National News

Precious metals¬Ý are on fire! Gold, Silver, Platinum have beaten Nifty 50

Precious metals are on fire, blazing past equities and stealing every ounce of market spotlight this year! While the Nifty barely manages a polite 5.49% nod year-to-date, the metals market is throwing a full-blown victory parade — platinum has rocketed 80%! Silver has soared 66%! Gold is glittering with a jaw-dropping 52%!

The message is loud and clear: this is the year of the metals!As investors rush to the safety and sparkle of hard assets, the once-mighty equities are gasping for attention.At 25,046.15, the Nifty’s climb from 23,700 looks more like a gentle stroll — meanwhile, the metal charts are practically melting screens with their red-hot momentum.

At 25,046.15, the Nifty’s gentle rise from 23,700 levels feels tame compared to the red-hot surge in metals. Precious metals are benefitting from a cocktail of global trends — from supply constraints and rising industrial demand, to investor appetite for safe havens amid geopolitical turbulence.

Platinum’s rally has been especially dramatic, buoyed by expectations of strong demand from the automotive and green energy sectors, where the metal plays a critical role in hydrogen fuel cells and catalytic converters. Silver, often dubbed “gold’s poor cousin,” has gained newfound glamour as both an industrial and investment metal, with booming demand from solar and electronics manufacturing.

Gold, meanwhile, remains the ultimate symbol of safety and value, riding a wave of central bank buying, jewellery demand, and global monetary uncertainty. Its ascent reflects both its emotional and financial hold on investors — a hedge against chaos, and a trusted store of wealth.

The contrast between metals and equities could not be starker. As corporate earnings moderate and valuations stretch, investors are recalibrating risk. While India’s equity markets continue to show resilience, the metals rally highlights an underlying unease about inflationary pressures, interest rate shifts, and global capital flows.

National News

IJEX 6TH Fam provides¬Ýcomprehensive insights into ME market

Five-day immersion under GJEPC’s Export Mentorship Programme equips Indian exporters with market intelligence, retail exposure, and strategic clarity across the UAE jewellery landscape.

The five-day Familiarisation (FAM) Program by GJEPC’s India Jewellery Exposition Centre (IJEX), Dubai, provided Indian jewellery exporters with comprehensive insights into the Middle East market, focusing on regional dynamics, consumer preferences, and retail environments across the UAE.

The 6th batch of the IJEX FAM Programme,¬Ýinitiated¬Ýand facilitated under GJEPC‚Äôs Export Mentorship Programme (EMP),¬Ýdelivered a structured five-day immersion into the UAE jewellery ecosystem, combining market intelligence, design orientation,¬Ýlogistics¬Ýguidance, and extensive retail visits across Dubai, Abu Dhabi, and Sharjah. Participants consistently highlighted the programme‚Äôs practical value, mentorship, and clarity in building export readiness.¬Ý

Day 1: Understanding the Middle East Landscape

The programme commenced at IJEX with an introduction session followed by a presentation on navigating the Middle East jewellery market, covering regional dynamics, consumer preferences across emirates, export opportunities, and positioning strategies across wholesale and retail segments. Delegates then visited Ithraa Wholesale & Retail, Goldcenter Building, Gold House, Jewel Plaza, Traditional Gold Souq, African Souq, and Gold Land, together representing around 475 retailers and 460 offices, giving participants a broad view of both wholesale and traditional trading ecosystems.

Day 2: New Dubai Retail and Design Insights

A designer interaction session focused on branding, cultural motifs, and regional aesthetics relevant to GCC consumers. Market visits to Mall of the Emirates, Lulu Hypermarket ‚Äì Al Barsha, Gold & Diamond Park, and Dubai Hills Mall allowed delegates to¬Ýobserve¬Ýnearly 115¬Ýjewellery retailers across luxury malls, diaspora-focused outlets, and specialised diamond boutiques, highlighting differences in merchandising, product mix, and customer behaviour.¬Ý

Day 3: Logistics, Compliance and Market Diversity

A session by Ferrari Freight Forwarders covered import procedures, documentation, duties, and secure¬Ýlogistics¬Ýhandling.¬ÝSubsequent¬Ývisits to Dubai Mall, Dubai Design District (d3), Karama Centre, and Meena Bazaar brought delegates in contact with about 150 retailers, spanning ultra-luxury international brands to culturally driven Indian diaspora markets, reinforcing the diversity of customer segments within the UAE.¬Ý.

Day 4: Abu Dhabi Market Exploration¬Ý

Visits to Madinat Zayed Gold Centre, Hamdan Street, and Abu Dhabi Mall covered¬Ýroughly 132¬Ýjewellery stores, offering insights into the capital‚Äôs consumer preferences across luxury, traditional Arabic styles, and price-sensitive segments. Delegates reported improved clarity in¬Ýidentifying¬Ýsuitable positioning and product strategies for different emirates.¬Ý

Day 5: Strategy Alignment and Expansion

The final day focused on one-to-one consultations with the IJEX team, followed by a certificate ceremony and a visit to Sharjah Blue Souq, where delegates explored around 110 jewellery stores known for 18kt, 21kt, and 22kt gold, diamonds, and silver collections, further expanding their understanding of regional demand across the Northern Emirates.¬Ý

Overall, participants described the programme as informative, well-organised, and strongly supportive, with several stating that the experience provided clarity, confidence, and a concrete roadmap for entering export markets through IJEX.¬Ý

-

DiamondBuzz31 minutes ago

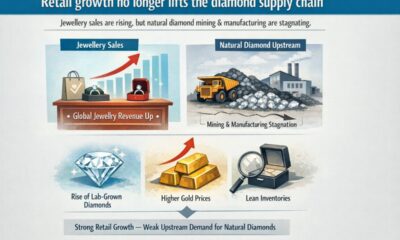

DiamondBuzz31 minutes agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News2 hours ago

International News2 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News3 hours ago

International News3 hours agoGold continues to get strength on the Middle East conflict

-

National News4 hours ago

National News4 hours agoIJEX 6TH Fam provides¬Ýcomprehensive insights into ME market