National News

True Diamond Secures ₹26 Crore in Pre-Series a Funding to Fuel Omnichannel Expansion

Led by India Quotient, the funding round will accelerate offline growth and support True Diamond’s mission to redefine lab-grown diamond jewellery retail.

Lab-grown diamond jewellery brand True Diamond has raised ₹26 crore ($3 million) in a pre-Series A funding round led by venture capital firm India Quotient, with participation from existing investors Titan Capital Winners Fund and Huddle Ventures.

The fresh capital will be used to fast-track True Diamond’s omnichannel growth strategy, with a focus on expanding its physical retail presence. The brand already operates stores in Mumbai, Hyderabad, and Noida, and aims to establish outlets across other metro cities in the near future.

Founded in early 2024 by Parin Shah and Darayus Mehta, True Diamond offers a wide range of products including rings, earrings, pendants, necklaces, mangalsutras, bracelets, and tennis bracelets — all crafted with high-quality lab-grown diamonds.

Parin Shah, founder of True Diamond, shared the vision behind the brand: “We never wanted to be just another jewellery brand. We’re building a next-gen brand experience, through high-quality lab-grown diamonds, cutting-edge content, and a retail journey that breaks away from the conventional. This round gives us the ability to scale this vision faster.”

Sahil Makkar of India Quotient added: “We see immense potential in the lab-grown diamond and gold combination as a category within the massive jewellery market. Under the leadership of Parin and Darayus, we’ve observed True Diamond evolving into an aspirational omnichannel retailer within this segment, and we are thrilled to be a partner in this journey.”

GlamBuzz

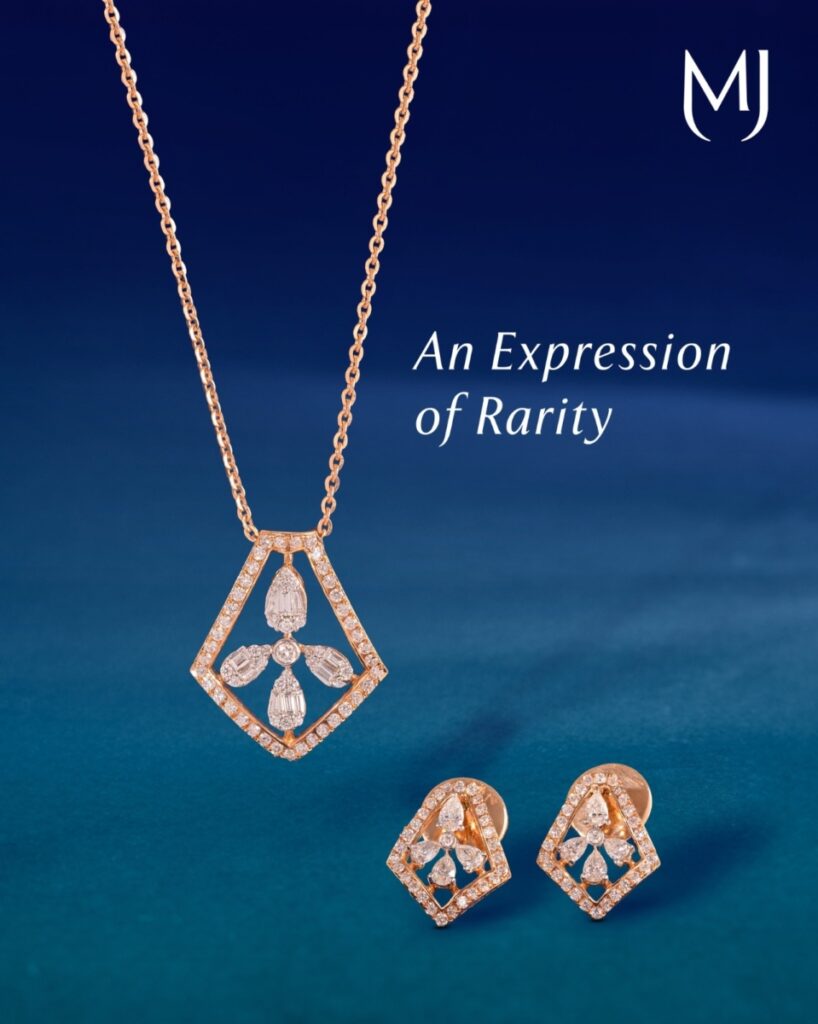

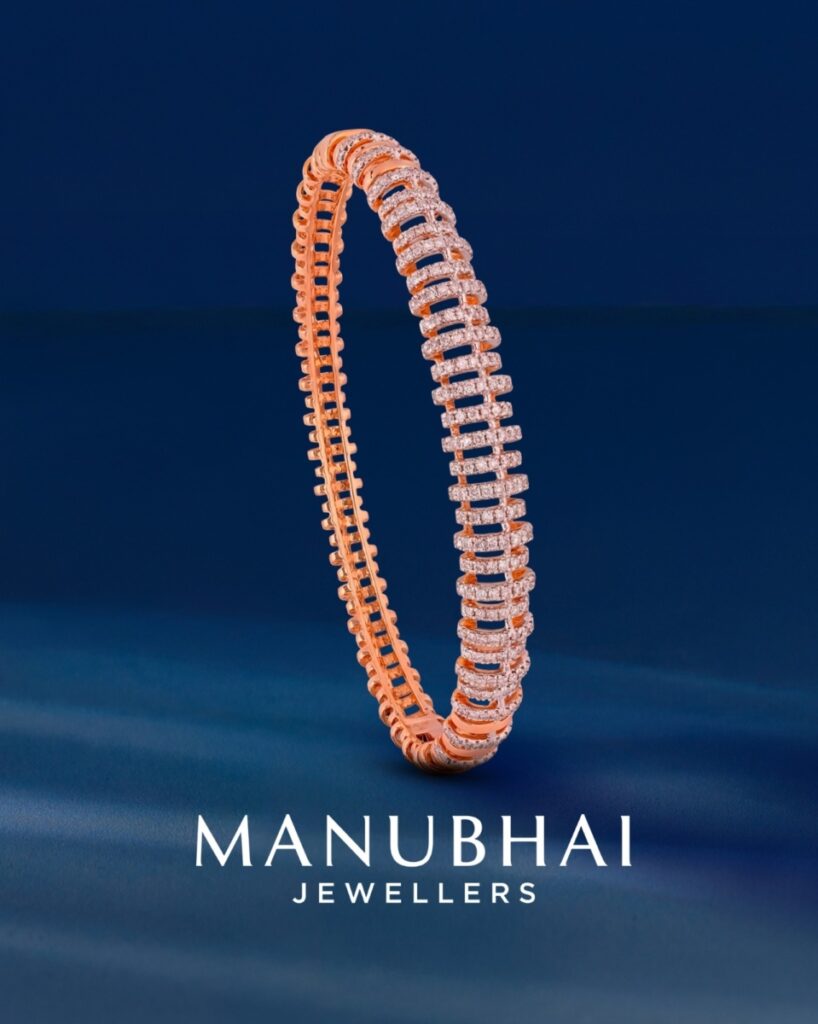

Rakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

A celebration of understated luxury, luminous sparkle, and modern sophistication crafted for moments that matter.

Bollywood actress, Rakul Preet embodies refined elegance in the latest showcase of Manubhai Natural Diamonds, where timeless craftsmanship meets contemporary design. Styled in sleek silhouettes adorned with luminous natural diamonds, she reflects a narrative of confidence, grace, and effortless sophistication.

The collection highlights the enduring appeal of natural diamonds — pieces that do not demand attention, yet command it with quiet brilliance. Each creation is thoughtfully designed to complement modern femininity while preserving the legacy of fine craftsmanship that defines Manubhai Jewellers.

With clean lines, radiant sparkle, and a focus on authenticity, the campaign reinforces a powerful message: true luxury doesn’t need to speak loudly — it simply glows.

-

ShowBuzz2 days ago

ShowBuzz2 days agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

International News12 hours ago

International News12 hours agoThe HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

-

GlamBuzz14 hours ago

GlamBuzz14 hours agoRakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

-

International News16 hours ago

International News16 hours agoGold surges as US-Israel-Iran tensions boost safe-haven demand