ShowBuzz

India Pavilion draws strong buyer interest at Jewellery Show London

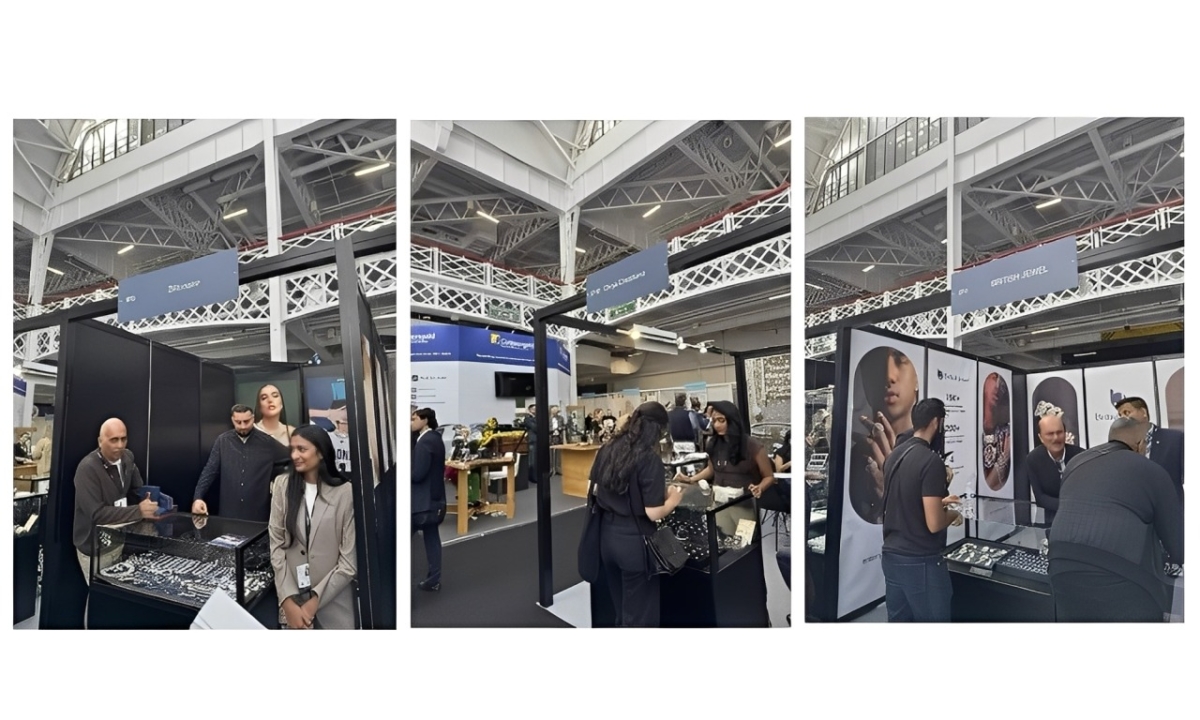

GJEPC organised the India Pavilion at the Jewellery Show London, held from 31st August to 1st September at Olympia London, showcasing the strengths of Indian jewellery manufacturing to global buyers.

The pavilion featured nine leading Indian exporters, namely, G.C. Gems Corp, Minal Info Jewels, Steckbeck Jewellery Pvt. Ltd, Sejal Exports, Romil Jewellery, Blossom Jewels LLP, Dharam Export (India) Pvt. Ltd, Shrinath Rotopack (MP) Pvt. Ltd, and Divya Creations. Exhibitors presented a wide spectrum of products spanning plain gold jewellery, studded jewellery, cut and polished diamonds, silver jewellery, and coloured stones.

Attendance was high at the Jewellery Show 2025, from the start- Aug 31, 2025- auguring for strong orders by retailers for the festive season. Visitors packed into the Jewellery Show at Olympia, London, from the opening of the fourth edition, now the UK’s largest trade event, with many independent retailers present from across the UK and Ireland, and beyond. The Jewellery Show ends today, September 1, 2025.

Over 150 national and international exhibitors, thousands of trade professionals including owners, buyers, managers, designers, and manufacturers were present. Exhibitors reported brisk enquiries right across the show, which offered a vast array of products, including gold, silver, platinum and diamond jewellery, loose gemstones, machinery, new technologies, and accessories.

ShowBuzz

Nurturing Talent, Showcasing Excellence – Bangkok Gems Leads the Way

From emerging designers to world-class pearls, the fair reinforces its position as a global hub for innovation, craftsmanship, and industry growth.

Meet the New Waves at the New Faces Zone

The New Faces zone at the 73rd Bangkok Gems & Jewelry Fair is a strategic platform empowering SMEs and emerging jewelry entrepreneurs to step confidently onto the global stage. Designed to support small and medium-sized enterprises, the zone features promising Thai brands with fresh perspectives, precious craftsmanship, and export readiness.

Unveiling Creative Talents at Bangkok Gems

Bangkok Gems & Jewelry Fair continues to affirm its role as more than a global trading platform, serving also as a vital center for knowledge exchange and talent development within the gems and jewelry industry. Under the “Creative Jewelry Sandbox” program, four leading Thai universities — Srinakharinwirot University, Silpakorn University, Burapha University, and Chiang Mai University — presented innovative jewelry works created by students and emerging designers.

Pearls Shine with Global Variety

At the 73rd Bangkok Gems & Jewelry Fair, pearls have garnered outstanding feedback from buyers worldwide, reaffirming Bangkok Gems as a premier sourcing destination for fine pearls.This year’s showcase features exceptional pearls from Thailand’s southern waters alongside renowned varieties from Japan, China, and other leading pearl-producing countries. The enthusiastic response from international buyers highlights the continued global demand for pearls — both in classic fine jewelry and contemporary design.

-

International News4 days ago

International News4 days agoOroarezzo 2026, with Italian Exhibition Group, Manufacturing Explores New Markets

-

National News4 days ago

National News4 days agoIIBS-11: Navigating the ‘New Gold Rush’ in a fragmenting global economy

-

International News4 days ago

International News4 days agoGemfields nets $53m in Bangkok ruby auction

-

New Premises4 days ago

New Premises4 days agoLimelight Diamonds Unveils Exclusive Visakhapatnam Store in the Presence of Union Minister of Civil Aviation Shri Kinjarapu Ram Mohan Naidu