National News

GJEPC and India Post Collaborate to Host Export Awareness Seminar in Delhi

Industry Experts Discuss Exporting Gems and Jewellery via India Post to Boost E-Commerce and Market Reach

The Gem and Jewellery Export Promotion Council (GJEPC) and India Post Delhi Circle jointly organised an export awareness seminar to promote the use of India Post for exporting gems and jewellery. The seminar, held at Meghdoot Bhawan near Jhandewalan Metro Station, attracted 65 industry members eager to explore postal services as an efficient export solution.

Key figures from the industry, including Mr. Ajay Singh Chauhan, PMG (Mails & BD), Mr. Antarpal Singh Sawhney, Regional Chairman – North, GJEPC, and Mr. Vickey Kumar, DPS (M&BD), graced the event along with other notable dignitaries.

During his welcome address, Mr. Chauhan assured participants of India Post’s commitment to providing comprehensive support and guidance for export operations. Mr. Sawhney emphasised the growing importance of e-commerce in the gems and jewellery sector, encouraging exporters to leverage digital platforms to reduce costs, extend their market reach, and operate efficiently around the clock.

A key highlight of the seminar was Mr. Vickey Kumar’s presentation on Dak Niryat Kendras (DNKs), which focused on how India Post’s postal services provide a cost-effective alternative to private courier services for exporters. Mr. Dinesh Kumar Sehgal, ME, NDHO, also conducted a live session to demonstrate the operational processes of DNKs, offering valuable insights into its functioning.

Col. Akhilesh Kumar Pandey, CPMG of Delhi Circle, recognised the unique needs of jewellery exporters and pledged to create a tailored policy through further discussions. Mr. Sanjeev Bhatia, Regional Director – North, GJEPC, also outlined several initiatives by the Council, including the IIGJ-RLC and IIGJ Delhi, aimed at further supporting the industry’s growth.

National News

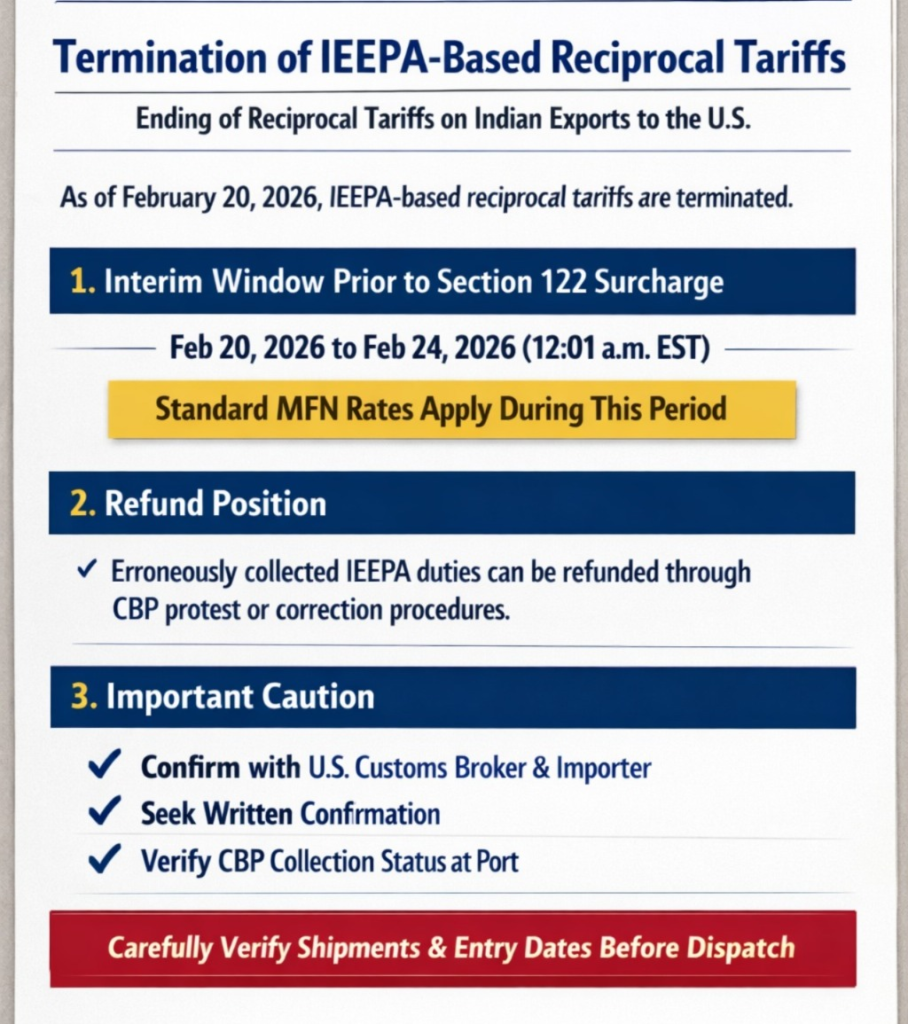

GJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

GJEPC informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

The Gem & Jewellery Export Promotion Council (GJEPC) informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

A letter issued by Sabyasachi Ray, Executive Director, GJEPC, addressed the Termination of IEEPA-Based Reciprocal Tariffs and outlined key implications for exporters.

Termination of IEEPA-Based Reciprocal Tariffs

Pursuant to the Executive Order dated February 20, 2026, titled “Ending Certain Tariff Actions”, the additional ad valorem duties imposed under IEEPA, including the reciprocal tariff framework under Executive Order 14257, shall no longer remain in effect and are directed to be terminated as soon as practicable.

Accordingly, entries made on or after February 20, 2026 should not be subject to the earlier IEEPA-based reciprocal tariffs.

1. Interim Window Prior to Section 122 Surcharge

A separate Presidential Proclamation dated February 20, 2026 imposes a temporary 10% surcharge under Section 122 of the Trade Act of 1974, effective 12:01 a.m. EST on February 24, 2026.

Therefore, between: February 20, 2026 – before 12:01 a.m. EST on February 24, 2026 imports into the United States should be subject only to ordinarily applicable HTSUS (MFN) rates, without the earlier reciprocal tariff, and prior to the commencement of the Section 122 surcharge.

For products such as cut and polished diamonds (where the MFN rate is ordinarily 0%), this period represents a limited operational window.

2. Refund Position (If Collected in Error or Due to Implementation Lag)

In cases where reciprocal IEEPA duties are collected due to implementation lag, such duties should be eligible for refund through the standard:

- U.S. Customs and Border Protection (CBP) protest mechanism under 19 U.S.C. §1514, or

- Post-summary correction procedures, as applicable.

However, exporters should note that there is no assurance that the refund process will not be time-consuming.

3. Important Caution for Exporters

While GJEPC is actively engaging with U.S. customs authorities and keeping customs at Bharat Diamond Bourse informed, members are strongly advised to:

- Seek confirmation from their U.S. customs broker and trade counsel

- Obtain written confirmation from their U.S. buyer/importer regarding entry treatment

- Confirm that CBP has ceased collection of the reciprocal tariff at the port of entry

Given the evolving implementation environment, entry-level verification is critical.

Members are encouraged to carefully assess:

- Shipment timing

- Entry dates

- Applicable HTS classification

before dispatching consignments, wherever applicable.

source: GJEPC

-

National News5 hours ago

National News5 hours agoGJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

-

National News6 hours ago

National News6 hours agoWGC India gold market update: Price strength fuels demand Looking ahead

-

International News8 hours ago

International News8 hours agoIGI approves an investment of up to $150,000 in Saudi Arabia

-

National News7 hours ago

National News7 hours agoIndia’s polished diamond exports dip by 3.6 per cent yoy in  January 2026