National News

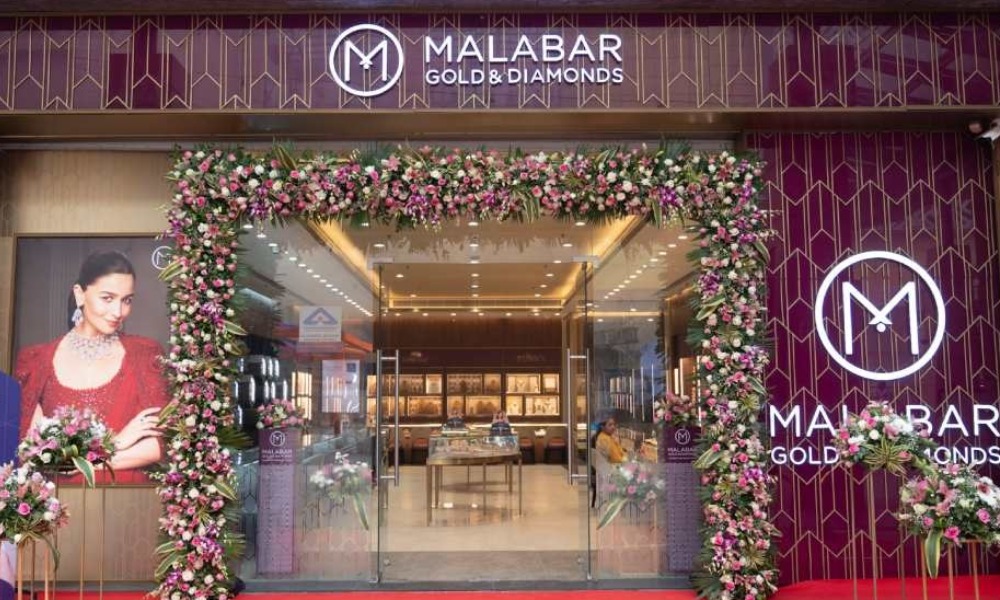

Malabar Gold & Diamonds Targets Strong Double-Digit Growth in H2 FY26, Driven by Festive Cheer and Rural Momentum

Malabar Gold & Diamonds is eyeing strong double-digit growth in the second half of FY26, powered by festive demand, a rebound in discretionary spending, and a surge in rural consumption. The jewellery major’s growth strategy is increasingly shaped by digitally influenced purchase journeys and its continued expansion into Tier 2 and Tier 3 markets.

“As consumer journeys become more digital, shoppers are browsing and comparing products online before walking into stores to make the final purchase. This omnichannel behavior is now at the heart of our retail expansion,” said Asher O., Managing Director – India Operations.

Malabar currently operates 262 stores across India and over 150 international outlets in 14 countries, including the US, UK, Canada, Australia, New Zealand, Singapore, Malaysia, and the GCC region. The company aims to cross a global count of 410 stores by the end of FY26, with over 35 new showrooms slated to open in India over the next few months.

Tier 2 and Tier 3 cities have emerged as major growth engines, supported by rising disposable incomes, social media exposure, and aspirational consumption patterns. “Even in agriculture-led districts, post-harvest income is translating into gold purchases. Lightweight, contemporary designs are seeing the highest traction in these markets,” Asher added.

Recently, the brand relocated its Pitampura showroom to a new 9,500 sq. ft. space at Vaishali Enclave, Delhi, which was inaugurated by Bollywood actor and brand ambassador Anil Kapoor.

On the financial front, Malabar expects its India retail revenue to climb from Rs.42,000 crore in FY25 to around Rs.54,000–Rs.55,000 crore in FY26. Its global B2C revenue is projected to surpass Rs.76,000 crore.

The company continues to focus on natural gold and diamond jewellery while keeping a close watch on the evolving lab-grown diamond (LGD) segment. “We are exploring lab-grown diamonds, but our core remains natural diamonds. At the same time, 18-carat collections are showing strong growth alongside traditional 22-carat designs,” Asher said.

Malabar’s pricing advantage stems from its backward-integrated manufacturing setup, with multiple production units and design studios across India. Its ‘one-year-one-rate’ pricing model ensures uniform rates nationwide, reinforcing customer trust.

The group is also in the process of consolidating its operations in preparation for a potential IPO, signaling its intent to strengthen governance and scalability ahead of public listing.

BrandBuzz

The Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

Timeless pearl creations from GIVA that honour the quiet strength, elegance, and individuality of modern women.

For generations, pearls have defined timeless elegance — an evergreen classic that transcends trends and seasons. Effortlessly refined, they carry a quiet sophistication that has remained relevant across eras.

Neither fleeting nor ornamental, pearls embody a kind of understated luxury, graceful, enduring, and always in style.

This Women’s Day, GIVA celebrates women who are building, leading, choosing, and redefining life on their own terms. Women who don’t need to be loud to be powerful, because their presence speaks for itself.

In that spirit, pearls make for a meaningful gift. Timeless yet modern, they move effortlessly from everyday moments to milestone celebrations, making them a thoughtful way to honour the women who inspire us, whether it’s a mentor, a friend, a colleague, or even yourself.

Here are some pearl pieces that make for perfect Women’s Day gifts.

Stay With Me Golden Pendant With Link Chain

For the one who wears her heart unapologetically. A radiant pearl drop pendant set in gold-plated 925 silver, designed with an elegant lattice motif that blends timeless romance with modern craftsmanship. From the Barkha Singh x GIVA Glow in Motion collection, this piece celebrates intricate CNC artistry while offering a refined statement for everyday elegance.

Gold Pearl Centred Diamond Earrings

Elegant and timeless, these 18K BIS-hallmarked gold earrings feature a delicate circular motif with a luminous pearl at the centre, accented by sparkling lab-grown diamonds below. Designed for everyday luxury, they blend classic sophistication with modern brilliance, making them a graceful statement for any occasion.

Rose Gold On Mom’s Path Bracelet

A heartfelt rose gold-plated bracelet crafted in 925 silver, featuring a charming baby shoe motif with enamel detailing, a delicate pearl accent, and a subtle “mom” engraving. Thoughtfully designed to celebrate the unbreakable bond between a mother and her child, it makes for a meaningful keepsake.

Anushka Sharma Silver Drops of Pearls Set

Inspired by the hidden beauty of ocean pearls, the Anushka Sharma Silver Drop of Pearl Set captures effortless elegance with a graceful pearl drop and sparkling zircon accents. Crafted in 925 silver, the set includes a delicate pendant and matching earrings designed to add timeless charm to any look.

Rose Gold Glam Drops Necklace

Graceful and statement-making, this rose gold-plated lariat necklace in 925 silver features a central oblong pearl with delicate cascading strands ending in luminous pearls. Elegant yet contemporary, it’s the perfect piece to elevate evening looks and special occasions with effortless glamour.

-

BrandBuzz16 hours ago

BrandBuzz16 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz17 hours ago

BrandBuzz17 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz20 hours ago

BrandBuzz20 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News21 hours ago

National News21 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression