International News

$40+ million: Sky is the limit for Fabergé at auction

A Fabergé egg, carved from rock crystal more than 100 years ago, is expected to command a remarkable return when it heads to auction in December.

The Winter Egg is studded with 1,660 diamonds and was a gift from Nicholas II, the last Emperor of Russia, to his mother, Dowager Empress Maria Feodorovna. The piece was crafted by Alma Theresia Pihl, one of only two female designers at Fabergé, and includes platinum, double-handled trelliswork basket set with carved quartz flowers and rose-cut diamonds

The Winter Egg will head to Christie’s auction house in London on 2 December and is expected to sell for more than £20 million ($AUD40.93 million). This piece has already set the world record for the sale of a Fabergé egg at auction on two occasions – returning $AUD13.95 million at Christie’s in Geneva in 1994 and $AUD14.72 million at Christie’s in New York in 2002.

“The highly important Winter Egg has twice set the world record for a work by Fabergé and represents a once-in-a-lifetime opportunity to acquire a masterpiece of such calibre,” Christie’s explained.

“It is among the most lavish of Fabergé’s Imperial creations and is widely regarded as one of the most original and artistically inventive Easter eggs the house produced for the Imperial family.

“The sale will also feature just under 50 exceptional works by Fabergé, including hardstone figures, animals, objects de vertu and furniture, offering collectors a rare opportunity to acquire masterpieces from this extraordinary collection.”

A total of 50 Imperial Easter Eggs were produced by Fabergé between 1885 and 1916. Of those, 43 eggs are still believed to exist and are located in museums around the world. It’s believed that seven, including the Winter Egg, are privately owned.

Fabergé was founded in 1842 and, earlier this year, was sold to a technology investor as part of a $AUD76.2 million deal.

International News

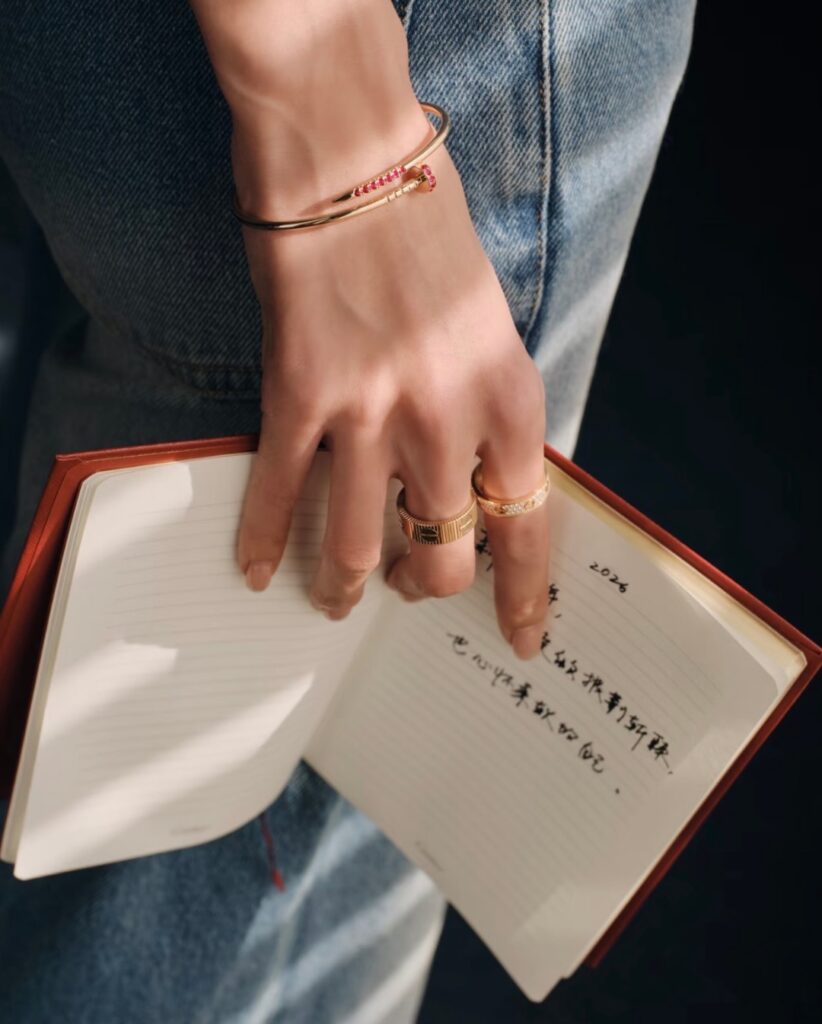

Cartier Reimagines an Icon: The Ruby-Set ‘Juste un Clou’ Debuts for Lunar New Year

A Fusion of Industrial Rebellion and Festive Elegance Marks a Limited-Edition Celebration of Luck and Prosperity.

In a bold intersection of high-fashion defiance and cultural tradition, Cartier has unveiled a limited-edition interpretation of its legendary Juste un Clou collection. This special release sees the iconic “nail” silhouette transformed with a festive row of vivid red rubies, launched specifically to commemorate the Lunar New Year.

Originally conceived in 1970s New York by designer Aldo Cipullo, the Juste un Clou has long been a symbol of the “rebellious spirit” and the elevation of the ordinary into the extraordinary. By integrating rubies—stones that traditionally symbolize luck, vitality, and renewal—Cartier effectively bridges its radical Western design heritage with the deep-rooted values of the East.

The collection features the signature wrap-around nail design in gold in bracelets, necklaces, earrings & rings with the “head” and “point” of the nail meticulously pavé-set with high-quality rubies. Industry experts view this move as a strategic masterstroke, as the “festive red” aesthetic continues to be a primary driver for luxury consumption during the spring transition.

-

BrandBuzz3 days ago

BrandBuzz3 days agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises3 days ago

New Premises3 days agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

National News3 days ago

National News3 days agoBakul Limbasiya Receives Prestigious APO National Award for LGD Pioneering

-

Appoinment4 days ago

Appoinment4 days agoTiffany & Co. Strengthens Leadership with David Ponzo as Deputy CEO