International News

WGC REPORT: Is the threat of US tariffs moving the gold market?

Key highlights

• The gold market has seen a significant rise in COMEX gold inventories, along with a widening of the spread between futures and spot prices, sparked by tariff uncertainty

• This, combined with reports of falling inventories in London, has fuelled speculation about stability in the gold market

• Events like these have happened before and the market has normalised • As such, we believe that the disruptions will likely ease…although the current environment of elevated geoeconomic risks could result in intermittent spikes

• Most importantly, despite all the noise, the gold spot market has remained well behaved – and has generally benefited from flight-to-quality flows.

Gold bullion flows West amidst tariff uncertainty

In late 2024 COMEX inventories started to rise as concerns grew that tariffs could impact gold imports.1 This surge of gold imports into the US caught many gold market observers by surprise, as the country is (more or less) self-sufficient in its gold needs, being both a significant producer and a consumer.2 While gold itself hasn’t been directly targeted, speculation and shifting risk management strategies amid concerns of broad-based tariffs have still had a noticeable impact on prices and trading patterns. This trend has continued into early 2025 and, as of date, COMEX registered and eligible inventories have increased by nearly 300t (9mn oz) and more than 500t (17mn oz), respectively (Chart 1).

By way of context, short-term speculators and some investors often hold large net-long gold futures positions on the COMEX futures market, while banks and other financial institutions short these futures contracts as counterparties. But these financial institutions are generally not short gold; instead, they run long over-the-counter (OTC) positions to hedge their futures shorts. And because physical gold is more often found in the London OTC market – as a large trading hub and often a cheaper location in which to vault gold – financial institutions typically prefer to hold these hedges in London, knowing that they can quickly – in normal market times – ship gold to the US when there is a need. In recent months, many traders have chosen to pre-empt the threat of tariffs by moving gold to the US, thus avoiding the possibility that they may have to pay higher charges.

Alongside the increase in inventories, the price of COMEX gold futures contracts – and their spread to spot gold traded in London – also rose, with traders factoring in potential tariff-related costs. For example, the spread between the COMEX active gold futures contract and gold spot reached as much as US$40/oz to US$50/oz (140-180 bps), significantly above the US$13/oz (60 bps) average from the past two years.3

Now…this is not new. COMEX inventories – and the differential between futures and spot prices – have risen before, most notably at the onset of the COVID pandemic.

The main question from investors, amidst reports of falling inventories, is: can gold’s largest OTC trading hub, London, cope with the market disruption? We can look at past examples for guidance and analyse all the currently available data to offer an informed opinion – considering, of course, the heightened level of uncertainty all financial markets are experiencing in the current environment.

London inventories have fallen…but not as much as some think

As COMEX inventories rose during COVID, London inventories fell. And both eventually normalised. At present, total LBMA reported inventories stand at approx. 8,500t (Chart 2), out of which approx. 5,200t are held at the Bank of England (BoE). And while there are reports of queues to retrieve gold, it is important to note that BoE operates differently from commercial vaults – longer wait times create a perception of scarcity that is more likely explained by logistics instead.4

Another consequence has been an increase in gold’s lending rate. A calculation based on overnight borrowing rates and gold swap rates, as a proxy, suggests that one-month lease rates reached as high as 5% during January, reflecting ‘tightness’ in the London gold market (Chart 3).

Gold’s diverse sources of supply can promote normalisation

Trade data from the Census Bureau suggests that a good portion of gold flowing into the US comes from Switzerland. In turn, some of this gold could have originated in the UK as it needs to be refined from Good Delivery (~400 oz) bars into 1 kg bars – the weight accepted for delivery into COMEX futures.5 Other sources of gold include Canada, Latin America, Australia and, to a lesser degree, Hong Kong. And then there’s gold from domestic mine production – the US being the fifth largest producer globally – which can be refined locally.

Of course, gold flowing into the US from around the world may limit the amount of gold going into other markets, including London, but we believe that the impact should be temporary. This is especially true as gold has multiple sources of supply – mine production and recycling – spread around the world, reducing the reliance on imported gold to meet local demand in the medium term.

A few signs of normality are starting to emerge: the buildup of COMEX inventories has slowed; the spread differential between gold futures and spot prices is falling,6 and the bid-ask spread for gold ETFs – many of which vault their gold in London – remain well behaved.7 In addition, the lease rates also seems to be cooling down, with data suggesting it is now closer to 1% and well below January’s record high (Chart 3).

While part of gold’s strong price performance could be attributed to momentum, our analysis suggests that it has been supported by flight-to-quality flows amid increased financial market volatility driven by geoeconomic and geopolitical concerns.8

In summary

Gold has not been a direct target of tariffs, but market reactions to trade uncertainty has driven a significant shift in trading behaviour and impacted the gold price. The movement of gold from London to the US, rising COMEX premiums and concerns over availability were largely the result of risk management decisions rather than true supply issues.

Now that COMEX inventories appear to be well-stocked and the backlog of withdrawals from the BoE continues to be cleared, these disruptions should ease over the coming weeks. However, this period serves as a stark reminder that even indirect trade policy concerns can send ripples through global financial markets.

This may not be the last time we see temporary distortions in the gold market. The signs are, however, that the depth and liquidity of the gold market is able to absorb – over time – most of these shocks.

International News

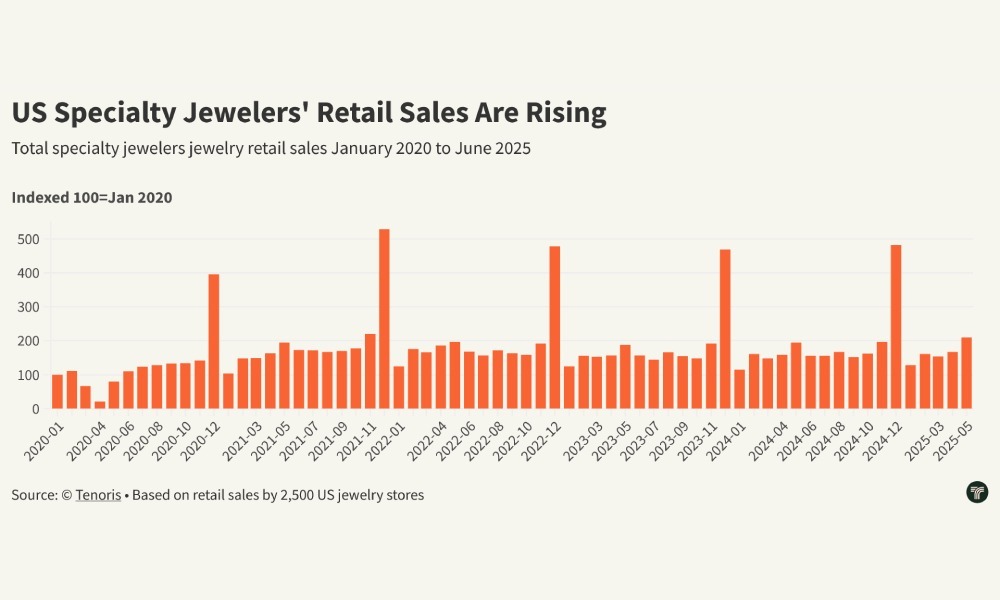

Tenoris Report: 5% rise in jewellery sales in H1 2025

Gold jewellery led category growth with low double-digit revenue gains

The jewellery market posted a healthy 5% revenue growth in H1 2025, according to Tenoris, sustained by a steady five-month rise and a 3% increase in June sales. While the total number of pieces sold declined, consumers spent more per item, leading to a 10% surge in expenditure per unit in June and higher average prices across diamond, sapphire, gold, platinum, and silver jewellery.

Lab-grown jewels stood out, recording higher unit sales despite falling average prices, reflecting shifting consumer preferences. Round diamonds, though still dominant at 52% of sales, are gradually losing ground to oval shapes, which now account for 20%.

Finished jewellery also performed well, especially bracelets, which saw nearly 10% year-on-year revenue growth. Demand is strengthening in higher price segments, notably items priced between $7,500 and $10,000.

Natural diamond jewellery sales dipped in June but rose 3% year-to-date, driven by demand for pendants, bracelets, and necklaces above $2,500, often featuring lab-grown diamonds. The loose natural diamond market saw higher average carat weights but longer inventory turnover, while lab-grown loose diamonds continued to capture market share. Overall, the industry is rebounding from flat sales in H1 2024 and is focused on tapping new consumer demographics to sustain momentum.

International News

Gold edges lower on rebounding Dollar as trade war intensifies AUGMONT BULLION REPORT

As the trade war heats up, the dollar trades at a two-week high against the yen, while gold drops below $3300.

- A 50% tariff on copper imports, possible 200% duties on pharmaceuticals, and a 10% levy on goods from BRICS nations are just a few of the extensive new measures that President Donald Trump announced, ruling out future extensions to the August 1 tariffs.

- Meanwhile, following a strong US jobs report last week, which allayed concerns about a slowing economy, the Fed lowered its July rate drop predictions.

- The expectation for more rate cuts has also decreased because the tariffs are anticipated to increase US inflation in the upcoming months.

- Investors are now waiting for the minutes of the June FOMC meeting to be released in order to gain further understanding of the Fed’s policy position.

Technical Triggers

- Gold continues to trade near the lower side of the range of $3300 (~Rs 96250) and $3400 (~Rs 98500). If prices sustain below $3280 (~Rs 96000), weakness could further extend to $3200 (~Rs 94000).

- Silver is not able to sustain above its range of $37.5 (~ Rs 108,500) and $35.5 (~ Rs 105,000). Consolidation continues before heading higher towards the next target is $38 (~Rs 110,000)

Support and Resistance

For Gold

| Region | Support Level | Resistance Level |

|---|---|---|

| International Gold | $3280/oz | $3370/oz |

| Indian Gold | ₹96,000/10 gm | ₹97,700/10 gm |

For Silver

| Region | Support Level | Resistance Level |

|---|---|---|

| International Silver | $35.5/oz | $37.5/oz |

| Indian Silver | ₹1,05,000/kg | ₹1,10,000/kg |

International News

WGC REPORT :Gold ETF Flows- June 2025

Global gold ETFs’ total AUM rose to a month-end peak and holdings bounced to the highest in 34 months

H1 in review

Global physically backed gold ETFs1 saw inflows of US$38bn during H1, boosted by strong positive flows in June (Chart 1), marking the strongest semi-annual performance since H1 2020.2 All regions saw inflows last month, with North American and European investors leading the charge.

During the first half, North America accounted for the bulk of inflows, recording the strongest H1 in five years. And despite slowing momentum in May and June, Asian investors bought a record amount of gold ETFs during H1, contributing an impressive 28% to net global flows with only 9% of the world’s total assets under management (AUM). European flows finally turned positive in H1 2025 following non-stop semi-annual losses since H2 2022.

By the end of H1 the surging gold price and notable inflows pushed global gold ETFs’ total AUM 41% higher to US$383bn, a month-end record. Collective holdings in H1 grew 397t to 3,616t, the highest month-end value since August 2022 (Chart 2).

Regional overview

North America attracted US$4.8bn in June – the strongest monthly inflow since March – bringing total H1 inflows to US$21bn. Spiking geopolitical risks amid the Israel-Iran conflict boosted investor demand for safe-haven assets and supported inflows into North American gold ETFs. Although it held rates steady in June, the US Fed continued to express concerns about slowing growth and rising inflation.3 Markets are now pricing in three rate cuts by the end of 2025 and an additional two in 2026.

The investor response has been swift: US Treasury yields declined, and the dollar continued to weaken. Persistent policy uncertainty and ongoing fiscal concerns are likely to remain an overhang on the market, which in turn could help support gold ETF demand in the near to medium term.

European inflows continued for a second month, adding US$2bn in June – the strongest since January – and lifting the region’s H1 total to US$6bn. The UK led inflows in the month; although the Bank of England kept rates unchanged at its June meeting, the stance was generally dovish. 4 Combined with weaker growth, easing inflation and the cooling labour market, investors raised their bets on future rate cuts. This resulted in local yields declining and pushed up gold’s allure. Meanwhile, the eighth cut from the European Central Bank, uncertainties surrounding growth, and rising geopolitical risks generally, contributed to gold ETF demand in several major markets.

Asian flows flipped positive in June, albeit only mildly at US$610mn, ending at US$11bn – a record amount for any H1 period. India led inflows in June, likely supported by rising geopolitical risks in the Middle East. Japan recorded inflows for the ninth consecutive month (US$198mn, US$1bn H1), possibly driven by elevated inflationary concerns – particularly when the rice price surged.6 China only saw mild inflows in the month (US$137mn) as trade tensions eased and the local gold price moderated.7 Nonetheless, China’s H1 inflows of US$8.8bn (85t) were unprecedented amid spiking trade risks with the US, growth concerns and the surging gold price.

-

National News5 days ago

National News5 days agoMalabar Gold & Diamonds Inaugurates Landmark Integrated Manufacturing Site in Hyderabad, Cementing Its Position as a Global Manufacturing Leader

-

National News2 months ago

National News2 months agoEmmadi Silver Jewellery Launches First Karnataka Store with Grand Opening in Bengaluru’s Malleshwaram

-

BrandBuzz3 months ago

BrandBuzz3 months agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

GlamBuzz2 months ago

GlamBuzz2 months agoGokulam Signature Jewels Debuts in Hyderabad with Glamorous Launch at KPHB