International News

CIBJO Introduces New Guidelines for Measuring ESG Performance in the Jewellery Supply Chain

The World Jewellery Confederation (CIBJO) has launched a new set of guidelines aimed at assisting jewellery businesses in assessing their environmental, social, and governance (ESG) performance. This follows last year’s release of the ESG principles document and builds upon it by offering practical measurement tools.

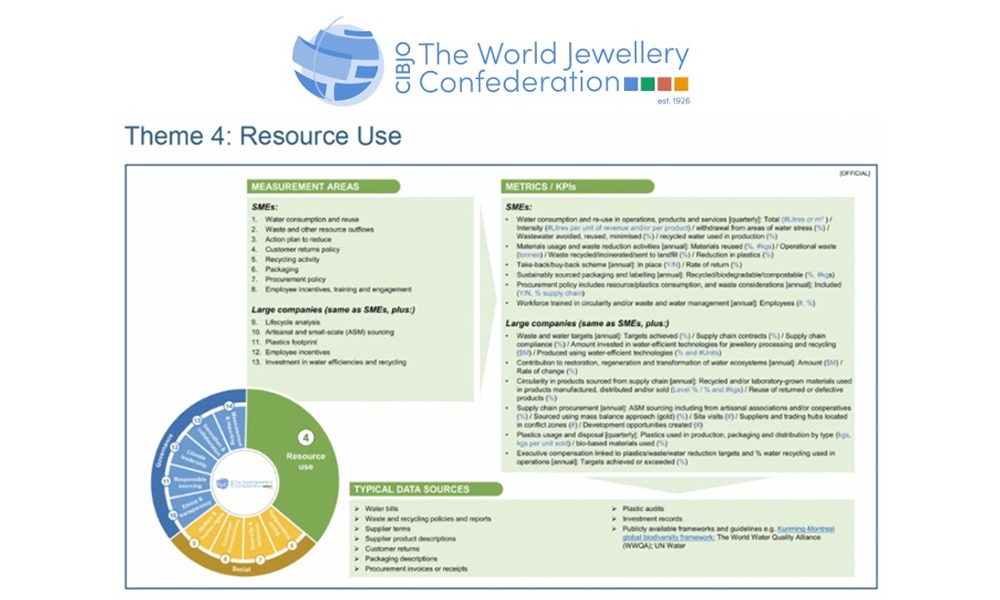

The “CIBJO Guidelines for Measuring ESG Performance,” created by CIBJO’s Laboratory-Grown Diamond Committee in collaboration with Key & Co. and the Sustainable Development Commission, provides a comprehensive framework suitable for various sectors of the jewellery industry, ranging from large corporations to smaller businesses. Unlike the earlier document, which focused solely on lab-grown diamonds, these updated guidelines apply across the entire jewellery supply chain.

The guidelines are organized around 14 key ESG themes, each with detailed measurement areas and example metrics. Acknowledging the diverse and fragmented nature of the jewellery industry—especially the challenges faced by artisanal mining and small and medium-sized enterprises (SMEs)—the document presents a practical 10-step approach for companies beginning their ESG journey. It also includes a glossary of terms to clarify complex language.

CIBJO President Gaetano Cavalieri emphasized the importance of the guidelines, stating, “This is a highly valuable resource, and we are pleased to make it freely available to all industry members.” He also pointed out the increasing trend of turning ESG principles into legal obligations, referencing the European Commission’s upcoming ESG regulations as an example.

Set to take effect in 2027, these new regulations will require many listed SMEs to disclose their ESG impacts. Cavalieri highlighted the need for the industry to prepare in advance, positioning the guidelines as an essential tool in this preparation process.

DiamondBuzz

Diamond Slump forces Debswana to diversify into copper, platinum and solar

Diamond-centric mining models is giving way to broader resource portfolios

Debswana Diamond Company, the 50–50 joint venture between the Botswana government and De Beers, is moving to diversify into copper, platinum and renewable energy as the prolonged downturn in natural diamond demand pressures earnings and forces the industry to rethink its growth strategy.

The company’s board has approved plans to invest in a portfolio of non-diamond projects after revenue fell 46% in 2024, the latest available financial year, highlighting the scale of the downturn in the global diamond market.

The move signals a strategic shift toward commodities with stronger long-term demand fundamentals, particularly copper, which is central to global electrification and energy-transition infrastructure.

Debswana’s diversification reflects a broader industry pivot as diamond producers confront weak consumer demand, rising competition from lab-grown stones and elevated inventories across the supply chain.

The shift is also visible among smaller exploration companies. Botswana Diamonds recently rebranded as Botswana Minerals, signalling its own strategic focus on copper exploration rather than diamonds.

Together, these moves underscore a growing consensus across the sector: the era of diamond-centric mining models is giving way to broader resource portfolios anchored in energy-transition metals.

-

BrandBuzz11 hours ago

BrandBuzz11 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz12 hours ago

BrandBuzz12 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz15 hours ago

BrandBuzz15 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News16 hours ago

National News16 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression