JB Insights

VICENZAORO JANUARY 2025 confirms its success as leading international business and networking platform

The show saw 1,300 brands, increase in international attendance and buyers from 145 countries

Vicenzaoro January 2025, the event of reference for the global jewellery industry and the starting point of the sector’s global calendar. The edition not only confirmed last year’s exceptional numbers, it also touched the international dimension record: in fact, foreign visitation – greater than that of Italians – reached the extraordinary participation number of 145 countries from all over the world , with Turkey, the United States, Germany, Spain and Greece in the lead and interesting increases in countries such as North Korea and Australia.

“We have won the internationality challenge,” commented Corrado Peraboni, CEO of Italian ExhibitionGroup, in regard to Vicenzaoro January 2025. “Several years ago, we decided to develop our leading products abroad. A successful strategy that has decisively increased foreign visitation at our most important events in Italy.”

Matteo Farsura, head of IEG’s gold and jewellery division, underlined: “With 1,300 brands and the involvement of the entire jewellery supply chain, from technologies to haute joaillerie, Vicenzaoro confirms its position as a global platform of reference, favouring dialogue among the different segments to meet the needs of the various markets.

US retailers were out in force at the Italian Exhibition Group (IEG) event staged in the Vicenza show. In attendance were buyers from leading companies, such as Macy’s, Neiman Marcus, Saks Off 5th, Ben Bridge Jeweler, Diane Glynn Jewelry, and Manfredi Jewels.

“Vicenzaoro was a fruitful experience where I filled some orders and discovered unique, well-crafted jewelry,” Lisa Vinicur of Pennsylvania-based Diane Glynn Jewelry told Rapaport News. “I specifically sought important pieces like bangles, earrings, necklaces, and rings that are only available in Vicenza, and I’m pleased to say I found them.”

“Although the venue had construction happening, [the organizers] increased the signage to make the show easy to navigate,” said Nina Bruno of Macy’s, based in New York. “We are always shopping for new inspiration in chains. We were pleased to see fresh manipulations in chains and innovative diamond cutting.”

Laura Barringer, Seattle-based senior buyer at Ben Bridge Jeweler, said the brand refilled all of its core selections and resourced and created a new collection it hoped to launch this spring. Managing partner of New York-based Manfredi Jewels Bianca Chiappelloni explained that part of the show’s draw is the ability to access Italian companies in one place. “It’s been beneficial for us to visit with so many of our Italian brands, in most cases seeing a much more complete and fuller showcase of their offerings than we see at some of the shows in the US,” she said

Vicenzaoro was held in conjunction with T.Gold, which showcased the excellence of the sector’s technologies (a T.Gold that, thanks to the Expo Centre’s expansion, will be staged inside the Vicenzaoro areas as of the second half of 2026), and VO Vintage, the fine vintage watch show, and the collaboration with Vicenza Municipality at VIOFF, the experiential off-show event that involved guests from all over the world.

A “rhythm” of business and innovation that never stopsbut continues for twelve months a year in a unicum of Italian Exhibition Group appointments and jewellery & fashion projects all over the world. IEG’s agenda will see OROAREZZO in May, SIJE in Singapore in July, Vicenzaoro September at the end of the summer (and the return of VO’Clock Privé) preceded by the new Vicenza Symposium, the Valenza Jem Forum in October, JGTD Dubai in November, and the Italian Jewellery Summit in Arezzo in December.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

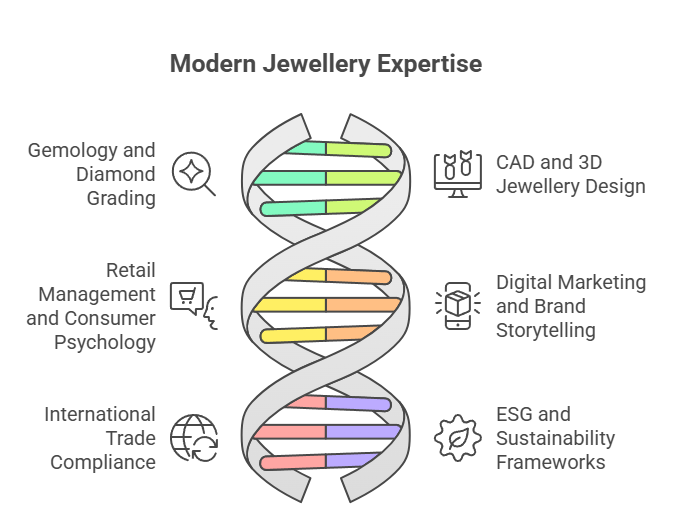

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

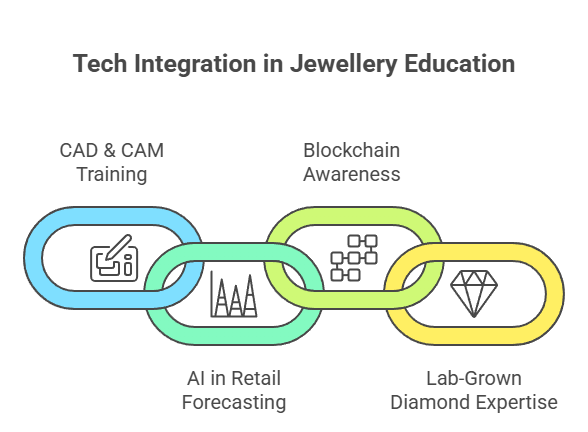

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

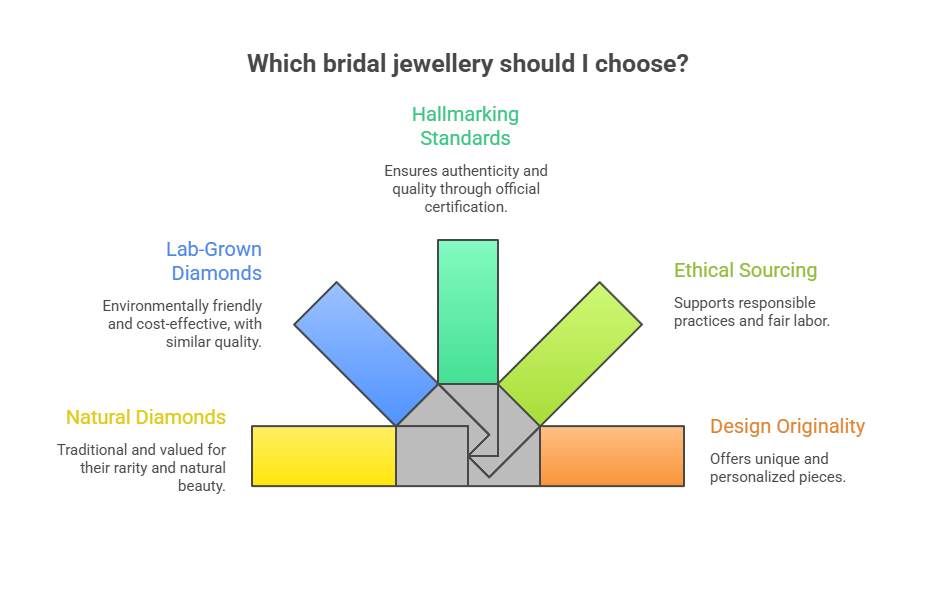

The Bridal Economy & Consumer Education

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

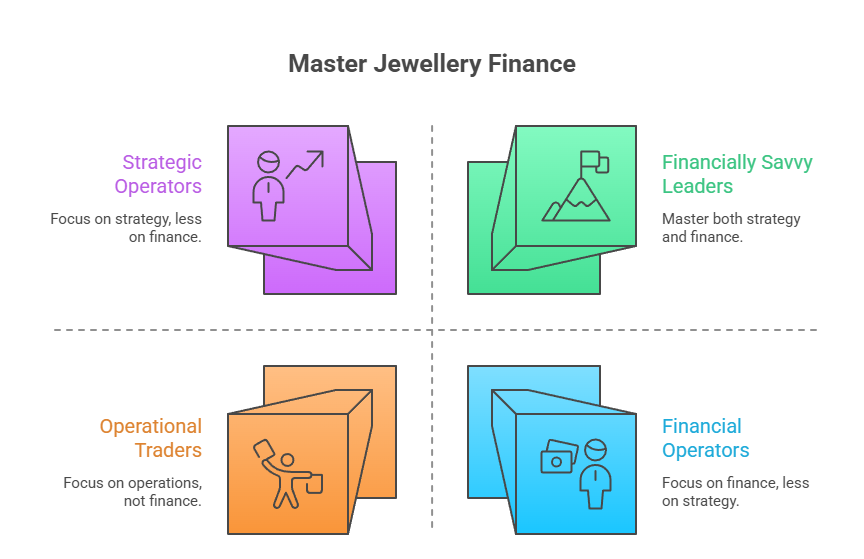

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

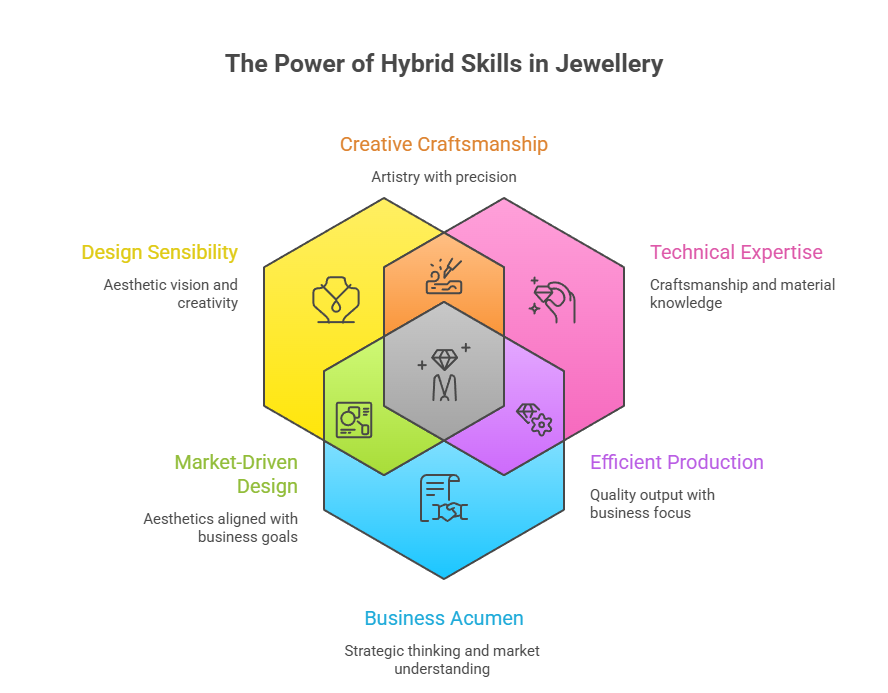

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

DiamondBuzz6 hours ago

DiamondBuzz6 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz7 hours ago

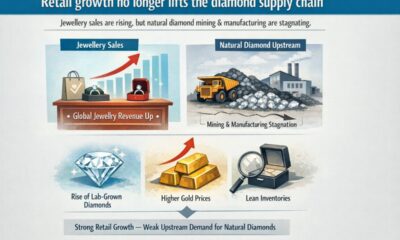

DiamondBuzz7 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News9 hours ago

International News9 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News9 hours ago

International News9 hours agoGold continues to get strength on the Middle East conflict