JB Insights

The State of Fashion:Luxury 2025

McKinsey & Company and BoF Insights report

Global fashion faces challenging landscape

The ninth annual State of Fashion report by McKinsey & Company and BoF Insights highlights the challenging landscape the global fashion industry faces in 2025. With economic uncertainty, changing consumer behaviors, and evolving market dynamics, the year is expected to be a critical juncture for many brands.

Overview

Economic Challenges: 80% of executives foresee no improvement in the industry, and only 18% rank sustainability as a top concern, down from 29% in 2024. Consumer confidence and spending remain major issues.

Key Drivers: Price sensitivity, the rise of dupes, climate change acceleration, and reshuffled global trade create a difficult environment.

Geographic Shifts: Growth engines in Asia, particularly India, Japan, and Korea, are becoming pivotal as China faces economic challenges.

Themes Driving the Agenda

Trade Reconfigured: Brands are diversifying sourcing to align with evolving trade policies and sustainability targets. Nearshoring and political alignment are critical considerations.

Asia’s Growth Engines: While China slows, India, Japan, and Korea are emerging as vital markets for growth.

Discovery Reinvented: AI-driven curation in e-commerce promises to help overwhelmed shoppers navigate abundant choices.

Silver Spenders: The growing over-50 demographic offers new opportunities for incremental growth, emphasizing the need for inter-generational appeal.

Value Shift: Resale, off-price, and dupe markets are flourishing as consumers seek better value amid persistent economic pressures.

The Human Side of Sales: Enhancing in-store experiences by empowering well-trained sales staff can drive demand for physical retail.

Marketplaces Disrupted: Online non-luxury marketplaces face existential challenges, struggling with declining demand and rising customer acquisition costs.

Sportswear Showdown: Challenger brands are rapidly gaining market share, driving competition in the dynamic sportswear segment.

Inventory Excellence: Advances in inventory management and agile supply chains are key to addressing margin pressures and meeting sustainability goals.

The Sustainability Collective: Collective action is essential to meet decarbonization goals despite consumer reluctance to pay premiums for sustainable products.

Looking Ahead

The industry’s outlook remains sluggish, with revenue growth stabilizing in low single digits. Luxury’s dominance in profit creation is challenged by non-luxury segments for the first time since 2010. Brands that act nimbly to address geographic shifts, demographic changes, and technological innovations will find opportunities amid the turbulence.

Growth in the jewellery sector will be fueled by rising demand from ultra-high spenders and continuous investment from luxury houses in technology and expertise.

The new playbook for 2025 emphasizes adaptability, localization, and sustainability, while redefining value and consumer engagement. The fashion sector must innovate, embrace technology, and prioritize long-term resilience to navigate this period of reckoning successfully.

