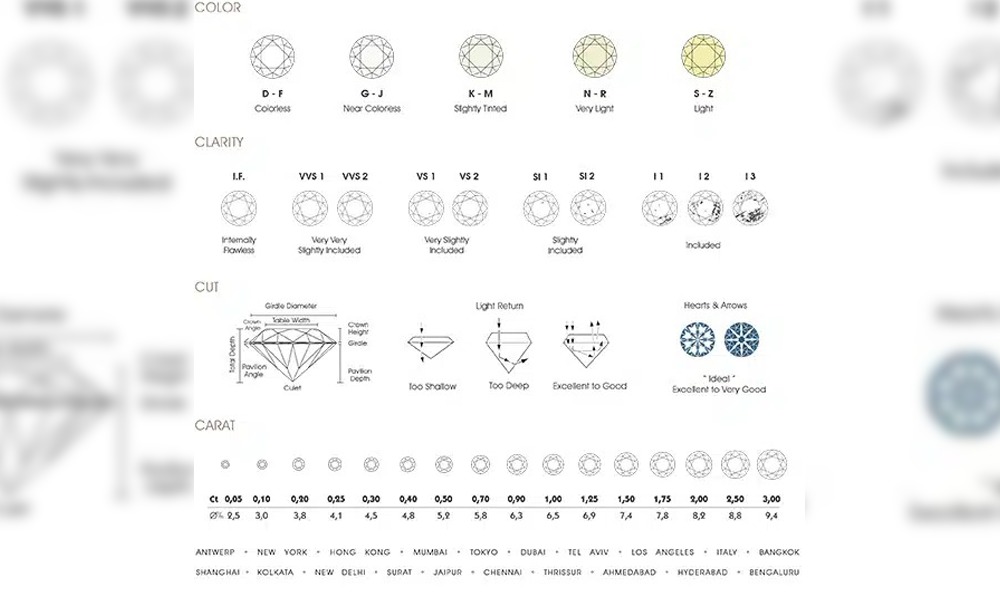

IGI announced on July 14, 2025, that it will continue grading laboratory-grown diamonds using the established 4Cs framework (Cut, Color, Clarity, and Carat weight). The institute, which began grading lab-grown diamonds in 2005, cited the need to “prevent industry and consumer confusion” as the primary rationale for maintaining consistent grading standards across all diamond types.

This announcement comes in direct response to GIA’s June 2025 decision to transition from detailed color and clarity grading to a simplified “standard” or “premium” classification system for laboratory-grown diamonds. GIA, which began grading lab-grown stones in 2006, justified this change by arguing that the vast majority of lab-grown diamonds fall within such a narrow quality range that traditional nomenclature has become less relevant.

IGI’s stance creates clear differentiation in the gemological services market. While GIA focuses primarily on natural diamond grading, IGI has positioned itself as the specialist for laboratory-grown stones, with lab-grown diamonds now comprising 54% of its total grading volume according to recent financial disclosures.

Industry Impact The divergent approaches between the two major grading institutes reflects broader industry tensions regarding the standardization of laboratory-grown diamond evaluation. IGI’s commitment to maintaining traditional grading standards may appeal to:

- Retailers seeking consistent grading terminology across their inventory

- Consumers who prefer familiar quality metrics

- Manufacturers invested in producing higher-grade laboratory-grown stones

This policy difference highlights the evolving competitive landscape in diamond grading services. IGI’s emphasis on comprehensive grading for lab-grown stones may attract clients who view the simplified GIA approach as insufficient for their business needs.

IGI’s strategy carries both opportunities and risks. While maintaining detailed grading standards may preserve consumer confidence and industry familiarity, it also requires continued investment in specialized expertise and equipment for what GIA considers an increasingly homogeneous product category.

The industry’s response to these competing approaches will likely influence future grading standards and market dynamics. Retailers and consumers will ultimately determine whether detailed grading or simplified classification better serves their needs in the laboratory-grown diamond segment.

IGI’s decision to maintain traditional 4Cs grading for all diamonds represents a strategic bet on the continued relevance of detailed quality assessment in the laboratory-grown diamond market. This positions the institute as the primary advocate for comprehensive grading standards while creating clear market differentiation from GIA’s simplified approach. The success of this strategy will depend on industry adoption and consumer preference for detailed versus simplified grading systems.

National News

Outstanding gold-backed loans surge by 128% from a year earlier

India’s appetite for borrowing against gold is reshaping the country’s credit landscape. Outstanding gold-backed loans have surged 128% from a year earlier, crossing Rs.4 lakh crore ($48 billion) for the first time, according to data from the Reserve Bank of India. As of Jan. 31, loans secured by gold jewellery stood at Rs.4,00,517 crore, marking one of the fastest expansions in retail credit in recent years.

The boom in gold loans has helped propel overall non-food bank credit growth to 14.4% year-on-year. Personal loans now account for 34.5% of total bank lending, outpacing other segments and underscoring a broader shift toward consumer-driven credit expansion

Gold loans alone contributed roughly 9% of incremental bank credit during the period. Between January 2024 and January 2026, outstanding gold-backed credit rose by nearly Rs.3.1 lakh crore—an increase of about 338% over two years—more than quadrupling the size of the portfolio.

Two factors are driving the surge. First, gold prices have climbed roughly 152% over the past two years, increasing the collateral value of household holdings. Second, regulatory guidance requiring banks to classify loans secured by gold explicitly as gold loans has sharpened reporting and accelerated balance-sheet growth in the segment.

The trend highlights a distinctive feature of India’s financial system: households’ vast stock of physical gold, long viewed primarily as a store of wealth, is increasingly being mobilized as collateral for formal credit.

While personal lending and credit to nonbank financial companies within the services sector continue to expand rapidly, industrial credit remains uneven. Loans to micro, small and medium enterprises are growing steadily, but borrowing by large corporations has stayed relatively muted.

Since March 21, 2025, banks have added Rs.21.8 lakh crore to their non-food loan books, translating into 12% growth for the financial year to date. Yet it is gold—rather than factories or infrastructure—that is emerging as one of the most dynamic engines of India’s current credit cycle.

-

ShowBuzz3 hours ago

ShowBuzz3 hours agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

National News4 days ago

National News4 days agoIIBS-11: Navigating the ‘New Gold Rush’ in a fragmenting global economy

-

International News4 days ago

International News4 days agoOroarezzo 2026, with Italian Exhibition Group, Manufacturing Explores New Markets

-

GlamBuzz9 hours ago

GlamBuzz9 hours ago#ViRosh Ki Shaadi: Rashmika Mandanna & Vijay Deverakonda Celebrate Love with Temple Gold & Timeless Tradition