JB Insights

INDIA GOLD CONFERENCE 2024

Fostering insightful discussions; paving the way for collaborations and innovation in the gold industry

The India Gold Conference 2024, held from August 23-25 at Hilton Manyata Business Park, Bengaluru, proved to be a significant event for the global gold industry. Organized by Eventell Global Advisory Pvt Ltd in association with the India Bullion Jewellers Association, the conference brought together over 666 delegates from around the world, including more than 39 sponsors, 22 exhibitors, and 61 distinguished speakers.

The conference kicked off with a grand inaugural ceremony : In attendance were Chief Guest Pralhad Joshi, Union Minister for Consumer Affairs (joined via video link), H.E. Mr. Javier Manuel Paulinich Velarde, Ambassador of Peru to India; Prithviraj Kothari, National President of IBJA; Sakhila Mirza, Deputy CEO of the London Bullion Market Association (LBMA); Sachin Jain, Regional CEO – India – World Gold Council; Vipin Raina, President Marketing – MMTC PAMP India Pvt Ltd and leading players from the gold mining, bullion, jewellery sectors and dignitaries from the global and domestic gold industry.

Their speeches set the tone for the conference, emphasizing the importance of collaboration and innovation in the gold industry.

A special session on gold dore offered deep insights into the refining and processing aspects of gold, followed by the launch of the Self-Regulatory Organization (SRO) for the Indian gold industry, a significant milestone aimed at enhancing the transparency and efficiency of the market.

The conference also featured a roundtable discussion titled “India Gold Market – What Next?” where over eight panelists from various segments of the industry shared their perspectives on the future of India’s gold market. This discussion was particularly engaging, providing attendees with diverse viewpoints on the challenges and opportunities facing the industry.

Several key sessions were held over the three days, focusing on critical aspects of the gold industry:

India’s Gold Jewellery Industry: Crafting a Vision for the Future – This session explored the evolving trends and future outlook of India’s gold jewellery sector.

Future of Gold Refining – Experts discussed the technological advancements and regulatory changes shaping the refining industry.

Loan Against Gold: Opportunities and Issues – This session delved into the financial aspects of gold loans, highlighting both the opportunities and challenges in this segment.

Gold Investment Demand – A detailed analysis of the current and future demand for gold as an investment was presented, providing valuable insights for investors and market analysts.

Price Outlook on Gold – Industry experts provided their forecasts on gold prices, considering various global economic factors.

Start-ups in Gold and Gold Jewellery Industry – The session spotlighted innovative start-ups that are disrupting the traditional gold and jewellery markets, showcasing new business models and technologies.

Overall, the India Gold Conference 2024 successfully provided a platform for industry leaders, experts, and stakeholders to connect, share knowledge, and discuss the future of the gold industry. The conference fostered numerous meaningful discussions, paving the way for new collaborations and developments in the gold market.

As the conference concluded, the anticipation for India Gold Conference 2025 is already building, with the promise of more insightful discussions and networking opportunities.

Jewellers Association, Bengaluru was felicitated at India Gold Conference 2024

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

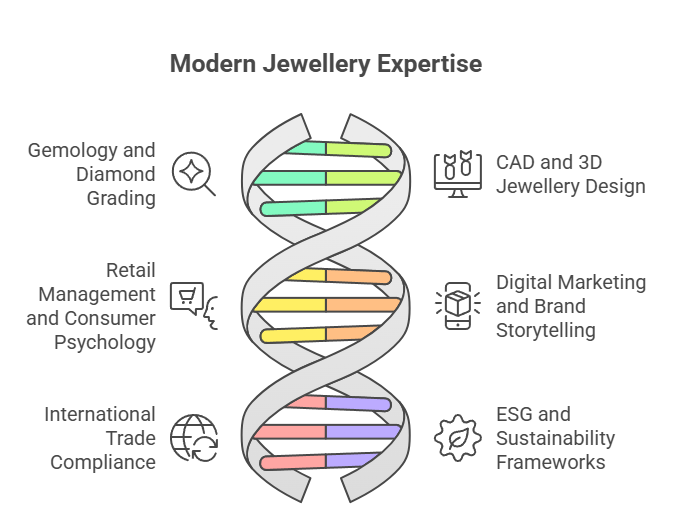

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

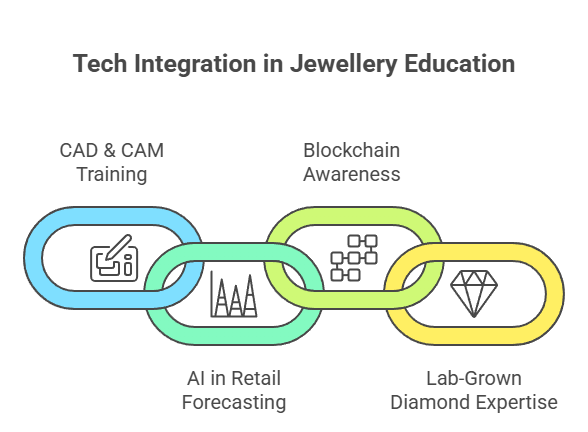

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

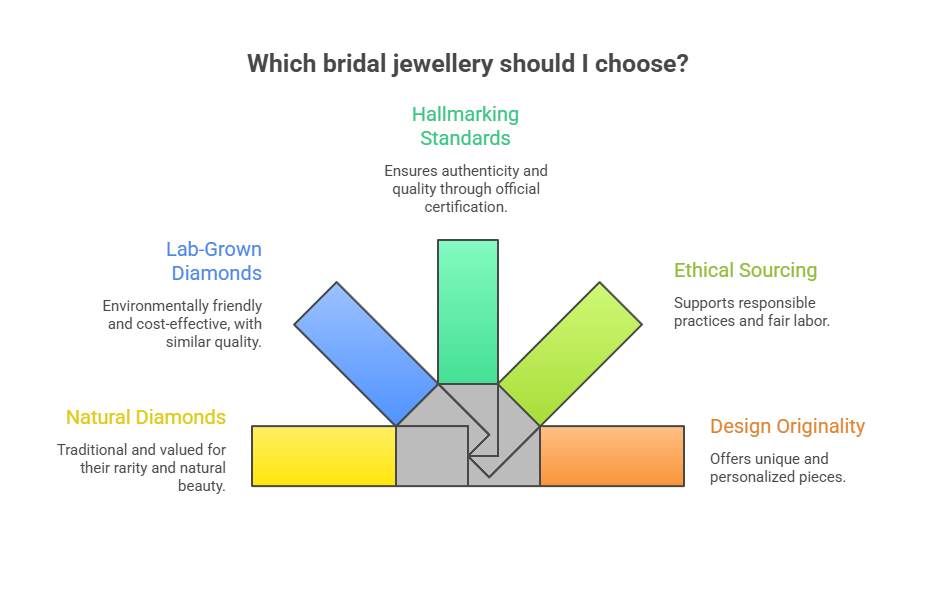

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

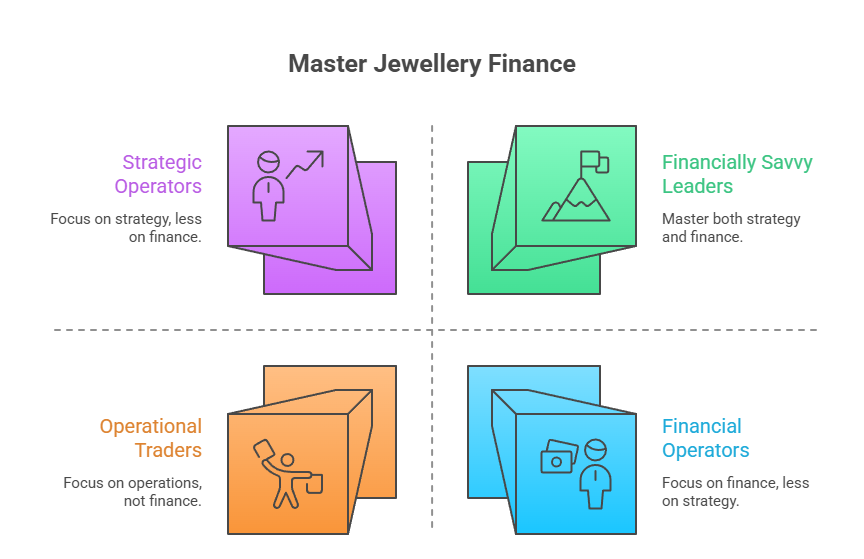

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

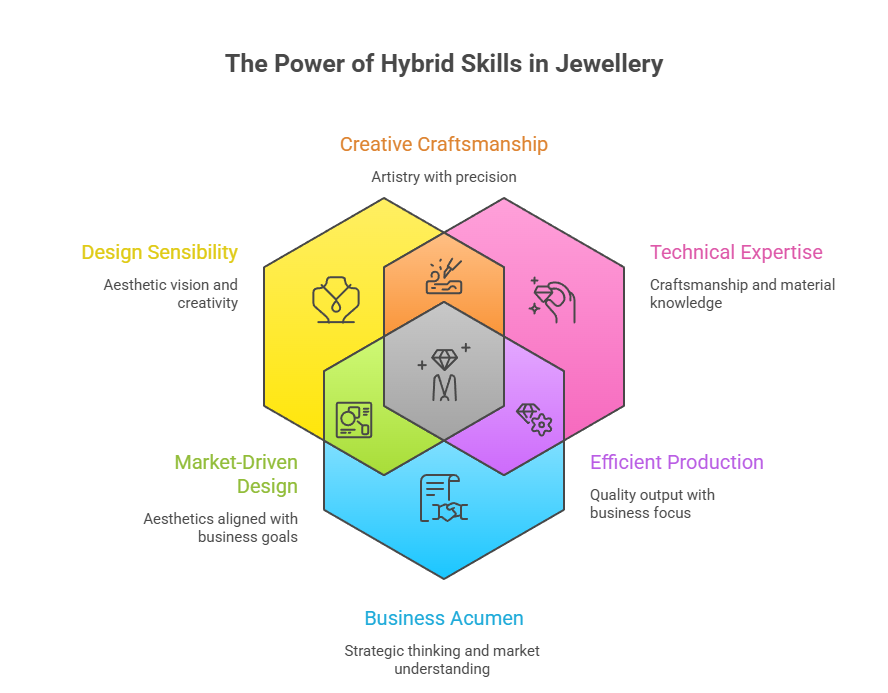

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

BrandBuzz10 hours ago

BrandBuzz10 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz10 hours ago

BrandBuzz10 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz14 hours ago

BrandBuzz14 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News14 hours ago

National News14 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression