National News

Mumbai Jewellery Manufacturers & Wholesalers release draft MOU for Fair and Transparent Trade

Industry Initiative Aims to Standardise Payment Practices, Credit Norms and Compliance Across the Jewellery Trade

Manufacturers and wholesalers from the Mumbai jewellery fraternity convened a meeting to unveil a draft Memorandum of Understanding (MoU) aimed at fostering transparent and efficient transactions among manufacturers/wholesalers and retailers.​

The MoU tackles critical areas including payment terms, credit periods, KYC compliance, gold rate fixing, and forward premiums aligned with retailer credit.​

“Participants voiced strong optimism, viewing the initiative as a driver for fair dealings and compliant with government policies – and sustained growth in India’s gem and jewellery sector,” said Saiyam Mehra, Director & CEO, Unique Chains & Jewels Ltd.

“I am very happy to see Zaveri Bazaar Manufacturers and wholesalers come together and present a united front. This MoU is critical for the survival and growth of our business. We need to be united and firm in our decision to enable this MoU,” said, Chetan Thadeshwar, CMD Shringar – House of Mangalsutra Ltd.

The release of the draft MoU marks a significant step toward strengthening trust, accountability and unity within Mumbai’s jewellery manufacturing and wholesale ecosystem. By addressing long-standing challenges around payments, credit discipline and compliance, the initiative reflects the industry’s collective resolve to adopt fair trade practices aligned with regulatory frameworks. If implemented effectively, the MoU is expected to create a more stable, transparent and sustainable operating environment—supporting long-term growth for India’s gem and jewellery sector.

National News

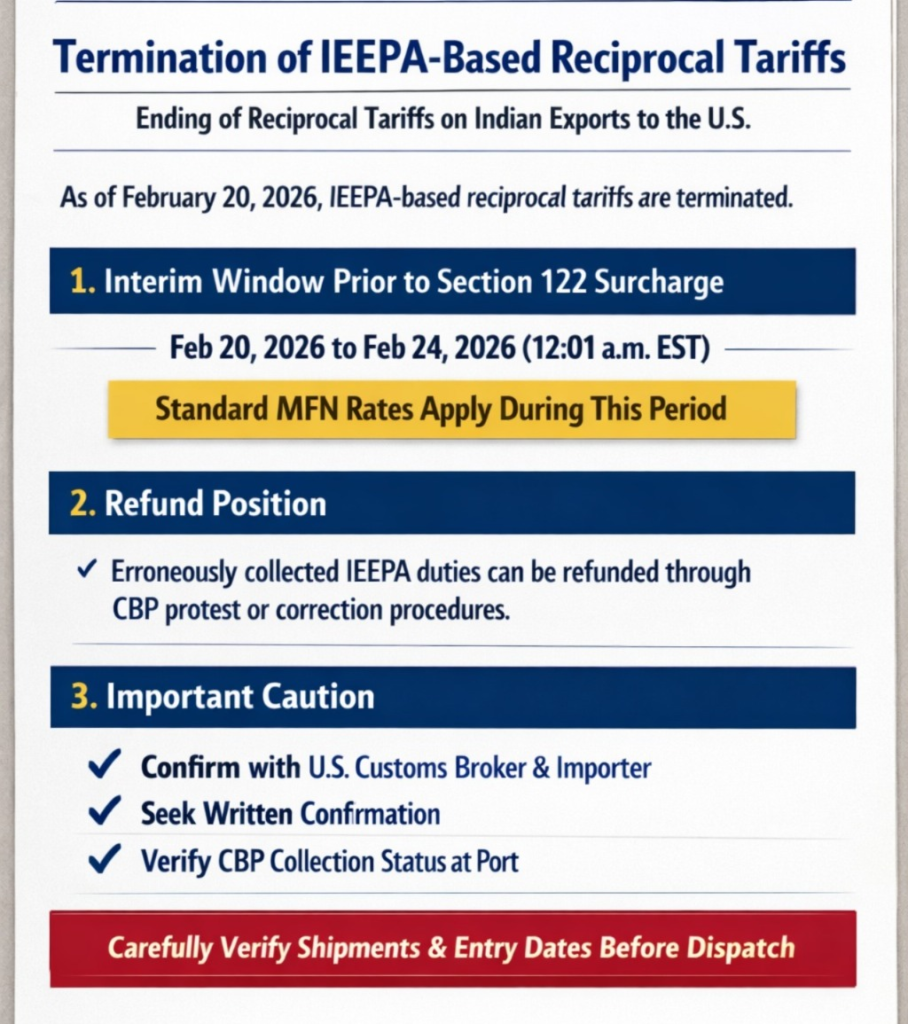

GJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

GJEPC informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

The Gem & Jewellery Export Promotion Council (GJEPC) informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

A letter issued by Sabyasachi Ray, Executive Director, GJEPC, addressed the Termination of IEEPA-Based Reciprocal Tariffs and outlined key implications for exporters.

Termination of IEEPA-Based Reciprocal Tariffs

Pursuant to the Executive Order dated February 20, 2026, titled “Ending Certain Tariff Actions”, the additional ad valorem duties imposed under IEEPA, including the reciprocal tariff framework under Executive Order 14257, shall no longer remain in effect and are directed to be terminated as soon as practicable.

Accordingly, entries made on or after February 20, 2026 should not be subject to the earlier IEEPA-based reciprocal tariffs.

1. Interim Window Prior to Section 122 Surcharge

A separate Presidential Proclamation dated February 20, 2026 imposes a temporary 10% surcharge under Section 122 of the Trade Act of 1974, effective 12:01 a.m. EST on February 24, 2026.

Therefore, between: February 20, 2026 – before 12:01 a.m. EST on February 24, 2026 imports into the United States should be subject only to ordinarily applicable HTSUS (MFN) rates, without the earlier reciprocal tariff, and prior to the commencement of the Section 122 surcharge.

For products such as cut and polished diamonds (where the MFN rate is ordinarily 0%), this period represents a limited operational window.

2. Refund Position (If Collected in Error or Due to Implementation Lag)

In cases where reciprocal IEEPA duties are collected due to implementation lag, such duties should be eligible for refund through the standard:

- U.S. Customs and Border Protection (CBP) protest mechanism under 19 U.S.C. §1514, or

- Post-summary correction procedures, as applicable.

However, exporters should note that there is no assurance that the refund process will not be time-consuming.

3. Important Caution for Exporters

While GJEPC is actively engaging with U.S. customs authorities and keeping customs at Bharat Diamond Bourse informed, members are strongly advised to:

- Seek confirmation from their U.S. customs broker and trade counsel

- Obtain written confirmation from their U.S. buyer/importer regarding entry treatment

- Confirm that CBP has ceased collection of the reciprocal tariff at the port of entry

Given the evolving implementation environment, entry-level verification is critical.

Members are encouraged to carefully assess:

- Shipment timing

- Entry dates

- Applicable HTS classification

before dispatching consignments, wherever applicable.

source: GJEPC

-

National News9 hours ago

National News9 hours agoGJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

-

National News11 hours ago

National News11 hours agoWGC India gold market update: Price strength fuels demand Looking ahead

-

International News12 hours ago

International News12 hours agoIGI approves an investment of up to $150,000 in Saudi Arabia

-

International News9 hours ago

International News9 hours agoUS Supreme Court ruling reshapes trade landscape for Indian GJ exports