National News

10th edition of IIBS puts the spotlight on trends, policies, and innovations in the bullion and jewellery markets

Platform for key stakeholders, including refiners, jewellers, traders, policymakers, and financial institutions to deliberate key issues

The 10th edition of India International Bullion Summit (IIBS-10) organized by India Bullion & Jewellers Association’s (IBJA) was held in Mumbai on 7th & 8th March, 2025. More than 800 bullion dealers and jewellers attended this event.IIBS provided a platform for key stakeholders, including refiners, jewellers, traders, policymakers, and financial institutions to deliberate.

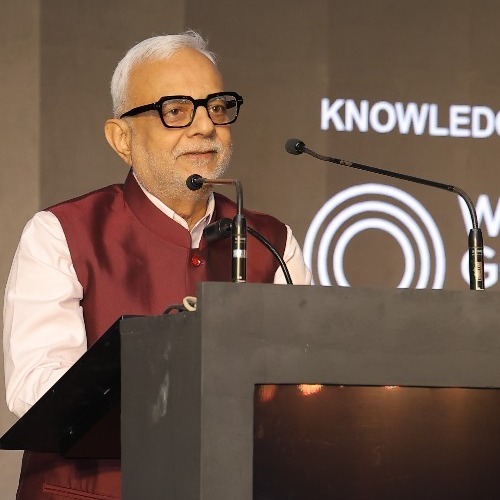

IIBS was formally unveiled by Dr. Hasmukh Adhia – IAS (Retd.) – Chairman, GIFT City in the presence of Guests of Honour Pradeep Ramakrishnan – Executive Director – International Financial Services Centres Authority (IFSCA), Prithviraj Kothari – National President – India Bullion and Jewellers Association Ltd (IBJA), David Tait – Chief Executive Officer – World Gold Council, Shivanshu Mehta – SVP & Head-Bullion, MCX Director, IIBX IFSCÂ LTD, Rajesh Rokade – Chairman – All India Gem and Jewellery Domestic Council (GJC), Samit Guha – Chief Financial and Technology Officer – MMTC – PAMP India Private Limited

Dr. Hasmukh Adhia, IAS (Retd.)- Chairman, GIFT City said, “Don’t be complacent about the US tariff as the collateral damage will happen to India, but we have to watch out how industrial trade will shape and we hope that the outcome of US tariff will be good on India. I believe the Indian economy is doing well but India needs formalization of gold and we would like to address any concerns of the bullion Industry. I wish IBJA a grand success. Thank you for organizing this knowledgeable summit and inviting me to be a part of it.”

Prithviraj Kothari, National President, IBJA speaking at 10th IIBS said, “Bullion and Jewellery plays a great role in boosting the economy and it will continue to in future. Also, Gold and Silver has been in the limelight for the past five years and will continue further. IBJA has been active to support industry and to help grow the jewellery industry, we make sure that Gold Monetization Scheme is more accessible to SME Jewellers and IBJA is committed to maintain transparency in the Gold and Bullion Industry. I welcome everyone on behalf of IBJA to take advantage of this summit and thank you for the overwhelming response.”

The panel discussion included topics like Silver Industry Growth – Challenges And Opportunity, India’s Golden Ambition For Jewellery Market, Bringing Artisan In Main Stream, Leadership in Retail Jewellery Business, Is FTA & CEPA Distorting Market, Vision 2047 For Gold Industry by World Gold Council, Cyber Fraud in Gems & Jewellery Sector, Generating Funds For Gold Industry, Hedging Tool For Jewellers In Volatile Market, Bullion Hallmarking – A Way Forward, Opportunity at IIBX, Consumer Insights: The Role of Gold Jewellery, Gold Outlook and Regulation Governing Bullion And Jewellery Market was also discussed.

Speakers for the conference included eminent personalities like Sachin Jain – World Gold Council, Sudheesh Nambiath – DMCC, Prof. Sundaravalli Narayanaswami – India Gold Policy Centre (IGPC), Harish Pawani – Bin Sabt Jewellery LLC, Dubai, Dr. Saurabh Gadgil – PNG Jewellers, PR Somasundaram – Industry Alumnus, D. K. Surana – Intensive Fiscal Services Private Limited, Ashok Gautam – India International Bullion Exchange IFSC Ltd (IIBX), Avinash Pahuja,- ORO Precious Metals Pvt. Ltd., Varghese Alukkas -Jos Alukkas, Ba.Ramesh – Thangamayil Jewellery Limited.

