International News

Silver retreats Rs 9000/kg from its record high AUGMONT BULLION REPORT

- Prices of gold and silver fell as the US dollar appreciated and investors profited from the announcement that Israel and Hamas had reached an agreement on the first stage of a ceasefire plan.

- Federal Reserve officials agreed that the dangers to the U.S. labour market were significant enough to justify a rate cut, but they remained cautious due to persistent inflation, according to minutes of the U.S. central bank’s September meeting that were made public on Wednesday.

- Due to political unrest in France and Japan, as well as the ongoing government shutdown in the United States, markets have struggled this week. As a result, investors have turned to gold for safety.

Technical Triggers

- As the gold prices fell more than $100, volatility is very high. If gold futures sustain below yesterday’s low of $3958 (~Rs 120,200), we can say, top has been made, and a correction will follow for at least 4-5%.

- Silver achieved the target of $50 (~Rs 153,000). And then prices retreated by almost Rs 9000 from their high in volatile momentum. Yesterday’s low of $46.90 (~Rs 145,000) is a very strong support. If Silver futures sustain below this level, we could see more correction or profit booking by at least 4-5%.

Support and Resistance

| Metal | Market | Support Level | Resistance Level |

|---|---|---|---|

| Gold | International | $3850/oz | $4100/oz |

| Gold | Indian | ₹117,000/10 gm | ₹124,000/10 gm |

| Silver | International | $47/oz | $50/oz |

| Silver | Indian | ₹145,000/kg | ₹150,000/kg |

DiamondBuzz

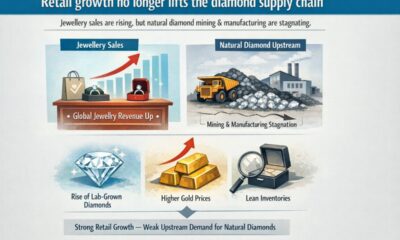

Despite revenue growth in jewellery sector, natural diamond upstream sees stagnation

Lab-grown disruption, soaring gold prices and leaner retail inventories decouple jewellery revenue growth from natural diamond mining and manufacturing demand

Despite robust revenue growth in the global jewellery sector, the natural diamond upstream (mining and manufacturing) is facing stagnation due to a fundamental shift in product mix and inventory strategy. Jewellery sales are rising across key markets, but a shift toward lab-grown stones, higher gold prices and leaner inventories means that growth at the counter is no longer translating into stronger demand for natural diamonds upstream.

Market Performance vs. Natural Diamond Demand

- Strong Retail Indicators: Major luxury conglomerates and commercial retailers reported significant YOY revenue growth (e.g., Richemont +6%, Titan Company +24%, Chow Tai Fook +18%).

- The Disconnect: While total jewellery revenue is rising, the natural diamond component of that revenue is shrinking. Diamonds now represent ~41% of total jewellery sales, down from 50% a decade ago.

Primary Drivers of Structural Disruption

- Market Share Erosion by Lab-Grown Diamonds (LGDs):

-

- LGDs have achieved dominant penetration in the bridal segment (61% of US engagements in 2025).

- Retailers are actively “leading” with LGDs, diverting unit volume away from natural stones.

- Segment Squeezing & Substitution:

- Consumers are opting for larger LGDs at price points previously reserved for 0.50–1.50 carat natural stones.

- This has hollowed out the “mid-market” natural diamond category, forcing upstream demand toward only the highest-value, large stones.

- Commodity Price Pressure (The Gold Factor):

-

- Surging gold prices have absorbed a larger share of the consumer’s total “per-piece” budget.

- Design Engineering: Manufacturers are reducing diamond counts or using smaller accent stones to maintain price points, leading to lower natural diamond volume per SKU.

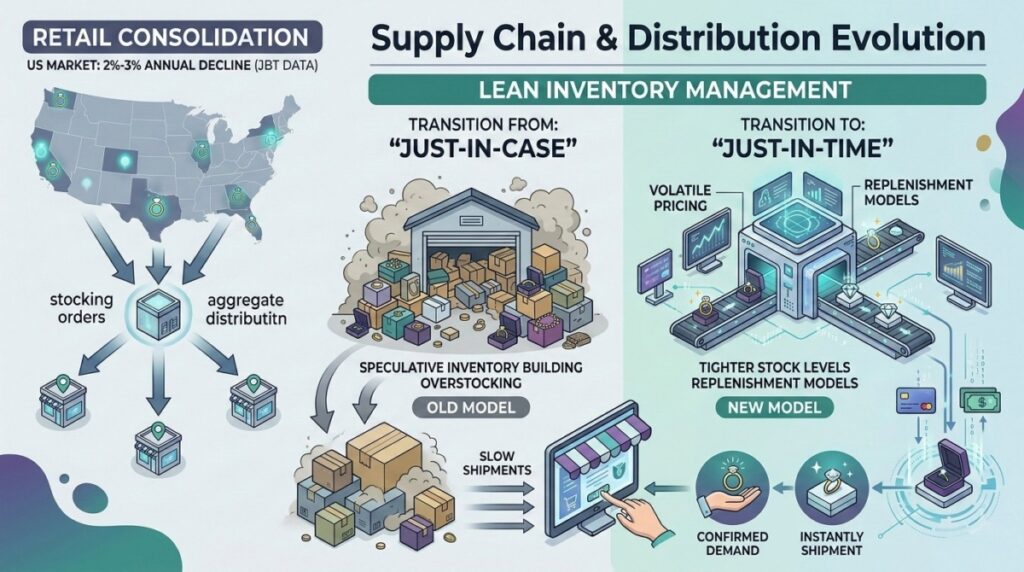

Supply Chain & Distribution Evolution

- Retail Consolidation: The US market is seeing a 2%–3% annual decline in the number of jewellery businesses (JBT data). A smaller retail footprint naturally results in fewer aggregate “stocking orders.”

- Lean Inventory Management: * Transition from “Just-in-Case” to “Just-in-Time” replenishment models.

Retailers are maintaining tighter stock levels due to volatile pricing and high credit costs, buying only against confirmed consumer demand rather than speculative inventory building.

The New Normal for Upstream Stakeholders

The traditional “bullwhip effect” that previously benefited miners and manufacturers has been dampened. Growth at the retail counter no longer guarantees a surge in the midstream. The natural diamond supply chain must now realign for a lower-volume, higher-value environment until natural stones can reclaim a distinct value proposition relative to LGDs and gold-heavy designs.

-

DiamondBuzz27 minutes ago

DiamondBuzz27 minutes agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News2 hours ago

International News2 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News2 hours ago

International News2 hours agoGold continues to get strength on the Middle East conflict

-

National News4 hours ago

National News4 hours agoIJEX 6TH Fam provides comprehensive insights into ME market