National News

CEPA completes 3 years; powering India-UAE trade and economic ties

Bilateral gem and jewellery trade surged from US$ 20.88 billion in FY2022 to US$ 28.15 billion in FY2024, reflecting a robust 35% increase

The *Comprehensive Economic Partnership Agreement (CEPA)* between *India and the UAE*, formalised on 18th February 2022, has profoundly strengthened economic ties between the two nations. As we commemorate its third anniversary, it is evident that CEPA has significantly enhanced trade opportunities, particularly for India’s gem and jewellery industry.

Since CEPA’s implementation, trade between India and the UAE has witnessed remarkable growth. The bilateral gem and jewellery trade surged from US$ 20.88 billion in FY2022 to US$ 28.15 billion in FY2024, reflecting a robust 35% increase. India’s gem and jewellery exports to the UAE also soared by over 60%, from US$ 4.95 billion in FY2022 to US$ 8.04 billion in FY2024.

Notably, UAE’s share in India’s total exports rose from 13% in FY2022 to 25% in FY2024, overtaking Hong Kong as India’s second-largest export market. This underscores the transformative impact of CEPA on India’s trade dynamics.

One of the most significant benefits of CEPA has been the duty-free access for all gem and jewellery products, including gold, silver, and platinum jewellery, along with polished diamonds and gemstones.This development has motivated Indian exporters to increase their supply of various gem and jewellery items to the UAE, capitalising on the enhanced market access provided by the agreement.

This policy shift has led to substantial growth in key export categories:

Plain Gold Jewellery: Exports surged by 127.62%, reaching US$ 4,240 million in FY2024.

Studded Gold Jewellery: Increased by over 50%, from US$ 917 million in FY2022 to US$ 1,382 million in FY2024.

Worked Lab-Grown Diamonds: Witnessed a 58.16% growth, reaching US$ 172 million in FY2024.

Platinum Jewellery: Recorded a staggering 820.87% increase, reaching US$ 23 million.

Coloured Gemstones: Grew by 17.19% to US$ 9.34 million

*Kirit Bhansali*, Chairman, GJEPC, said, “The India-UAE CEPA has propelled our gem and jewellery exports to new heights, growing by over 60% from US$ 4.95 billion in FY2022 to US$ 8.04 billion in FY2024. The UAE now accounts for nearly a quarter of India’s total gem and jewellery exports, surpassing Hong Kong. The duty-free advantage has unlocked immense opportunities, particularly in plain gold jewellery, which saw a 127% surge. As we celebrate three years of CEPA, we remain committed to strengthening this vital partnership and exploring new avenues for growth.”

JB Insights

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

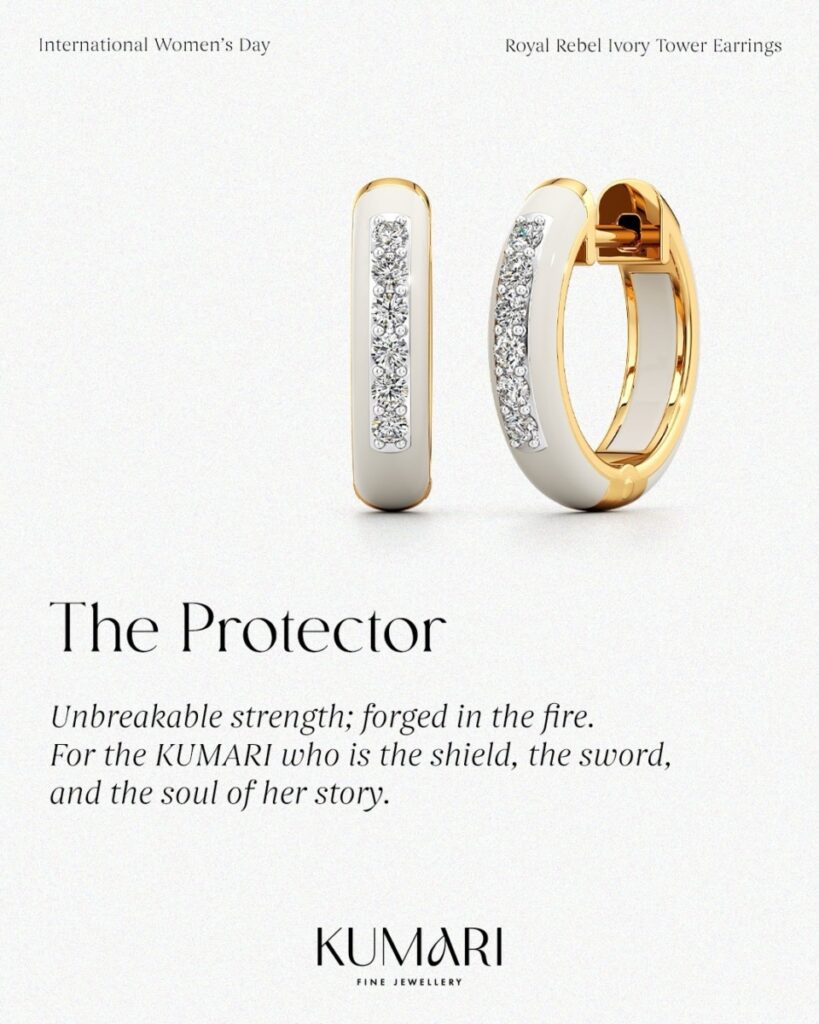

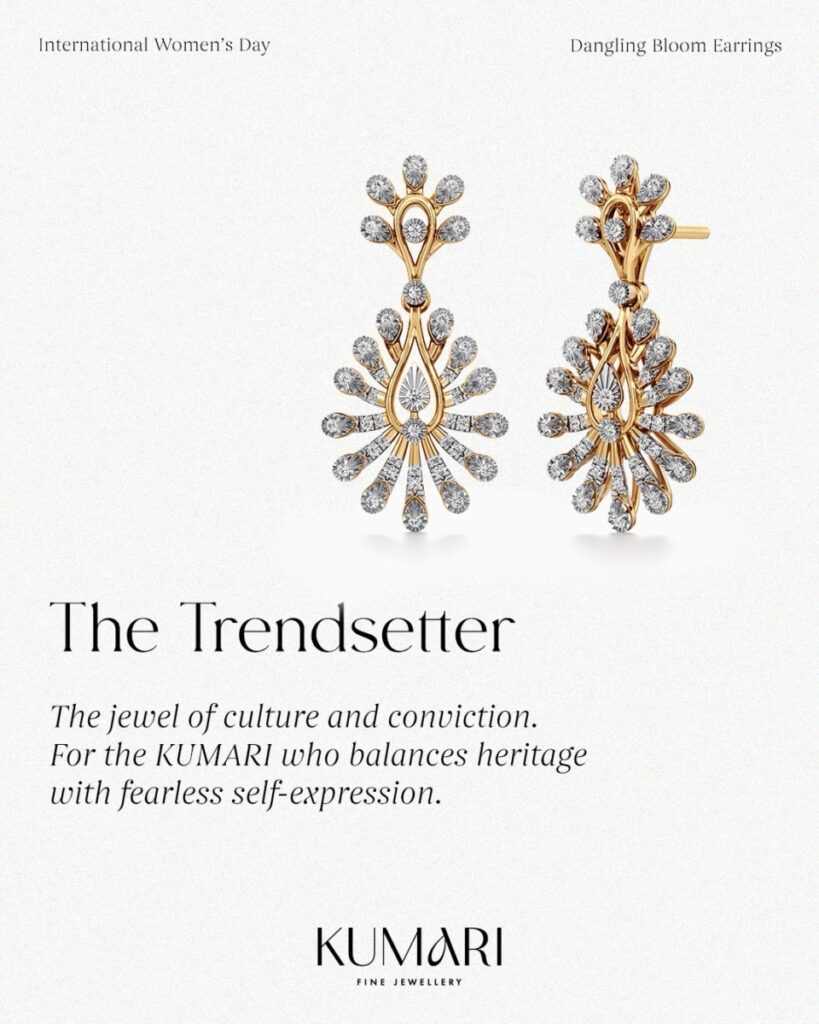

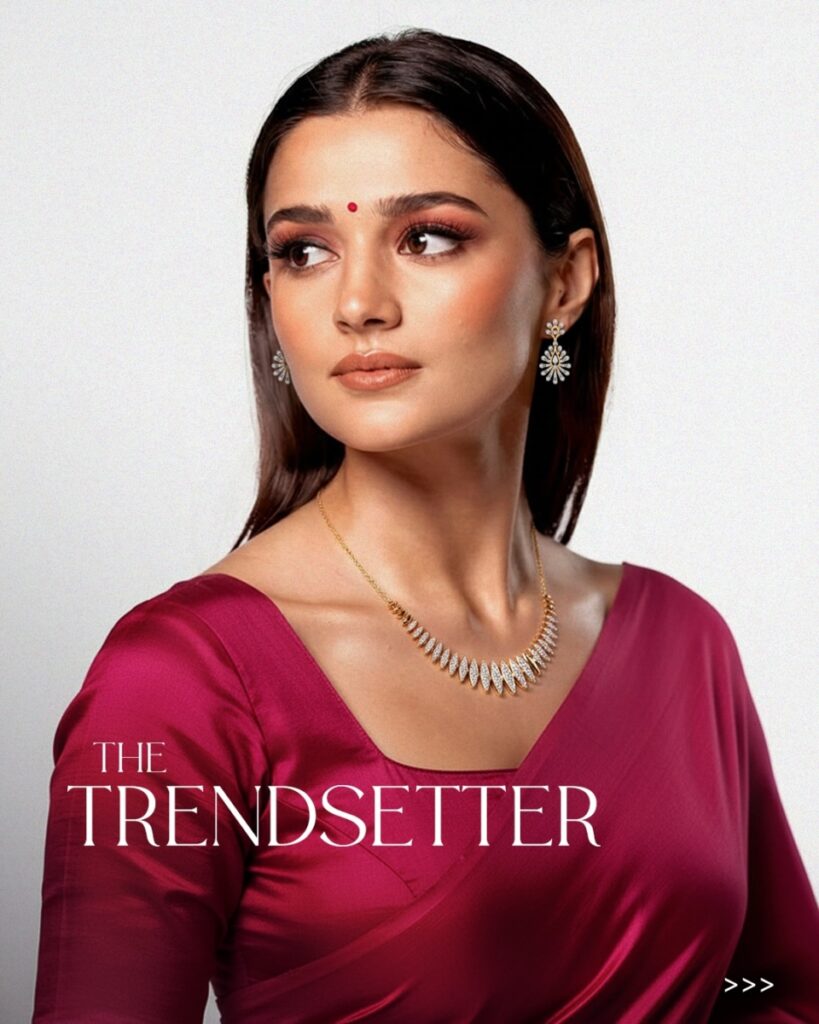

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

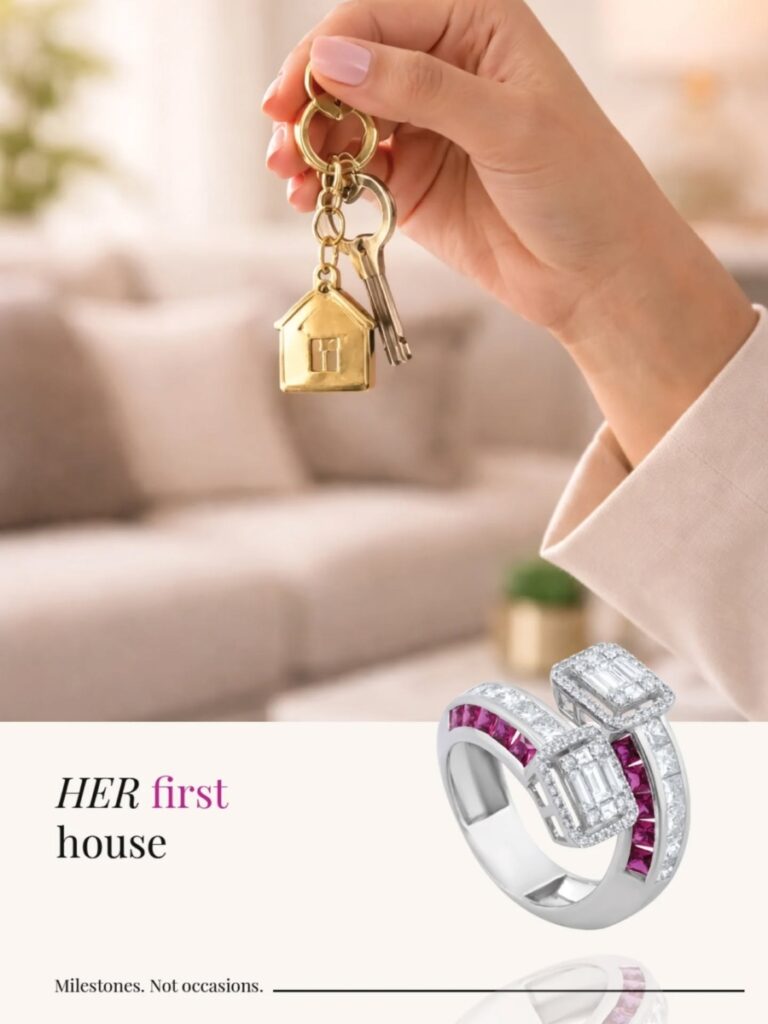

Dhirsons Jewellers

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

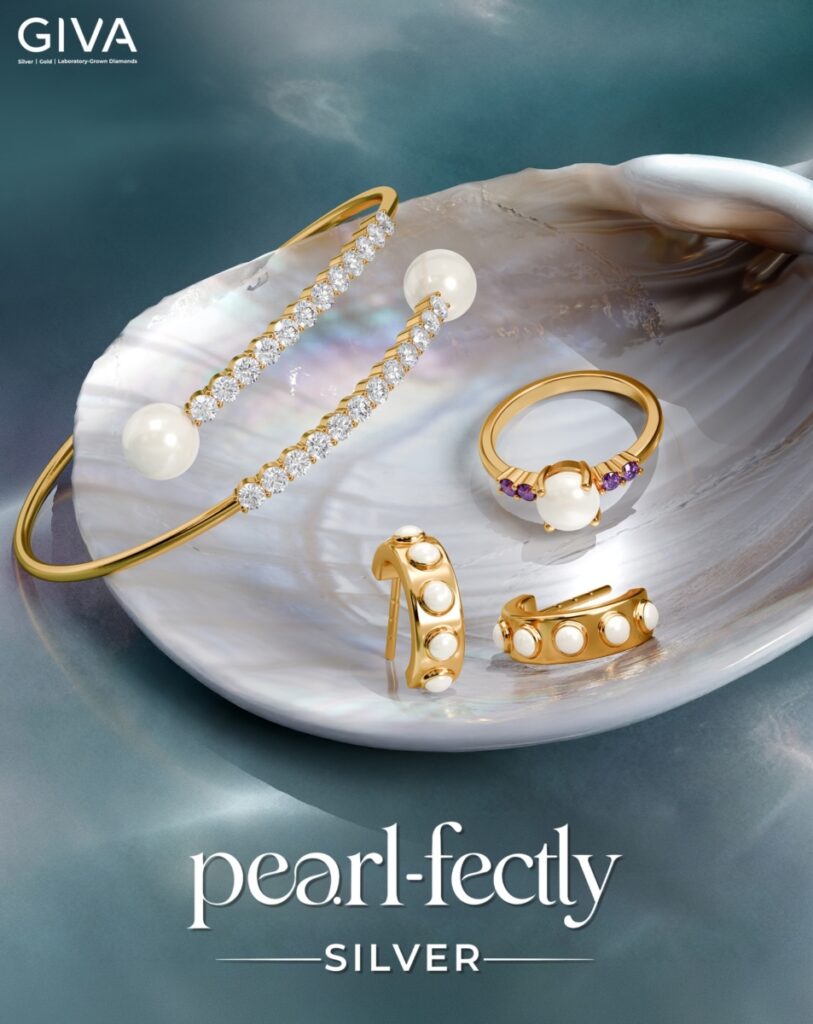

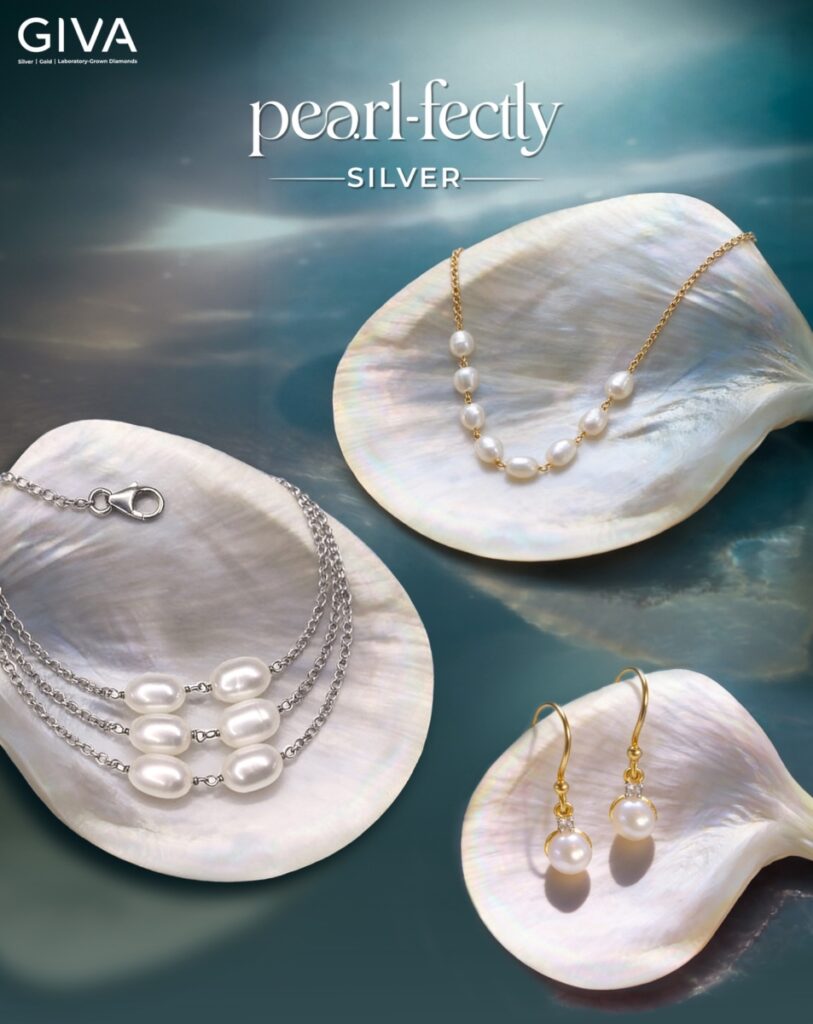

GIVA

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

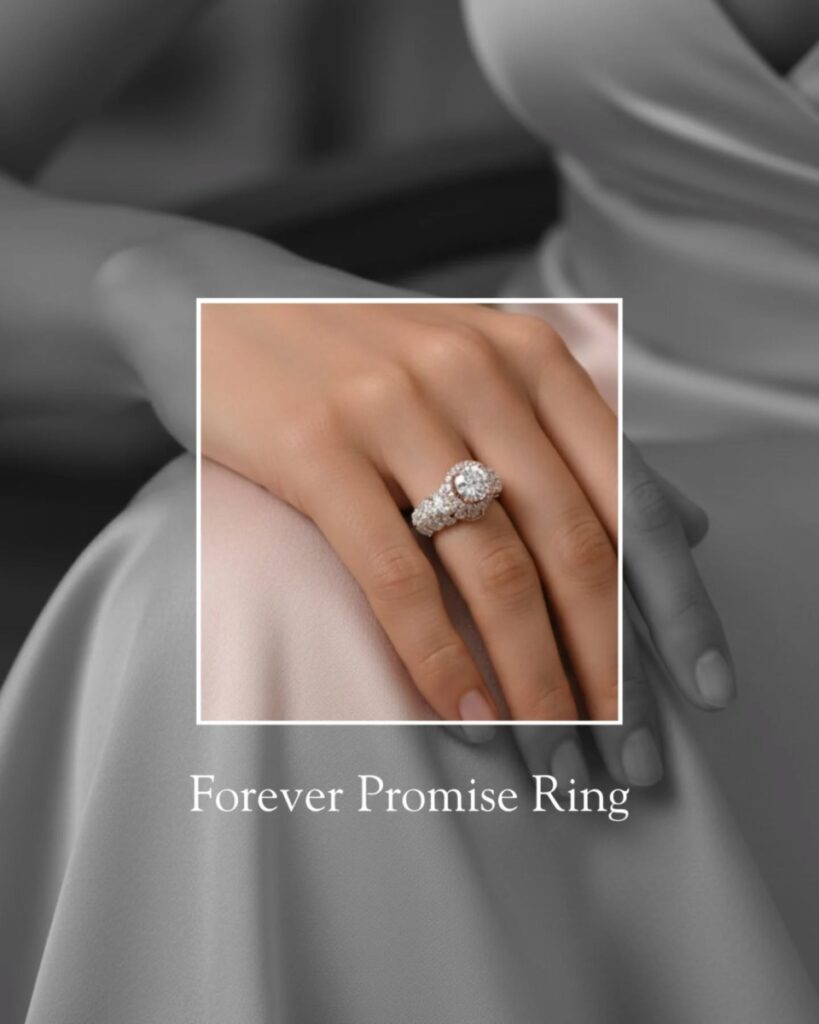

Divine Solitaires

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

JB Insights7 hours ago

JB Insights7 hours agoWomen’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

-

National News11 hours ago

National News11 hours agoGold Rebounds in India After Five-Day Slide; Dollar Strength Keeps Pressure Intact

-

National News12 hours ago

National News12 hours agoKumari Fine Jewellery Celebrates the “Modern Indian Original” with Exclusive Women’s Day Showcase

-

National News15 hours ago

National News15 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey