International News

WGC Report: Central bank gold statistics March 2025

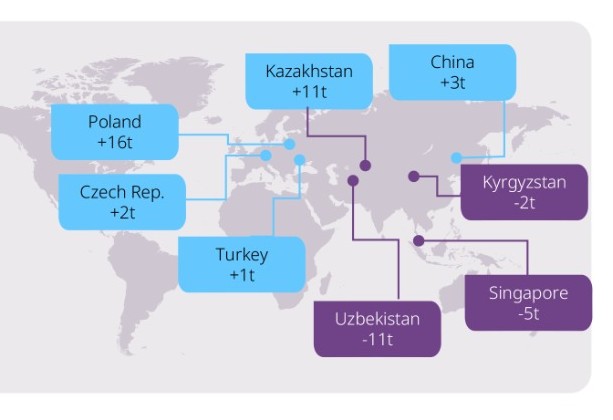

Central banks reported 17t of net buying in March via the IMF and other public data sources. Demand remains strong as the first quarter of the year ends: monthly gross purchases of 35t were offset by gross sales of 18t, with Uzbekistan reporting net sales of 11t.

March changes by country

Notably, National Bank of Poland was the largest reported net buyer this month (16t), followed by National Bank of Kazakhstan (11t) and People’s Bank of China (3t). Czech Republic (2t) and Turkey (1t) also added to their gold reserves in March. Central Bank of the Republic of Uzbekistan was the largest net seller (11t) for the month, followed by Singapore (5t) and Kyrgyzstan (2t)

Year-to-date changes by country

Poland is the largest reported net buyer in 2025 so far (49t) followed by Azerbaijan** (19t) and China (13t) over the same period. In the first quarter of 2025, Uzbekistan reported largest net sales (15t), followed by Singapore (5t), Kyrgyzstan (4t) and Russia (3t).

DiamondBuzz

Diamond Slump forces Debswana to diversify into copper, platinum and solar

Diamond-centric mining models is giving way to broader resource portfolios

Debswana Diamond Company, the 50–50 joint venture between the Botswana government and De Beers, is moving to diversify into copper, platinum and renewable energy as the prolonged downturn in natural diamond demand pressures earnings and forces the industry to rethink its growth strategy.

The company’s board has approved plans to invest in a portfolio of non-diamond projects after revenue fell 46% in 2024, the latest available financial year, highlighting the scale of the downturn in the global diamond market.

The move signals a strategic shift toward commodities with stronger long-term demand fundamentals, particularly copper, which is central to global electrification and energy-transition infrastructure.

Debswana’s diversification reflects a broader industry pivot as diamond producers confront weak consumer demand, rising competition from lab-grown stones and elevated inventories across the supply chain.

The shift is also visible among smaller exploration companies. Botswana Diamonds recently rebranded as Botswana Minerals, signalling its own strategic focus on copper exploration rather than diamonds.

Together, these moves underscore a growing consensus across the sector: the era of diamond-centric mining models is giving way to broader resource portfolios anchored in energy-transition metals.

-

BrandBuzz16 hours ago

BrandBuzz16 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz16 hours ago

BrandBuzz16 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz20 hours ago

BrandBuzz20 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News20 hours ago

National News20 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression