National News

Retail Gold Sales Drop 25% Amid Rising Prices, Lightweight Jewelry in Demand

A 4% rise in gold prices in March has led to a significant 25% decline in retail gold sales at jewelers and a 60% drop in Zaveri Bazaar. Indian families with upcoming weddings are feeling the pinch of higher gold prices, turning to lighter, lower-carat jewelry to meet bridal jewelry demands. Despite this, demand is expected to pick up during Akshay Tritiya in April, though lightweight jewelry remains the preferred choice.

Gold prices saw a near-4% increase in the first half of March, bringing down retail sales by 25% compared to the same period last year. Zaveri Bazaar, a hub where retail jewellers buy bullion and jewelry in bulk, saw a 60% drop in sales.

Senco Gold & Diamonds, Joy Alukkas, PNG Jewellers, Mamraj Musaddilal Jewellers, and senior executives from the India Bullion & Jewellers Association mentioned that Indian families, especially those with weddings planned for the upcoming season, are stressed by the escalating prices. As a result, they are opting for lightweight jewelry, as high prices make it difficult to stick to the traditional gold jewelry budgets.

Suvankar Sen, the chief of Senco Gold, shared that sales of small-ticket gold jewelry in the ₹30,000 – ₹40,000 price range have dried up. “The high prices are keeping customers away from spending on gold,” he said. On March 18, gold was priced at ₹88,256 per 10 gm in the physical market, with a 3% Goods and Services Tax (GST), pushing the cost to ₹90,903 per 10 gm.

“Those who have weddings in the family are buying lightweight jewellery as they cannot stretch the budget. Demand has dropped by 15% beginning from March and if this rally continues, the recovery in demand may not happen. The next big sales can only happen during Akshay Tritiya, which falls on April 30,” said the MD of Senco Gold & Diamond.

Despite the rise in prices, the demand has remained sluggish in South India too. “Compared to last March, demand is down by up to 25%. While the high price is a big factor in this demand drop, other things like board exams have slowed down demand as well,” said Baby George, CEO of Joy Alukkas.

Saurabh Gadgil, chairman of PNG Jewellers, also highlighted the shift in preferences. “People are buying lightweight jewellery, and many are exchanging old gold jewellery with new ones. The volumes are getting impacted but value-wise the jewellers are not facing any issue.”

Avinash Gupta, partner at Hyderabad-based Mamraj Musaddilal Jewellers, noted that while demand has softened, it hasn’t reached alarming levels. “Demand will bounce back in April due to weddings and Akshaya Tritiya, but definitely the preference will shift to lightweight and lower caratage jewellery.”

JB Insights

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

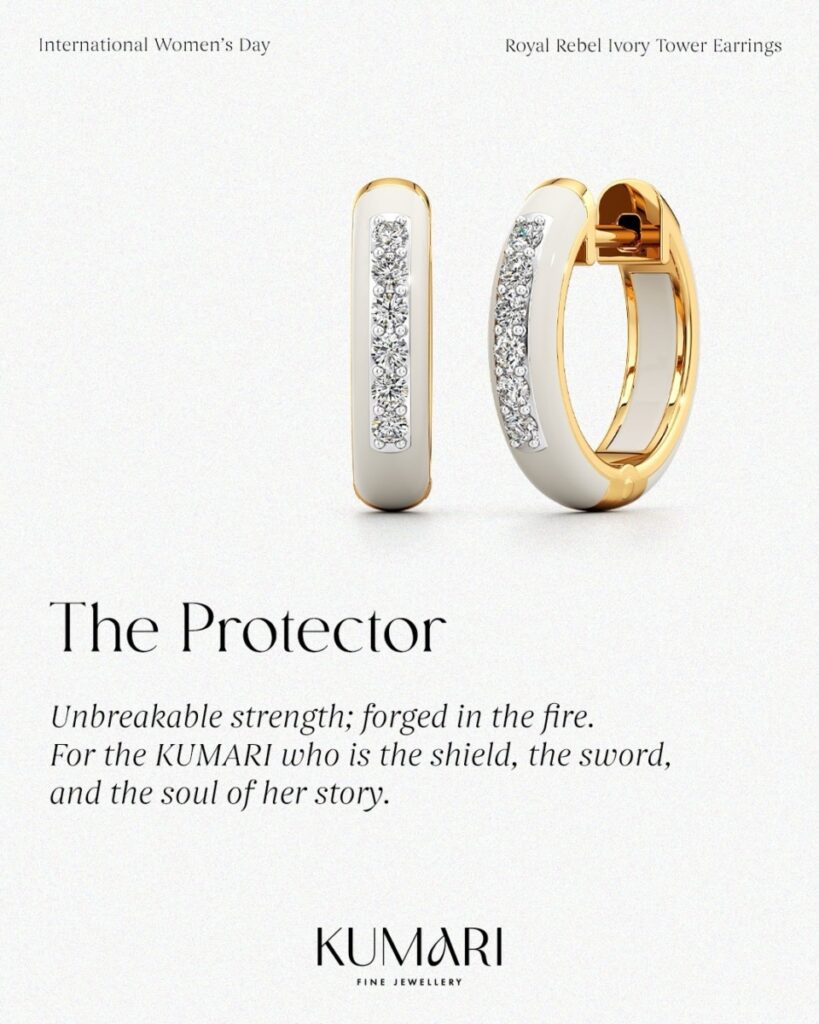

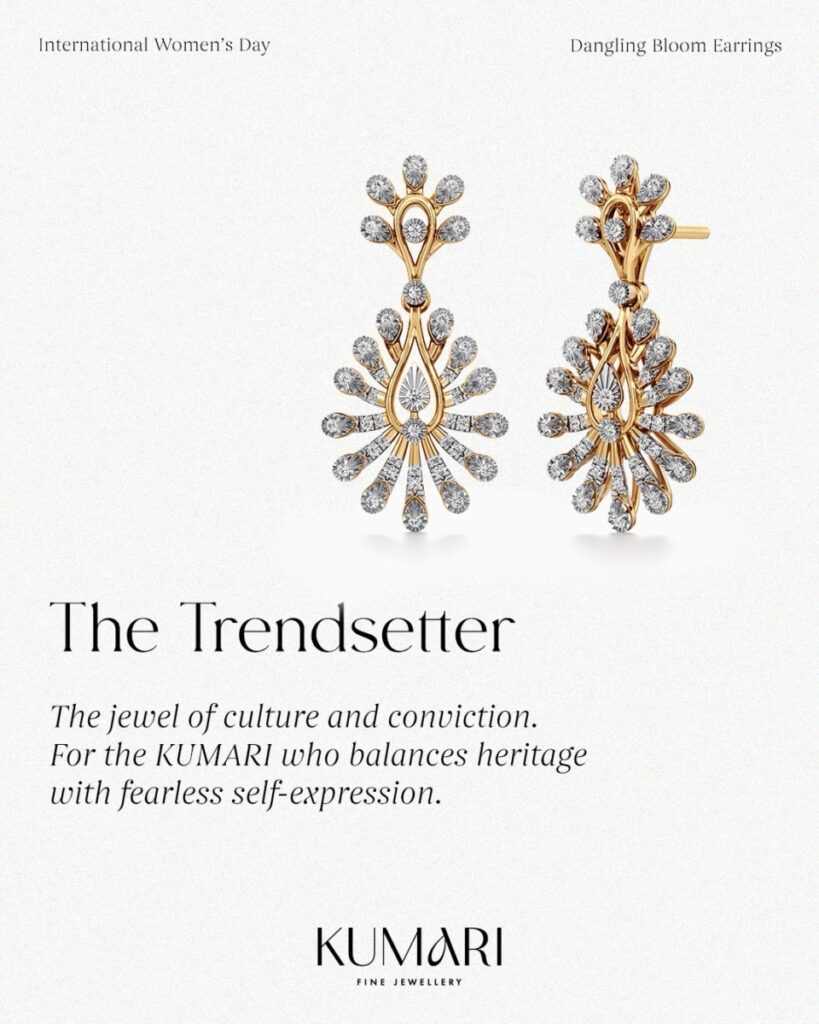

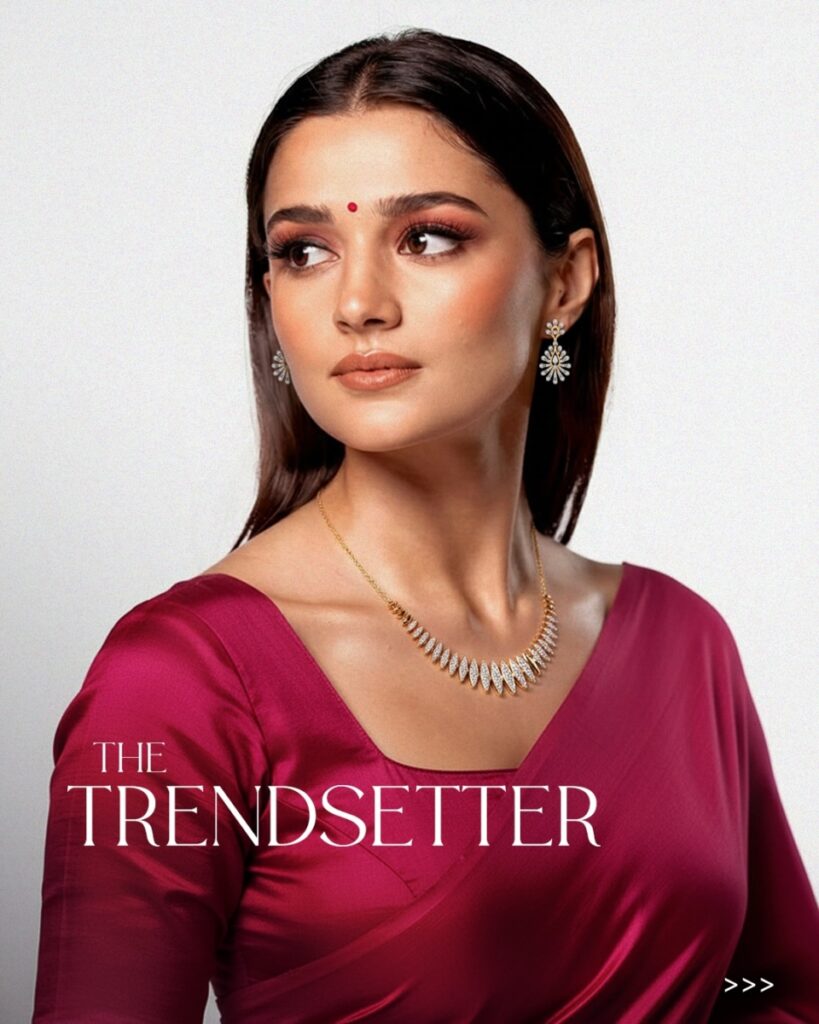

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

Dhirsons Jewellers

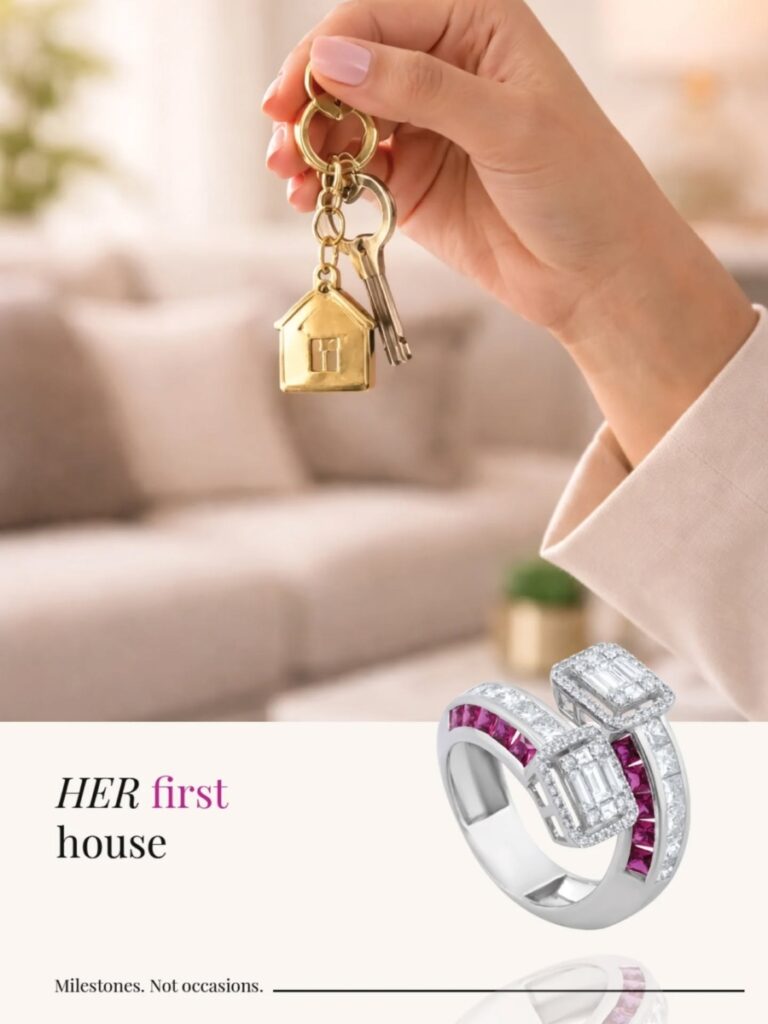

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

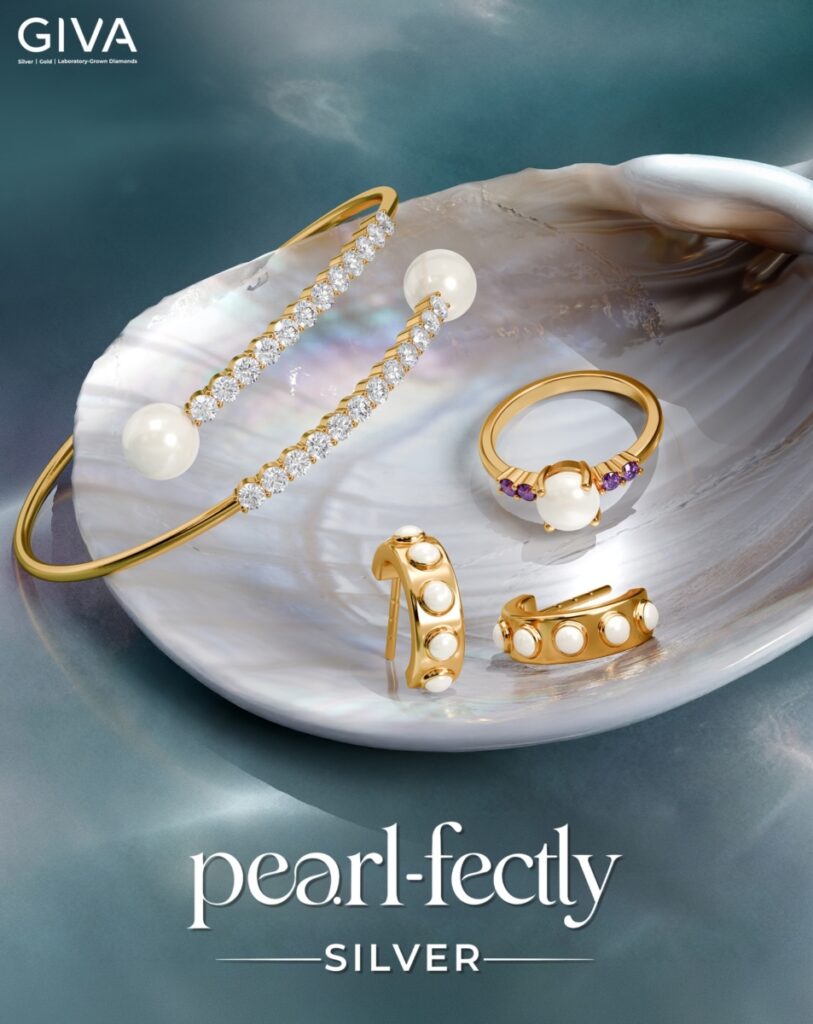

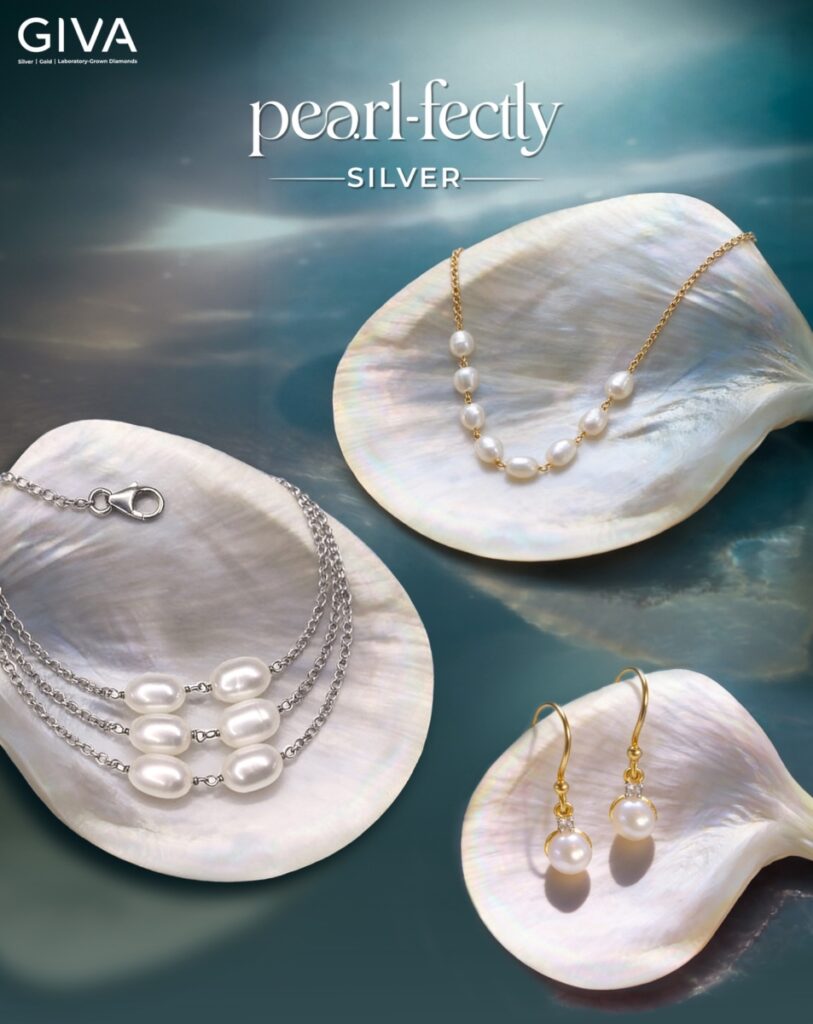

GIVA

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

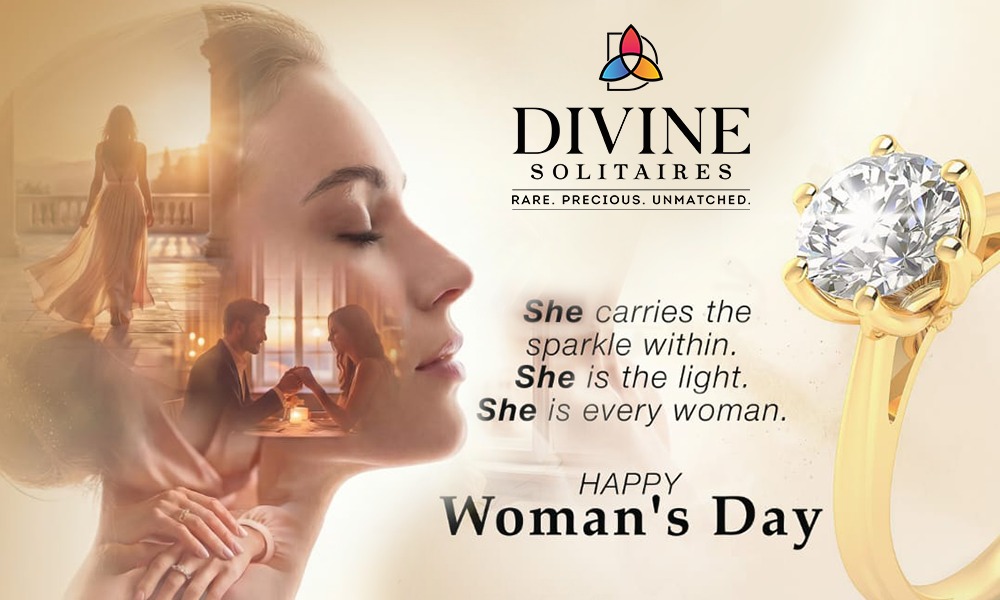

Divine Solitaires

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

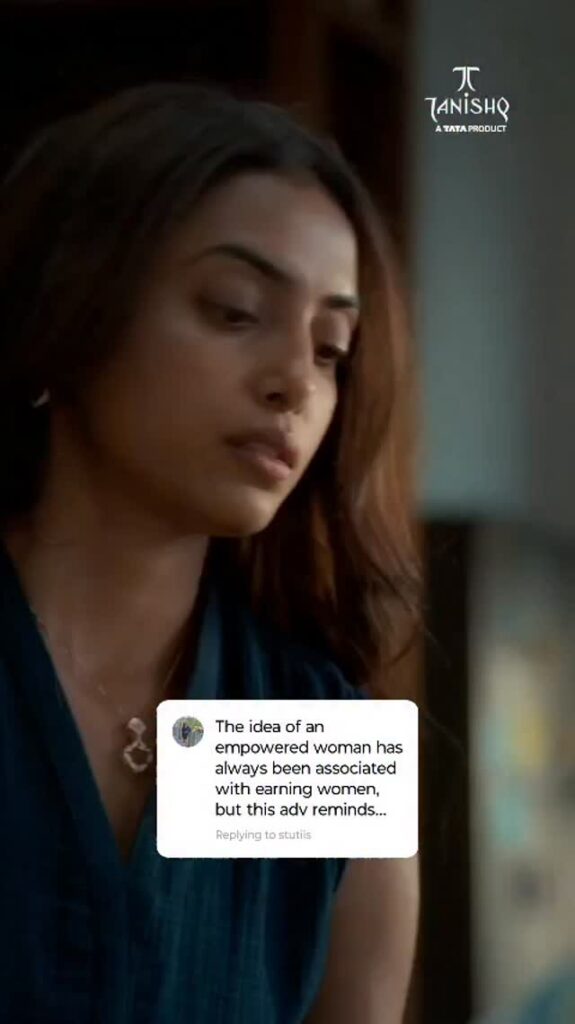

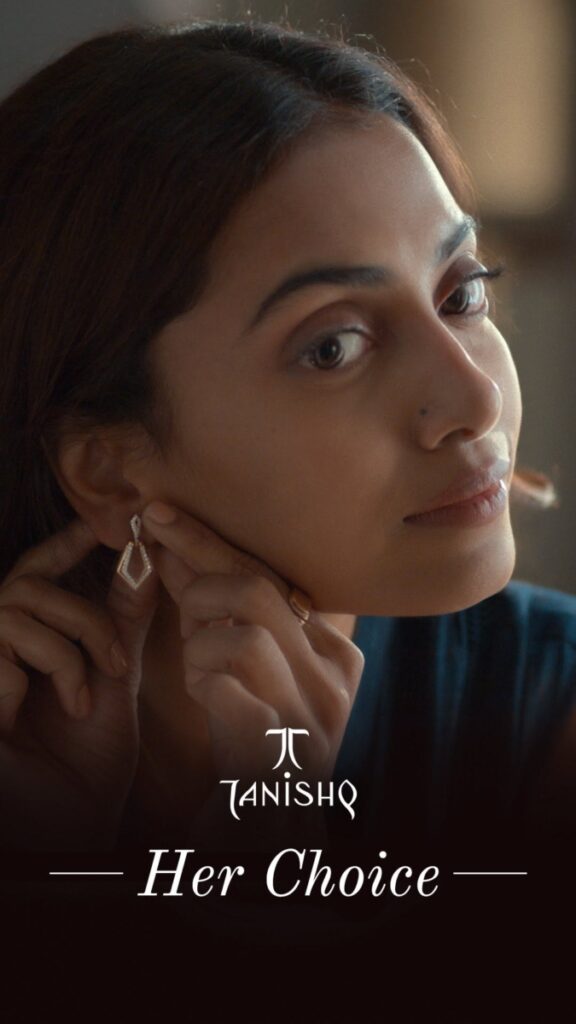

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

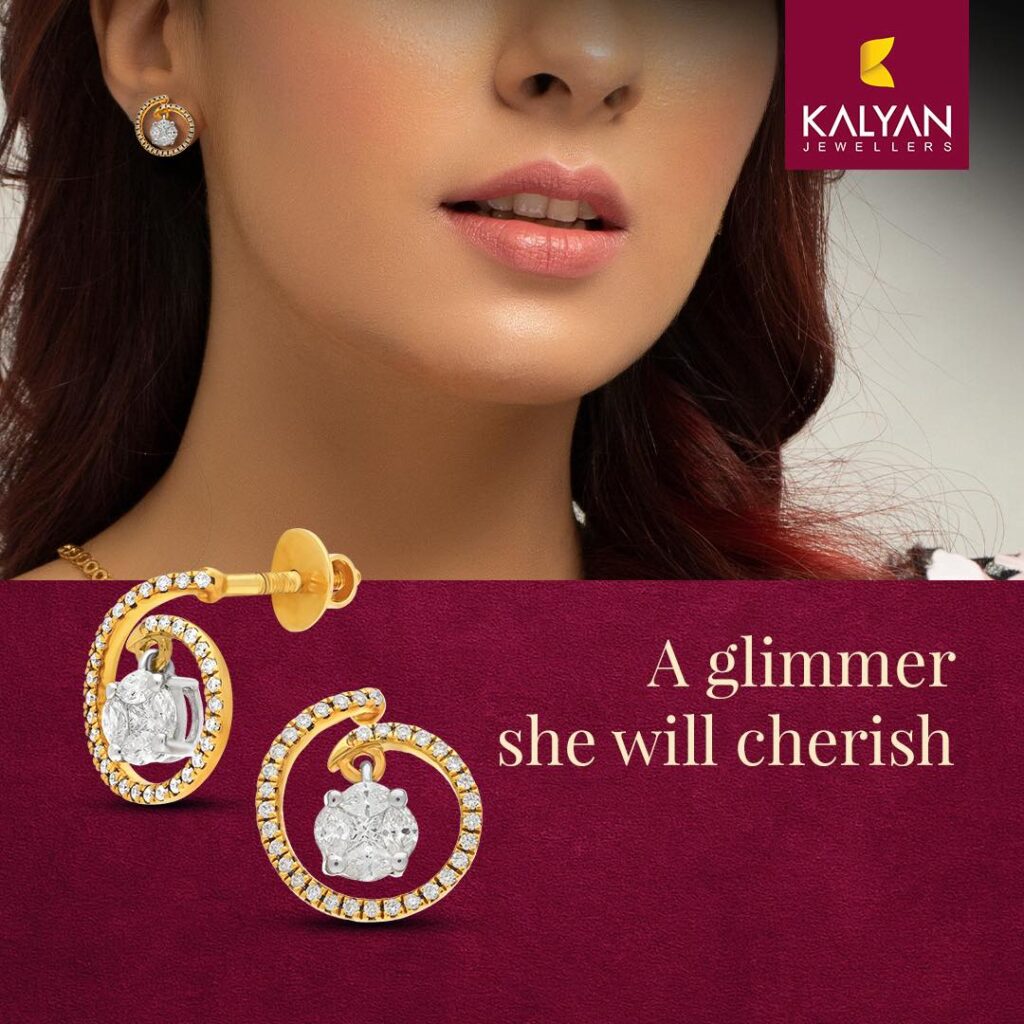

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

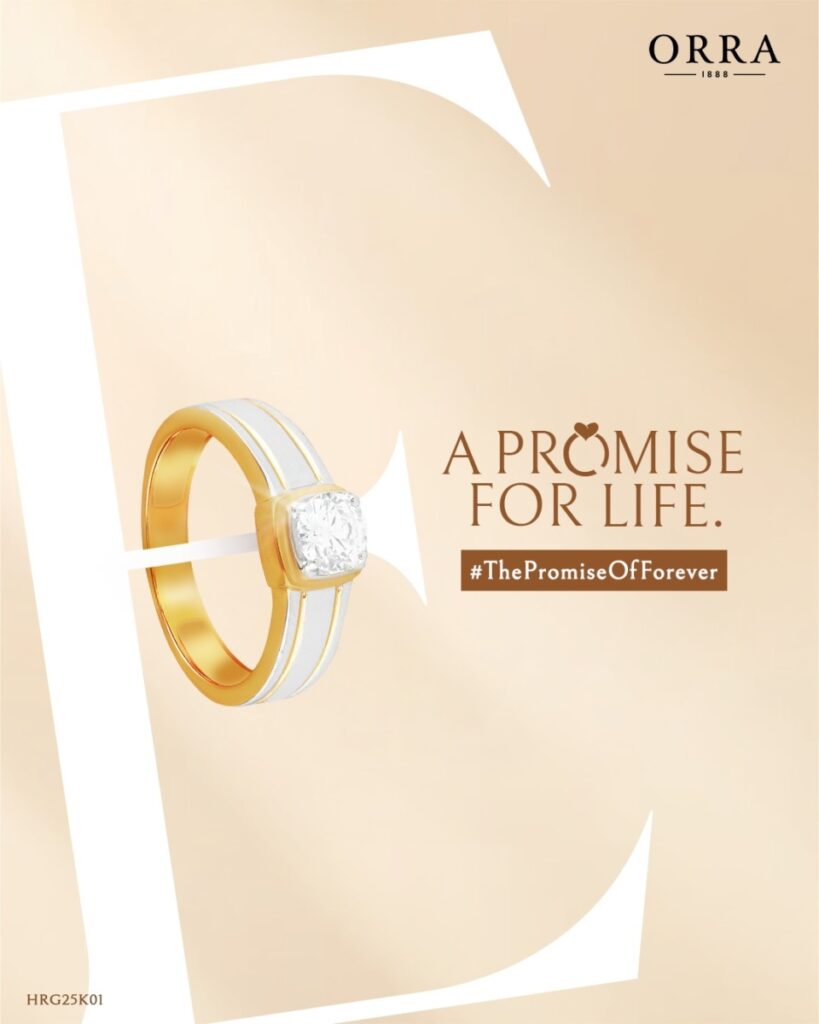

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

JB Insights15 hours ago

JB Insights15 hours agoWomen’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

-

National News19 hours ago

National News19 hours agoGold Rebounds in India After Five-Day Slide; Dollar Strength Keeps Pressure Intact

-

National News20 hours ago

National News20 hours agoKumari Fine Jewellery Celebrates the “Modern Indian Original” with Exclusive Women’s Day Showcase

-

National News24 hours ago

National News24 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey