JB Insights

Gold Market AnalysisGold shows continued relevance as a hedge against systemic risks

Executive Summary

- Gold experienced unprecedented volatility in 2025, reaching historic highs before facing significant corrections

- Multiple macroeconomic and geopolitical factors created complex market dynamics

- Major financial institutions maintain bullish long-term outlook despite short-term volatility

Key Performance Metrics

- Peak Price: $3,500+ per ounce (April 22, 2025)

- Year-to-Date Gain: 32% increase from January 2025

- Rapid Appreciation: $500 increase in 5 weeks (March-April 2025)

- Maximum Correction: 12% decline to $3,130 per ounce (mid-May)

- Current Range: Trading above $3,300 per ounce

Primary Market Drivers

Political/Policy Factors

- Trump administration tariff policies and executive orders

- Trade negotiations with China and EU (50% tariff imposed)

- Federal Reserve vs. Presidential conflict on interest rate policy

- US trade court rulings blocking “Liberation Day” tariffs

Geopolitical Tensions

- Ongoing Ukraine-Russia conflict

- Israel-Gaza military operations

- US-Houthis skirmishes (later ceasefire)

- India-Pakistan “Operation Sindoor” conflict

Economic Fundamentals

- Weakening US Dollar (index fell below 100)

- Mounting US national debt ($36 trillion, potential $4 trillion increase)

- Global stock market decline (Dow: 37,000 to 42,000 recovery)

- Bond market stress (30-year Treasury yields at 5%, highest since 2023)

Institutional Analysis & Forecasts

Major Bank Predictions (End 2025)

- JP Morgan: $3,675 average, $4,000 by mid-2026

- Goldman Sachs: $3,700 (with $6,000 by 2029)

- UBS: $3,500 (conservative estimate)

- Bank of America: $4,000

Investment Demand Indicators

- Continued central bank purchasing globally

- Increased ETF demand

- Moody’s US debt downgrade (AAA to AA1) supporting safe-haven appeal

- Chinese capital flight from US markets

Competitive Precious Metals Analysis

- Silver: Struggling below $35/oz despite $40 predictions, confined to $33-34 range

- Platinum: Two-year highs with 10% weekly gains, supply shortage concerns (1M oz deficit forecast)

- Palladium: Underperforming, vulnerable to recession impacts

- Bitcoin: Recovery from 76,000 to 102,000+ following federal reserve establishment

Risk Factors & Challenges

Economic Risks

- Recession probability due to tariff uncertainties

- Federal Reserve hawkish stance preventing rate cuts

- Inflation concerns from trade policies

- Weak US Treasury bond auctions

Market Volatility Triggers

- Policy flip-flops on trade tariffs

- Geopolitical ceasefire announcements

- Currency index fluctuations

- Court challenges to administrative policies

Strategic Market Developments

Regulatory Changes

- India: Mandatory hallmarking expansion for gold jewelry and bullion

- United States: Florida accepting gold/silver as legal currency

- Global: Enhanced standardization initiatives

Corporate Responses

- Apple relocating computer manufacturing to India to avoid tariffs

- Supply chain restructuring due to trade policies

Investment Thesis & Outlook

Bullish Factors

- Persistent geopolitical uncertainties

- Fiscal sustainability concerns

- Currency debasement risks

- De-dollarization trends

- Strong institutional demand

Bearish Risks

- Interest rate policy normalization

- Geopolitical conflict resolution

- Economic recession impacting all assets

- Trade policy stabilization

Strategic Recommendations

For Portfolio Managers

- Consider gold allocation as hedge against policy uncertainty

- Monitor Federal Reserve policy divergence signals

- Assess correlation with other safe-haven assets

For Risk Management

- Track geopolitical event calendars

- Monitor US fiscal policy developments

- Evaluate currency exposure implications

For Corporate Strategy

- Assess supply chain vulnerabilities to trade policies

- Consider precious metals exposure in treasury management

- Evaluate geographic diversification strategies

Conclusion

Gold’s 2025 performance demonstrates the asset’s continued relevance as a hedge against systemic risks, despite increased volatility. The convergence of political uncertainty, fiscal concerns, and geopolitical tensions creates a complex but potentially favorable environment for precious metals investment strategies.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

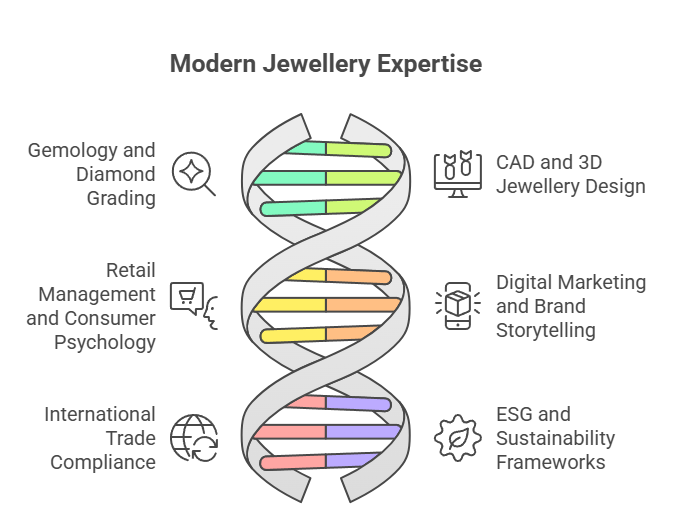

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

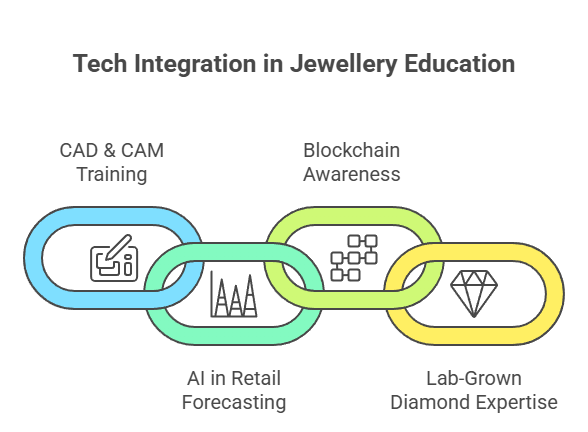

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

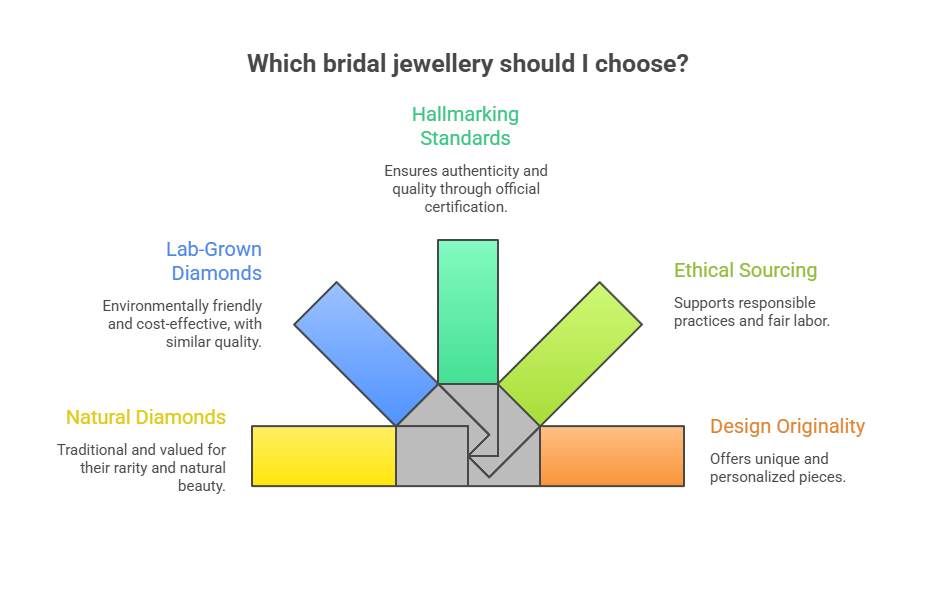

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

Financial Literacy in Jewellery

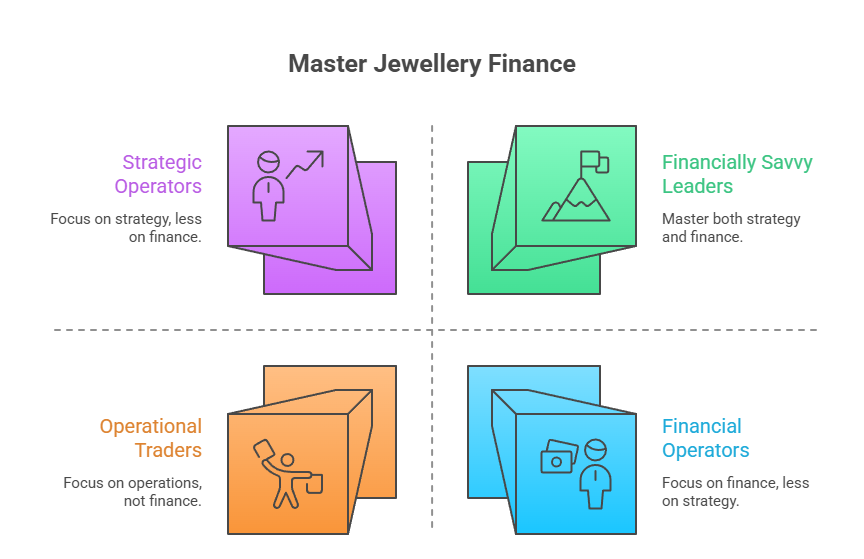

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

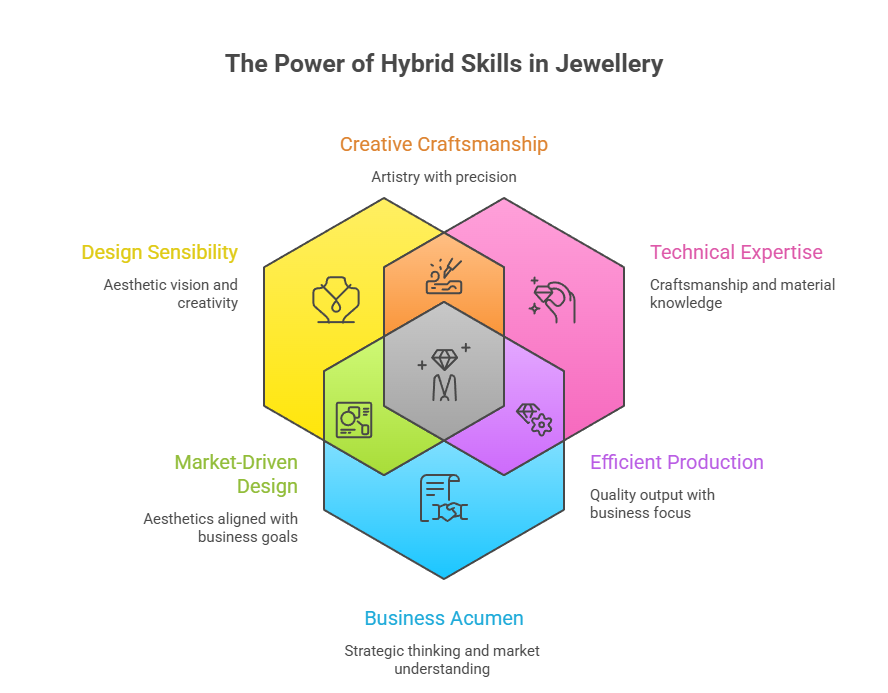

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

National News2 hours ago

National News2 hours agoGold Rebounds in India After Five-Day Slide; Dollar Strength Keeps Pressure Intact

-

National News3 hours ago

National News3 hours agoKumari Fine Jewellery Celebrates the “Modern Indian Original” with Exclusive Women’s Day Showcase

-

National News7 hours ago

National News7 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz23 hours ago

BrandBuzz23 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA