JB Insights

CIBJO PRE-CONGRESS SPECIAL REPORTS

Examining jewellery’s role in expressing the best in humanity

Prepared by the CIBJO Marketing and Education Commission, headed by Jonathan Kendall, Special Report No.1 considers what must be done to ensure that jewellery remains the ultimate expression of love, friendship and peace.

“As we stand at the confluence of tradition and innovation, the role of the jewellery industry in expressing and promoting these universal values becomes ever more significant,” writes Kendall. “In a world teeming with transient messages and fleeting moments, its enduring nature offers a beacon of hope and continuity. It invites us to look beyond the surface, to find within its sparkle a deeper connection to the values that bind us.”

To meet the challenge, the industry is going to have innovate iconic jewellery, which, as it has in previous times, manages to match the sentiment and consciousness of new consumers, Mr. Kendall stated. “In an era where symbols carry the weight of ideologies and beliefs, the jewellery industry stands at the threshold of an unprecedented opportunity – to conceptualize new statement pieces that embody global peace and harmony. It’s an endeavour requiring not only creativity and craftsmanship, but also a profound understanding of the universal symbols that resonate with humanity’s deepest aspirations for unity and tranquillity,” he wrote.

The ethical integrity of the jewellery is also fundamental. “Through conscious practices and meaningful engagement, the industry “has the potential to contribute to a legacy of positive change, proving that the true value of jewellery lies in the beauty it brings to the world, both inside and out,” wrote Kendall.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

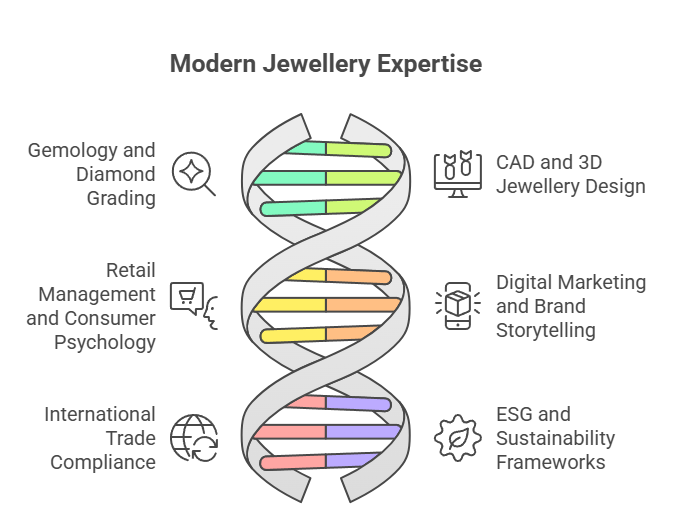

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

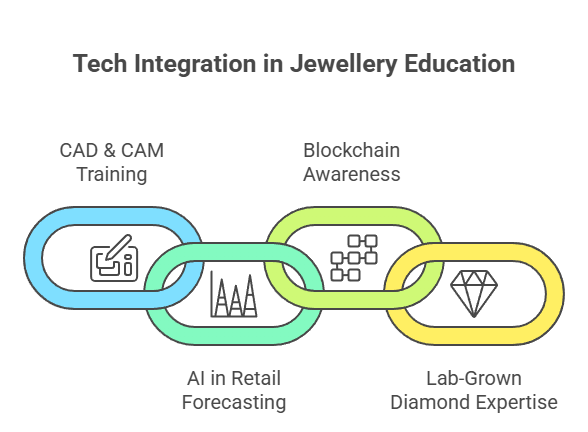

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

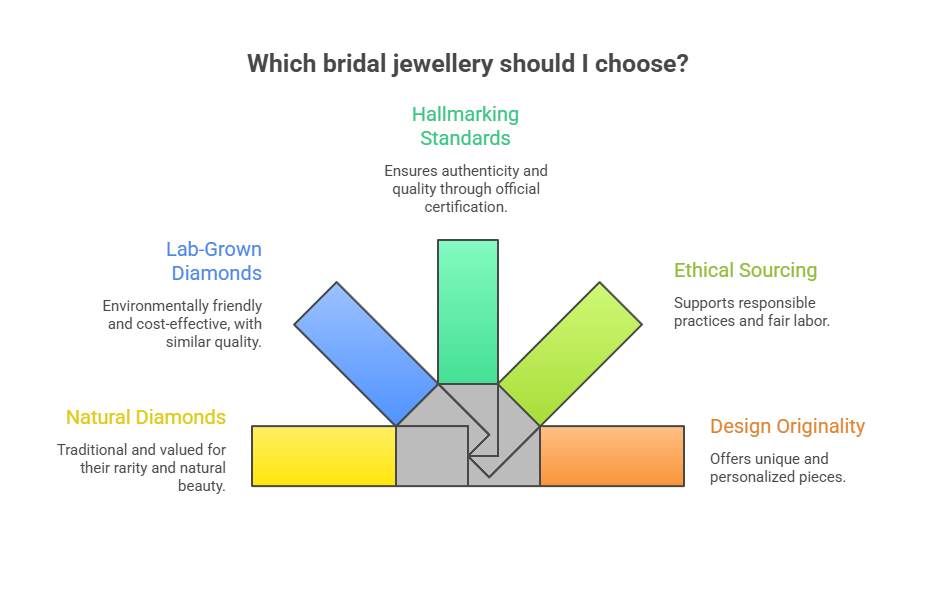

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

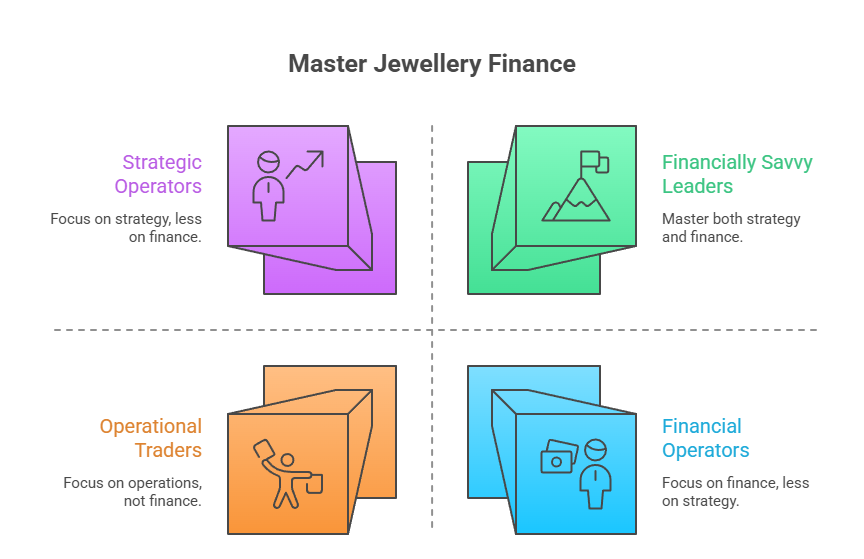

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

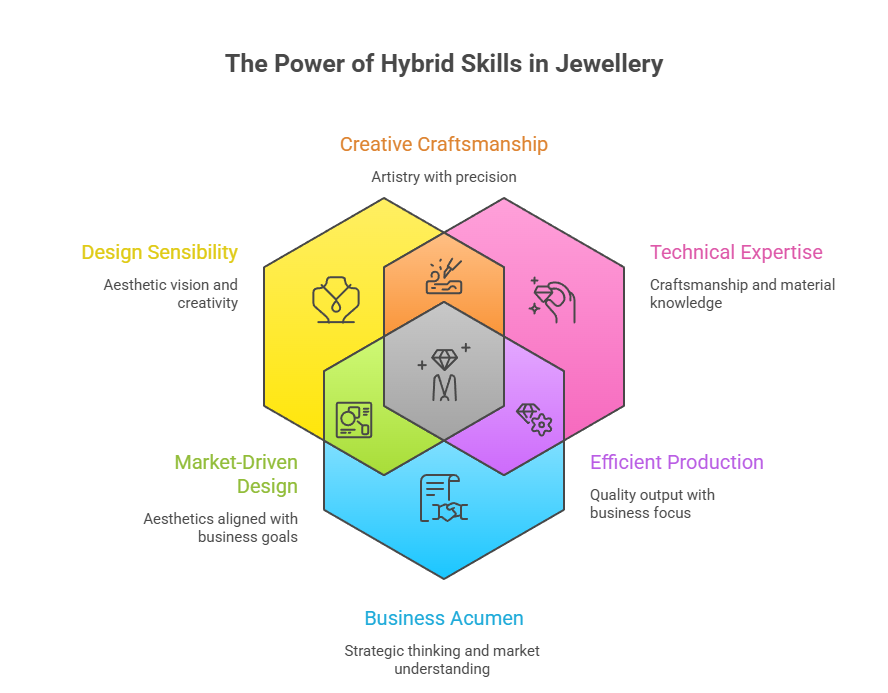

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

BrandBuzz5 hours ago

BrandBuzz5 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz5 hours ago

BrandBuzz5 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz9 hours ago

BrandBuzz9 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News9 hours ago

National News9 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression