JB Insights

India’s natural diamond market is set to double to $20 billion by 2030: De Beers Group CEO Al Cook

De Beers Group CEO Al Cook, during his first visit to India since taking the helm in February 2023, announced that India’s natural diamond market—currently valued at just under $10 billion—is set to double to $20 billion by 2030. Speaking at a press conference at Taj Lands End, Mumbai, on May 22, Cook highlighted India’s historic and growing significance in the global diamond industry, noting its status as the world’s second-largest market for natural diamonds and the processing hub for 90% of global supply, supporting over a million jobs.

Cook attributed the projected growth to India’s rapidly expanding middle class, rising disposable incomes, and a deep cultural affinity for natural diamonds, with demand increasing at 12% year-on-year. He described India’s economy as “the envy of the world” and outlined De Beers’ multi-pronged strategy to capture this momentum. Key initiatives include the launch of the Forevermark retail brand in Mumbai and Delhi in late 2025, with a plan to expand to over 100 stores across major cities within five years, using both company-owned and franchise models alongside robust e-commerce offerings.

Talking about the world’s four key regions for diamond consumption, he said there has been a substantial decline in China. In the US, the market has been stable over the last year with some growth in recent months, and De Beers will focus many of its marketing campaigns there to boost demand. The Middle East, meanwhile, continues to show strong and sustained growth, he added.

Talking about lab-grown diamonds (LGD), he said its wholesale prices in the jewellery sector have fallen 90 per cent. “Our drive to educate consumers about the difference between natural diamonds and LGDs has accelerated. The myth that you can’t tell the difference between a natural diamond and an LGD is beginning to shatter, and Diamond Proof’s influence is only going to grow,” he added.

Al Cook visited the GJEPC office in Mumbai, reinforcing the group’s commitment to deeper collaboration with the Indian diamond industry. The visit follows the successful joint launch of the Indian Natural Diamond Retailer Alliance (INDRA) earlier this year—a strategic initiative to boost India’s natural diamond retail ecosystem.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

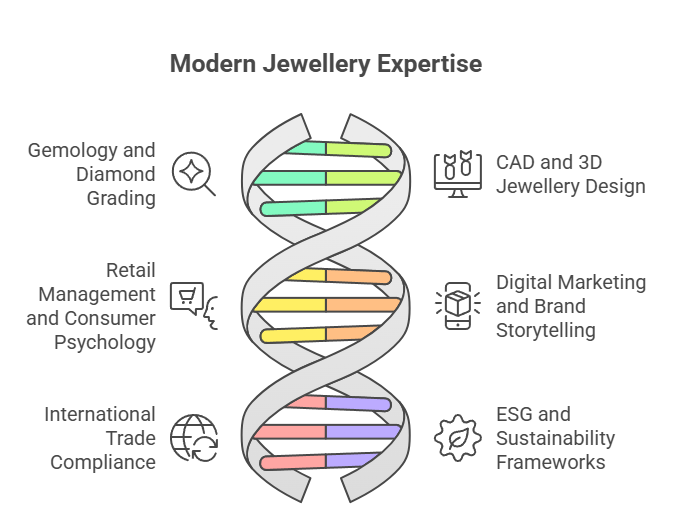

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

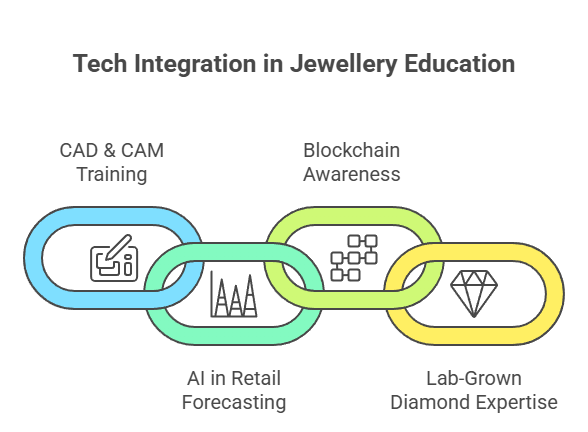

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

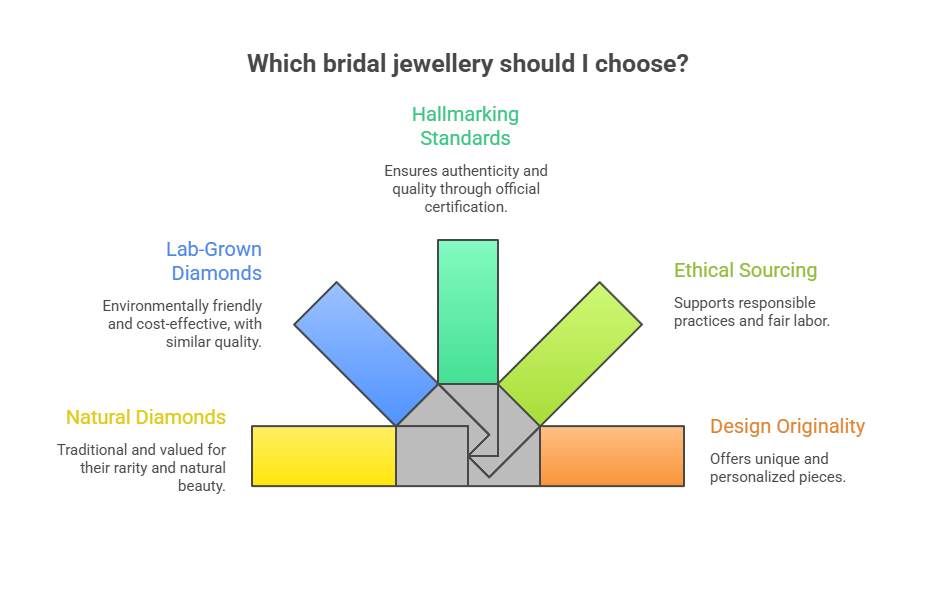

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

Financial Literacy in Jewellery

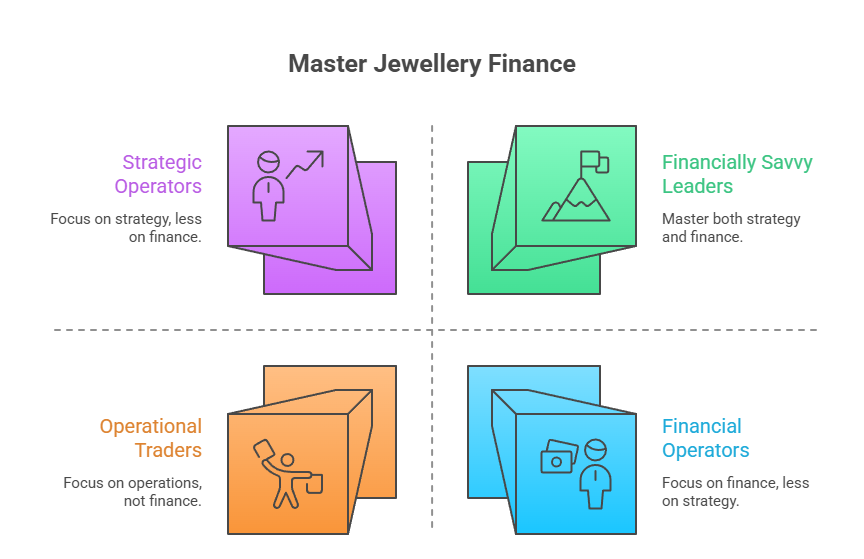

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

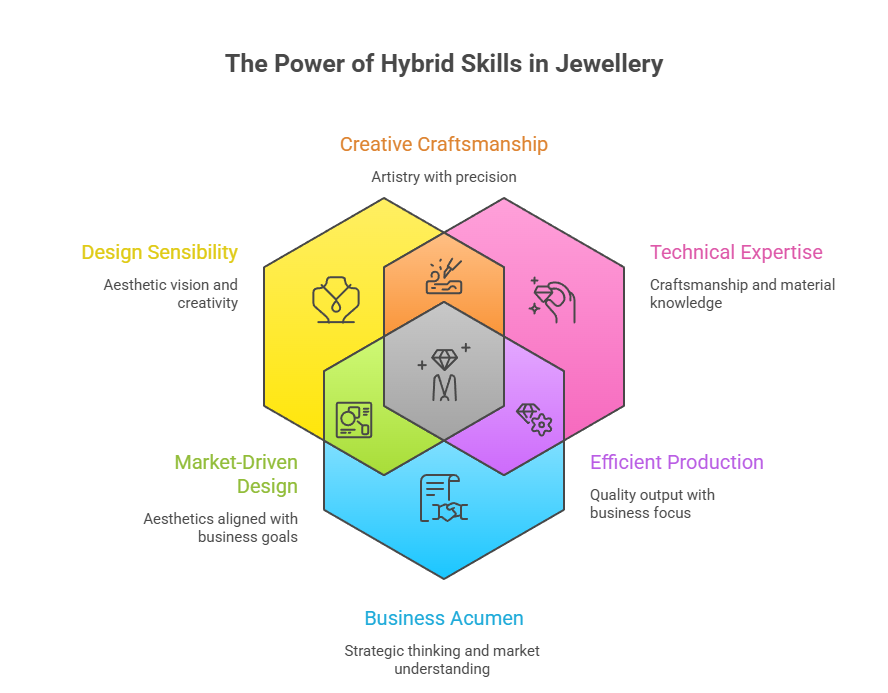

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

National News2 hours ago

National News2 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz19 hours ago

BrandBuzz19 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration