International News

Gold faces tug-of-war at highs: Augmont Bullion Report

Gold markets are in a tug-of-war at highs, with bears focusing on a potential ceasefire deal in Ukraine and bulls anticipating key U.S. inflation data to gauge the Federal Reserve’s interest rate path amid trade tensions and economic slowdown fears.

The US agreed to resume military aid and intelligence sharing with Ukraine after Kyiv agreed to a 30-day ceasefire proposal.

U.S. President Donald Trump defended his tariff policies during a meeting with CEOs of major American companies. Many of these companies have seen their market value fall due to recession and inflation fears.

Investors are awaiting U.S. CPI statistics to determine the Fed’s interest rate stance for this year.

Technical Triggers

Gold prices are consolidating in a range between $2885(~Rs 85400) and $2935(~Rs 86200), prices need to break this range for a decisive move towards upside momentum of $2975 (~Rs 87000).

Silver May Futures is gaining strength and if sustains above $33(~Rs 96700), the next target is $34(~Rs 100,000), and once it sustains above that, it can head higher towards $35(~Rs 103,000).

International News

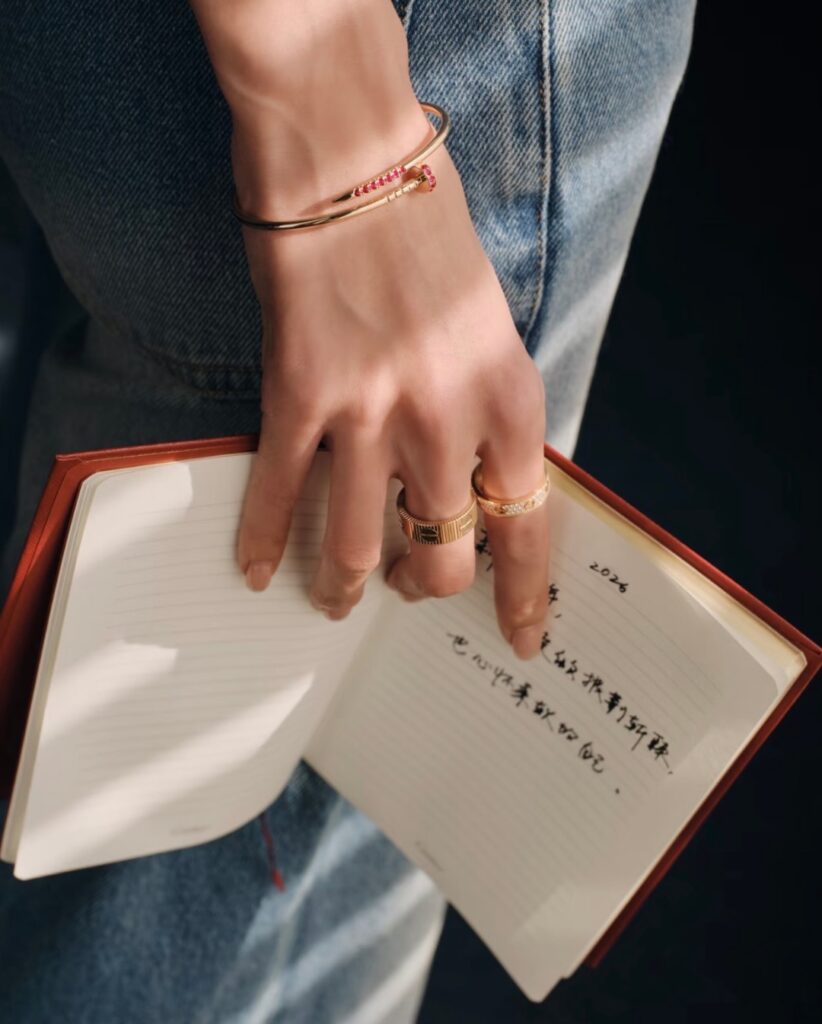

Cartier Reimagines an Icon: The Ruby-Set ‘Juste un Clou’ Debuts for Lunar New Year

A Fusion of Industrial Rebellion and Festive Elegance Marks a Limited-Edition Celebration of Luck and Prosperity.

In a bold intersection of high-fashion defiance and cultural tradition, Cartier has unveiled a limited-edition interpretation of its legendary Juste un Clou collection. This special release sees the iconic “nail” silhouette transformed with a festive row of vivid red rubies, launched specifically to commemorate the Lunar New Year.

Originally conceived in 1970s New York by designer Aldo Cipullo, the Juste un Clou has long been a symbol of the “rebellious spirit” and the elevation of the ordinary into the extraordinary. By integrating rubies—stones that traditionally symbolize luck, vitality, and renewal—Cartier effectively bridges its radical Western design heritage with the deep-rooted values of the East.

The collection features the signature wrap-around nail design in gold in bracelets, necklaces, earrings & rings with the “head” and “point” of the nail meticulously pavé-set with high-quality rubies. Industry experts view this move as a strategic masterstroke, as the “festive red” aesthetic continues to be a primary driver for luxury consumption during the spring transition.

-

BrandBuzz4 days ago

BrandBuzz4 days agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises4 days ago

New Premises4 days agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

National News4 days ago

National News4 days agoBakul Limbasiya Receives Prestigious APO National Award for LGD Pioneering

-

Appoinment4 days ago

Appoinment4 days agoTiffany & Co. Strengthens Leadership with David Ponzo as Deputy CEO