International News

Cash transaction curbs hit Hong Kong diamond trade, impacting its competitiveness.

Cash transaction curbs hit Hong Kong diamond trade, impacting its competitiveness.

Hong Kong’s jewellery trade shows, historically significant hubs for diamond and gemstone transactions, are undergoing a period of significant transformation. Recent regulatory changes, particularly the elimination of cash transactions for diamond dealers, have fundamentally altered the market dynamics. This analysis examines the impact of these changes, the resulting challenges, and potential future implications for the industry.

Hong Kong has long been a vital center for the global jewellery trade, renowned for its strategic location, established infrastructure, and vibrant trade shows. Historically, the city’s appeal lay in its status as a cash market, facilitating swift and discreet transactions, particularly in diamonds.

Hong Kong’s position as a prominent cash market has been compromised, impacting its competitiveness. This has caused a decrease in some of the revenue that was historically generated at the trade shows. Compounding the challenges posed by regulatory changes is the simultaneous decline in Chinese diamond demand.

The implementation of regulations prohibiting cash transactions for diamond dealers two years ago has significantly disrupted the traditional trading practices. This change has eliminated a key attraction for dealers who relied on the anonymity and speed of cash transactions. This regulatory change was likely implemented to increase transparency, prevent money laundering, and adhere to international financial standards.

Exhibitors are now required to display regulatory certifications, indicating a heightened focus on compliance. The presence of Hong Kong’s Customs and Excise Department representatives at trade shows underscores the government’s commitment to enforcing cash rules. This has increased the level of trust in the market, for legitimate businesses.

Hong Kong’s jewellery trade shows are navigating a period of significant change driven by regulatory adjustments and evolving market dynamics. While the elimination of cash transactions has posed challenges, it also presents an opportunity to strengthen the industry’s integrity and long-term sustainability. By embracing digital innovation, diversifying market focus, and maintaining a strong regulatory framework, Hong Kong can solidify its position as a leading global jewellery trading hub.

• Increased Compliance and Transparency

• Decline in Cash Market Status

• Weakened Chinese Diamond Demand

This external factor further exacerbates the difficulties faced by the Hong Kong jewellery trade.

Challenges and Implications:

• Reduced Transactional Volume:

The elimination of cash transactions may have led to a decrease in the overall volume of transactions at trade shows, as some dealers may have shifted to alternative markets.

• Shift in Market Dynamics:

The industry is adapting to a new era of transparency and compliance, requiring adjustments in business practices and strategies.

• Competitive Pressure:

Hong Kong faces increased competitive pressure from other jewellery trading hubs that may offer more flexible transaction options.

Impact on Small and Medium-Sized Enterprises (SMEs):

Smaller businesses that relied on cash transactions may be disproportionately affected by the regulatory changes.

Need for Digital Adaptation:

The industry must embrace digital transaction methods and technologies to remain competitive.

Potential Future Strategies

Enhancing Digital Infrastructure:

Investing in secure and efficient digital payment systems to facilitate seamless transactions.

Diversifying Market Focus:

Exploring new markets and diversifying product offerings to mitigate the impact of declining Chinese demand.

Strengthening Regulatory Framework:

Maintaining a strong and transparent regulatory framework to build trust and attract reputable businesses.

Promoting Hong Kong’s Strengths:

Highlighting Hong Kong’s strengths, such as its established infrastructure, skilled workforce, and strategic location, to attract international buyers.

Focus on high end goods:

Hong Kong could focus on becoming the high end market for very expensive and rare stones, where the added security and regulations are a positive.

International News

The HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

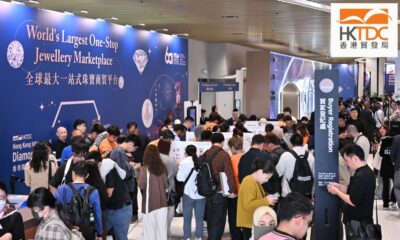

The twin shows reinforce their position as the world’s largest one-stop jewellery marketplace

Organised by the Hong Kong Trade Development Council (HKTDC), the 12th Hong Kong International Diamond, Gem & Pearl Show opens today and will run for five consecutive days at Asia World-Expo. The 42nd Hong Kong International Jewellery Show will be held from 4–8 March at the Hong Kong Convention and Exhibition Centre (HKCEC) in Wan Chai.

Jenny Koo, Deputy Executive Director of the HKTDC, said: “As the world’s largest one-stop jewellery marketplace, the HKTDC’s twin jewellery shows return under ‘Two Shows, Two Venues’ format, presenting an extensive spectrum of product categories. These include diamonds, gemstones and pearls, as well as showcasing the finest finished jewellery pieces, designer brands, mounting components, product packaging and identification instruments and technologies. This year, the twin shows bring together some 4,000 exhibitors from over 40 countries and regions, with 70% coming from outside Hong Kong, reinforcing the highly international nature of the events.”

International Diamond, Gem & Pearl Show showcases top-tier raw materials

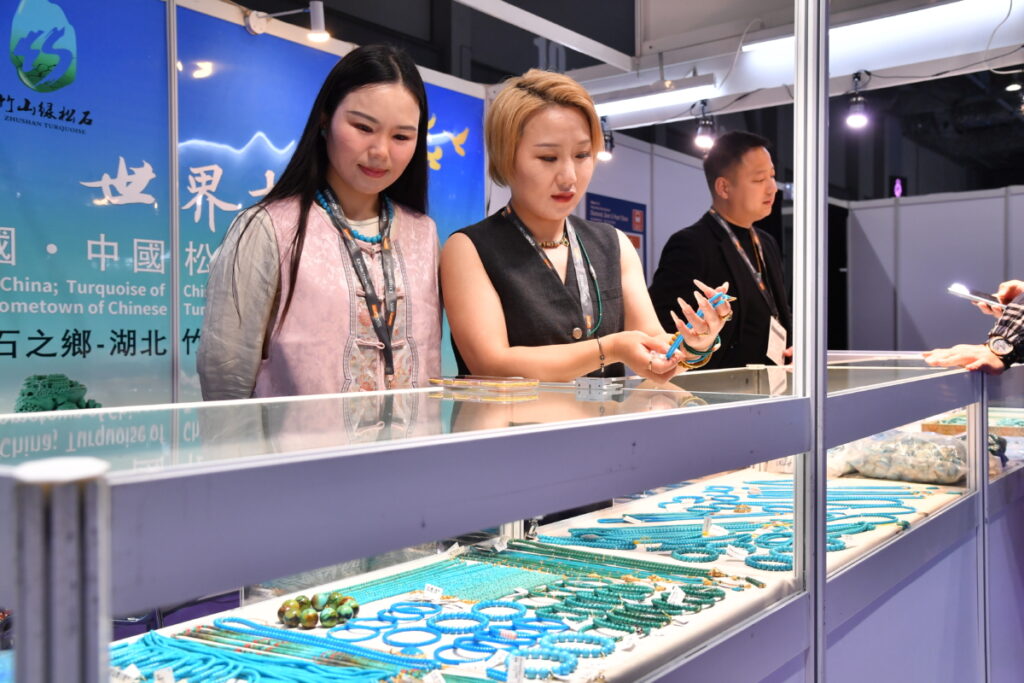

The Hong Kong International Diamond, Gem & Pearl Show features more than 20 pavilions representing various countries, regions and trade organisations, such as Germany, Italy, Colombia, the United States, India, Thailand, etc. Notably, the Zhushan Turquoise Pavilion is making its debut. Zhushan County in Hubei Province of Chinese Mainland, is known as the “Hometown of Chinese Turquoise” and is one of the world’s renowned production regions for high-quality turquoise. The pavilion brings together 11 exhibitors showcasing natural treasures formed in the Qinba Mountains.

The Tanzanite Foundation, a long-time favourite among buyers, once again participates in the show. The International Colored Gemstone Association presents 37 exhibitors with a wide array of rare coloured gemstones. Cody Opal (Australia) Pty Ltd (Booth: AWE 8–E01) features Lightning Ridge black opal.

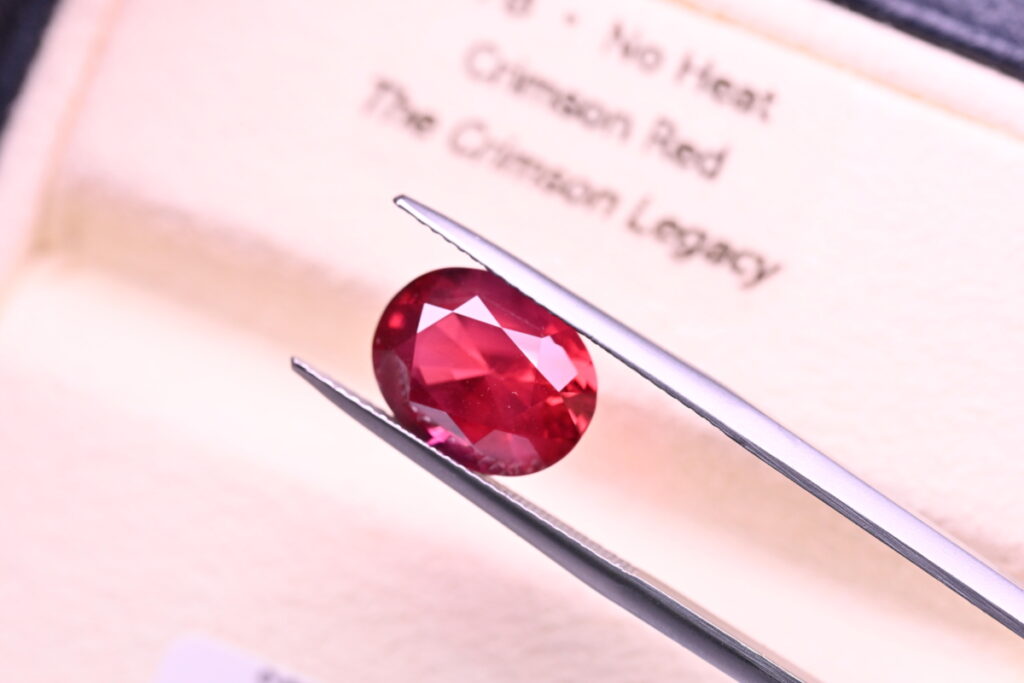

Three major product zones at the Hong Kong International Diamond, Gem & Pearl Show—the Hall of Fine Diamonds, Treasures of Nature, and Treasures of Ocean—highlight materials including high-end diamonds, natural gemstones and pearls sourced from around the world. Hong Kong exhibitor Arihant Star (HK) Limited (Booth: AWE 5–C15) showcases a fancy intense pink VVS2 diamond. U.S. exhibitor Emco Gem Inc. (Booth: AWE 7–H01) presents an 11-carat cushion-cut Colombian emerald. French exhibitor Alain Boite S.A.S. (Booth: AWE 1–A20) exhibits a freshwater pearl strand measuring 14 to 15.8 mm.

This year, around 10 exhibitors are featured in the GIA Hong Kong Laboratory Limited (Booth: AWE 9, offering jewellery authentication services. GIA Hong Kong Laboratory Limited (Booth: AWE 9–M03) will launch a new coloured gemstone report that presents clearer information on a stone’s type, processing and origin, helping the industry and consumers understand the unique value of each gem. Hong Kong Limited (Booth: AWE 7– laboratory and research institution, provides professional testing services and actively promotes H26), a leading-laboratory and research institution, provides professional testing services and actively promotes origin technologies to enhance accuracy and transparency in gemstone identification.

Exciting events to uncover market trends

Throughout the Hong Kong International Diamond, Gem & Pearl Show, multiple industry seminars, jewellery parades, networking receptions and other activities will be held. Highlights include:

| Date | Theme | Seminar |

| 2 March (Monday) | Diamonds | Forever Forward: Igniting Desire for Natural Diamonds Representatives from De Beers analyse trends and developments in the natural diamond market from multiple perspectives. |

| 4 March (Wednesday) | Jewellery origin-tracing certification | Sustainable Gem Practices: Provenance & Ethical Traceability from Gem LabGübelin Gem Lab Limited, will , a gemological laboratory, will introduce integration of scientific testing and blockchain records. |

| 5 March (Thursday) | Turquoise from Zhushan | Special Promotion Conference for Zhushan Turquoise The speaker will share the process of how Zhushan Turquoise is mined and transformed into jewellery, and will explain how to appreciate the beauty of turquoise. |

International Jewellery Show to shine on Wednesday

In addition to the Hong Kong International Diamond, Gem & Pearl Show, the Hong Kong International Jewellery Show will open this Wednesday and showcase a wide array of finished jewellery pieces. The fair will feature 20 group pavilions from around the world. Notably, the World Gold Council will debut the Hard Pure Gold Pavilion, bringing altogether 11 exhibitors to promote innovative gold craftsmanship from Chinese Mainland. Also making its debut is the Hong Kong Watch Manufacturers Association Pavilion, highlighting exquisite jewellery and timepiece craftsmanship.

The creative design zones, including Designer Galleria, will feature about 50 designer exhibitors. Meanwhile, the Hall of Fame has expanded by more than 40%, presenting an even broader selection of magnificent international jewellery brands.

To facilitate buyer visits to both shows, the HKTDC will arrange free shuttle bus services between Asia World-Expo and urban areas (including the HKCEC in Wan Chai). Special measures have also been continued this year to facilitate Muslim buyers visiting the shows. These include the provision of dedicated prayer rooms at both exhibition venues, providing shuttle buses to and from local mosques, as well as offering a list of Muslim-friendly hotels and restaurants.

Additionally, to enrich the sourcing experience for international buyers, the HKTDC has partnered with the Hong Kong Tourism Board and various enterprises to offer exclusive buyer privileges, including dining, air tickets, hotels and more, allowing visitors to enjoy Hong Kong’s unique charm while attending the twin jewellery shows.

Digital platform helps participants explore business opportunities around the clock

This year’s twin jewellery shows continue to adopt the Exhibition+ online and offline hybrid format. The AI-powered Click2Match will provide online business matching for exhibitors and buyers from 23 February to 13 March. Physical buyers can use Scan2Match to scan the QR codes of exhibitors, enabling them to continue discussions with exhibitors online during or after the show. Buyers can also enhance their efficiency by completing registration and buyer verification in advance through the HKTDC Marketplace App and the official websites of the two fairs.

The Hong Kong International Diamond, Gem & Pearl Show and Hong Kong International Jewellery Show have attracted some 4,000 exhibitors from more than 40 countries and regions. The Hong Kong International Diamond, Gem & Pearl Show features over 20 national, regional and industry pavilions, and three high-end product zones – the Hall of Fine Diamonds, Treasures of Nature and Treasures of Ocean – to showcase top-quality diamonds, gemstones, pearls, and jewellery raw materials from around the world. Zhushan Turquoise Pavilion from Hubei Province makes its debut at the Hong Kong International Diamond, Gem & Pearl Show, showcasing high-quality turquoise with rich, vibrant colour to global buyers. German exhibitor Caram e.K. (Booth: AWE 8–F05) is showcasing a 7 carat Mozambique ruby —a particular rare find. French exhibitor Alain Boite S.A.S. (Booth: AWE 1–A20) exhibits a freshwater pearl strand measuring 14 to 15.8 mm

-

ShowBuzz3 days ago

ShowBuzz3 days agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

International News17 hours ago

International News17 hours agoThe HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

-

GlamBuzz20 hours ago

GlamBuzz20 hours agoRakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

-

International News21 hours ago

International News21 hours agoMiddle East Conflict Halts Global Diamond Trade in Dubai and Israel