National News

AWDC launches Know Your Customer Portal application

Antwerp World Diamond Centre (AWDC) announced the launch of the KYCP (Know Your Customer Portal) application, designed to automate the screening of customers and transactions.

New KYCP platform

- The Antwerp World Diamond Centre (AWDC) has unveiled KYCP – a Know Your Customer Portal that automates customer and transaction screening for diamantaires.

- Offered free of charge, the tool is tailored to help dealers comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) rules with far less manual paperwork.

How it changes compliance

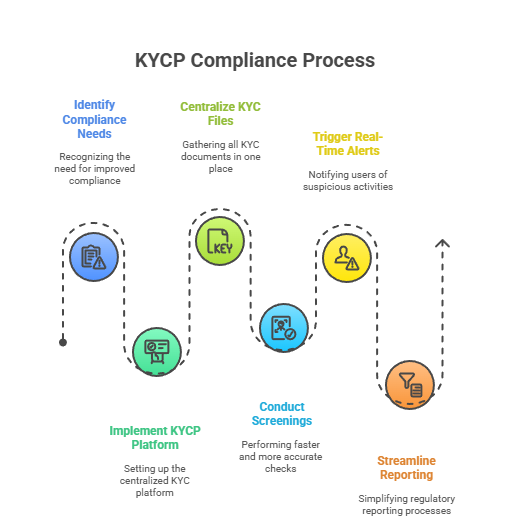

- KYCP replaces scattered, spreadsheet-based checks with a single platform that centralizes KYC files, runs faster and more accurate screenings, and triggers real-time alerts on suspicious activity.

- It also streamlines regulatory reporting, easing a burden that has weighed especially heavily on small and family-run trading firms.

Scale and strategic impact

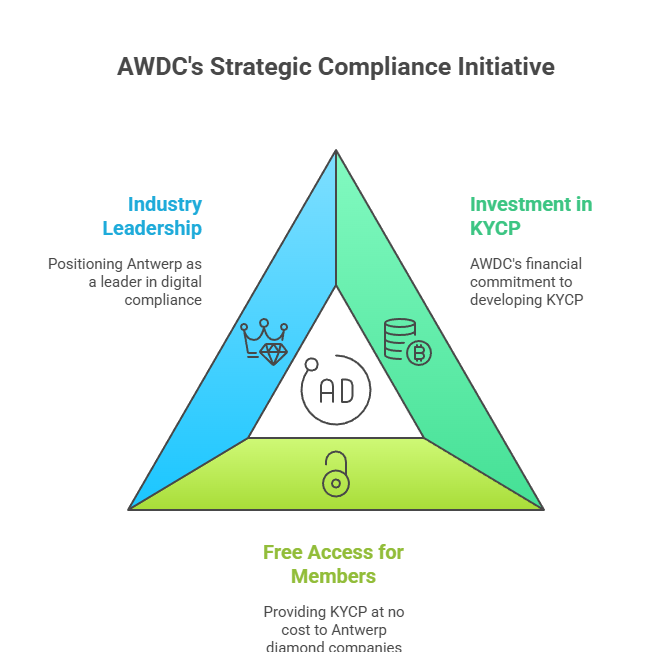

- AWDC invested about EUR 250,000 in developing KYCP and is making it available to the 1,470 Antwerp diamond companies it represents at no cost.

- By introducing the first collective digital compliance solution of its kind in Belgium, Antwerp’s diamond sector positions itself as a frontrunner among non-financial industries on transparency and AML/KYC compliance.

National News

Outstanding gold-backed loans surge by 128% from a year earlier

India’s appetite for borrowing against gold is reshaping the country’s credit landscape. Outstanding gold-backed loans have surged 128% from a year earlier, crossing Rs.4 lakh crore ($48 billion) for the first time, according to data from the Reserve Bank of India. As of Jan. 31, loans secured by gold jewellery stood at Rs.4,00,517 crore, marking one of the fastest expansions in retail credit in recent years.

The boom in gold loans has helped propel overall non-food bank credit growth to 14.4% year-on-year. Personal loans now account for 34.5% of total bank lending, outpacing other segments and underscoring a broader shift toward consumer-driven credit expansion

Gold loans alone contributed roughly 9% of incremental bank credit during the period. Between January 2024 and January 2026, outstanding gold-backed credit rose by nearly Rs.3.1 lakh crore—an increase of about 338% over two years—more than quadrupling the size of the portfolio.

Two factors are driving the surge. First, gold prices have climbed roughly 152% over the past two years, increasing the collateral value of household holdings. Second, regulatory guidance requiring banks to classify loans secured by gold explicitly as gold loans has sharpened reporting and accelerated balance-sheet growth in the segment.

The trend highlights a distinctive feature of India’s financial system: households’ vast stock of physical gold, long viewed primarily as a store of wealth, is increasingly being mobilized as collateral for formal credit.

While personal lending and credit to nonbank financial companies within the services sector continue to expand rapidly, industrial credit remains uneven. Loans to micro, small and medium enterprises are growing steadily, but borrowing by large corporations has stayed relatively muted.

Since March 21, 2025, banks have added Rs.21.8 lakh crore to their non-food loan books, translating into 12% growth for the financial year to date. Yet it is gold—rather than factories or infrastructure—that is emerging as one of the most dynamic engines of India’s current credit cycle.

-

National News4 days ago

National News4 days agoIIBS-11: Navigating the ‘New Gold Rush’ in a fragmenting global economy

-

International News4 days ago

International News4 days agoOroarezzo 2026, with Italian Exhibition Group, Manufacturing Explores New Markets

-

GlamBuzz2 hours ago

GlamBuzz2 hours ago#ViRosh Ki Shaadi: Rashmika Mandanna & Vijay Deverakonda Celebrate Love with Temple Gold & Timeless Tradition

-

International News4 days ago

International News4 days agoGemfields nets $53m in Bangkok ruby auction