National News

GJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

GJEPC informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

The Gem & Jewellery Export Promotion Council (GJEPC) informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

A letter issued by Sabyasachi Ray, Executive Director, GJEPC, addressed the Termination of IEEPA-Based Reciprocal Tariffs and outlined key implications for exporters.

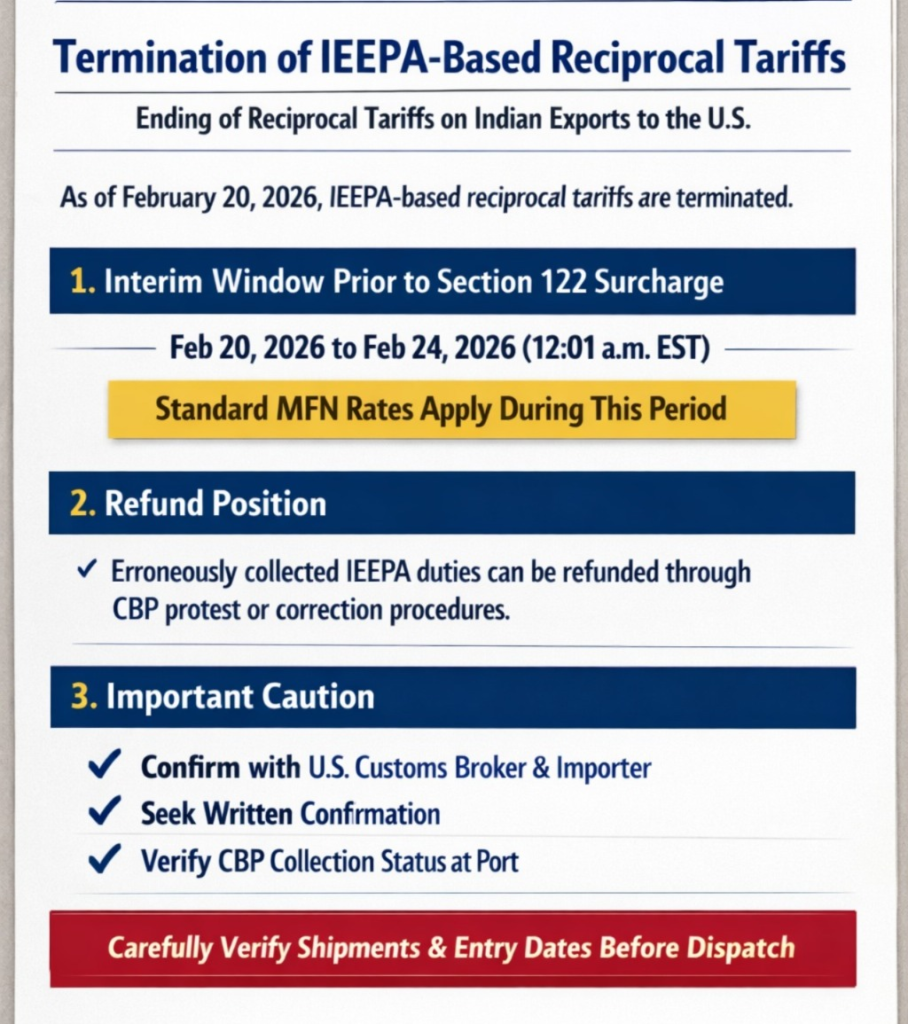

Termination of IEEPA-Based Reciprocal Tariffs

Pursuant to the Executive Order dated February 20, 2026, titled “Ending Certain Tariff Actions”, the additional ad valorem duties imposed under IEEPA, including the reciprocal tariff framework under Executive Order 14257, shall no longer remain in effect and are directed to be terminated as soon as practicable.

Accordingly, entries made on or after February 20, 2026 should not be subject to the earlier IEEPA-based reciprocal tariffs.

1. Interim Window Prior to Section 122 Surcharge

A separate Presidential Proclamation dated February 20, 2026 imposes a temporary 10% surcharge under Section 122 of the Trade Act of 1974, effective 12:01 a.m. EST on February 24, 2026.

Therefore, between: February 20, 2026 – before 12:01 a.m. EST on February 24, 2026 imports into the United States should be subject only to ordinarily applicable HTSUS (MFN) rates, without the earlier reciprocal tariff, and prior to the commencement of the Section 122 surcharge.

For products such as cut and polished diamonds (where the MFN rate is ordinarily 0%), this period represents a limited operational window.

2. Refund Position (If Collected in Error or Due to Implementation Lag)

In cases where reciprocal IEEPA duties are collected due to implementation lag, such duties should be eligible for refund through the standard:

- U.S. Customs and Border Protection (CBP) protest mechanism under 19 U.S.C. §1514, or

- Post-summary correction procedures, as applicable.

However, exporters should note that there is no assurance that the refund process will not be time-consuming.

3. Important Caution for Exporters

While GJEPC is actively engaging with U.S. customs authorities and keeping customs at Bharat Diamond Bourse informed, members are strongly advised to:

- Seek confirmation from their U.S. customs broker and trade counsel

- Obtain written confirmation from their U.S. buyer/importer regarding entry treatment

- Confirm that CBP has ceased collection of the reciprocal tariff at the port of entry

Given the evolving implementation environment, entry-level verification is critical.

Members are encouraged to carefully assess:

- Shipment timing

- Entry dates

- Applicable HTS classification

before dispatching consignments, wherever applicable.

source: GJEPC

National News

WGC India gold market update: Price strength fuels demand Looking ahead

Price stability may unlock deferred demand, while investment demand persists and wedding-related purchases support jewellery sales.

Records and resilience

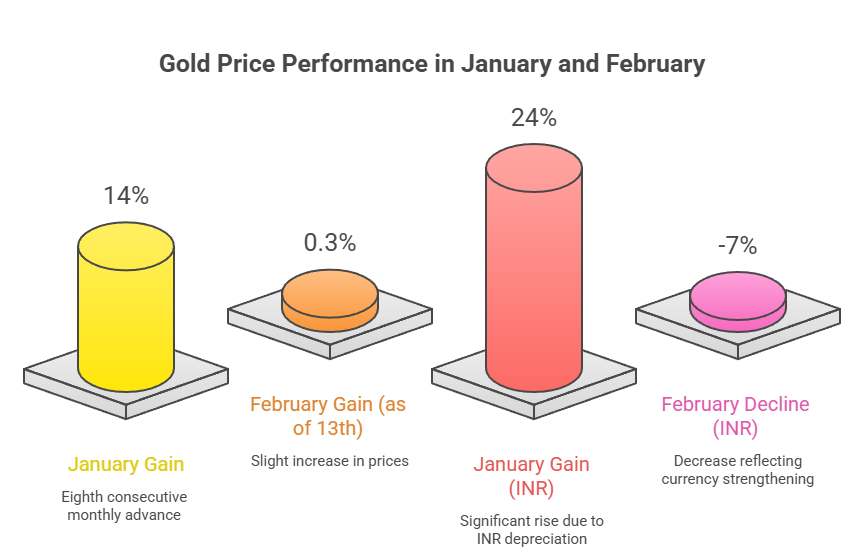

The first six weeks of 2026 marked a record-breaking yet turbulent phase for gold. International gold prices scaled 12 all-time highs, breached US$5,400/oz, and then corrected sharply at the end of January. Despite the pullback, prices have largely hovered around the US$5,000/oz level, signifying resilience.

January closed with a 14% gain, the eighth consecutive monthly advance, with prices up a further 0.3% as of 13 February. Strong gold ETF inflows, persistent and widening geopolitical risks, and US dollar weakness powered the gains.

Domestic gold prices mirrored international trends, rising to a record INR175,231/10g. Gains were more pronounced in INR terms, with prices up 24% as of end-January, aided by INR depreciation. Since then, prices have eased by 7%, partly reflecting currency strengthening.

Domestic gold prices traded at a premium to international benchmarks during the latter half of January ahead of the Union Budget (1 February). Multiple upward revisions in customs tariff value, expectations of a potential increase in import duty (above 6%), and healthy underlying demand pushed domestic prices to a premium of US$10/oz – US$70/oz over international prices. This premium persisted until 11 February, after which prices shifted to a discount, likely due to fewer tariff revisions and an increase in supply.

Buying on strength and on dips

Feedback from physical market participants suggests consumer demand remained resilient following the inauspicious period (mid-December to mid-January) despite record-high gold prices and elevated volatility, with buying skewed towards investment products.

Sharp price gains reinforced bullish sentiment, with limited expectations of a meaningful correction. The rally attracted new buyers across age groups, while price dips triggered purchases.

Jewellery buying has become more measured, with consumers preferring staggered accumulation rather than lump-sum purchases, even for weddings. Jewellery demand volumes are estimated to be ~20% lower y/y, but value sales growth increased ~25–30%, supported by elevated prices. Old gold exchange purchases remain high, accounting for ~40–70% of transactions in some markets.

Investment demand for bars and coins continues to hold firm, with indications of a shift in allocation from capital markets to gold. Meanwhile, liquidation activity remains limited, reflecting strong price confidence among holders.

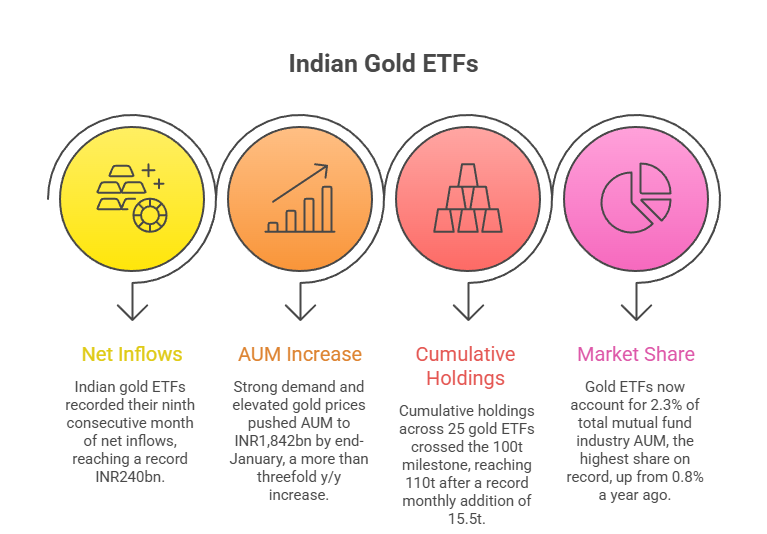

Gold ETFs scale new highs, outpacing equity flows

January marked a historic month for Indian gold ETFs, with record-breaking inflows, holdings, AUM, and investor participation.

Indian gold ETFs recorded their ninth consecutive month of net inflows, reaching a record INR240bn (US$2.5bn) — the third highest globally, after the US and China. Notably, gold ETF inflows surpassed equity fund inflows for the first time, signalling evolving investor asset allocation preferences.

Strong demand, combined with elevated gold prices, pushed AUM to INR1,842bn (US$20bn) by end-January — a more than threefold y/y increase. Cumulative holdings across 25 gold ETFs crossed the 100t milestone, reaching 110t after a record monthly addition of 15.5t.

Momentum extended into February, with INR46bn (US$501mn) net inflows between 1–12 February, adding another 3t to holdings. Gold ETFs now account for 2.3% of total mutual fund industry AUM, the highest share on record, up from 0.8% a year ago.

Investor participation surged, with 1.2mn new accounts (folios) added, taking total gold ETF accounts to 11.44mn, highlighting the growing prominence of gold ETFs in portfolios.

Strong uptick in digital gold buying

Digital gold buying strengthened significantly in January, reaching the highest level since data tracking began in January 2025.

Purchases via Unified Payments Interface (UPI) totalled INR39bn (US$432mn) — a ~90% m/m increase and more than fourfold y/y growth. In volume terms, about 2.6t was purchased, marking a 70% m/m increase.

The surge reflects momentum-driven demand, as both domestic and international prices hit multiple all-time highs. The ease of transactions and low minimum investment requirements continue attracting retail investors. Despite remaining unregulated, digital gold products are gaining traction, underscoring the need for regulatory oversight.

Marginal addition to RBI gold reserves

The Reserve Bank of India (RBI) added 0.13t to gold reserves in January — the first monthly increase in four months — lifting total holdings to a record 880.3t.

Gold now accounts for 17.2% of India’s foreign exchange reserves, the highest proportion on record, up nearly 6% y/y, largely due to sharp gold price appreciation (over 70% growth during the period). In contrast, physical gold holdings increased only 1.3t (0.15%), indicating gains were primarily valuation-driven rather than due to net purchases.

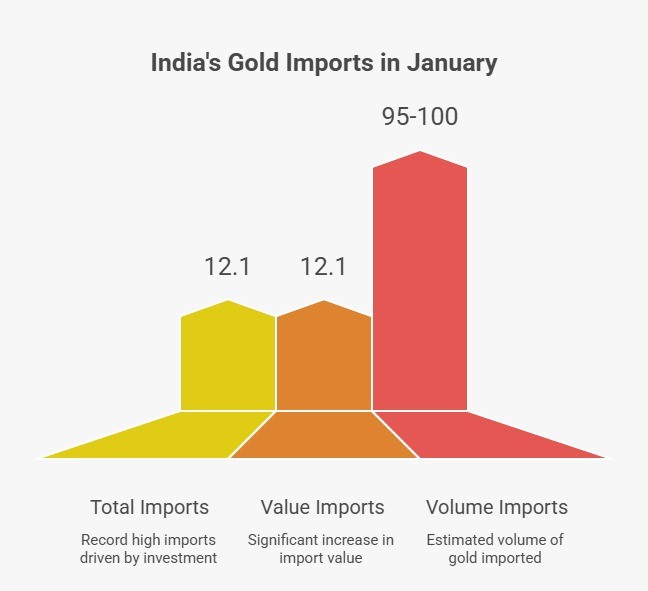

Imports climb

India’s gold imports rose to a three-month high in January, driven by strong investment demand across gold ETFs and physical gold. Anticipation of a possible import duty revision in the Union Budget likely prompted front-loaded shipments.

In value terms, imports reached US$12.1bn, up 192% m/m. In volume terms, imports are estimated at 95t–100t, supported by record gold prices and strong investor demand.

source:WGC

-

National News2 hours ago

National News2 hours agoWGC India gold market update: Price strength fuels demand Looking ahead

-

International News3 hours ago

International News3 hours agoIGI approves an investment of up to $150,000 in Saudi Arabia

-

National News4 hours ago

National News4 hours agoVAIRAM 2026 Opens at IIT Madras with Focus on India’s LGD Growth

-

National News2 hours ago

National News2 hours agoIndia’s polished diamond exports dip by 3.6 per cent yoy in January 2026