National News

P N Gadgil Jewellers Records ₹365 Crore sales during the 3 Day foundation day celebrations

Strong gold-led demand and widespread customer participation power record performance across key markets during the three-day celebration

P N Gadgil Jewellers, one of India’s most trusted jewellery brands with over 193 years of legacy, celebrated its Foundation Day with a Foundation Day sales offering from 7th to 9th February 2026.

The Company received an exceptional customer response, reflecting sustained consumer confidence and strong brand loyalty. The performance during the period was driven by strong demand across all the stores in Maharashtra and other states across India.

The Total Sales during the period amounted to Rs.365 crore, with healthy contribution across all the categories.

The Gold segment emerged as the leading contributor, recording sales of Rs.336 crore with volumes of 203 kg. This was followed by healthy traction in the silver category, which recorded sales of ₹7.4 crore with volumes of 274 kg, while the diamond category reported sales of ₹7.9 crore. The Other segment contributed Rs13.7 crore during the period.

Dr. Saurabh Gadgil, Chairman & Managing Director, commented

The Foundation Day sales contributed very positively to the business momentum and exceeded management expectations. This strong customer response, despite elevated gold prices, reflects the trust customers place in PNG Jewellers and the strength of our value focused offerings.

We witnessed strong performance across our core western markets, complemented by robust traction in Madhya Pradesh, Uttar Pradesh, and Bihar. This response to the Foundation Day initiative has provided a positive start to the quarter. With ongoing wedding demand and the upcoming Gudi Padwa season, we are well placed to sustain the current momentum.

source:P N Gadgil Jewellers,

National News

RBI guidelines: Gold, silver allowed as collateral for micro, small enterprises

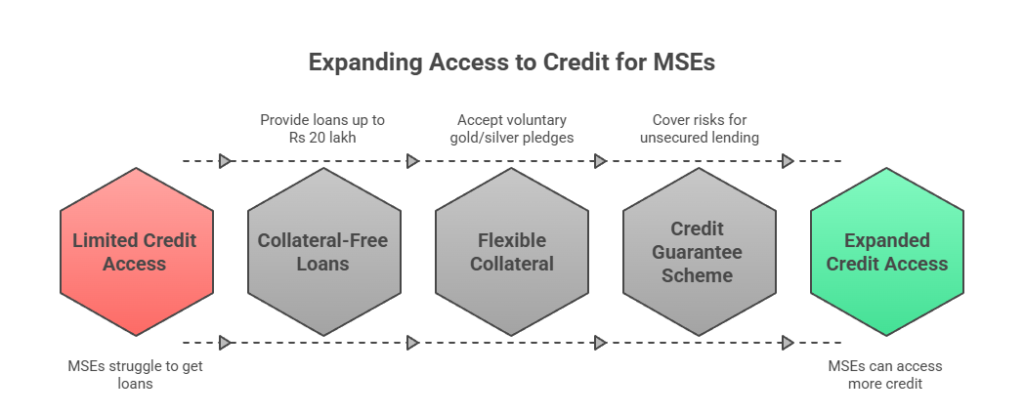

The Reserve Bank of India (RBI) has introduced revised guidelines to bolster credit access for micro and small enterprises (MSEs), allowing banks to accept voluntarily pledged gold and silver as collateral for loans up to the collateral-free threshold. This policy, effective for loans sanctioned or renewed from April 1, 2026, mirrors a provision extended to agricultural loans nearly a year ago and aims to support MSE growth without breaching collateral-free mandates.

Key Provisions of the Guidelines

- Collateral-Free Loans as Standard:

Banks must provide loans up to Rs 20 lakh without insisting on collateral security. This applies to all MSE units, including those under the Prime Minister Employment Generation Programme (PMEGP) run by the Khadi and Village Industries Commission (KVIC). - Flexible Gold and Silver Collateral:

Borrowers can voluntarily pledge gold or silver for these loans, and banks accepting such collateral will not face regulatory violations. Based on the borrower’s track record and financials, banks may extend collateral-free loans up to Rs 25 lakh under internal policies.

- Risk Mitigation Options:

Lenders can leverage the Credit Guarantee Scheme (CGS) to cover risks, enhancing confidence in unsecured lending. - The RBI’s clarification states:“Accepting gold and silver as collateral pledged voluntarily by borrowers for loans sanctioned by the banks up to the collateral-free limit will not be construed as a violation of the above mandate.”

Implications for MSEs and the Economy

This move addresses a key pain point for MSEs, which often struggle with collateral requirements despite strong growth. RBI data (end-December 2025) shows outstanding MSE credit exceeding Rs 10 lakh crore, with a robust 30% year-on-year increase.

Sectors like gems and jewellery—where gold and silver form core assets—stand to benefit significantly. Artisans and small manufacturers can now leverage household or business-held precious metals for quick funding, potentially spurring innovation, exports, and job creation under schemes like PMEGP.

For banks, the guidelines balance inclusivity with prudence, encouraging lending while offering CGS-backed safeguards. This could accelerate MSE credit expansion, aligning with India’s push for a $5 trillion economy through grassroots entrepreneurship.

-

JB Insights2 weeks ago

JB Insights2 weeks ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains