National News

India-UK CETA adds dazzle & glitter to India’s gold and diamond jewellery exports

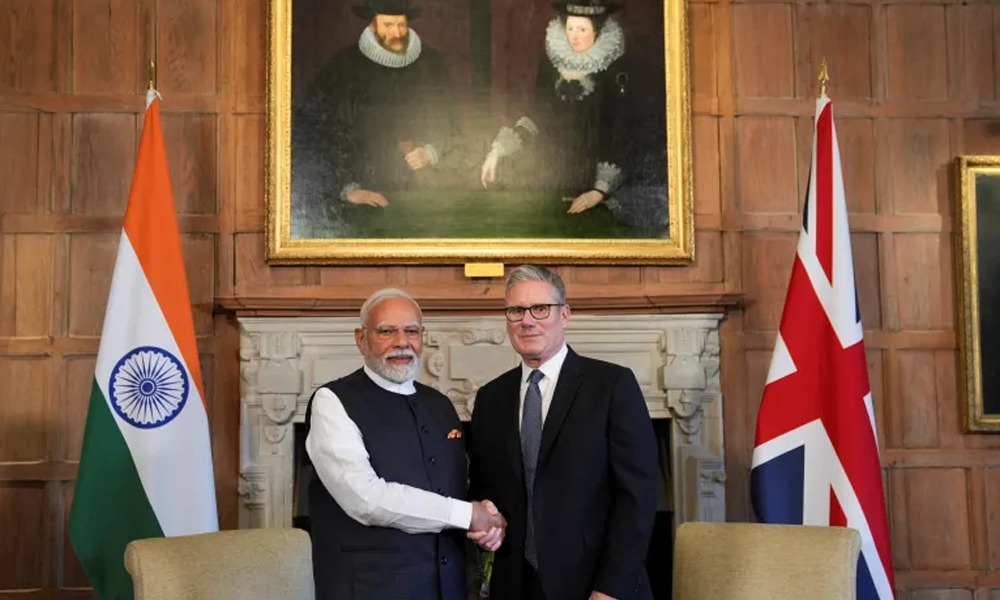

The United Kingdom and India signed a historic free trade agreement (FTA), boosting bilateral trade by around $34 billion annually. The FTA, signed during Prime Minister Narendra Modi’s visit to the UK, includes tariff cuts, improved mobility for professionals, and market access guarantees that together mark one of India’s most comprehensive trade pacts.

The FTA offers duty-free access to the UK’s $23 billion market, giving Indian MSMEs a strong advantage over other countries in labour-intensive sectors such as gems and jewellery, leather and footwear, textiles. India’s gems and jewellery exports to the UK are currently valued at $941 million, with jewellery alone accounting for $400 million. With the UK importing $3 billion worth of jewellery annually, India’s exports are expected to double in 2–3 years.

The deal took three years to reach and also commits to a new India-UK plan to tackle illegal migration.Opponents had warned the deal could undercut British workers due to extended social security terms, but UK Business Secretary Jonathan Reynolds said this was “completely wrong” and Indian workers on temporary secondment to the UK would get the same deal already offered to many other countries.

The trade deal is expected to ensure comprehensive market access for Indian goods across all sectors and India will gain from tariff elimination on about 99 per cent of tariff lines (product categories) covering almost 100 per cent of the trade values, the officials said.

After signing the landmark deal, the two prime ministers are also expected to unveil an “UK-India Vision 2035” to take their partnership to new heights in a time of rapid global change.

The UK said Indian consumers will benefit from improved access to the best British products — from soft drinks and cosmetics to cars and medical devices — as average tariffs will drop from 15 per cent to 3 per cent after the FTA kicks in.

National News

Gold & Precious Metals – A future outlook

The session saw a power packed panel of experts that comprisedSurendra Mehta, National Secretary- IBJA,Ranjith Singh,Head of Business Development, IIBX, Shweta Dhanak, Director – Vijay Exports,S Thirupathi Rajan, MD Goldsmith Academy, Shivanshu Mehta, SVP & Head Bullion-MCX.The session was moderated by Chirag Seth, Principal Consultant, Metals Focus.

Some salient points made by the panelists:

- Gold prices are not linked to consumer demand. They are linked to central bank buying and ETFs

- Till the banking system doesn’t collapse, gold price will continue to rise

- Jewellers were advised to use a mix of futures and options for risk mitigation

- Given the current situation manufacturers selling on credit or unfavorable deals could be fatal flaw for business.

- Precious metals forecast: Surendra Mehta said he sees gold in 2026 in $4900-5100 range and silver in $90-105.Looking further he said by 2030-2035 gold could touch $18000- 20000 and silver could reach $500. Chirag Seth predicted silver touching $105 this year and gold moving in the $ 5200- $ 5500.

-

GlamBuzz2 weeks ago

GlamBuzz2 weeks agoGIVA Launches ‘Glow in Motion’, Unveils New Jewellery Collection Fronted by Barkha Singh

-

International News2 weeks ago

International News2 weeks agoSilver retraces down on margin hike pressure AUGMONT BULLION REPORT

-

JB Insights2 weeks ago

JB Insights2 weeks agoThe JewelBuzz E-zine: Your Fortnightly Pulse of the Jewellery Industry

-

JB Insights2 weeks ago

JB Insights2 weeks agoIIJS Bharat Signature 2026 set to open the year with scale, innovation and global momentum