International News

Gemfields June ‘24 Rubies Auction nets $68.7mn

Gemfields is pleased to announce the results of a ruby auction comprised of mixed-quality rough rubies held during the period 3 to 18 June 2024.

Highlights:

- Total auction revenues of USD 68.7 million

- 94 of the 97 lots (comprising 217,044 carats) offered for sale were sold (97%)

- Average realised price of USD 316.95 per carat

- The 22 auctions of MRM gemstones held since June 2014 have now generated USD 1.12 billion in total revenue

Adrian Banks, Gemfields’ Managing Director of Product & Sales, commented: “This auction marks the 10th anniversary of Gemfields’ first auction in June 2014 of rubies from the Montepuez Ruby Mine in Mozambique. We are pleased to announce another strong result demonstrating the confidence that loyal customers have in our product offering and auction platform. While auction results should not be directly compared, our team is proud to have crossed the milestone of an average selling price of USD300 per carat at this auction.

While the industry is currently facing some headwinds, arising in part from a softening in China, we hope this result provides good comfort to other stakeholders in our sector. As always, our thanks and appreciation goes out to the hardworking team at MRM, our partners Mwiriti and the Government of Mozambique, whose support makes these results and achievements possible.”

The rough rubies were extracted by Montepuez Ruby Mining Limitada. The proceeds of this auction will be fully repatriated to MRM in Mozambique, with all royalties due to the Government of the Republic of Mozambique being paid on the full sales price achieved at the auction.

International News

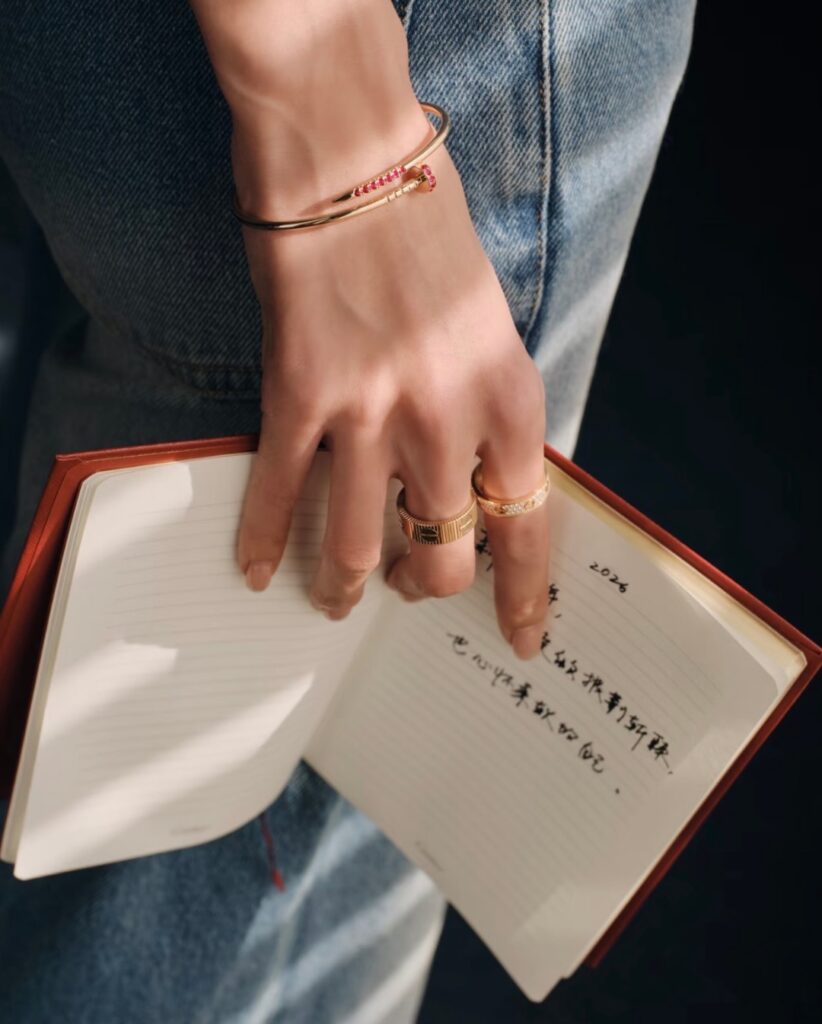

Cartier Reimagines an Icon: The Ruby-Set ‘Juste un Clou’ Debuts for Lunar New Year

A Fusion of Industrial Rebellion and Festive Elegance Marks a Limited-Edition Celebration of Luck and Prosperity.

In a bold intersection of high-fashion defiance and cultural tradition, Cartier has unveiled a limited-edition interpretation of its legendary Juste un Clou collection. This special release sees the iconic “nail” silhouette transformed with a festive row of vivid red rubies, launched specifically to commemorate the Lunar New Year.

Originally conceived in 1970s New York by designer Aldo Cipullo, the Juste un Clou has long been a symbol of the “rebellious spirit” and the elevation of the ordinary into the extraordinary. By integrating rubies—stones that traditionally symbolize luck, vitality, and renewal—Cartier effectively bridges its radical Western design heritage with the deep-rooted values of the East.

The collection features the signature wrap-around nail design in gold in bracelets, necklaces, earrings & rings with the “head” and “point” of the nail meticulously pavé-set with high-quality rubies. Industry experts view this move as a strategic masterstroke, as the “festive red” aesthetic continues to be a primary driver for luxury consumption during the spring transition.

-

BrandBuzz4 days ago

BrandBuzz4 days agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises3 days ago

New Premises3 days agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

National News4 days ago

National News4 days agoBakul Limbasiya Receives Prestigious APO National Award for LGD Pioneering

-

Appoinment4 days ago

Appoinment4 days agoTiffany & Co. Strengthens Leadership with David Ponzo as Deputy CEO