National News

Gem & Jewellery Exports at US$ 23.19 Billion Remain Stable in April 2025ŌĆōJanuary 2026; IndiaŌĆōUS Trade Agreement Framework Brings Relief and Sets Stage for Recovery: Gem & Jewellery Export Promotion Council (GJEPC)

Marginal 0.64% dip in dollar terms offset by 3.57% rupee growth; new IndiaŌĆōUS trade framework and market diversification signal revival momentum for FY 2026ŌĆō27

IndiaŌĆÖs gem and jewellery exports remained broadly stable during April 2025ŌĆōJanuary 2026, reflecting resilience amid global trade headwinds and tariff-related pressures in key markets.

Overall gross exports stood at US$ 23.19 billion (Rs.2,03,280.72 crore), registering a marginal decline of 0.64% in dollar terms while growing 3.57% in rupee terms, compared to US$ 23.33 billion (Rs.1,96,277.49 crore) recorded during the same period last year. This performance underscores the sectorŌĆÖs underlying stability despite volatile global conditions.

The export outcome was significantly influenced by a sharp contraction in shipments to the United States, IndiaŌĆÖs largest gem and jewellery export destination, where exports declined by over 45% due to elevated tariffs and pricing disadvantages. However, the recently announced IndiaŌĆōUS trade deal, which restores tariff access for gems and jewellery at 18%, is expected to be a major inflection point. The tariff rollback is projected to lift IndiaŌĆÖs gem and jewellery exports by up to US$ 3 billion in the near term, driven by renewed price competitiveness and trade re-creation.

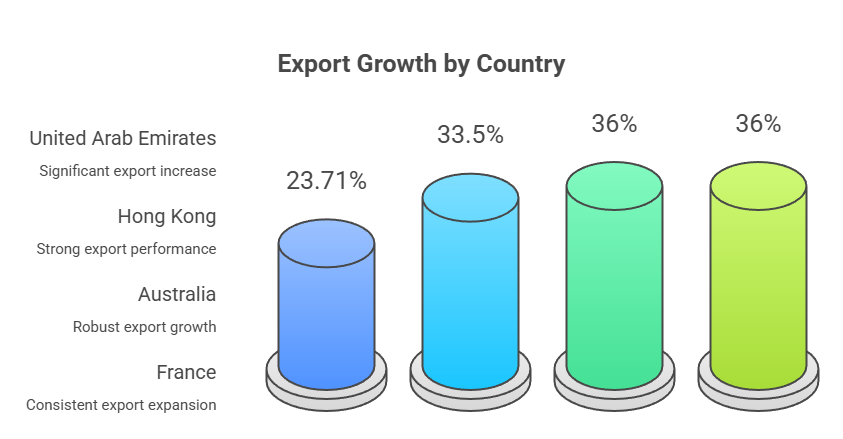

Even as exports to the US faced temporary pressure, India successfully diversified its export markets, recording strong growth across several key destinations. During April 2025ŌĆōJanuary 2026:

- Exports to the United Arab Emirates grew 23.71%

- Hong Kong rose 33.5%

- Australia and France posted robust growth of over 36% each

- Other markets such as Belgium, Thailand, and Israel also recorded double-digit growth

This demonstrates IndiaŌĆÖs expanding global footprint and the industryŌĆÖs ability to adapt to shifting trade dynamics.

Shri Kirit Bhansali, Chairman, GJEPC, said:ŌĆ£IndiaŌĆÖs gem and jewellery exports have remained broadly stable during AprilŌĆōJanuary at US$ 23.19 billion, despite global headwinds, with a marginal decline in dollar terms and positive growth in rupee terms underscoring the sectorŌĆÖs resilience. The announcement of the framework for the IndiaŌĆōUS trade deal has brought much-needed relief.

The revised 18% tariff on jewellery and zero duty on diamonds and coloured gemstones will place India in a structurally superior position over key competitorsŌĆöacross diamonds, coloured gemstones and studded gold jewellery.

This advantage is expected to help Indian exporters regain lost ground in the US market and re-create trade, potentially adding up to US$ 3 billion in the near term. Supported by market diversification and a strong pipeline of trade agreements, the industry is well positioned for recovery and sustained growth in FY 2026ŌĆō27.ŌĆØ

He further added:

ŌĆ£This outward-looking trade strategy has been strongly complemented by domestic reforms. Union Budget 2026ŌĆō27 is highly positive for the gem and jewellery sector, with a clear focus on ease of doing business, customs reforms, faster clearances and improved access to finance. Measures such as digital appraisals, advance filing of Bills of Entry, concessional SEZ-to-DTA sales and targeted MSME support will reduce costs, improve cash flow and strengthen export competitiveness.

Overall, the Budget lays a solid foundation for growth, job creation and export expansion, aligned with the sectorŌĆÖs long-term vision of achieving US$ 100 billion in exports by 2047.ŌĆØ

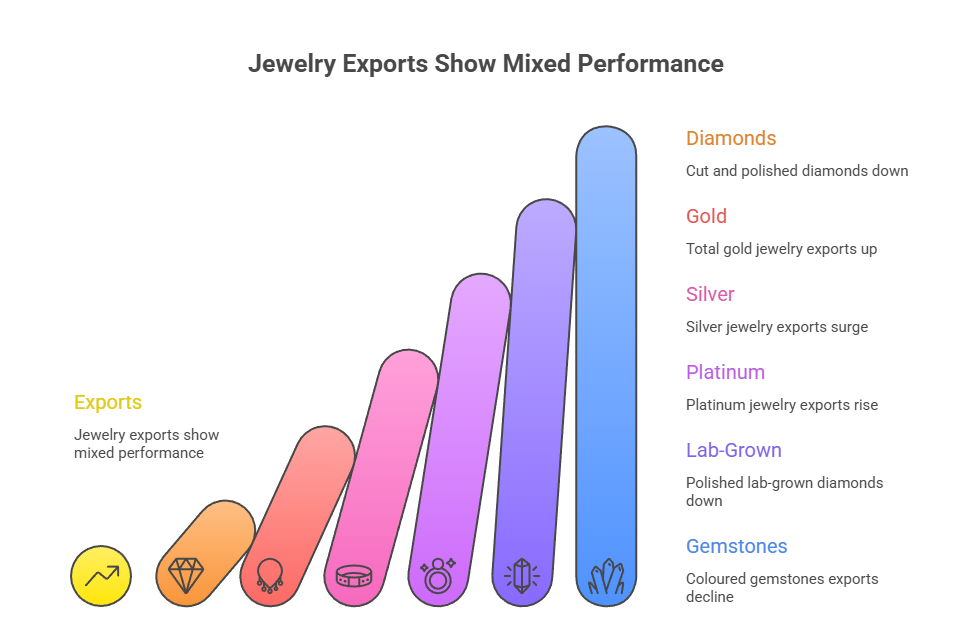

Segment-wise Performance (April 2025ŌĆōJanuary 2026)

- Cut and polished diamonds: US$ 9.97 billion, down 7.46% year-on-year

- Total gold jewellery exports (plain and studded): US$ 9.71 billion, up 5.53% year-on-year

- Plain gold jewellery: up 1.57%

- Silver jewellery: US$ 1.28 billion, up 51.21%, driven by strong international demand and higher silver prices

- Platinum jewellery: US$ 215.15 million, up 49.09%, supported by growing acceptance in niche and premium markets and price appreciation

- Polished lab-grown diamonds: US$ 923.62 million, down 9.73% in value, despite significant volume growth, indicating price softness

- Coloured gemstones: US$ 342.34 million, down 3.38%, reflecting stable but subdued demand

The overall performance highlights the sectorŌĆÖs resilience, strengthened by market diversification, supportive trade agreements, and reform-oriented domestic policy measures.

source:GJEPC

National News

GJEPC felicitates Piyush Goyal, Jitin Prasada on successful completion of the IndiaŌĆōUSA Interim Agreement

GJEPC felicitated HonŌĆÖble Commerce & Industry Minister Piyush Goyal and MoS Jitin Prasada in New Delhi today (11 Feb 2026) on the successful completion of the IndiaŌĆōUSA Interim Agreement. Conversations were directed toward scaling exports and fortifying IndiaŌĆÖs gem & jewellery trade landscape.

The delegation was led by Kirit Bhansali, Chairman, GJEPC and included Anoop Mehta, Convener, Diamond Panel; Mital Doshi, Convener, Banking, Insurance & Taxation; Antarpal Singh Sawhney, Regional Chairman, Northern Region; and K.K. Duggal, Director, Policy.

Prominent trade members present included Govind Dholakia, MP, Rajya Sabha & SRK; Alkesh Shah, Goldstar Jewellery; and Milan Parikh, Mahendra Brothers.

Kirit┬Ā Bhansali , Chairman GJEPC said,┬Ā ” Honoured to felicitate Hon’ble CIM┬Ā Piyush Goyal ji & MoS┬Ā┬Ā Jitin Prasada ji with the GJEPC delegation.Grateful for your leadership in securing zero-duty on Indian diamonds & steep tariff reduction on jewellery in the US market. A game-changer for our Exporters and MSMEs.India’s G&J sector shines brighter now. Tha nk you for always backing this sector & ‘Made in India’.”

Source :GJEPC

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains

-

International News2 weeks ago

International News2 weeks agoWGC: Gold Investment Rockets in 2025, Setting a New High as Uncertainty Bites