National News

Jos Alukkas Unveils Renovated Showroom in Vijayawada with Exclusive Offers

Andhra Pradesh: Jos Alukkas has reopened its extensively renovated showroom in Vijayawada. The store was inaugurated by MLA Gadde Rama Mohan, with actress Nabha Natesh attending as the celebrity guest.

The event was attended by Jos Alukkas Managing Director John Alukkas.

To celebrate the grand opening, Jos Alukkas is offering a flat 50% discount on making charges of gold jewellery. Additionally, the brand has introduced special inaugural offers, including a â‚ą15,000 discount on every carat of diamond jewellery and a complimentary 500-milligram gold coin with every carat of diamond purchased.

Customers can also enjoy a 7% discount on platinum jewellery, zero making charges on silver ornaments, and special discounts tailored for wedding purchases. As a token of appreciation, a gift will be presented with every purchase. Furthermore, Jos Alukkas offers attractive benefits for customers wishing to exchange their old gold for new HUID-hallmarked gold jewellery.

Jos Alukkas, Chairman, stated, “Vijayawada has always been integral to our growth journey, and we are thrilled to deepen our connection with this vibrant city. The newly renovated showroom offers a unique jewellery shopping experience with a blend of traditional and modern designs.”

The store promises to bring the finest collection of gold, diamond, and platinum jewellery to the people of Vijayawada, catering to every occasion, from weddings to everyday elegance.

Jos Alukkas invites all jewellery enthusiasts to visit the new showroom and experience first- hand the elegance and craftsmanship that the brand epitomizes.

National News

GJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

GJEPC informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

The Gem & Jewellery Export Promotion Council (GJEPC) informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

A letter issued by Sabyasachi Ray, Executive Director, GJEPC, addressed the Termination of IEEPA-Based Reciprocal Tariffs and outlined key implications for exporters.

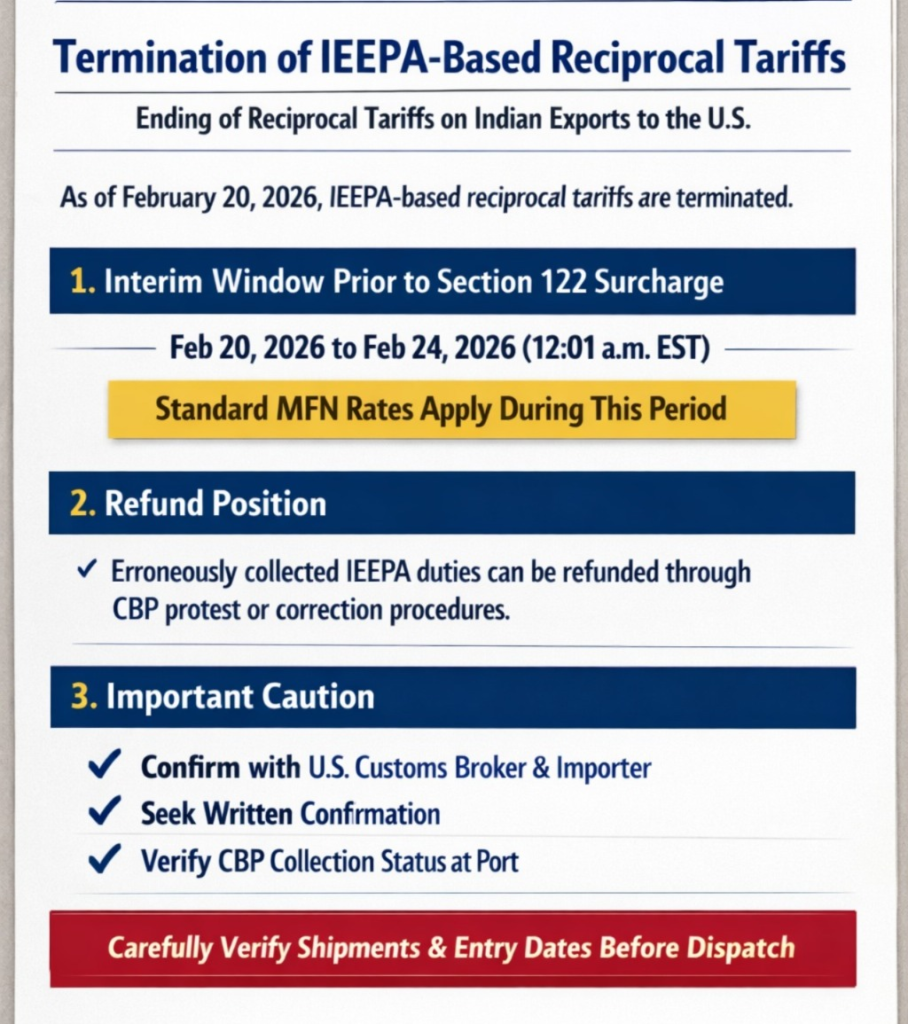

Termination of IEEPA-Based Reciprocal Tariffs

Pursuant to the Executive Order dated February 20, 2026, titled “Ending Certain Tariff Actions”, the additional ad valorem duties imposed under IEEPA, including the reciprocal tariff framework under Executive Order 14257, shall no longer remain in effect and are directed to be terminated as soon as practicable.

Accordingly, entries made on or after February 20, 2026 should not be subject to the earlier IEEPA-based reciprocal tariffs.

1. Interim Window Prior to Section 122 Surcharge

A separate Presidential Proclamation dated February 20, 2026 imposes a temporary 10% surcharge under Section 122 of the Trade Act of 1974, effective 12:01 a.m. EST on February 24, 2026.

Therefore, between: February 20, 2026 – before 12:01 a.m. EST on February 24, 2026 imports into the United States should be subject only to ordinarily applicable HTSUS (MFN) rates, without the earlier reciprocal tariff, and prior to the commencement of the Section 122 surcharge.

For products such as cut and polished diamonds (where the MFN rate is ordinarily 0%), this period represents a limited operational window.

2. Refund Position (If Collected in Error or Due to Implementation Lag)

In cases where reciprocal IEEPA duties are collected due to implementation lag, such duties should be eligible for refund through the standard:

- U.S. Customs and Border Protection (CBP) protest mechanism under 19 U.S.C. §1514, or

- Post-summary correction procedures, as applicable.

However, exporters should note that there is no assurance that the refund process will not be time-consuming.

3. Important Caution for Exporters

While GJEPC is actively engaging with U.S. customs authorities and keeping customs at Bharat Diamond Bourse informed, members are strongly advised to:

- Seek confirmation from their U.S. customs broker and trade counsel

- Obtain written confirmation from their U.S. buyer/importer regarding entry treatment

- Confirm that CBP has ceased collection of the reciprocal tariff at the port of entry

Given the evolving implementation environment, entry-level verification is critical.

Members are encouraged to carefully assess:

- Shipment timing

- Entry dates

- Applicable HTS classification

before dispatching consignments, wherever applicable.

source: GJEPC

-

National News11 hours ago

National News11 hours agoGJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

-

National News13 hours ago

National News13 hours agoWGC India gold market update: Price strength fuels demand Looking ahead

-

International News14 hours ago

International News14 hours agoIGI approves an investment of up to $150,000 in Saudi Arabia

-

International News11 hours ago

International News11 hours agoUS Supreme Court ruling reshapes trade landscape for Indian GJ exports