International News

Gold near fresh all-time highs ahead of US trading session

Gold’s price (XAU/USD) is seeing gains tick up trading near $2,952 at the time of writing, fueled by a weaker US Dollar (USD) and softening US yields in a reaction to the recent German federal election outcome. Although the far-right party Alternative for Germany (AfD) has gained 20% of votes, the Christian Democratic Union of Germany (CDU) is comfortable in the lead with 208 seats against AfD’s 152. US yields dropped off and the CME Federal Reserve (Fed) Futures are now favoring a 25 basis points (bps) rate cut in June, where last week odds were rather for no rate cut in June.

Meanwhile, traders will watch the US Gross Domestic Product (GBP) release for the fourth quarter of 2024 later this week. Given the recent slowdown in US activity and economic data (for example, the softer Services Purchase Managers Index (PMI) reading on Friday), another drop in US yields could be triggered, with markets anticipating the Federal Reserve lowering its monetary policy rate to boost the economy and demand. The US dollar weakened after several reports and economic data points last week revealed that US business activity slowed and consumer confidence waned, with expectations for inflation surging and markets pricing in more rate cuts by the Federal Reserve this year.

International News

Gold prices in India continued to decline, modest recovery in global prices

geopolitical risks,rising energy prices continue to underpin gold demand globally.

Gold prices in India continued to decline on Thursday, marking the third straight session of losses even as global bullion prices attempted a modest recovery amid rising geopolitical tensions.

In the domestic market, 24-karat gold has fallen sharply over the past three days, with prices dropping by about ₹85,800 per 100 grams. The correction reflects a mix of global market volatility, profit-taking after recent highs, and currency movements affecting local bullion pricing.

As of Thursday morning, 24-karat gold was quoted at ₹16,451 per gram, down ₹311 from the previous session. The price of 22-karat gold slipped to ₹15,080 per gram, a decline of ₹285.

The drop in domestic prices comes even as international gold markets showed signs of stabilizing. Global bullion prices climbed back above $5,160 an ounce on Wednesday after recovering part of their earlier losses.

The rebound followed escalating tensions in the Middle East as the conflict involving the U.S., Israel and Iran entered its fifth day. Reports that Israel targeted a building where clerics were meeting to discuss the selection of a new Supreme Leader heightened geopolitical uncertainty, prompting renewed safe-haven flows into gold.

In India, however, retail bullion prices continued to reflect the recent correction.

On the derivatives side, gold futures on the Multi Commodity Exchange (MCX) were largely flat. The April 2026 contract opened at ₹1,63,265 per 10 grams, traded between ₹1,61,241 and ₹1,64,047 during the session, and was last quoted around ₹1,61,550—up marginally by ₹25, or 0.02%.

Market participants say geopolitical risks and rising energy prices could continue to underpin gold demand globally. Analysts note that if international prices hold above the $5,200 level, bullion could move toward the $5,450–$5,600 range in the near term, with price dips likely to attract strategic buying.

-

International News3 hours ago

International News3 hours agoGold prices in India continued to decline, modest recovery in global prices

-

DiamondBuzz19 hours ago

DiamondBuzz19 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz20 hours ago

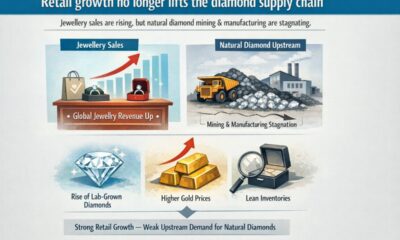

DiamondBuzz20 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News22 hours ago

International News22 hours agoGold continues to get strength on the Middle East conflict