JB Insights

GEMS & JEWELLERY BANKING SUMMIT

The GEMS & JEWELLERY BANKING SUMMIT held in Mumbai addressed the critical issue of perceived lack of transparency in the GJ industry, due to which bankers are reluctant to finance GJ businesses to a large extent. The industry is facing challenges such as higher interest rates on business loans, lack of transparency on the banking policy, and limited access to bank loans.

Avenues explored for enhancing access to finance, fostering entrepreneurship and catalysing digital transformation

The GEMS & JEWELLERY BANKING SUMMIT held in Mumbai addressed the critical issue of perceived lack of transparency in the GJ industry, due to which bankers are reluctant to finance GJ businesses to a large extent. The industry is facing challenges such as higher interest rates on business loans, lack of transparency on the banking policy, and limited access to bank loans.

The Gems & Jewellery Banking Summit was inaugurated at the Jio World Convention Centre, Mumbai .Present at the inauguration were Sachin Jain, CEO -WGC, Saiyam Mehra, Chairman -GJC, Rajesh Rokde, Vice Chairman-GJC ,Ravi Prakash Agarwal, Director-GJC and Convenor – Gems & Jewellery Banking Summit, Sunny Dholakia, Co Convenor -Gems & Jewellery Banking Summit, committee members of GJC and dignitaries of the GJ industry and banking & finance sector.

Gems & Jewellery Banking Summit, an initiative of GJC, is presented by WGC. The Summit is powered by ShreeKunj- Kolkata and supported by Banglore Refinery, Mukti Gold , Yes Bank and Laxmi Diamonds, Bengaluru.

The GJ sector communicated to the banks and financial institutions that they want to be treated like any other mature sector. Saiyam Mehra,Chairman- GJC in his inaugural welcome address said “Like other industries, GJ sector is also transforming. The GJ sector is requesting all bankers to treat GJ industry on par with other industries; keep interest rates at 8-9 % with a spread of 0-1%. Additionally the industry is seeking easier policies and facilitation for EMI based buying facilities for end-consumers, credit card swiping interest rates and EDC/POS machine implementation in every retail showroom.”

An advantage of dealing with GJ SECTOR was underscored at the summit::This industry not only provides sales profit but also benefits from price increases. Gold prices rarely decrease, so the increased price profit is also shared with the bankers. Furthermore, the domestic G&J sector has a unique modus operandi, requiring proper KYC of the end consumer, creating a database for more transparency in the sector.

Leading players from the GJ and banking sectors held intensive panel discussions. The session on Strength of the GJ industry: Financing opportunities for Bankers & Building resilience in the GJ industry pointed out that for a long time banks viewed the GJ sector with scepticism. But, there has been a change in the relationship with industry getting organized, especially post the Gold Control Act. There was a unanimous opinion that compliance, governance, ethical and efficient accounting were key to building a reputation as an ethical player. It was essential to share data with banks, maintain accounts and meticulous documentation.

In Understanding of Financial Tools for Jewellery Industry the panelists underscored the importance of taking advantage of facilities offered by banks if one wishes to grow. It is imperative to get a credit rating for one’s business. Finance is based on data, not just on collaterals. There was an intense discussion on the features and modalities of gold metal loan including the fact it is an affordable way of funding and that it is a pure hedge. There were various suggestions from the panel and the audience on how the GML could be streamlined and contributed to ease of doing business.

In the Banking strategy to revitalize and empower session panellists concurred that jewellery industry must take cognizance of the fact that to grow and expand one cannot rely on internal accruals; one has to avail of the funds and products available from banks. The panel concurred that there was lack of awareness on why one should avail of credit – especially against a rising asset like gold.A large percentage of jewellers don’t want to take a loan or don’t get loans because of improper financial statements and documentation.

The panellists in the session Risk Management Mechanism stressed on understanding and respecting regulations and laws of the land .Ratings and credit scores that demonstrate creditworthiness are crucial. It is important to understand that banks don’t wish to place any hindrances, they just work within regulatory and risk management guidelines. Compliance and transparency will be crucial in upliftment of the GJ industry.

The summit concluded on a positive note with both parties keen on continuing the conversation. As Sachin Jain stated that we may not have all the answers and solutions at the end of the summit, but it is encouraging that we have commenced a dialogue.

The next edition of the GEMS & JEWELLERY BANKING SUMMIT is scheduled for 17 May 2025.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

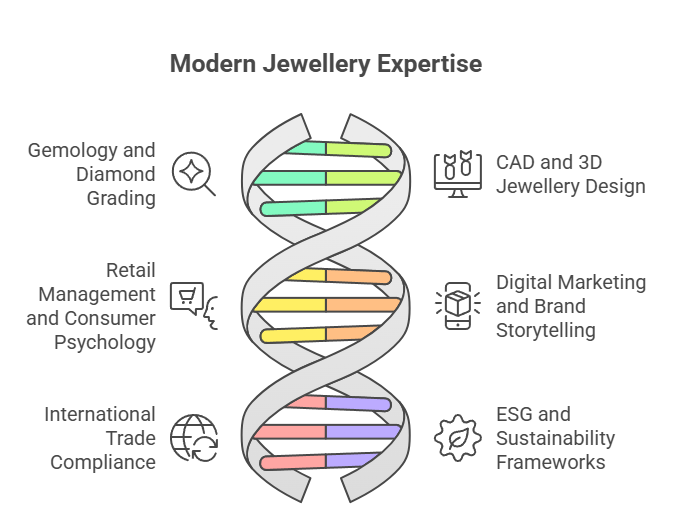

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

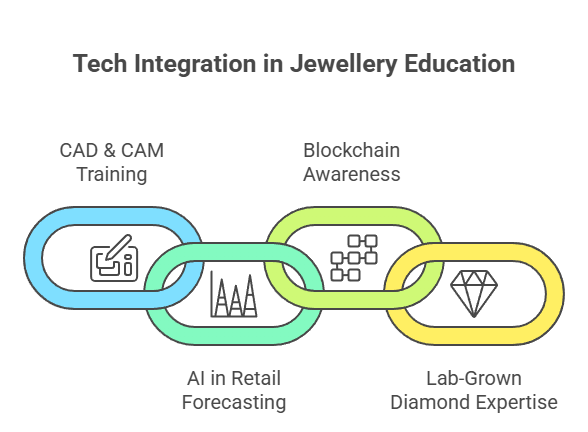

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

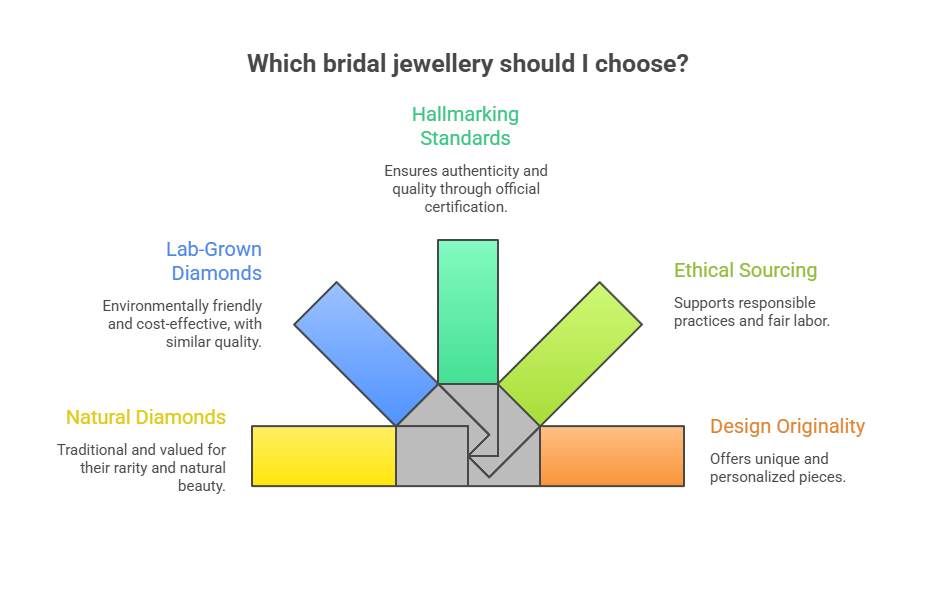

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

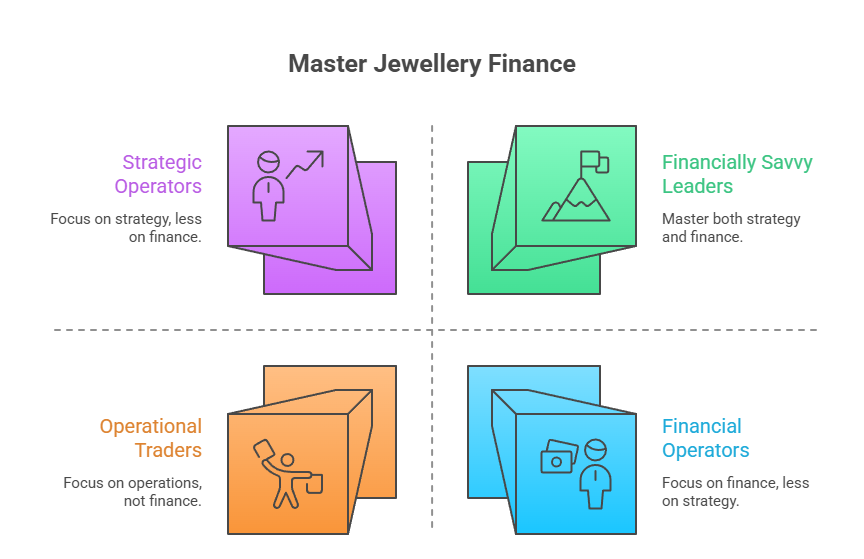

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

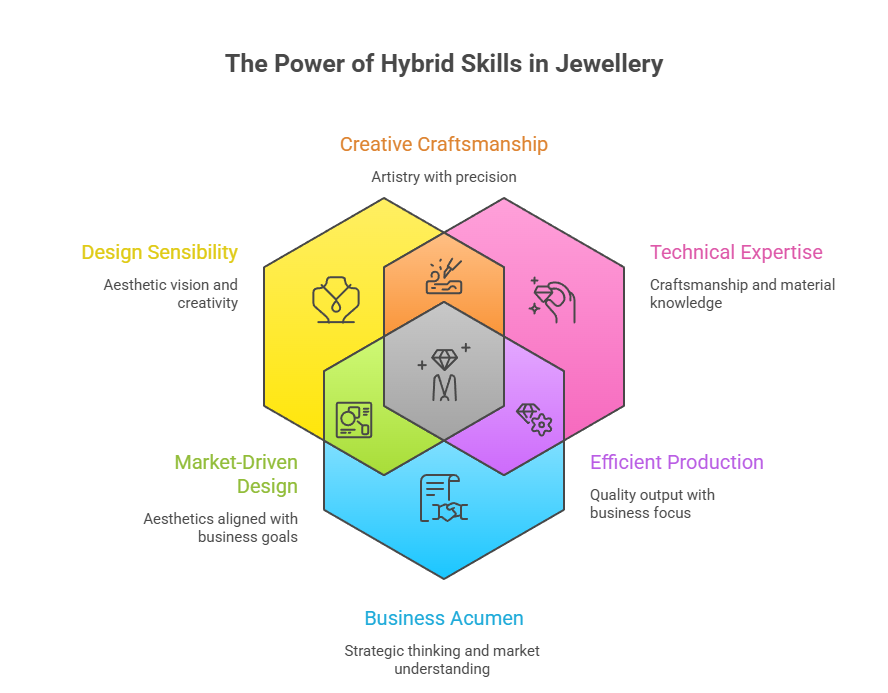

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

BrandBuzz11 hours ago

BrandBuzz11 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz12 hours ago

BrandBuzz12 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz15 hours ago

BrandBuzz15 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News16 hours ago

National News16 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression