International News

Christie’s to Auction $12M Kashmir Sapphire Ring in Hong Kong

Rare 35.09-Carat Sapphire Leads Magnificent Jewels Sale Featuring High-Value Colored Diamonds and Designer Pieces

A rare Kashmir sapphire ring valued at up to HKD 95 million ($12.2 million) is set to headline Christie’s Magnificent Jewels auction in Hong Kong on May 27. The ring, featuring a 35.09-carat antique cushion-shaped royal blue sapphire surrounded by round diamonds, is expected to be the star lot among 129 pieces offered at the event.

Previously, the sapphire ring gained international attention after selling for $7.4 million at Christie’s Geneva in 2015—well above its high estimate—and was also featured in the auction house’s New York sale in 2000.

Colored gemstones dominate the top end of the upcoming auction, with half of the top 10 lots featuring fancy-colored diamonds. Among them is a ring with a 13.22-carat Burmese ruby flanked by diamond side stones, estimated to reach up to HKD 80 million ($10.3 million). Another standout is a ring showcasing a 4.08-carat fancy-vivid-purple-pink diamond, expected to fetch as much as HKD 58 million ($7.4 million).

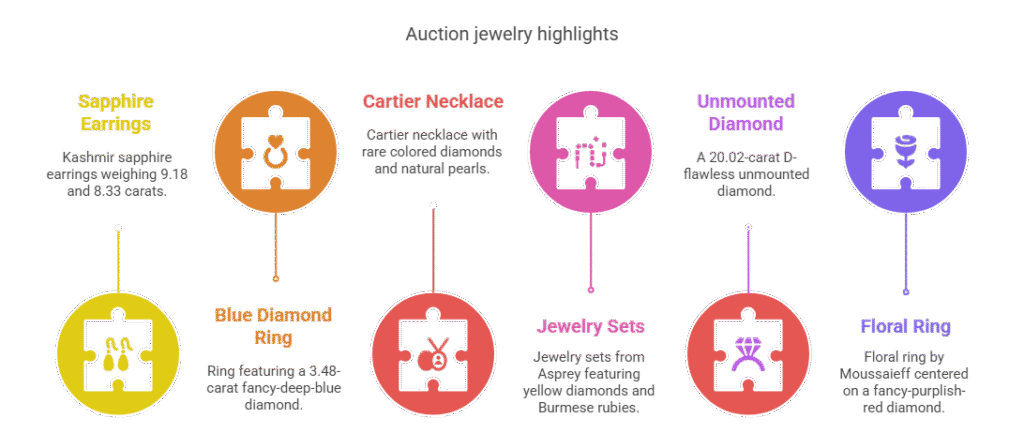

Other highlights include:

- A pair of Kashmir sapphire earrings with stones weighing 9.18 and 8.33 carats, estimated at HKD 28 million ($3.6 million).

- A ring featuring a 3.48-carat fancy-deep-blue diamond with pink and white accents, estimated at HKD 24 million ($3.1 million).

- A Cartier necklace with rare colored diamonds and natural pearls, valued at up to HKD 18 million ($2.3 million).

- Jewelry sets from Asprey and other designers featuring vivid yellow diamonds and Burmese rubies, each expected to reach up to HKD 18 million and HKD 15 million ($2.3 million and $1.9 million), respectively.

- A 20.02-carat D-flawless unmounted diamond, estimated at HKD 15 million ($1.9 million).

- A floral ring by Moussaieff centered on a fancy-purplish-red diamond, also projected to sell for as much as HKD 15 million.

In addition to marquee gems, Christie’s will offer several pieces with no reserve and others from renowned houses like Cartier, Harry Winston, Bulgari, and Tiffany & Co., reflecting continued global interest in high-end, collectible jewels.

DiamondBuzz

Diamond Slump forces Debswana to diversify into copper, platinum and solar

Diamond-centric mining models is giving way to broader resource portfolios

Debswana Diamond Company, the 50–50 joint venture between the Botswana government and De Beers, is moving to diversify into copper, platinum and renewable energy as the prolonged downturn in natural diamond demand pressures earnings and forces the industry to rethink its growth strategy.

The company’s board has approved plans to invest in a portfolio of non-diamond projects after revenue fell 46% in 2024, the latest available financial year, highlighting the scale of the downturn in the global diamond market.

The move signals a strategic shift toward commodities with stronger long-term demand fundamentals, particularly copper, which is central to global electrification and energy-transition infrastructure.

Debswana’s diversification reflects a broader industry pivot as diamond producers confront weak consumer demand, rising competition from lab-grown stones and elevated inventories across the supply chain.

The shift is also visible among smaller exploration companies. Botswana Diamonds recently rebranded as Botswana Minerals, signalling its own strategic focus on copper exploration rather than diamonds.

Together, these moves underscore a growing consensus across the sector: the era of diamond-centric mining models is giving way to broader resource portfolios anchored in energy-transition metals.

-

National News1 hour ago

National News1 hour agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration