National News

P N Gadgil Jewellers Delivers Strong Quarterly Performance with EBITDA of ₹1,228.5 Mn, up 85.4% Y-o-Y, and PAT of ₹693.4 Mn, up 96.3% Y-o-Y, alongside Margin Expansion

P N Gadgil Jewellers Ltd, with over 192 years of legacy in gold, silver, and diamond jewellery, announced its unaudited financial results for the quarter ended June 30, 2025.

P N Gadgil Jewellers Limited, one of the most reputed jewellers in the country, boasts over 192 years of excellence in craftsmanship and customer trust in the retail business of gold, silver, and diamond jewellery, announced its unaudited financial results for the quarter ended 30th June, 2025.

For Q1 FY26, average revenue per store stands at around Rs. 311.7 million, while net profit per store reached Rs. 12.6 million, demonstrating strong efficiency and profitability at the store level.

PNG Jewellers:

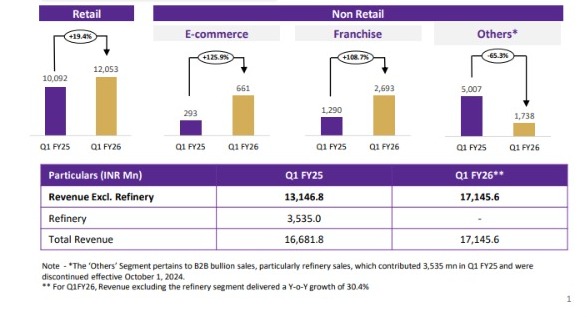

• Retail segment is 70.3% of our total sales, and continues to lead the way, achieving an impressive revenue growth of 19%, an EBITDA margin of 10% and a PAT margin of 5.7%.

• The company’s E‐commerce segment experienced exceptional growth, with revenue increasing to Rs. 661.3 million, a 125.9% rise.

• Franchise revenue also grew to Rs. 2,692.8 million, with an 15.7% increase for Q1 FY26.

• The Same Store Sales Growth for Q1 FY26 stood at 8%, primarily impacted by the absence of the Gudi Padwa festival during the quarter. The festival, which was part of Q1 in FY25 last year, was preponed in Q4 FY25 this year, thereby affecting Like-for-Like comparability.

Operational Financial Highlights:

• Increased Transaction Count and ATV: As customer engagement continues to rise, there has been a notable uptick in both transaction volumes and average spending per visit. The transaction count grew by 23% and ATV at Rs. 93k.

• Customer Footfall and Conversion Rate: A 25% increase in foot falls, coupled with a strong Conversion rate of 92%, further fuels our growth, reflecting increased Demand, customer engagement and sustained purchasing behavior at the store level.

• Festive Sales Surge: Festive sales remain a key driver of our success. This year, we achieved our highest-ever single-day festive sales on Akshaya Tritiya, amounting to 1,395.3 Mn, with a remarkable 35.1% increase over last year.

• Stud Ratio: The share of studded jewellery increased by 41.6% YoY in Q1 FY26, taking the stud ratio to 10% of the retail sales.

Dr. Saurabh Gadgil, Chairman & Managing Director, PN Gadgil Jewellers Limited, said, “This has been a good quarter for us. We recorded revenue of Rs17,145.6 Mn, EBITDA of Rs 1,228.5 Mn, up 85.4% from last year, and PAT of Rs 693.4 Mn, also up 96.3% year-onyear. The growth has come from retail expansion, increase in studded portion, and better cost discipline. Even with gold price volatility and a challenging market environment, we are seeing healthy traction across our retail network and have improved profitability through better operational efficiency. We will continue to build on this momentum, staying true to our promise of quality and design, and creating value for our customers and shareholders in the quarters ahead.”

National News

Outstanding gold-backed loans surge by 128% from a year earlier

India’s appetite for borrowing against gold is reshaping the country’s credit landscape. Outstanding gold-backed loans have surged 128% from a year earlier, crossing Rs.4 lakh crore ($48 billion) for the first time, according to data from the Reserve Bank of India. As of Jan. 31, loans secured by gold jewellery stood at Rs.4,00,517 crore, marking one of the fastest expansions in retail credit in recent years.

The boom in gold loans has helped propel overall non-food bank credit growth to 14.4% year-on-year. Personal loans now account for 34.5% of total bank lending, outpacing other segments and underscoring a broader shift toward consumer-driven credit expansion

Gold loans alone contributed roughly 9% of incremental bank credit during the period. Between January 2024 and January 2026, outstanding gold-backed credit rose by nearly Rs.3.1 lakh crore—an increase of about 338% over two years—more than quadrupling the size of the portfolio.

Two factors are driving the surge. First, gold prices have climbed roughly 152% over the past two years, increasing the collateral value of household holdings. Second, regulatory guidance requiring banks to classify loans secured by gold explicitly as gold loans has sharpened reporting and accelerated balance-sheet growth in the segment.

The trend highlights a distinctive feature of India’s financial system: households’ vast stock of physical gold, long viewed primarily as a store of wealth, is increasingly being mobilized as collateral for formal credit.

While personal lending and credit to nonbank financial companies within the services sector continue to expand rapidly, industrial credit remains uneven. Loans to micro, small and medium enterprises are growing steadily, but borrowing by large corporations has stayed relatively muted.

Since March 21, 2025, banks have added Rs.21.8 lakh crore to their non-food loan books, translating into 12% growth for the financial year to date. Yet it is gold—rather than factories or infrastructure—that is emerging as one of the most dynamic engines of India’s current credit cycle.

-

National News4 days ago

National News4 days agoIIBS-11: Navigating the ‘New Gold Rush’ in a fragmenting global economy

-

International News4 days ago

International News4 days agoOroarezzo 2026, with Italian Exhibition Group, Manufacturing Explores New Markets

-

International News4 days ago

International News4 days agoGemfields nets $53m in Bangkok ruby auction

-

New Premises4 days ago

New Premises4 days agoLimelight Diamonds Unveils Exclusive Visakhapatnam Store in the Presence of Union Minister of Civil Aviation Shri Kinjarapu Ram Mohan Naidu