GlamBuzz

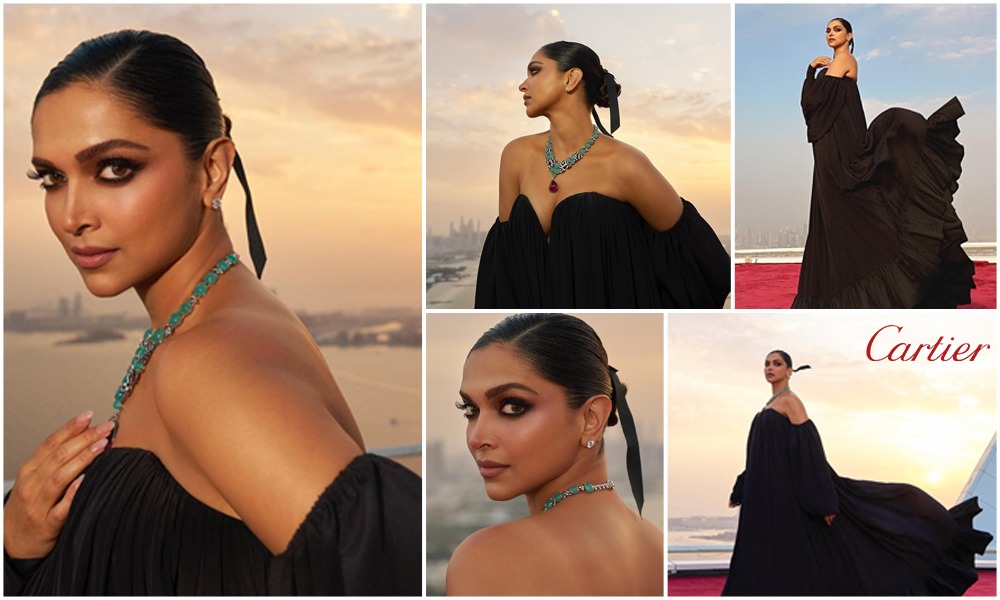

Deepika Padukone Shines in Dubai at Cartier’s 25th Anniversary Celebration with a Stunning 63.76-Carat Necklace

The Bollywood star dazzles in a black gown and a show-stopping piece of jewelry at the prestigious event.

Deepika Padukone, the global icon and Cartier brand ambassador, made an unforgettable appearance at the luxury brand’s 25th anniversary celebration in Dubai. The actress stunned the crowd in an elegant black gown paired with a jaw-dropping 63.76-carat necklace, cementing her place as the highlight of the evening.

However, it was the massive Cartier necklace that truly stole the show. A piece from the brand’s Nature Sauvage collection, the Chryseis necklace was a tribute to the delicate black-and-white patterns of butterfly wings, a symbol close to Cartier’s heart. The stunning 63.76-carat rubellite pendant took center stage, surrounded by black and white diamonds, and highlighted by vibrant chalcedony beads. The red-green-black trio of shades, emblematic of the Maison, added a touch of rich symbolism to the already mesmerizing necklace.

Complementing her necklace, Deepika accessorized with dazzling diamond ear studs, completing her luxurious look. Her makeup was equally impeccable, with feathered brows, shimmering gold eyeshadow, smudged kohl, winged eyeliner, and long mascara-adorned lashes. Her cheeks were flushed with a soft glow, and her lips were dressed in a glossy mauve hue. Deepika’s hair was styled in a side-parted twisted bun, elegantly topped with a silk black bow, adding the finishing touch to her impeccable ensemble.

The evening was an epitome of glamour and grace, with Deepika Padukone effortlessly taking over Dubai with her show-stopping style.

GlamBuzz

Sai Tamhankar Inaugurates Litestyle by PNG Jewellers’ First Standalone Store in Chhatrapati Sambhaji Nagar

The contemporary lightweight jewellery brand marks its 7th store launch with a glamorous inauguration, expanding its presence in Maharashtra’s emerging lifestyle market.

Litestyle by PNG Jewellers, the contemporary lightweight jewellery brand from the House of PNG Jewellers, has expanded its retail footprint with the launch of its 7th store and first standalone outlet in Chhatrapati Sambhaji Nagar, inaugurated by actress Sai Tamhankar

Strategically located at Shop No. 31, Ground Floor, Prozone Mall, MIDC Chikhalthana, the newly launched 1200 sq. ft. store marks a significant milestone for the brand as it strengthens its presence in emerging lifestyle markets. The store was inaugurated by the actress adding glamour and excitement to the launch celebration.

Designed to cater to the evolving preferences of modern, style-conscious consumers, the store showcases an exclusive range of lightweight gold and diamond jewellery. Staying true to the Litestyle philosophy, the collections feature contemporary, versatile, and easy-to-wear designs that seamlessly transition from everyday wear to special occasions. The store offers gold jewellery in 14 karat, 18 karat, and 22 karat, along with finely crafted diamond jewellery set in 18 karat gold. With a focus on comfort, minimalism, and elegance, Litestyle aims to make fine jewellery more accessible and relevant for today’s dynamic lifestyles.

To celebrate the launch, Litestyle is offering up to 50 percent off on making charges of all Litestyle jewellery, valid until 15th March 2026. The offer is aimed at encouraging customers to explore fine jewellery that blends modern aesthetics with comfort and affordability, making it suitable for work, casual outings, and social occasions.

Speaking at the inauguration, Sai Tamhankar said, “I am delighted to be part of Litestyle’s first standalone store launch in Chhatrapati Sambhaji Nagar. The brand beautifully captures how today’s women want jewellery that is light, expressive, and effortlessly stylish. It’s wonderful to see fine jewellery being reimagined in such a contemporary way.”

Hemant Chavaan, Head – Marketing, CRM and CSR, Litestyle by PNG, said, “Chhatrapati Sambhaji Nagar is a growing city with a strong cultural identity and evolving fashion sensibilities. With our first standalone Litestyle store here, we aim to offer customers a dedicated space to explore lightweight gold and diamond jewellery designed for modern lifestyles. This launch aligns with our vision to expand Litestyle across key cities and bring contemporary fine jewellery closer to our customers.”

With this launch, Litestyle by PNG Jewellers continues to strengthen its position as a preferred destination for modern, lightweight fine jewellery, combining contemporary design aesthetics with the legacy of trust and craftsmanship associated with PNG Jewellers.

-

BrandBuzz15 hours ago

BrandBuzz15 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz15 hours ago

BrandBuzz15 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz19 hours ago

BrandBuzz19 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News19 hours ago

National News19 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression