DiamondBuzz

De Beers offers rough diamond discounts of 10% to 20% in secret deals

Multiple industry sources report that De Beers has secretly offered rough diamond discounts of 10% to 20% to a select group of sightholders, a departure from its usual practice of uniform pricing. These “secret deals” have not been officially confirmed by De Beers but are widely discussed within the industry.

The selective discounts appear aimed at quickly moving inventory and generating cash flow, given the company’s financial losses and pressure from Anglo American to improve performance.

Market Reaction: This selective discounting is unprecedented for De Beers and risks alienating sightholders who were not offered these preferential terms, potentially undermining trust and long-term relationships within its customer base.

The company is attempting to reduce a rough diamond stockpile estimated at $2 billion, the largest since the 2008 financial crisis, as global demand remains weak and manufacturers are hesitant to restock.

De Beers’ consolidated rough diamond revenue for the first two sights of 2025 dropped 44% year-over-year, with the average realized price per carat falling by 38%. The company has also cut its 2025 production forecast by up to 40%, now targeting 20–23 million carats, down from an initial 30–33 million.

Strategic Implications

Short-Term Cash Flow:

Long-Term Risks: The lack of transparency and favoritism in discounting could damage De Beers’ reputation for fairness and erode the loyalty of sightholders not included in the deals. This could have lasting effects on its ability to maintain a stable, committed customer base.

Industry Impact: The move signals ongoing distress in the natural diamond sector, with persistent oversupply, weak demand, and heightened competition from lab-grown diamonds contributing to industry-wide price declines.

Conclusion

De Beers’ decision to offer significant, selective discounts on rough diamonds marks a notable shift in its sales strategy, reflecting the severity of current market challenges. While this may provide short-term relief in reducing stockpiles and supporting cash flow, it introduces risks to long-term customer relationships and market stability. The industry will closely watch how De Beers manages these tensions and whether transparency and trust can be restored among its sightholders.

Related

How might these discounts impact De Beers’ long-term relationships with sightholders

What are the potential risks for De Beers if these discounts become public

How does De Beers determine which sightholders receive these special discounts

What strategies can De Beers use to manage the stockpile effectively

How might these discounts affect the overall diamond market

BrandBuzz

De Beers Group Rewrites the Diamond Story with ‘Intention Pendants’ for the Woman Who Chooses Herself

Where natural diamonds become expressions of intent for women shaping their own path

De Beers Group taps into the modern ritual of intention-setting with the launch of ‘The Intention Pendant’ collection, where natural diamonds become intimate expressions of purpose and personal power. Designed for the woman who marks her milestones quietly yet deliberately, the high-glamour collection reflects a new language of self-gifting rooted in meaning, emotion, and self-belief. The launch speaks to a wider cultural shift, one where success is defined internally and luxury becomes a deeply personal signature.

For Gen Z and millennials, practices like manifestation, vision boarding, and ‘scripting dreams’ are no longer trends; they are core lifestyle rituals. Intention-setting has become a daily act of self-empowerment. De Beers Group captures this sentiment through a personal campaign narrative that features a young woman crafting a vision board and reconnecting with her inner clarity, with the pendant serving as her constant companion through quiet moments and self-discovery.

“Women today are choosing to celebrate themselves through everyday intentions. The Intention Pendants draw from the extraordinary legacy of natural diamonds while honouring this cultural shift,” said Toranj Mehta, Vice President of Marketing, De Beers Group India. “Rooted in the extraordinary legacy of natural diamonds, this collection reflects a shift toward jewellery as a personal marker of growth. Each piece serves as a quiet reminder a woman wears for herself, honouring her inner resolve and the promises she makes to her future.”

The launch is supported by a comprehensive 360° campaign designed to inspire and engage across print, television, radio, cinema, outdoor, digital, and social media outreach. Leading Bollywood and sports icons including Tamannaah Bhatia, Athiya Shetty and Sania Mirza have created and shared their personal vision boards while wearing the pendants, amplifying authenticity and aspiration.

Each Intention Pendant features a natural diamond, formed over billions of years and shaped patiently by nature, carrying a sense of timeless continuity into the present. Refined through the forces of time, it stands as a lasting symbol of resilience and brilliance. Inspired by celestial forms and personal energy, the design brings this journey from nature’s heart to hers into a modern, wearable expression. Worn close to the heart, the pendant becomes a personal touchstone, subtly manifesting her best life while reflecting her intentions, inner strength, and the journey she continues to shape.

The Intention Pendant collection builds on De Beers’ global focus on self-gifting as an evolving expression of self-love. Across markets, natural diamonds are increasingly chosen to mark independent decisions, personal milestones, and moments of inner transformation, signalling a move beyond traditional gifting toward jewellery that reflects individuality and purpose.

Launching ahead of the year-end period of reflection, the collection aligns naturally with a season devoted to renewal, clarity, and intention. The Intention Pendant emerges not as a statement piece, but as a personal symbol, one that accompanies a woman quietly as she defines success on her own terms.

‘The Intention Pendant Collection’, serves as a reminder of one’s potential through the timeless beauty of a natural diamond and personal expression. De Beers invites you to connect with cosmic energy, flowing from nature’s core to your own.

-

BrandBuzz6 hours ago

BrandBuzz6 hours agoMCA raises “small company” thresholds – up to ₹10 cr capital & ₹100 cr turnover from 1st December 2025, major relief for jewellery trade

-

JB Insights6 hours ago

JB Insights6 hours agoWomen Leaders Driving the Luxury Renaissance

-

National News10 hours ago

National News10 hours agoSHINESHILPI Announces the Launch of The Shine House, India’s Biggest B2B Jewellery Hub

-

National News8 hours ago

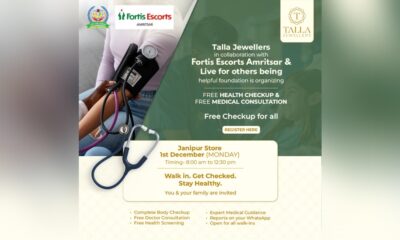

National News8 hours agoTalla Jewellers Successfully Hosts Free Health Checkup Camp with Fortis Escorts Amritsar and Live For Others Foundation