International News

CIBJO recommends new definition of ‘recycled gold’

The World Jewellery Confederation (CIBJO) is recommending a new definition of “recycled gold״ to be used in the jewellery and watch sectors, so as to provide greater clarity and consistency both within the industry and marketplace. CIBJO will henceforth include the definition in the guidance documents it produces.

The definition, which covers recycled materials recovered during manufacturing and fabrication processes before being sold to consumers, and also gold recovered from materials after they have been sold to consumers, was developed through extensive discussions among industry experts. It is designed to set stricter criteria for secondary and circular gold supplies, and aims to improve the identification of inputs and outputs in the gold refining and fabrication processes, as well promoting transparent and responsible sourcing.

CIBJO acknowledged the contribution made by the International Standardisation Organization (ISO) in creating a draft of the definition, as part of a wider standard ISO was developing for responsibly sourced gold, a project in which CIBJO was an active participant.

“There has been growing confusion about the different names and labels for re-refined gold,” explained CIBJO President Gaetano Cavalieri. “The new definition provides a clear statement and set of criteria for recycled gold, which is more stringent than definitions for many other materials. The industry needs a clearer definition to avoid consumer confusion and greenwashing, and to enhance trading practices and supply chain transparency.”

The new definition has already being accepted as a substantial improvement by leading jewellery industry participants and associations, and key industry bodies like the London Bullion Market Association (LBMA) and the World Gold Council (WGC) are considering how to incorporate the main elements of this definition into their guidance and responsible sourcing practices. For its part, the Responsible Jewellery Council (RJC) has already included a definition based on the same criteria in its updated Chain of Custody standard.

International News

Global Platinum Jewellery Market Rebounds, Driven by Surging Demand in China and Resilience in Key Markets

The global platinum jewellery market showed strong recovery in the first quarter of 2025, according to Platinum Guild International’s (PGI) latest Platinum Jewellery Business Review. Growth was led by a sharp rebound in China and steady gains in India, alongside positive trends in the US, UAE, and Japan.

In India, platinum jewellery continued to grow despite wider market challenges, including record-high gold prices and the seasonal slowdown at the end of the financial year in March. PGI’s top 15 strategic partners in India posted an average year-on-year platinum sales growth of 7%, supported by in-store activations, digital campaigns such as Platinum Love Bands, and celebrity-led marketing.

China delivered the strongest performance, with platinum jewellery fabrication rising 50% year-on-year in Q1, significantly outperforming gold and diamond categories. The surge was driven by both plain and gem-set platinum jewellery, as jewellers shifted away from gold amid high prices and sluggish diamond demand. PGI reported the opening of over 40 platinum-dedicated wholesale showrooms and the conversion of several gold production lines to platinum. Retail sales rose 16% year-on-year, prompting calls for stronger marketing and new product offerings to sustain demand.

In the UAE, platinum jewellery retail sales grew 25% year-on-year. Platinum now has a presence in 136 stores across the GCC, with PGI’s focused partnerships and campaigns helping to expand the category’s footprint, particularly among South Asian communities.

Japan saw platinum jewellery outperform the broader market for the sixteenth straight quarter. Unit sales rose 1% year-on-year in Q1, driven by discount stores, department stores, and non-store channels. Pendants, necklaces, Kihei chains, and affordable platinum pieces remained in demand.

In the United States, platinum jewellery unit sales rose 19% year-on-year among PGI’s strategic partners, with revenue up nearly 24%. Wedding bands and fashion jewellery led the gains, and some retailers continued to convert inventory from white gold to platinum.

“As consumers increasingly seek meaningful, high-quality pieces at accessible price points, platinum is gaining ground not just in China, but also in key markets such as India, Japan, the United States and the United Arab Emirates,” said Tim Schlick, CEO, PGI. “PGI’s strategic partnerships remain at the heart of this growth story, helping to build lasting consumer connections with platinum.”

International News

Gold stable as Fed maintains data-driven stance AUGMONT BULLION REPORT

Supported by a declining dollar, gold extended its gains from the previous session to approximately $3325 (~Rs 96500) as investors continued to keep an eye on trade events and review the most recent FOMC minutes.

- The Fed’s June meeting minutes revealed disagreement among officials over the timing and scope of possible interest rate cuts.

- Views varied from supporting a reduction as early as July to favouring no cuts at all by year’s end, even though the majority expected some easing later this year.

- In the face of conflicting economic signals, such as tariff-related inflation threats, declining consumer spending, and a labour market that is nonetheless robust, the Fed remained cautious and data-driven.

Technical Triggers

- Gold continues to trade near the lower side of the range of $3300 (~Rs 96250) and $3400 (~Rs 98500). If prices sustain below $3280 (~Rs 96000), weakness could further extend to $3200 (~Rs 94000).

- Silver is not able to sustain above its range of $37.5 (~Rs 108,500) and $35.5 (~Rs 105,000). Consolidation continues before heading higher towards the next target is $38 (~Rs 110,000).

Support and Resistance

| Category | Support Level | Resistance Level |

|---|---|---|

| International Gold | $3280/oz | $3370/oz |

| Indian Gold | ₹96,000/10 gm | ₹97,700/10 gm |

| International Silver | $35.5/oz | $37.5/oz |

| Indian Silver | ₹1,05,000/kg | ₹1,10,000/kg |

International News

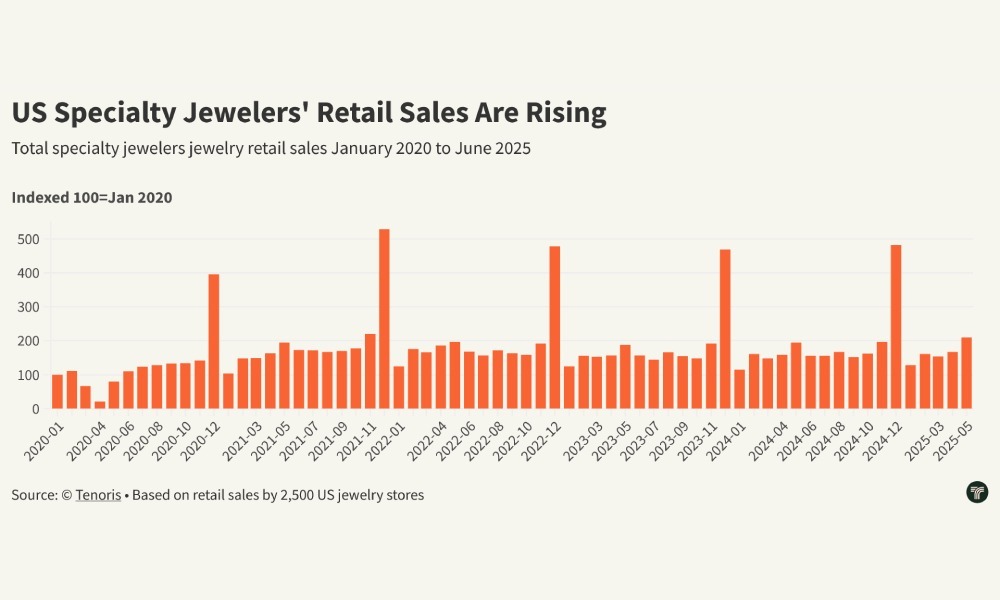

Tenoris Report: 5% rise in jewellery sales in H1 2025

Gold jewellery led category growth with low double-digit revenue gains

The jewellery market posted a healthy 5% revenue growth in H1 2025, according to Tenoris, sustained by a steady five-month rise and a 3% increase in June sales. While the total number of pieces sold declined, consumers spent more per item, leading to a 10% surge in expenditure per unit in June and higher average prices across diamond, sapphire, gold, platinum, and silver jewellery.

Lab-grown jewels stood out, recording higher unit sales despite falling average prices, reflecting shifting consumer preferences. Round diamonds, though still dominant at 52% of sales, are gradually losing ground to oval shapes, which now account for 20%.

Finished jewellery also performed well, especially bracelets, which saw nearly 10% year-on-year revenue growth. Demand is strengthening in higher price segments, notably items priced between $7,500 and $10,000.

Natural diamond jewellery sales dipped in June but rose 3% year-to-date, driven by demand for pendants, bracelets, and necklaces above $2,500, often featuring lab-grown diamonds. The loose natural diamond market saw higher average carat weights but longer inventory turnover, while lab-grown loose diamonds continued to capture market share. Overall, the industry is rebounding from flat sales in H1 2024 and is focused on tapping new consumer demographics to sustain momentum.

-

National News7 days ago

National News7 days agoMalabar Gold & Diamonds Inaugurates Landmark Integrated Manufacturing Site in Hyderabad, Cementing Its Position as a Global Manufacturing Leader

-

National News2 months ago

National News2 months agoEmmadi Silver Jewellery Launches First Karnataka Store with Grand Opening in Bengaluru’s Malleshwaram

-

BrandBuzz3 months ago

BrandBuzz3 months agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

GlamBuzz2 months ago

GlamBuzz2 months agoGokulam Signature Jewels Debuts in Hyderabad with Glamorous Launch at KPHB