National News

Gold loans to be repaid and closed rather than renewed or upgraded

Gold loans have gained significant traction in recent years, driven by their ease of access, minimal documentation requirements, and rapid disbursal process. These loans cater to a broad customer base, including individuals in need of emergency funds, small business owners, and those with limited credit history who may find traditional loans less accessible.

Banks have recently directed their branches to ensure that gold loans are repaid and closed rather than renewed or upgraded. This strategic shift has several implications for stakeholders, including borrowers, financial institutions, and the gold loan industry as a whole.

Risk Mitigation:The volatility of gold prices poses a risk to banks in case of non-repayment. Enforcing timely repayment minimizes the likelihood of loan defaults and the need for forced liquidation of pledged gold.

By ensuring closure instead of renewal, banks can better manage their exposure to fluctuating gold prices and potential under-collateralization.

Regulatory Compliance:The Reserve Bank of India (RBI) and other regulatory bodies have imposed strict guidelines on Loan-to-Value (LTV) ratios, capping non-agriculture gold loans at 75% of the pledged gold’s value.

Encouraging repayment aligns with broader financial regulations designed to ensure credit discipline and prevent the misuse of short-term lending facilities.

Liquidity and Capital Allocation:Regular loan closure allows banks to efficiently recycle their capital, ensuring they have adequate liquidity for new lending opportunities.

Rather than allowing renewals, banks can reallocate funds to different lending segments that promise higher profitability and lower risk.

Asset Quality Improvement:Encouraging repayment and closure enhances asset quality, reducing the risk of bad loans and improving the bank’s financial health.

Non-performing assets (NPAs) are a major concern for banks, and ensuring gold loans are repaid on time helps in maintaining a lower NPA ratio.

Borrower Discipline:Customers will be encouraged to plan repayments effectively rather than relying on renewals to extend the loan indefinitely.

Increased financial awareness and discipline in repayment schedules could improve overall creditworthiness.

Limited Liquidity for Borrowers:Individuals who depend on gold loans for recurring financial needs might face liquidity challenges if renewals are restricted.

Borrowers may need to seek alternative financing options, such as personal loans or secured loans with different collateral.

Revenue Considerations:Gold loan renewals often contribute to sustained interest income. Enforcing closures could impact this steady revenue stream.

However, ensuring timely repayments can reduce default rates, balancing out potential income loss.

National News

Hari Krishna Exports Mumbai Celebrates Annual Sports Day 2026 with Enthusiasm

Over 1,000 employees and families participate as Rs.3.5 lakh in prizes, gold coins and wellness recognition highlight the company’s commitment to employee well-being and team spirit.

Hari Krishna Exports Mumbai celebrated its Annual Sports Day 2026 on 22nd February with great enthusiasm, bringing together more than 1,000 employees and their families for a day of sports, unity, and celebration.

The event was graced by Chief Guest Ritu Rajesh Tawde, Mayor of Mumbai, along with respected dignitaries from the gem and jewellery industry. The programme began with the National Anthem, followed by a range of sports activities including cricket, volleyball, kabaddi, kho-kho, tug-of-war, running races, carrom, and box cricket. Employees from various departments participated with strong team spirit and sportsmanship.

A total prize pool of ₹3.5 lakh was awarded to recognise outstanding performances. Employees with perfect attendance were honoured with gold coins, and those demonstrating consistent discipline were appreciated with special rewards.

Addressing the gathering, Chairman Ghanshyambhai Dholakia said: “We are dedicated to the well-being of our employees, knowing that strong people build strong organisations. When others adopt similar efforts, it uplifts work culture across the entire industry.”

With over 60 wellness initiatives, Hari Krishna Exports continues to prioritise employee well-being and engagement. The Annual Sports Day reflects the organisation’s commitment to fostering teamwork, health, and a positive work culture.

source: Hari Krishna Exports

-

DiamondBuzz12 hours ago

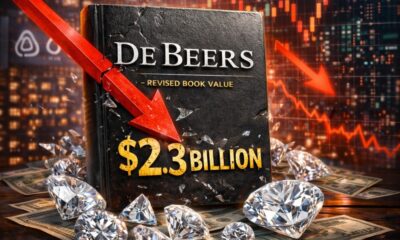

DiamondBuzz12 hours agoAnglo American cuts book value of De Beers to $2.3bn, reflects a convergence of structural and cyclical pressures

-

National News13 hours ago

National News13 hours agoHari Krishna Exports Mumbai Celebrates Annual Sports Day 2026 with Enthusiasm

-

DiamondBuzz14 hours ago

DiamondBuzz14 hours agoBAFTA 2026: De Beers Group- Desert Diamonds Emerged as the Jewellery Story of the Night

-

News15 hours ago

News15 hours agoIndia Pavilion showcases country’s finest jewellery craftsmanship at Inhorgenta Munich, Germany