JB Insights

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

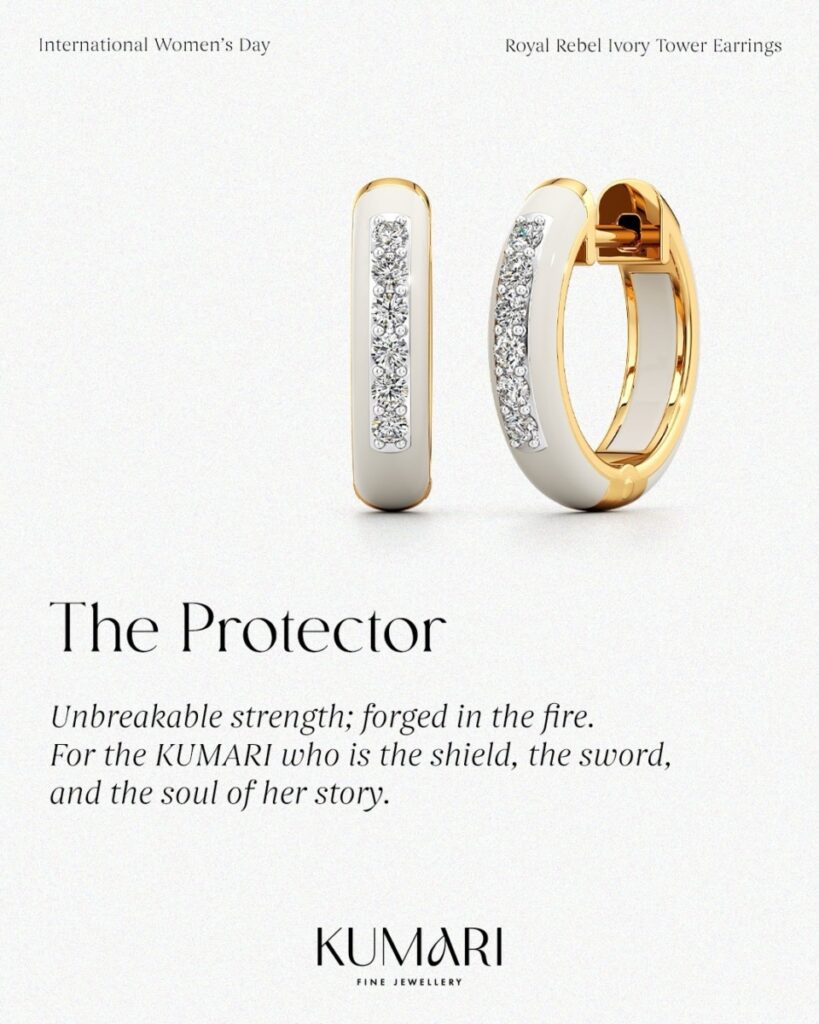

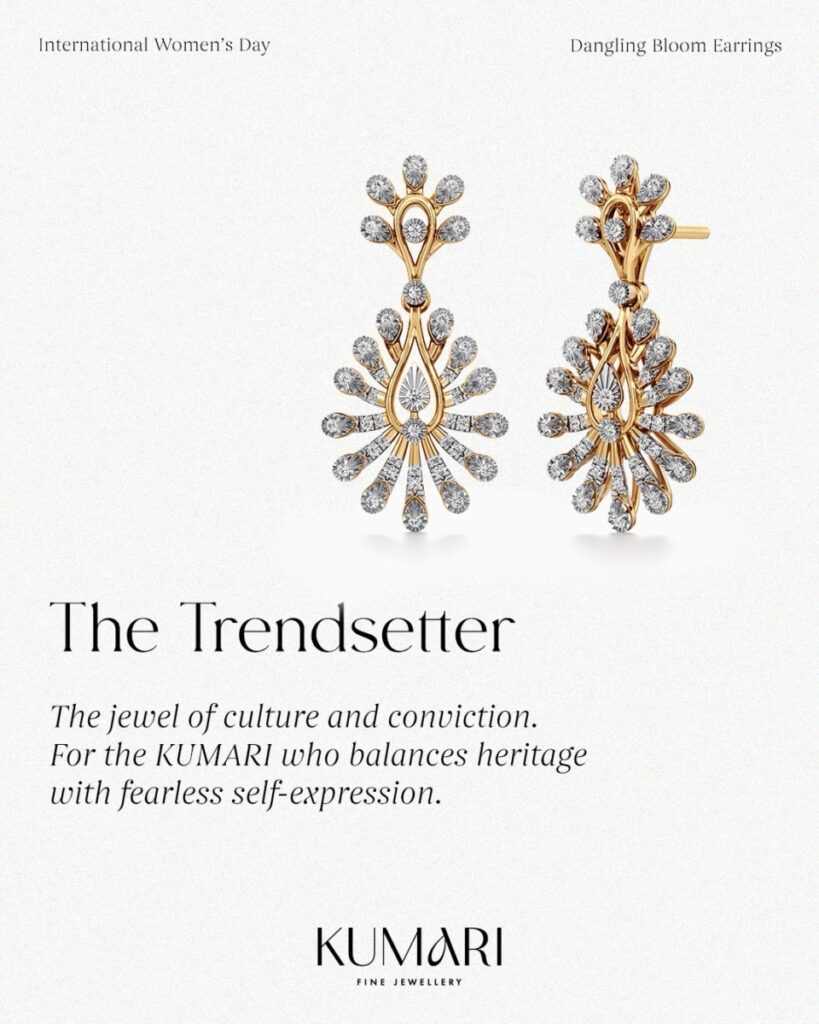

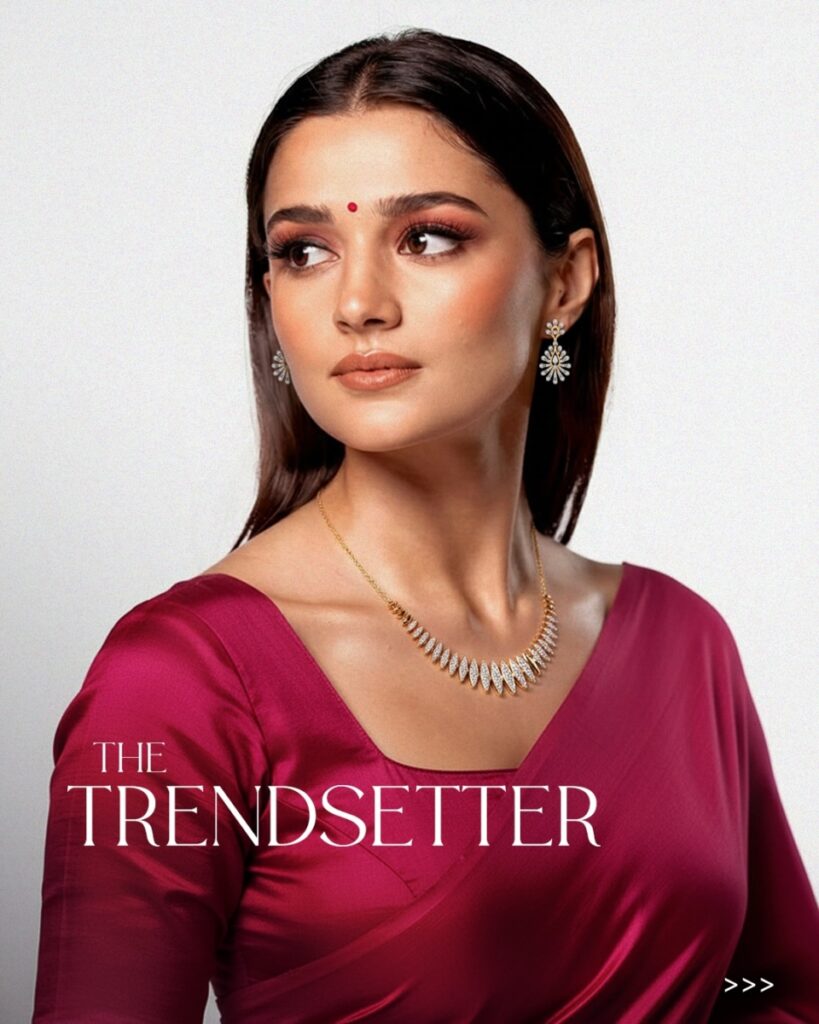

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

Dhirsons Jewellers

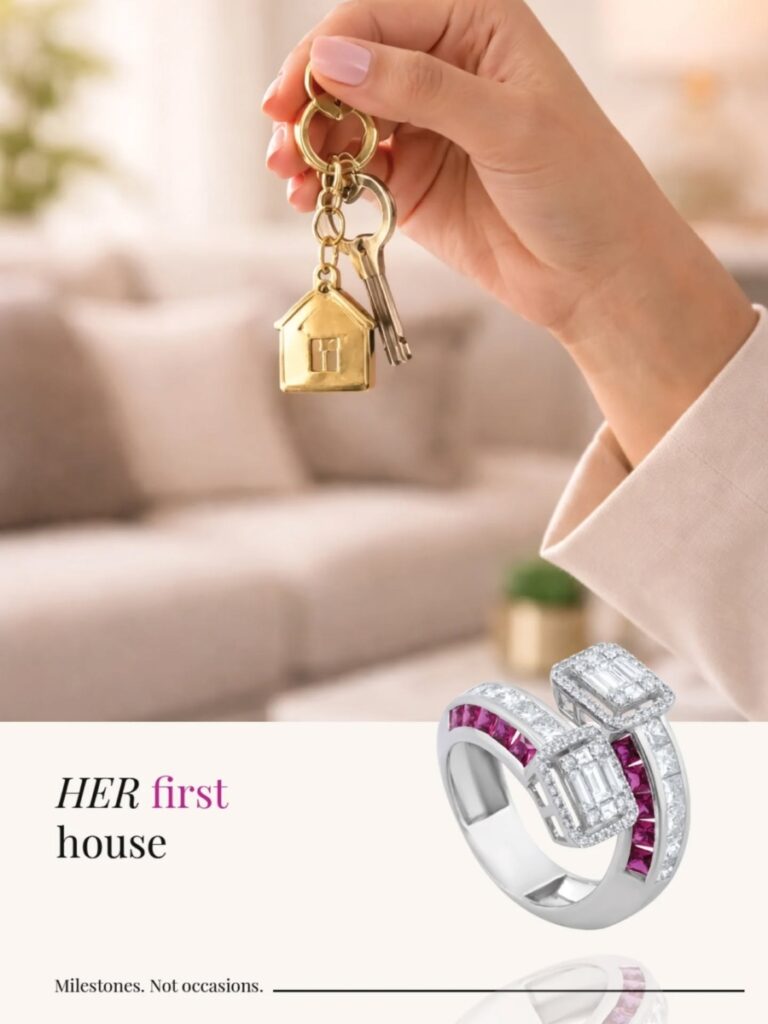

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

GIVA

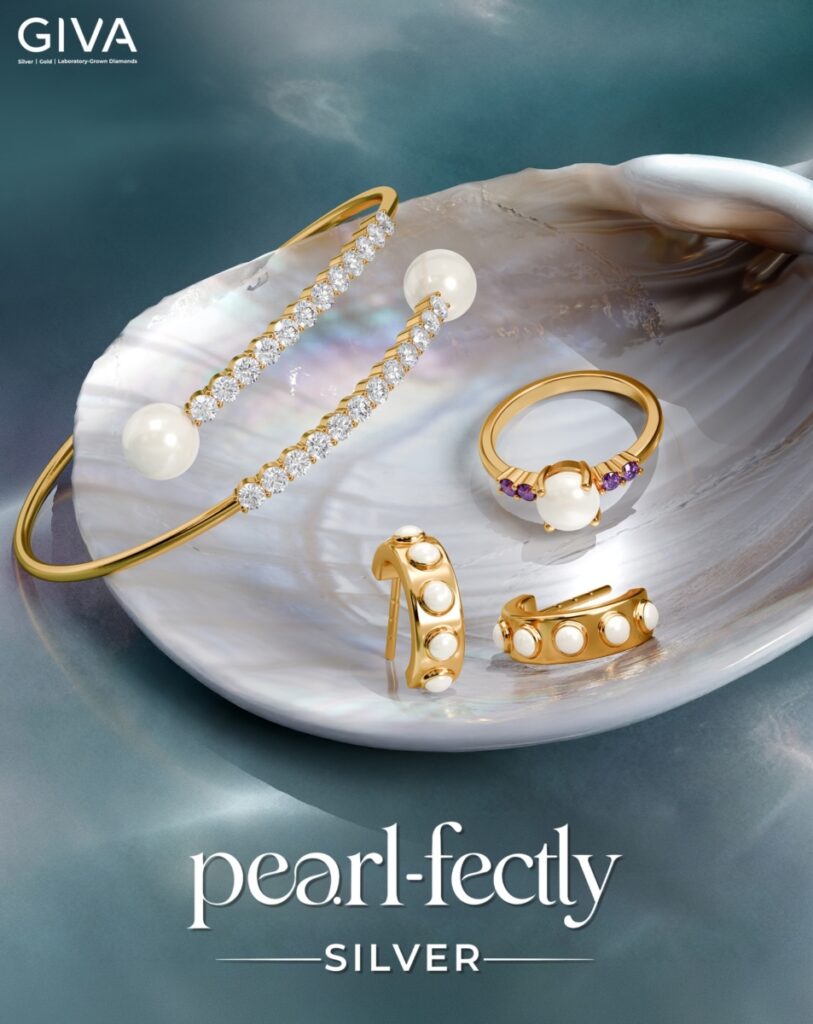

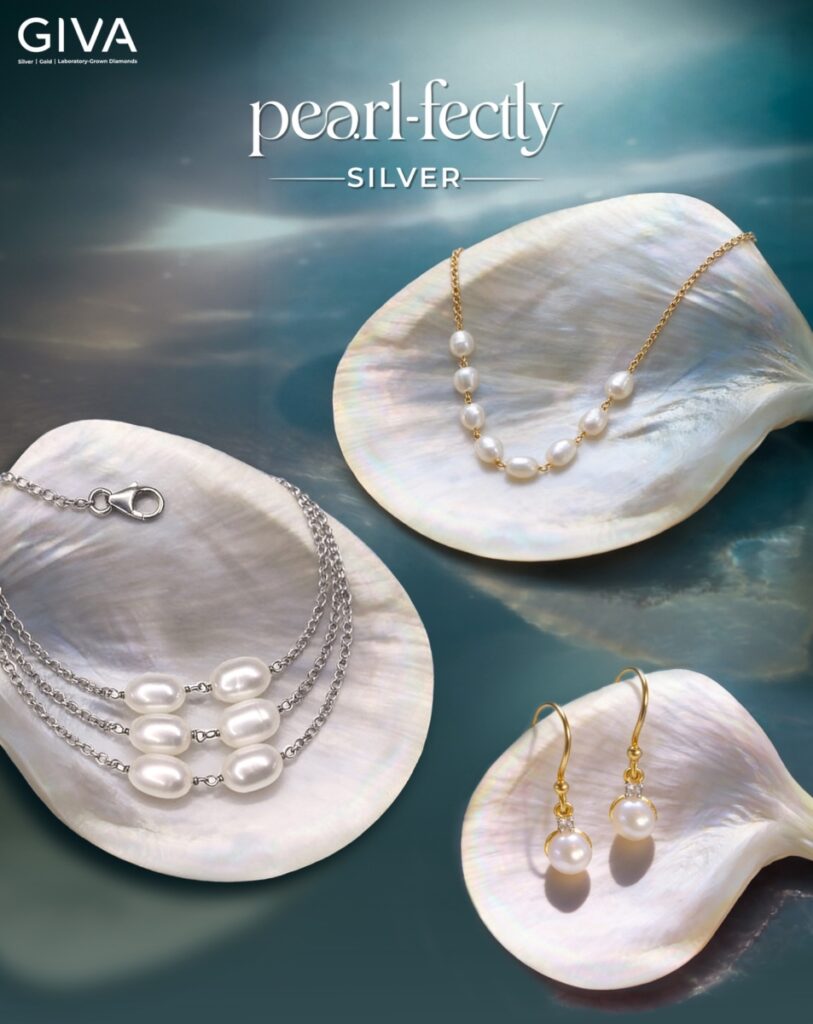

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

Divine Solitaires

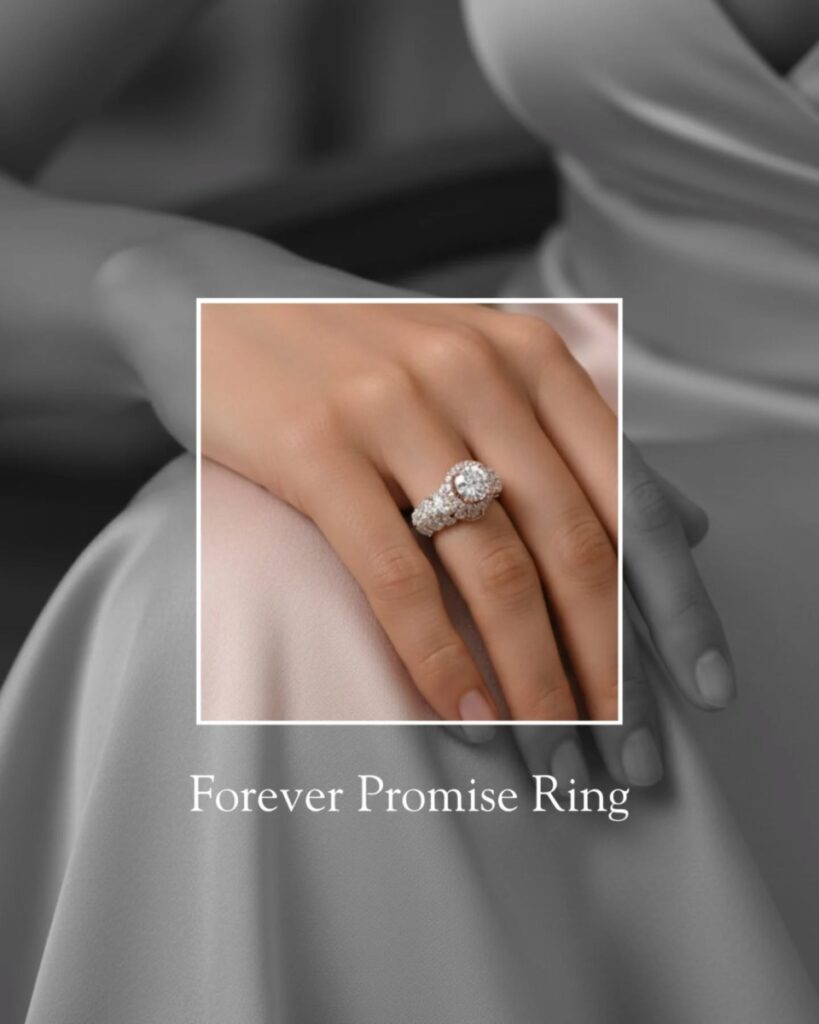

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

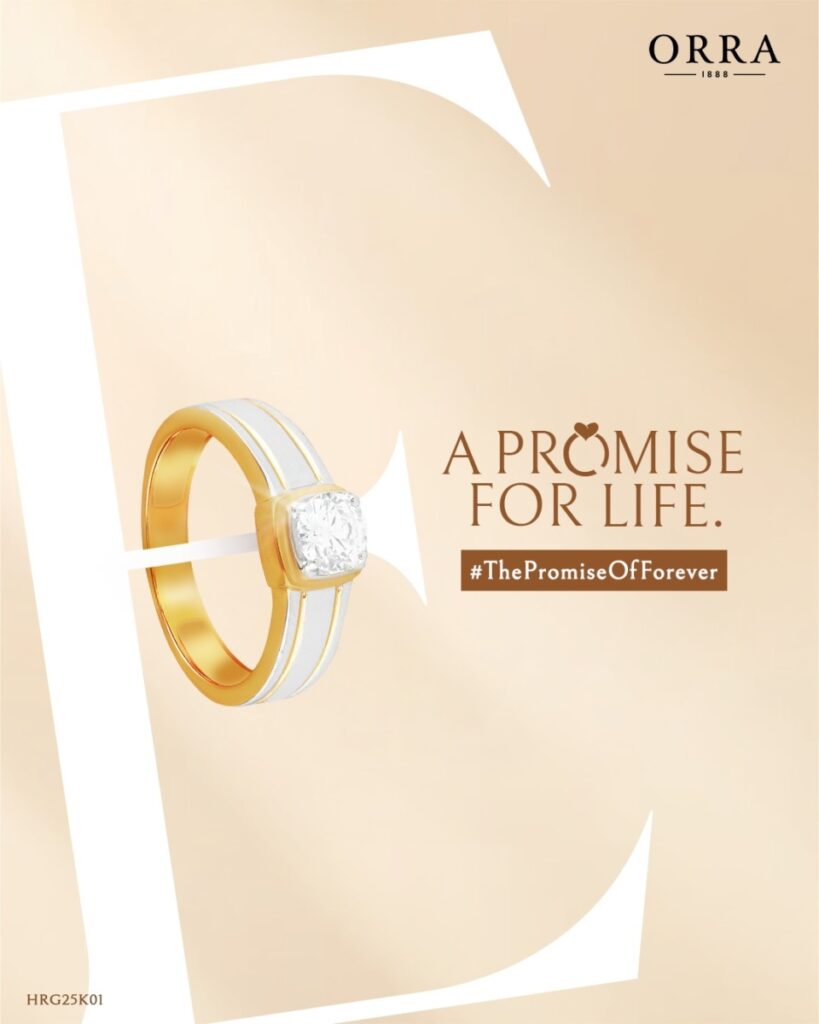

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

JB Insights8 hours ago

JB Insights8 hours agoWomen’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

-

National News11 hours ago

National News11 hours agoGold Rebounds in India After Five-Day Slide; Dollar Strength Keeps Pressure Intact

-

National News12 hours ago

National News12 hours agoKumari Fine Jewellery Celebrates the “Modern Indian Original” with Exclusive Women’s Day Showcase

-

National News16 hours ago

National News16 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey