International News

The Importance of Ergonomics in Jewellery Design

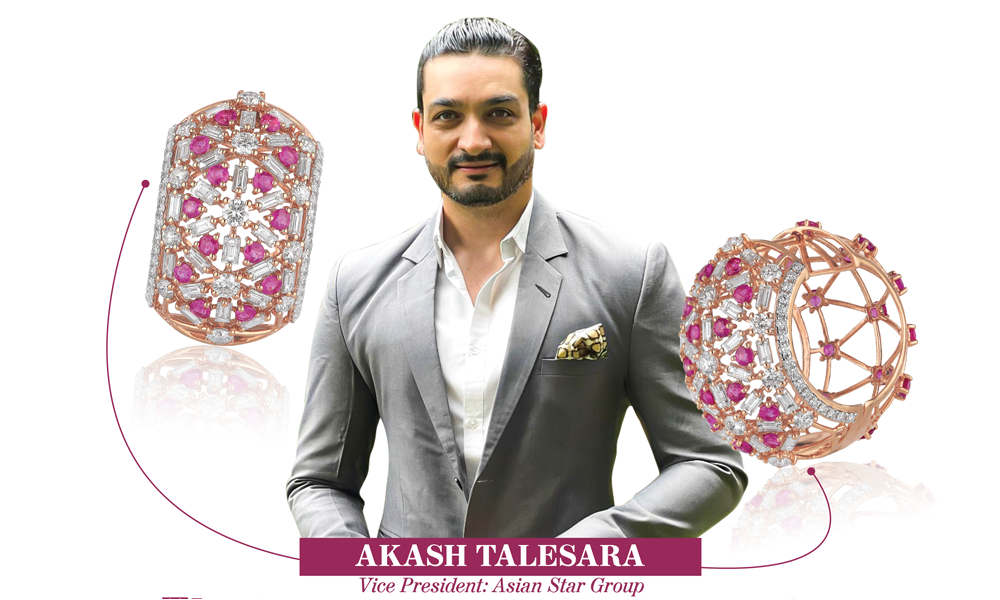

Akash Talesara

Vice President: Asian Star Group

What is Ergonomics?

Ergonomics is the science of designing and arranging things so that they interact efficiently and safely with people. It’s about creating products, environments, and systems that fit the people who use them, aiming to improve comfort, performance, and overall well-being. Ergonomics creates environments to optimize human well-being and performance. It is focused on creating products and spaces that are comfortable, efficient, and safe for people to use. In essence, ergonomics is all about making human experience better.

Why Ergonomics is such an important part of jewellery design?

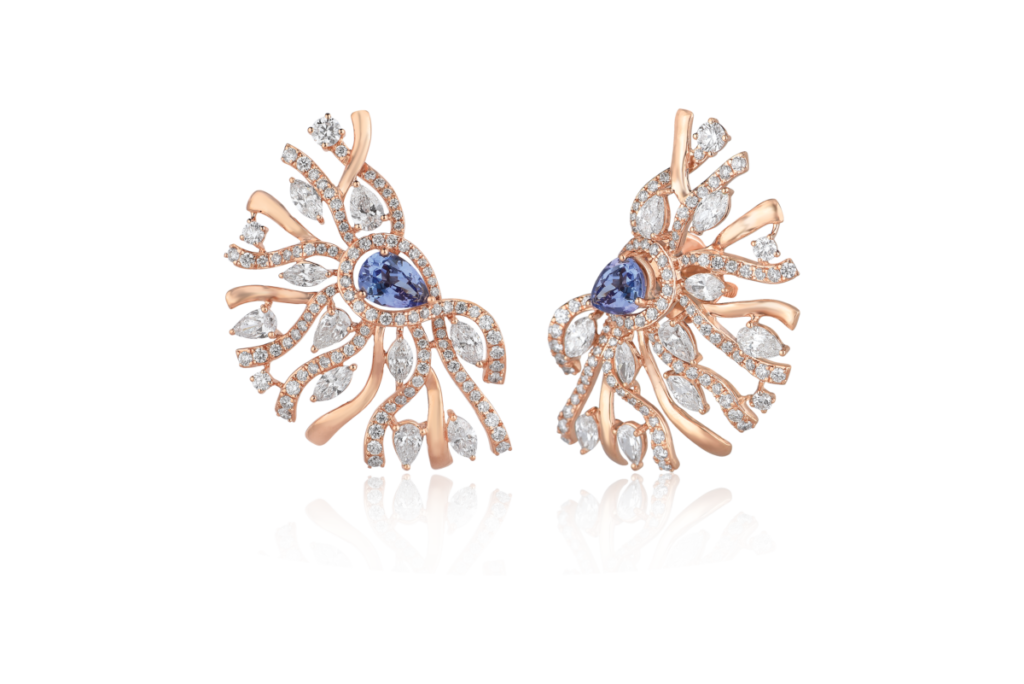

Ergonomics is all about designing products to fit the people who use them, making them more comfortable and efficient. In jewellery, ergonomics is important for several reasons. It involves creating pieces that are comfortable and functional for the wearer while also having a pleasing aesthetic.

How can it benefit the customer?

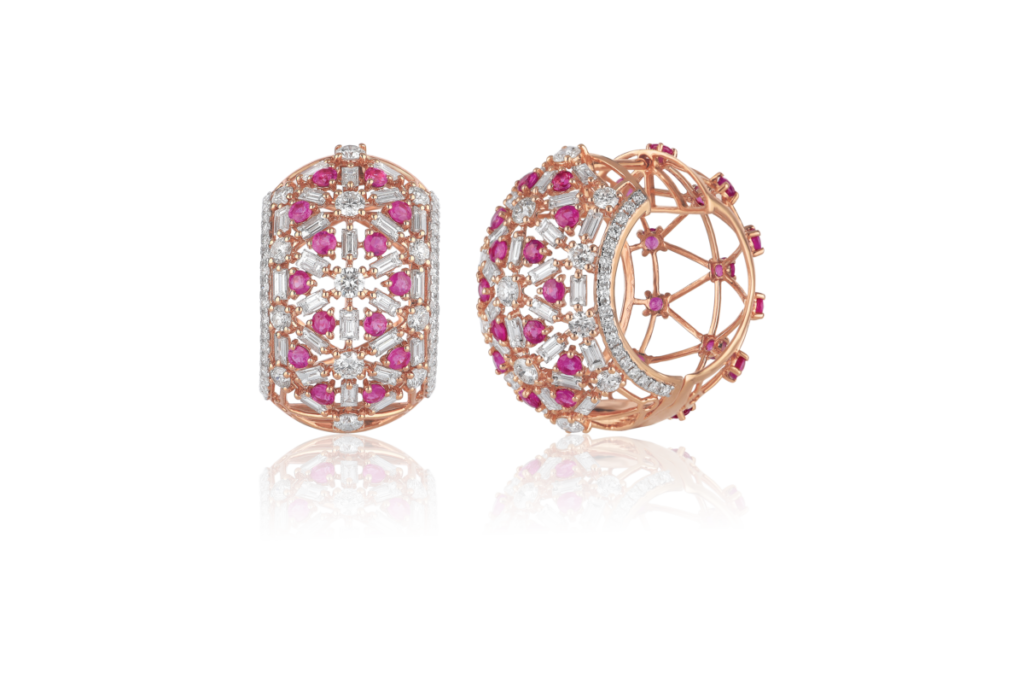

Ergonomically designed jewellery fits better and feels more comfortable to wear. For example, rings won’t pinch your fingers, necklaces won’t irritate your neck, and earrings won’t pull on your earlobes. This ensures that customers can wear their jewellery all day without discomfort. Understanding how ergonomics can be applied to diamond jewellery design is essential for creating durable, long-lasting pieces that will be worn with delight. Factors such as weight, shape, size, and materials must be taken into account to create pieces that are both beautiful and comfortable for the wearer.

How Ergonomics plays an important role in jewellery design?

By designing jewellery that is comfortable and functional, designers can create pieces that are not only beautiful but also practical for everyday use. Ergonomic design can also help to ensure the longevity and durability of the jewellery by reducing the risk of damage or breakage. Overall, ergonomics is an essential aspect of diamond jewellery design that ensures the well-being and satisfaction of the wearer.

When jewellery is designed with ergonomics in mind, it is more likely to withstand the wear and tear of daily use. For example, if a necklace is designed to be lightweight and properly balanced, it is less likely to break or become damaged due to excessive strain on the chain or clasp. Additionally, ergonomics can also affect the placement and security of the stones in the jewellery. If the jewellery is designed to fit comfortably on the wearer’s body, the stones are less likely to become loose or fall out. This can help to ensure the longevity and durability of the jewellery.

What are the effects of poor ergonomics on jewellery sales?

If jewellery is uncomfortable to wear, customers are less likely to buy it. Rings that pinch, earrings that are too heavy, or necklaces that irritate the skin will deter potential buyers. Customers who experience discomfort or problems with poorly designed jewellery are likely to leave negative reviews online or share their dissatisfaction with friends and family. This can damage the brand’s reputation and discourage new customers from purchasing. Customers who have a bad experience with a piece of jewellery are less likely to make repeat purchases from the same brand. This affects customer retention and long-term sales. So it’s very important to design jewellery that is made with Ergonomics in mind.

What are the challenges and solutions in Ergonomic diamond jewellery design?

Designing diamond jewellery that is both ergonomic and aesthetically pleasing can present several challenges for designers. Here are some of the challenges that designers may face and some solutions to help overcome them.

One of the biggest challenges in ergonomic diamond jewellery design is balancing the aesthetic appeal of the jewellery with its functional aspects. A piece of jewellery may look stunning, but if it is not comfortable to wear, it may not be practical. Size is another challenge that can affect the ergonomics of diamond jewellery. Jewellery that is too large or too small for the wearer can be uncomfortable and may not sit properly on the body.

A solution to this is to create adjustable pieces of jewellery that can be resized to fit the wearer’s body. Clasps and closures are other challenges in ergonomic diamond jewellery design. Closures that are difficult to use or that cause discomfort can make the jewellery less functional and less enjoyable for the wearer. A solution to this is to use closures that are easy to use and that do not cause discomfort.

International News

Hong Kong luxury jewellery, watches sales slip in May

In May 2025, Hong Kong witnessed a nuanced retail landscape: while total retail sales rebounded modestly, rising 2.4% year on year to HKD 31.32 billion ($3.99 billion), sales of luxury goods—specifically jewelry, watches, clocks, and other valuable gifts—contracted by 3.2% to HKD 3.87 billion ($493.1 million). This divergence offers critical insights into the shifting dynamics of consumer behavior, external macroeconomic pressures, and sector-specific challenges.

Several interrelated factors contributed to the luxury segment’s decline. First, surging gold prices significantly dampened consumer appetite for jewelry purchases, as higher costs discouraged discretionary spending on big-ticket items. Second, demand for luxury products on the Chinese mainland softened, reducing the influx of high-spending tourists traditionally pivotal to Hong Kong’s retail sector. Lastly, increased outbound tourism encouraged local consumers to shop abroad, further eroding domestic sales.

From January to May 2025, hard-luxury sales dropped by 9% to HKD 20.27 billion ($2.58 billion), while overall retail sales fell 4% to HKD 155.05 billion ($19.75 billion). These figures highlight a broader recalibration within Hong Kong’s retail environment, reflecting evolving consumer preferences and economic headwinds.

International News

US luxury jewellery spending in May 2025 sees increase of 10.1% y-o-y

Luxury jewelry spending in May saw a significant increase of 10.1% year-over-year, according to data from Citigroup. This figure stands in stark contrast to the U.S. Department of Commerce’s estimate of only 2.9% for the same period.Citigroup’s analysis is based on the spending habits of over 10 million U.S. credit card holders. In comparison, the Department of Commerce uses its own estimates, later revising them with actual transaction data.

Luxury watch spending also showed a substantial rise, with Citi reporting a 14.7% increase, while the Department of Commerce reported a more modest 2.4% rise.

Overall luxury goods spending, though still weak, showed signs of recovery in May, declining by 1.7% year-over-year. This is an improvement from April’s 6.8% decline and March’s 8.5% decline.

Since September 2024, luxury jewelry has consistently outperformed other luxury segments, including handbags and apparel. In May 2025, jewelry was the only category to experience growth in both average spend per customer and the number of individual customers. This suggests a growing consumer preference for jewelry over other luxury items like handbags.

International News

Gold upside capped by better-than-expected Employment Report AUGMONT BULLION REPORT

- Strong US labour market data which indicated that businesses added more jobs than anticipated in June and that the unemployment rate unexpectedly fell to 4.1% served as a lid on gold’s gains and strengthened the case for the Federal Reserve to keep interest rates unchanged.

- It is anticipated that President Donald Trump’s big package of tax and spending cuts, which was adopted by the House on Thursday, will increase the national debt by nearly $3 trillion over the next ten years.

- In contrast, Trump announced that he will start writing to nations on Friday, outlining the tariff rates they will be subject to on US imports. This is a significant change from his previous promises to negotiate individual agreements.

Technical Triggers

- Gold is expected to trade in the range of $3300 (~Rs 96000) and $3400 (~Rs 98500) this week.

- Silver has given a breakout of its range, trading above $37 (~ Rs 108,000). Now next target is $38 (~Rs 111,000)

| Metal | Region | Support Level | Resistance Level |

|---|---|---|---|

| Gold | International | $3250/oz | $3440/oz |

| Indian | ₹95,000/10 gm | ₹98,500/10 gm | |

| Silver | International | $35.5/oz | $37/oz |

| Indian | ₹1,04,500/kg | ₹1,07,500/kg |

-

National News3 days ago

National News3 days agoMalabar Gold & Diamonds Inaugurates Landmark Integrated Manufacturing Site in Hyderabad, Cementing Its Position as a Global Manufacturing Leader

-

National News2 months ago

National News2 months agoEmmadi Silver Jewellery Launches First Karnataka Store with Grand Opening in Bengaluru’s Malleshwaram

-

BrandBuzz3 months ago

BrandBuzz3 months agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

GlamBuzz2 months ago

GlamBuzz2 months agoGokulam Signature Jewels Debuts in Hyderabad with Glamorous Launch at KPHB