International News

Bangkok Gems and Jewelry Fair 2025

Shines Bright, Generating Over 3.7 Billion Baht in Sales

The Department of International Trade Promotion (DITP) and the Gem and Jewelry Institute of Thailand (GIT) have announced the remarkable success of the 71st Bangkok Gems and Jewelry Fair, held from February 22–26, 2025, at the Queen Sirikit National Convention Center. The event exceeded all expectations, drawing nearly 40,000 visitors from across the globe and generating over 3.7 billion baht in trade value. This reinforces Thailand’s position as a global hub for the gem and jewelry industry. With demand surging, organizers are already preparing for the 72nd edition, with exhibition space nearly fully booked.

Sunanta Kangvalkulkij, Director-General of DITP, highlighted the significance of the event: “The Bangkok Gems and Jewelry Fair is a premier international trade show that serves as a key platform for buyers and traders worldwide. Held twice a year, in February and September, the 71st edition saw an expanded exhibition area to accommodate growing industry demand, featuring over 2,628 booths. The response was overwhelmingly positive, with more than 40,000 visitors—71% of whom were international attendees—driving total trade value to 3.718 billion baht, a 3.35% increase from the previous edition. The top five best-selling product categories included gemstones, fine jewelry, silver jewelry, gold and fine jewelry, and diamonds. The fair’s continued success underscores its reputation as a premier global business platform for the gems and jewelry sector.

Her Royal Highness Princess Sirivannavari Nariratana Rajakanya graciously presided over the opening ceremony of the 71st Bangkok Gems and Jewelry Fair on February 22, 2025. In a moment of great honor, Her Royal Highness granted permission to showcase her high jewelry creations in the special exhibition AMOUR ÉTERNEL HAUTE JOAILLERIE. This prestigious display was a highlight of the event, demonstrating the Princess’s commitment to preserving Thai craftsmanship and promoting the Thai jewelry industry on the global stage. The exhibition received an overwhelming response from visitors.”

Sumed Prasongpongchai, Director-General of GIT, emphasized the fair’s role in reinforcing Thailand’s status as a leading gem and jewelry hub: “Bangkok Gems and Jewelry Fair is a must-attend event in the global gem and jewelry industry. It highlights Thailand’s expertise as a center for gemstone enhancement and trading, as well as its world-class artisans known for their exquisite craftsmanship. The fair also offered a range of industry-focused activities, including marketing seminars, technical knowledge-sharing sessions, and the highly anticipated Networking Reception, which brought together key figures from the Thai and international jewelry industries.” The overwhelmingly positive reception from exhibitors and buyers alike has resulted in strong demand for the next edition, with most exhibition booths already reserved. Organizers are confident that the upcoming 72nd edition will be even bigger and more successful.

Save the Date: 72nd Bangkok Gems and Jewelry Fair

The next edition of the Bangkok Gems and Jewelry Fair will take place from September 9–13, 2025, at the Queen Sirikit National Convention Center. Interested exhibitors and visitors can find more information or book exhibition space in advance by contacting +66 2 634 4999 ext. 639 or visiting www.bkkgems.com.

International News

Global Platinum Jewellery Market Rebounds, Driven by Surging Demand in China and Resilience in Key Markets

The global platinum jewellery market showed strong recovery in the first quarter of 2025, according to Platinum Guild International’s (PGI) latest Platinum Jewellery Business Review. Growth was led by a sharp rebound in China and steady gains in India, alongside positive trends in the US, UAE, and Japan.

In India, platinum jewellery continued to grow despite wider market challenges, including record-high gold prices and the seasonal slowdown at the end of the financial year in March. PGI’s top 15 strategic partners in India posted an average year-on-year platinum sales growth of 7%, supported by in-store activations, digital campaigns such as Platinum Love Bands, and celebrity-led marketing.

China delivered the strongest performance, with platinum jewellery fabrication rising 50% year-on-year in Q1, significantly outperforming gold and diamond categories. The surge was driven by both plain and gem-set platinum jewellery, as jewellers shifted away from gold amid high prices and sluggish diamond demand. PGI reported the opening of over 40 platinum-dedicated wholesale showrooms and the conversion of several gold production lines to platinum. Retail sales rose 16% year-on-year, prompting calls for stronger marketing and new product offerings to sustain demand.

In the UAE, platinum jewellery retail sales grew 25% year-on-year. Platinum now has a presence in 136 stores across the GCC, with PGI’s focused partnerships and campaigns helping to expand the category’s footprint, particularly among South Asian communities.

Japan saw platinum jewellery outperform the broader market for the sixteenth straight quarter. Unit sales rose 1% year-on-year in Q1, driven by discount stores, department stores, and non-store channels. Pendants, necklaces, Kihei chains, and affordable platinum pieces remained in demand.

In the United States, platinum jewellery unit sales rose 19% year-on-year among PGI’s strategic partners, with revenue up nearly 24%. Wedding bands and fashion jewellery led the gains, and some retailers continued to convert inventory from white gold to platinum.

“As consumers increasingly seek meaningful, high-quality pieces at accessible price points, platinum is gaining ground not just in China, but also in key markets such as India, Japan, the United States and the United Arab Emirates,” said Tim Schlick, CEO, PGI. “PGI’s strategic partnerships remain at the heart of this growth story, helping to build lasting consumer connections with platinum.”

International News

Gold stable as Fed maintains data-driven stance AUGMONT BULLION REPORT

Supported by a declining dollar, gold extended its gains from the previous session to approximately $3325 (~Rs 96500) as investors continued to keep an eye on trade events and review the most recent FOMC minutes.

- The Fed’s June meeting minutes revealed disagreement among officials over the timing and scope of possible interest rate cuts.

- Views varied from supporting a reduction as early as July to favouring no cuts at all by year’s end, even though the majority expected some easing later this year.

- In the face of conflicting economic signals, such as tariff-related inflation threats, declining consumer spending, and a labour market that is nonetheless robust, the Fed remained cautious and data-driven.

Technical Triggers

- Gold continues to trade near the lower side of the range of $3300 (~Rs 96250) and $3400 (~Rs 98500). If prices sustain below $3280 (~Rs 96000), weakness could further extend to $3200 (~Rs 94000).

- Silver is not able to sustain above its range of $37.5 (~Rs 108,500) and $35.5 (~Rs 105,000). Consolidation continues before heading higher towards the next target is $38 (~Rs 110,000).

Support and Resistance

| Category | Support Level | Resistance Level |

|---|---|---|

| International Gold | $3280/oz | $3370/oz |

| Indian Gold | ₹96,000/10 gm | ₹97,700/10 gm |

| International Silver | $35.5/oz | $37.5/oz |

| Indian Silver | ₹1,05,000/kg | ₹1,10,000/kg |

International News

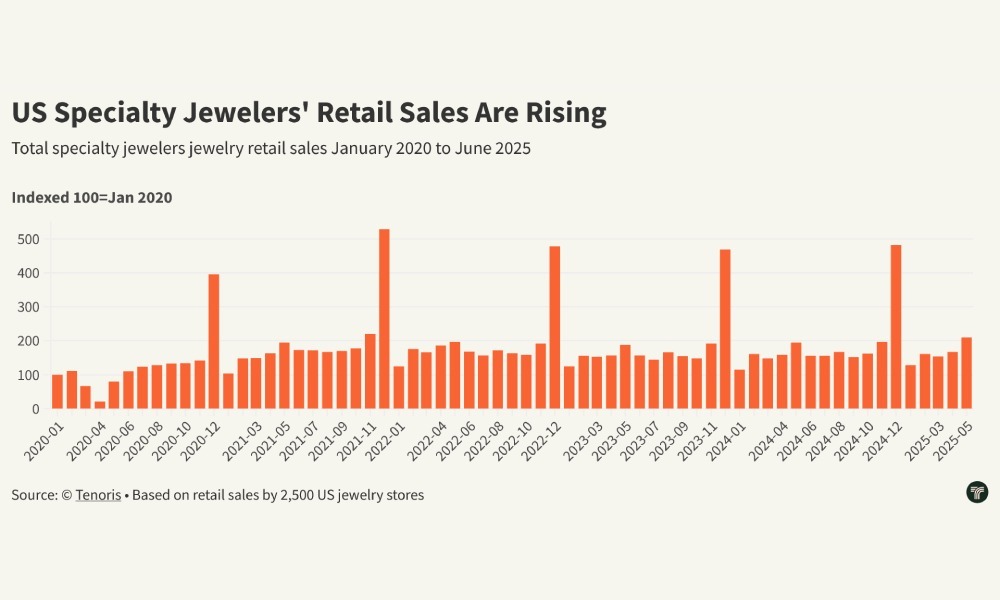

Tenoris Report: 5% rise in jewellery sales in H1 2025

Gold jewellery led category growth with low double-digit revenue gains

The jewellery market posted a healthy 5% revenue growth in H1 2025, according to Tenoris, sustained by a steady five-month rise and a 3% increase in June sales. While the total number of pieces sold declined, consumers spent more per item, leading to a 10% surge in expenditure per unit in June and higher average prices across diamond, sapphire, gold, platinum, and silver jewellery.

Lab-grown jewels stood out, recording higher unit sales despite falling average prices, reflecting shifting consumer preferences. Round diamonds, though still dominant at 52% of sales, are gradually losing ground to oval shapes, which now account for 20%.

Finished jewellery also performed well, especially bracelets, which saw nearly 10% year-on-year revenue growth. Demand is strengthening in higher price segments, notably items priced between $7,500 and $10,000.

Natural diamond jewellery sales dipped in June but rose 3% year-to-date, driven by demand for pendants, bracelets, and necklaces above $2,500, often featuring lab-grown diamonds. The loose natural diamond market saw higher average carat weights but longer inventory turnover, while lab-grown loose diamonds continued to capture market share. Overall, the industry is rebounding from flat sales in H1 2024 and is focused on tapping new consumer demographics to sustain momentum.

-

National News7 days ago

National News7 days agoMalabar Gold & Diamonds Inaugurates Landmark Integrated Manufacturing Site in Hyderabad, Cementing Its Position as a Global Manufacturing Leader

-

National News2 months ago

National News2 months agoEmmadi Silver Jewellery Launches First Karnataka Store with Grand Opening in Bengaluru’s Malleshwaram

-

BrandBuzz3 months ago

BrandBuzz3 months agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

GlamBuzz2 months ago

GlamBuzz2 months agoGokulam Signature Jewels Debuts in Hyderabad with Glamorous Launch at KPHB