The most interesting discussion was in respect of the Regulation Governing Bullion and Jewellery Market looks at the gold industry. Sachin Jain – Regional CEO, India of World Gold Council explained about the Vision 2047 For Gold Industry.Shivanshu Mehta – SVP & Head-Bullion- Multi Commodity Exchange of India Limited (MCX), Director, IIBX IFSC LTD explained Hedging Tool for Jewellers in Volatile Market

Elwin Jose – Head – Product Development, Strategy and Services – National Stock Exchange of India Ltd (NSE) explained the Pathway for Price Risk Management: Integration Bullion Spot & Derivatives Market. Ashok Gautam – MD & CEO- India International Bullion Exchange IFSC Ltd (IIBX) and Ajit Mauskar – Director, Market Infrastructure India and Middle East – World Gold Council explained the opportunity at IIBX. Kavita Chacko – Research Head, India- World Gold Council explained Consumer Insights: The Role of Gold Jewellery. Prithviraj Kothari- National President -India Bullion and Jewellers Association Ltd. Stated that IBJA will continue to work for the benefit of industry bringing transparency to the entire trade.

IBJA has also launched initiatives such as the “IBJA Verified Tag” for Platinum Members to ensure their online accounts represent legitimate and authentic businesses or brands. IBJA is also working on a jewellers awareness campaign in the entire country by educating the jewellers through various webinar and seminar. IBJA will soon be launching an innovative programme to boost the skills of karigars. IBJA is also setting up a world class bullion refinery at Gift City, Gujrat. IBJA is also honouring jewellers for their CSR activity.

The event was also followed by The India Bullion and Jewellers Association (IBJA) awards recognizing excellence in the jewelry and bullion industries.

BrandBuzz

Tamannaah Bhatia Unveils “Tamannaah Fine Jewellery” Label Rooted in Everyday Elegance

The actress steps into entrepreneurship with Tamannaah Fine Jewellery, a modern fine jewellery line designed for comfort, versatility, and effortless day-to-night wear.

Actress Tamannaah Bhatia has entered the fine jewellery space with the launch of her own label, Tamannaah Fine Jewellery, marking a new chapter in her creative journey. Known for her strong screen presence and distinctive personal style, Tamannaah brings her off-screen fashion philosophy to life through a collection that champions modern minimalism, wearability, and quiet luxury.

Launched through a sleek, fashion-forward digital film, the brand signals a shift away from occasion-centric jewellery towards pieces designed for real, everyday movement. Rooted in the idea of “modern better basics”, the collection focuses on elevated essentials that strike a balance between casual sophistication and understated glamour.

The debut line features a thoughtfully curated mix of contemporary mangalsutras, solid gold hoops, piercing-friendly designs, bold chains, and diamond-studded statement pieces. Crafted in gold and diamonds, the jewellery is designed to transition seamlessly from workdays to evenings out—without compromising on comfort or style.

What sets Tamannaah Fine Jewellery apart is its strong emphasis on wearability. Each piece is designed to move with the wearer, blending effortlessly into daily routines—be it an early morning meeting, a personal moment, or a celebratory dinner. With clean lines, neutral aesthetics, and timeless appeal, the designs are easy to style across outfits, moods, and moments.

By steering clear of fleeting trends and seasonal cycles, the brand positions itself as a destination for everyday fine jewellery that feels personal, powerful, and enduring—a reflection of Tamannaah Bhatia herself.

With this launch, Tamannaah Fine Jewellery redefines what fine jewellery looks like today: modern, versatile, and made to be lived in.

-

BrandBuzz2 days ago

BrandBuzz2 days agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises2 days ago

New Premises2 days agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

National News2 days ago

National News2 days agoBakul Limbasiya Receives Prestigious APO National Award for LGD Pioneering

-

Appoinment2 days ago

Appoinment2 days agoTiffany & Co. Strengthens Leadership with David Ponzo as Deputy CEO