International News

Gold declines and investors opt for dollar, prioritize liquidity

Gold, often considered the quintessential safe-haven asset, witnessed a notable retreat on Monday, slipping over 2% from last week’s record highs. This downturn came as investors, rattled by escalating trade tensions between the U.S. and China, shifted their focus towards the U.S. dollar and other safe-haven currencies like the Swiss Franc and Japanese Yen. The move reflects a broader market recalibration in the face of renewed economic and geopolitical uncertainties.

Spot gold prices fell by 2.4%, settling at $2,963.19 an ounce by early afternoon ET. During the session, the precious metal touched a near four-week low of $2,955.89. Meanwhile, U.S. gold futures also closed 2% lower at $2,973.60. This decline follows an all-time high of $3,167.57 reached just last Thursday, underscoring the volatility gripping the commodities market.

Investor sentiment shifted in favor of the U.S. dollar, which rebounded from a six-month low. A stronger dollar makes gold more expensive for holders of other currencies, putting downward pressure on its price. This change in preference indicates that, during times of acute uncertainty, investors may prioritize liquidity and ease of access — qualities traditionally associated with the dollar — over long-term value storage like gold.

The gold market is currently experiencing significant stress, largely driven by liquidity concerns and speculative activity. According to Bart Melek, head of commodity strategies at TD Securities, margin covering by traders — the need to cover losses on leveraged positions — has added to gold’s downward pressure. This phenomenon typically accelerates declines as investors sell assets to raise cash.

The primary catalyst for the market turmoil is the intensification of the U.S.-China trade conflict. President Donald Trump has floated the possibility of imposing a 50% tariff on Chinese imports if Beijing fails to roll back its own retaliatory tariffs. Meanwhile, speculation that the U.S. administration might pause tariffs for 90 days on all nations except China was dismissed by the White House as “fake news,” adding to the confusion and uncertainty.

Despite the short-term dip in gold, the broader macroeconomic backdrop continues to support a bullish outlook for the precious metal. Futures markets are now pricing in approximately 120 basis points of rate cuts from the U.S. Federal Reserve by the end of the year. The probability of a rate cut as early as May has also risen to 37%. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, thereby boosting their attractiveness.

Analysts remain optimistic about gold’s long-term potential. The metal continues to benefit from robust central bank demand and remains a favored hedge during periods of financial instability and geopolitical strain. The recent correction may be seen more as a pause or consolidation phase rather than a reversal of trend, particularly given the fragile state of the global economy.

International News

73rd Bangkok Gems and Jewelry Fair sets new record with 4.75 Billion Baht in trade value

Over 40,000 visitors from 118 countries propel the fair to its highest trade value since inception.

The Department of International Trade Promotion (DITP), in collaboration with the Gem and Jewelry Institute of Thailand (GIT), announced the successful conclusion of the 73rd Bangkok Gems and Jewelry Fair, held from February 22–26, 2026, at the Queen Sirikit National Convention Center (QSNCC). The event generated total trade value exceeding 4.75 billion baht, the highest since the fair’s inception.

The fair welcomed 40,721 visitors from 118 countries, with international visitors accounting for 61% of total attendance, reaffirming Thailand’s role as a global hub for the gem and jewelry trade. The top five visiting nations included India, Myanmar, China, Japan, and Sri Lanka, whose buyers drove high demand across key categories such as colored stones, silver jewelry, fine jewelry, diamonds, and industry machinery and equipment.

“The success of the 73rd Bangkok Gems & Jewelry Fair reflects the confidence of buyers and industry players worldwide in Thailand’s potential,” said Sunanta Kangvalkulkij, Director-General of DITP. “This event not only set a new record with over 4.75 billion baht in trade value, but it also reinforced Thailand’s vital role as a key global hub for gems and jewelry, even amidst the current challenges of the international economic landscape.”

To accommodate the industry’s growing interest, the 73rd edition expanded its exhibition space to over 53,000 square meters, covering Halls 1–8 and Plenary Halls 1–2. The fair hosted 1,222 companies from 19 countries across 2,794 booths.

The fair was also honored by the presence of Her Royal Highness Princess Sirivannavari Nariratana Rajakanya, who presided over the opening ceremony and viewed the “TREASURE OF DREAMS” exhibition. The showcase featured a high-jewelry collection designed by Her Royal Highness and crafted by master Thai artisans, reflecting her commitment to preserving and advancing traditional Thai craftsmanship while promoting Thailand’s jewelry industry on the international stage.

The 74th Bangkok Gems and Jewelry Fair is scheduled to take place from

September 8–12, 2026, at the Queen Sirikit National Convention Center (QSNCC).

-

National News10 hours ago

National News10 hours agoNeha Kishorkumar Shah, Director, Chandukaka Saraf felicitates influencers at Lokmat Women Influencer Awards

-

GlamBuzz12 hours ago

GlamBuzz12 hours agoDe Beers Group Partners with Abhishek Sharma to Champion Natural Diamonds in India

-

International News13 hours ago

International News13 hours ago73rd Bangkok Gems and Jewelry Fair sets new record with 4.75 Billion Baht in trade value

-

National News15 hours ago

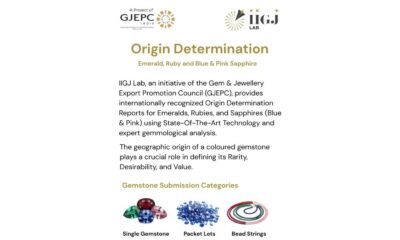

National News15 hours agoIIGJ Lab Jaipur Expands Origin Testing for Ruby, Emerald and Sapphire Lots & Strands