JB Insights

GJIIF 2025: South India’s Premier Jewellery Exhibition Delivers Exceptional Results with High Footfall and Robust Sales

GJIIF provides strong boost as trade prepares for Akshaya Tritiya

- Marked increase in Pan-India visitors and International participants

- Significant retailer presence – from small stores to corporate chains

- Concurrent events – Networking Evening and Knowledge Seminars – add sparkle to the show

The Akshaya Tritiya edition of South India’s oldest and most premier B2B jewellery event, Gem & Jewellery India International Fair (GJIIF) 2025 was a resounding success with turnout and business transactions exceeding expectations all round.

The venue remained crowded on all the three days with over 10,000 visitors, and the general overall feedback indicated that exhibitors were extremely satisfied having registering outright orders. Most also reported success in widening their clientnetwork with new potential contacts.

GJIIF, organised by the Jewellers and Diamond Traders Association, Madras (MJDTA) and Tamil Nadu Jewellers Federation (TNJF), is the only B2B jewellery show in the country with an exclusive focus on South Indian jewellery. This edition, held from February 28 to March 2, 2025 was well timed to help the trade prepare for the all-important Akshaya Tritiya festival.

Jayantilal Challani, Convener-GJIIF and President, MJDTA, said, “This year GJIIF was bigger and better in many ways. Not only were there more exhibitors and visitors than before, we also saw positive sentiment driving business deals. As the only show focusing on South Indian jewellery, GJIIF has become a must-visit event for large corporates and multi-store retailers, as well as huge numbers of smaller and medium retailers from the region.”

The show had over 400 exhibitors spread over 870 stalls covering a mammoth 2,00,000 sq ft area. These included many renowned manufacturers and wholesalers, most of whom have now been present at the show consistently for years. They believe GJIIF is the ideal platform to introduce new designs for the Akshaya Tritiya festival to the trade and feel GJIIF as the Gateway to South Indian Jewellery Market. Many new exhibitors also attracted attention with their innovative and creative offerings.

Over the years, the profile of the GJIIF has evolved from being a purely regional trade show to one that attracted visitors from all across India. This year, GJIIF took a further leap, welcoming a large number of overseas buyers including leaders of trade bodies from South Asia and South-East Asia too. Business visitors from Malaysia, Sri Lanka, Russia, Middle East, China and a few other places were also present.

Emphasising the key role that GJIIF plays for the retail trade, B Sabarinath, President TNJF said, “Most exhibitors not only had many visitors but also reported good business. Every visitor was keen to book orders to ensure that they have new collections for the auspicious wedding & festival season up ahead. There was a vast variety of choice, with many new designs that gave a contemporary look to the traditional southern ornaments.”

GJIIF has also been recognised as a premier trade event due to its business-friendly environment. Registration procedures, both prior to the event and at the show, have been streamlined for easy entry while maintaining strict B2B norms. The well-organised layout and the hospitality arrangements go a long way in allowing participants to focus on their business goals.

“The Organising Team aims to raise the bar each year while planning and executing GJIIF to ensure the highest standards in the arrangements and hospitality of top quality,” said V.K. Manoj, Project Director, United Exhibitions, the event managers. “GJIIF is a landmark event for the South Indian industry, with the entire jewellery fraternity – from the largest to the smallest – visiting the show to do business and network.”

Alongside, the main show there are also concurrent events of equally high quality & focused seminars, panel discussions and educational presentations to enhance knowledge-sharing and future preparedness.Among thehighlights of the three-day event were the Networking Nite & Gala Dinner for the informal interaction where the attendees were enthralled by the high-powered performance of world-renowned band STACCATO, a well know name in global musical circles.

GJIIF Festive Edition 2025 will be held in Chennai from 12th to 14th September 2025.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

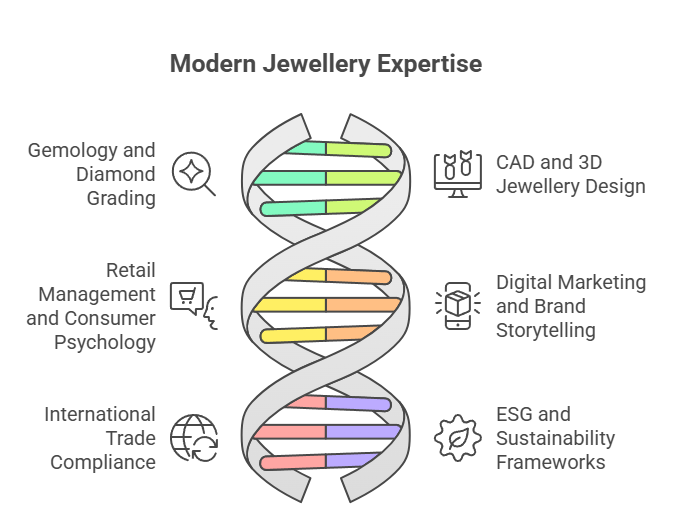

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

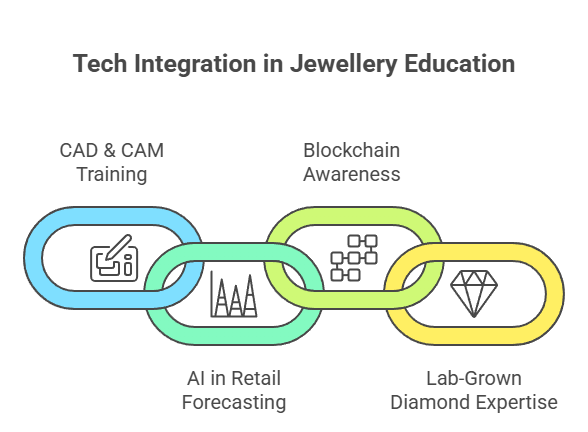

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

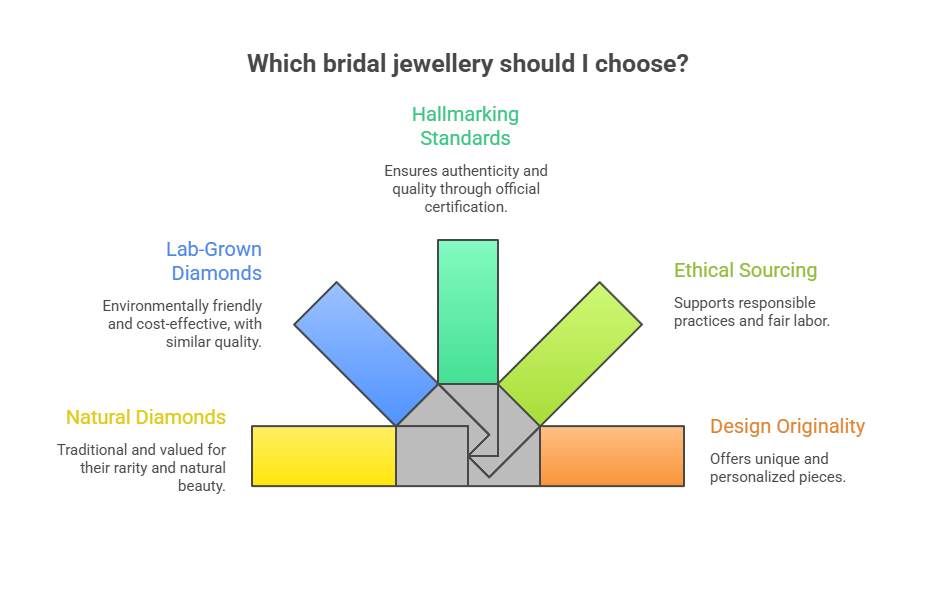

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

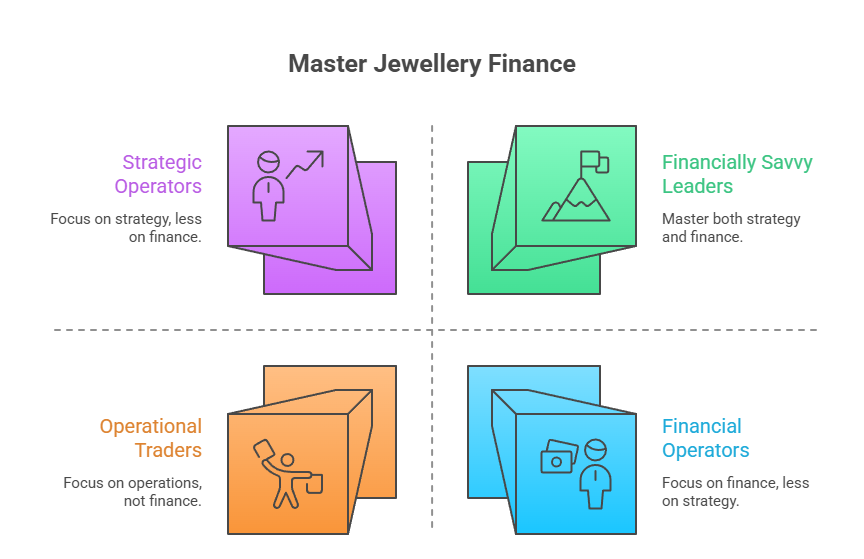

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

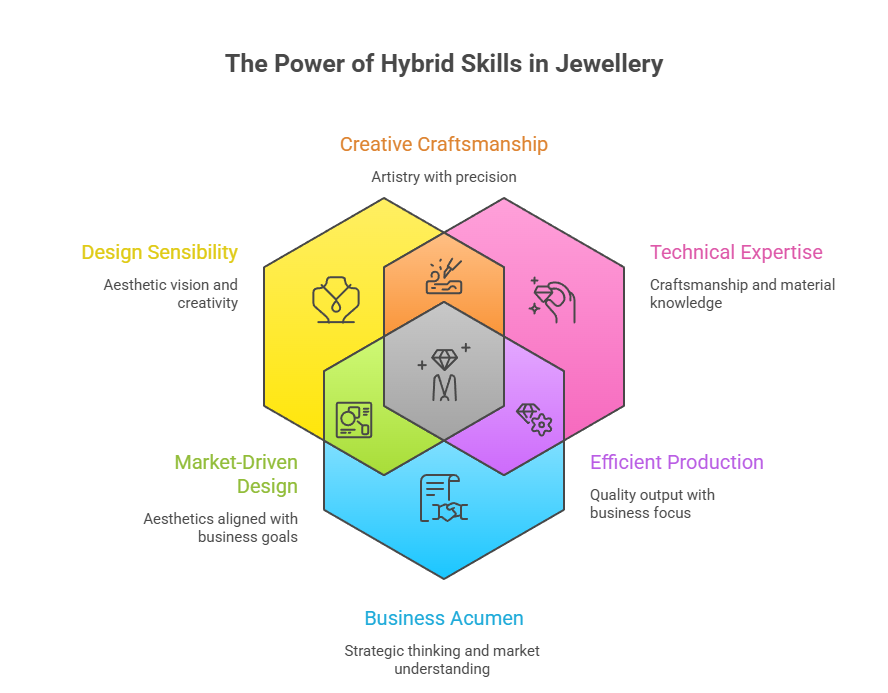

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

BrandBuzz9 hours ago

BrandBuzz9 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz10 hours ago

BrandBuzz10 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News14 hours ago

National News14 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression