International News

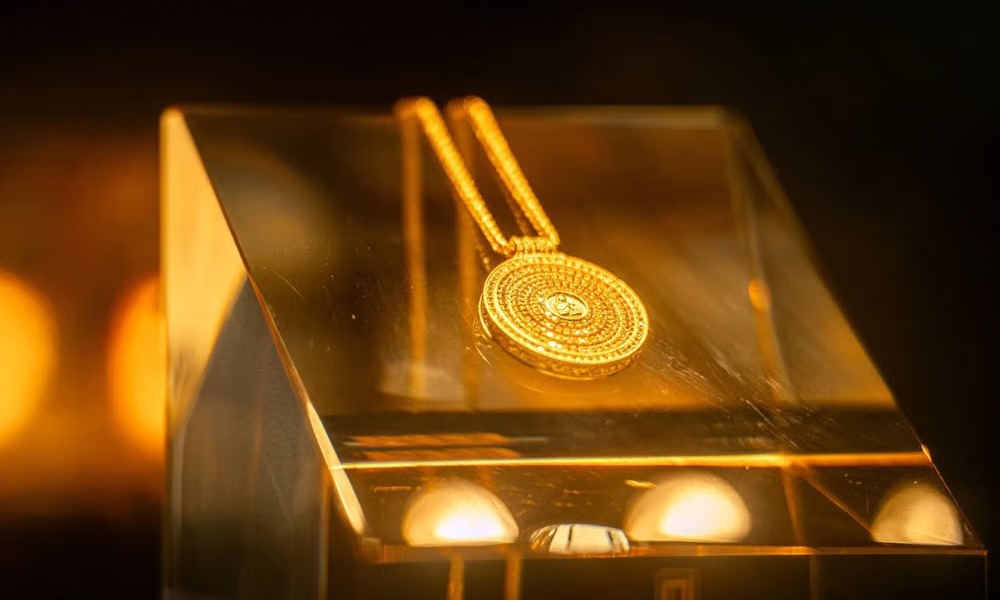

Kering Invests in China’s Gold Jewelry Surge as Laopu’s Explosive Growth Reshapes Market

Heritage-gold brands Borland and Lamchiu secure major funding amid soaring demand, fueled by Laopu’s meteoric rise and China’s booming 24-karat segment.

A wave of investor interest is sweeping through China’s gold jewelry sector as the rapid rise of Laopu Gold Co. galvanizes confidence in the country’s high-end heritage gold market. The latest beneficiary is Borland, a Hangzhou-based jeweler known for its traditional filigree craftsmanship, which this week announced more than 100 million yuan ($14 million) in new funding.

The investment round includes contributions from Kering Ventures, the startup arm of luxury group Kering SA, and Shunwei Capital, co-founded by Xiaomi chairman Lei Jun. Kering noted that its minority stake enables participation in the “rapid development of a particularly buoyant 24-karat gold jewelry segment,” reflecting growing appetite for culturally rooted premium gold pieces.

Meanwhile, Dayone Capital has made a separate investment exceeding 100 million yuan in Lamchiu, a Lanzhou-based maker of handcrafted bespoke gold jewelry. The firm will support Lamchiu in expanding distribution and reinforcing the brand’s supply-chain capabilities.

The surge of capital follows the remarkable ascent of Laopu, which has become one of China’s breakout jewelry success stories. The company reported 12.4 billion yuan in revenue in the first half of 2025 — a year-on-year increase of over 250%, building on 168% growth from the previous year. Laopu’s momentum has outpaced Western luxury houses struggling with softer China demand.

Heritage gold jewelry — deeply rooted in Chinese aesthetics and traditional techniques like filigree — is attracting a new generation of luxury consumers. Brands like Laopu, which operate in top-tier malls, increasingly compete with global maisons such as Hermès and Cartier for clientele.

Despite strong digital followings, newer brands still face distribution gaps. Borland operates only three mall stores, while Lamchiu, despite amassing more than 1 million followers on Douyin, runs just one physical outlet in Lanzhou. Both companies plan to use their fresh funding to accelerate expansion and strengthen operational infrastructure.

The latest investments signal rising confidence that China’s heritage-gold renaissance is evolving from a trend into a long-term luxury category shaping the future of the jewellery market.

DiamondBuzz

Diamond Slump forces Debswana to diversify into copper, platinum and solar

Diamond-centric mining models is giving way to broader resource portfolios

Debswana Diamond Company, the 50–50 joint venture between the Botswana government and De Beers, is moving to diversify into copper, platinum and renewable energy as the prolonged downturn in natural diamond demand pressures earnings and forces the industry to rethink its growth strategy.

The company’s board has approved plans to invest in a portfolio of non-diamond projects after revenue fell 46% in 2024, the latest available financial year, highlighting the scale of the downturn in the global diamond market.

The move signals a strategic shift toward commodities with stronger long-term demand fundamentals, particularly copper, which is central to global electrification and energy-transition infrastructure.

Debswana’s diversification reflects a broader industry pivot as diamond producers confront weak consumer demand, rising competition from lab-grown stones and elevated inventories across the supply chain.

The shift is also visible among smaller exploration companies. Botswana Diamonds recently rebranded as Botswana Minerals, signalling its own strategic focus on copper exploration rather than diamonds.

Together, these moves underscore a growing consensus across the sector: the era of diamond-centric mining models is giving way to broader resource portfolios anchored in energy-transition metals.

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz17 hours ago

BrandBuzz17 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News17 hours ago

National News17 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression